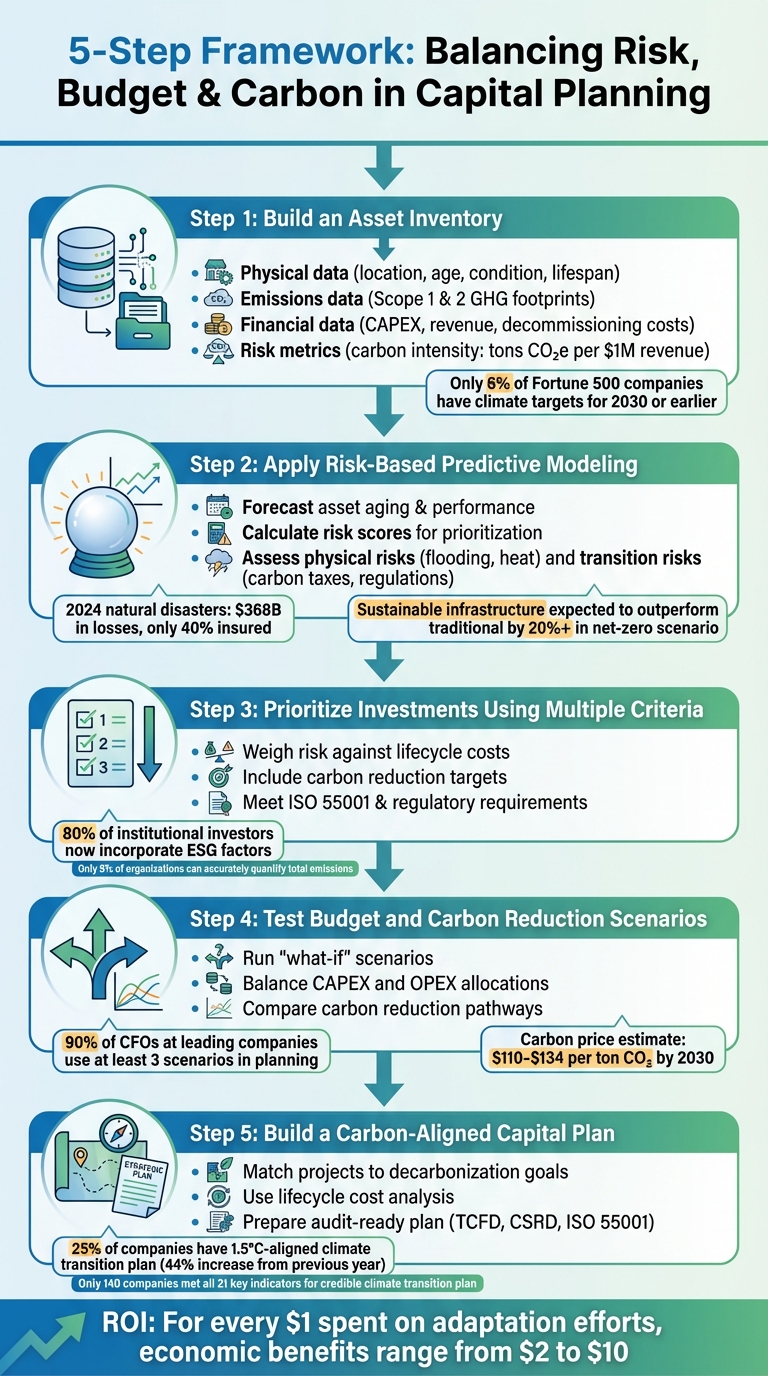

Owners of infrastructure and real estate face a tough challenge: how to protect assets from risks like extreme weather, work within tight budgets, and meet carbon reduction targets. These priorities often conflict, especially with the high upfront costs of low-carbon solutions. To solve this, a five-step framework connects financial planning with sustainability goals, helping organizations make smarter investment decisions.

Here’s a quick breakdown of the framework:

- Build an Asset Inventory: Create a detailed register of assets, including location, condition, lifespan, emissions, and costs. This helps track risks and prioritize investments.

- Use Predictive Models: Forecast asset aging, maintenance needs, and risks like flooding or carbon taxes. This prevents financial losses and identifies long-term opportunities.

- Rank Investments: Score projects based on risk, cost, and carbon reduction potential to prioritize spending effectively.

- Test Scenarios: Simulate different budget and carbon reduction paths to plan for various outcomes, like tighter regulations or funding changes.

- Create a Carbon-Aligned Plan: Develop a roadmap that ties every investment to carbon goals, ensuring compliance and long-term value.

