Oxand Simeo™ software and our experts turn asset data into risk-based, multi-year investment plans. Prioritize CAPEX and OPEX, extend asset lifespans, reduce total cost of ownership by up to 30%, and achieve sustainability targets faster.

For more than 20 years, Oxand has helped infrastructure and real estate leaders turn asset knowledge into risk-based, investment-ready plans. Our approach combines proven predictive models, portfolio-level simulations and expert insight to reduce total cost of ownership, secure long-term performance and deliver measurable financial and carbon outcomes.

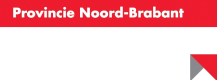

AIP Software optimizing risk, cost, energy and carbon footprint

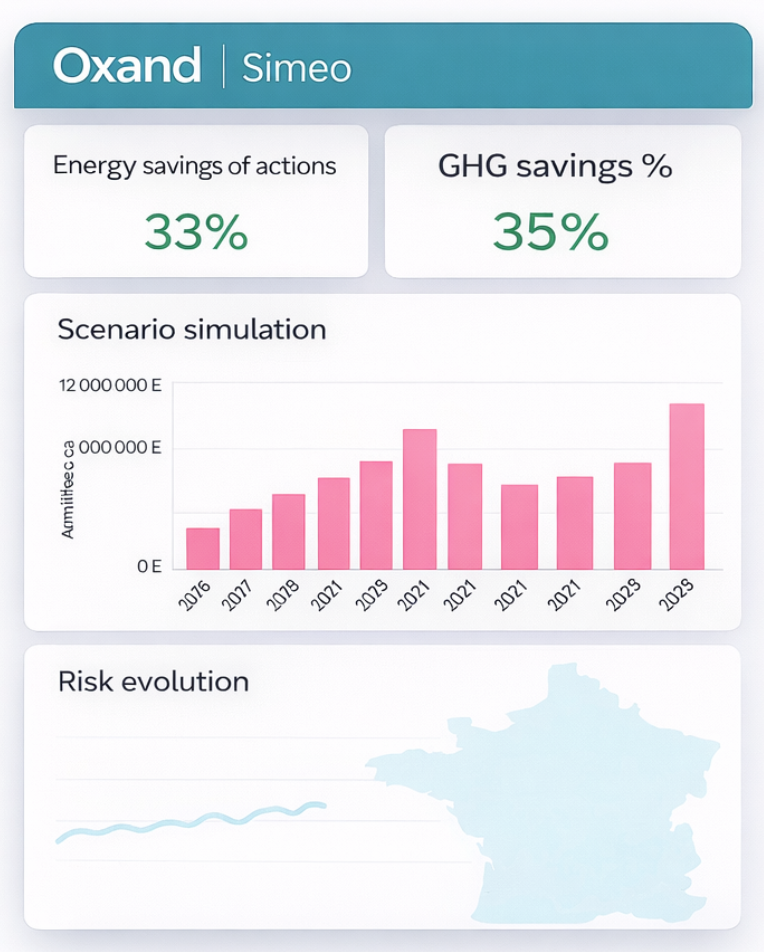

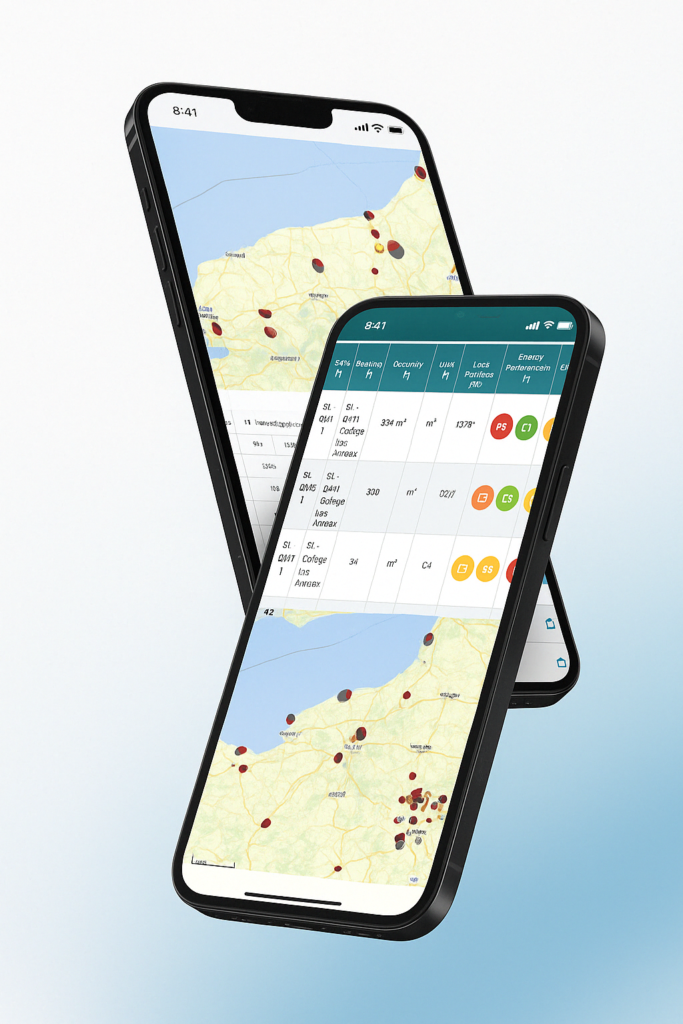

Clear, centralized asset inventory enabling smarter investment decisions

Gap analysis and ISO 55 001 Certification program

Predictive maintenance ROI and Sustainable priorization.

Oxand supports infrastructure, cities & regions, social housing, health buildings, commercial real estate with sector‑specific investment plans.

Launch first investment scenarios in weeks.

Integrate aging risk, cost, energy and carbon goals into one plan.

ISO 55 000 reports generated from investment plans.

Gain insights from industry-leading experts:

In-depth analysis of asset investment planning methodology, investment strategies for ageing infrastructure, return on investment for predictive maintenance, ISO 55000 frameworks and EU regulatory alignment.

Concrete examples illustrating how organisations are optimising their budgets, reducing their total cost of ownership and developing carbon-conscious investment plans.

Latest trends and regulatory impacts in infrastructure and real estate: European sustainability rules, risk-based investment planning, carbon targets and life cycle optimisation.

Ready to Transform Your Assets?

FAQs

Predictive asset management uses data analytics and modeling to predict when maintenance should be performed, helping to extend asset life, reduce costs, and avoid downtime.

Predictive asset management uses data analysis, ageing models and risk forecasting to determine when interventions should be planned.

It enables better investment decisions, extends asset life, reduces lifecycle costs and creates more reliable, ROI-focused investment plans.

Most clients obtain a first investment plan within 6–12 weeks, depending on data availability.

Measurable results follow quickly, including:

Yes. Oxand directly integrates sustainability and carbon metrics into investment planning.

Our models help organisations align their investments with European regulations, ISO 55000, CSRD/ESRS standards and long-term decarbonisation goals, providing compliant, transparent and verifiable investment plans.

Absolutely. Oxand supports investment planning in many sectors, including: public infrastructure, commercial property, energy and utilities, transport and manufacturing.

Our methodology adapts to the specific risk, compliance and budgeting requirements of each sector, ensuring robust investment plans.

You can start by requesting a demonstration or speaking directly to our experts.

We can help you quickly develop your first CAPEX/OPEX investment plan, prioritise actions and evaluate return on investment, even if your data is incomplete.