5-Step Framework for Balancing Risk, Budget and Carbon in Capital Planning

Introduction to the Carbon Risk Real Estate Monitor | Rik Recourt, GRESB

Step 1: Create a Complete Asset Inventory and Data Foundation

Before committing resources, you need a clear picture of your assets. Without this, it’s nearly impossible to set realistic budgets, prioritize investments, or plan effectively for the future. Aishah Mohd Isa from SSG puts it into perspective:

"Imagine trying to manage your personal finances without knowing how much money you have in the bank. Not knowing how much you have makes it difficult to set a realistic budget, prioritize expenses, or plan for the future" – SSG [8]

An asset register serves as the backbone for emissions tracking, financial planning, and risk assessment. It includes everything from factories and machinery to infrastructure, all of which contribute to emissions in different ways: direct emissions (Scope 1), indirect emissions from purchased energy (Scope 2), and value-chain emissions (Scope 3) [9]. For instance, electricity and heat generation alone have contributed 24% of total greenhouse gas emissions over the past decade [10]. This makes your inventory essential for identifying climate risks and mapping out a decarbonization strategy.

A thorough register also highlights stranded assets – fossil fuel–related infrastructure that may lose value as carbon costs rise. Without accurate data on these assets’ locations, conditions, and decommissioning costs, they could become financial liabilities, draining resources instead of being phased out efficiently [6]. This foundational data sets the stage for advanced risk modeling and smarter investment decisions in later steps.

Build a Centralized Asset Register

Start by setting up a standardized asset register that ensures consistency across all properties and infrastructure. This register should include:

- Physical data: Location, age, condition, and remaining lifespan.

- Emissions data: Greenhouse gas footprints for Scope 1 and Scope 2.

- Financial data: Capital expenditure needs, revenue generation, and decommissioning costs.

- Risk metrics: Carbon intensity measured as tons of CO₂ equivalent per million dollars of revenue [6][9][10].

Standardizing how you classify assets is crucial. For example, if you manage transportation infrastructure, consider aligning with the Federal Transit Administration’s Transit Asset Management plan. This way, a "chiller" in one building is recorded the same way as a "chiller" in another, making it easier to compare performance and allocate resources across your portfolio.

Don’t overlook decommissioning and retirement costs. Including these in your asset data ensures that outdated infrastructure can be safely retired without leaving the public or government to foot the bill [6]. With only 6% of Fortune 500 companies having climate targets for 2030 or earlier as of 2023, better short-term planning data is more critical than ever [9]. Once your data is standardized, you can move on to assessing asset conditions and risks.

Add Condition and Risk Assessment Data

With your register in place, the next step is to layer in data about asset conditions and risks. This helps pinpoint which assets pose the biggest threats to your operations and finances. Consider both physical risks, like flooding or heat stress, and transition risks, such as carbon pricing and new regulations.

For example, in 2020, Old Mutual Alternative Investments (OMAI) incorporated physical risk data models into their Environmental and Social Management System for a $4.07 billion portfolio. This allowed them to identify high-risk investments during the screening process [11].

It’s also important to think systemically. If a school is only accessible via a bridge, and that bridge fails in a flood, the value of both the road and the school is compromised [12]. Assess how assets work together to avoid investing in one while neglecting a critical dependency that could undermine the entire operation.

Investing in risk-led design can pay off significantly. For every $1 spent on adaptation efforts, economic benefits can range from $2 to $10 [12]. By quantifying avoided disaster losses and reduced insurance costs, resilience becomes more than just a cost – it becomes a measurable financial benefit. Accurate condition and risk data will also support the predictive modeling covered in the next step.

Use Digital Tools for Asset Data Collection

Manual data collection is time-consuming, prone to errors, and expensive. Digital tools can streamline this process dramatically. In 2025, JLL used its JLL Serve mobile app to automate asset onboarding. The app employs AI-driven Content-Based Image Retrieval (CBIR) to identify equipment through photos and Optical Character Recognition (OCR) to capture details like voltage, tonnage, and refrigerant type from nameplates. This data is then uploaded to a cloud database, achieving "5C-quality" data – Complete, Comprehensive, Consistent, Correct, and Current – much faster than manual inspections [14].

For IT and IoT assets, network discovery tools can automatically identify all connected devices using active methods (like pinging) and passive methods (monitoring traffic patterns). This ensures no unauthorized or "shadow" assets are overlooked, which is vital for both cybersecurity and accurate planning.

Equip your maintenance teams with mobile devices for routine inspections. When technicians log "as found" and "as left" data during their work, it automatically syncs with your Asset Performance Management system. This keeps your register up-to-date without requiring separate data collection efforts. For instance, Citizens Bank implemented a digital management platform that cut legal review workloads by 67% and reduced review cycles from 14–16 business days to just 4–6 [13]. These digital tools ensure your asset register stays accurate and current, supporting informed decision-making in future planning stages.

Step 2: Apply Risk-Based Predictive Modeling

After completing your asset register, the next move is to leverage predictive models. These models help forecast asset aging, potential failure points, and the implications for your budget and carbon targets. This shifts planning from static snapshots to dynamic scenarios, revealing both financial and environmental outcomes tied to different investment choices.

Predictive analytics rely on historical data, such as asset lifecycles, repair costs, and material recovery rates, to anticipate future performance and maintenance needs. Machine learning can be a game-changer here. For instance, in October 2024, a leading electronics manufacturer used machine learning to evaluate the financial impact of a product take-back program. By analyzing lifecycle and repair cost data, they projected savings and revenue from refurbishments over the next decade [1].

Physical risks like sea-level rise, wildfires, and flooding can wreak havoc on infrastructure, while transition risks – such as carbon taxes, policy changes, and market shifts – can transform profitable assets into liabilities. In 2024 alone, natural disasters led to $368 billion in losses, with only 40% covered by insurance [15]. Sustainable infrastructure, however, is expected to outperform traditional infrastructure by over 20% in a net-zero scenario, with cumulative returns around 10% higher even under limited climate action, thanks to better management of physical risks [15].

"The ClimateWise Transition risk framework introduces a compelling methodology, and accompanying tools, to help asset owners and managers gain a better understanding of transition risk, and integrate into their own financial decision-making." – Geoff Summerhayes, Chair, UNEP Sustainable Insurance Forum [5]

These predictive insights integrate seamlessly with your earlier asset data, paving the way for precise investment decisions.

Forecast Asset Aging and Performance

Predictive models can estimate how long assets will last and when they’ll need maintenance or replacement. Instead of waiting for equipment to fail, you can anticipate issues and schedule interventions before disruptions occur or costs spiral out of control.

Take HVAC systems, for example. Historical data can guide you to schedule replacements during planned downtime, minimizing operational disruptions. Climate scenario analysis adds another layer of foresight. In 2024, a global beverage company incorporated climate scenario modeling into its capital planning. This allowed it to predict water scarcity risks in key production areas and invest in water-efficient technologies, while diversifying sourcing locations to ensure business continuity [1]. Similarly, a coastal real estate developer used climate risk modeling to analyze sea-level rise scenarios. This led to a targeted investment strategy, prioritizing climate-resilient infrastructure and properties with lower long-term environmental risks [1].

Predictive models also shine in identifying circular economy opportunities. By comparing the costs and benefits of refurbishing equipment versus purchasing new assets, you can pinpoint where extending asset lifespans makes both financial and environmental sense. This approach is particularly useful when raw material prices fluctuate or supply chains face disruptions.

These forecasts now set the stage for prioritizing risks, which we’ll explore next.

Calculate Risk Scores to Prioritize Investments

Once you’ve predicted asset performance, the next step is to translate these insights into risk scores. These scores distill complex data – like physical climate risks, carbon lock-in, and lifecycle costs – into a single, actionable metric. They balance various factors, including physical threats, transition risks, resource scarcity, and traditional financial metrics like revenue generation and operating costs.

For example, a risk score might combine the likelihood of a building flooding in the next decade with repair costs, the building’s revenue contribution, and its carbon intensity. Assets facing immediate threats or producing high emissions should take priority. In 2022, the City of Fredericton introduced a "climate lens" policy, requiring all capital budget proposals to outline their climate mitigation and adaptation impacts. By 2024, the city advanced this framework to include quantified emissions data for eligible infrastructure projects, enhancing their ability to prioritize effectively [8].

Risk scores also help avoid investments in assets that could become stranded. Facilities dependent on scarce resources – like water in drought-prone areas – or those locking in high emissions for decades will have higher risk scores, reflecting their vulnerabilities. With 80% of institutional investors now incorporating Environmental, Social, and Governance (ESG) factors into their decision-making [1], aligning your risk scores with these expectations can improve access to capital.

Go beyond basic scorecards by integrating economic modeling that ties risks directly to revenue, operating costs, and uptime. This allows you to assess whether resilience investments – like upgrading a seawall or installing flood barriers – are financially justified by the losses they prevent and the extended asset life they provide. For every $1 spent on adaptation efforts, the economic benefits can range from $2 to $10 [12], making resilience a measurable financial advantage rather than just an expense.

Step 3: Prioritize Investments Using Multiple Criteria

With risk scores in hand, it’s time to rank projects across your portfolio. This step combines asset data, predictive models, and risk assessments into a clear, objective ranking system. The goal? To strike a balance between minimizing risk, managing costs, cutting carbon emissions, and meeting compliance requirements. This approach ties together risk management, cost efficiency, and sustainability into a single framework.

A ranking analysis works well here. Each project gets a composite score based on weighted criteria like risk exposure, lifecycle costs, carbon reduction potential, and regulatory necessity [16]. This system ensures decisions are grounded in data rather than intuition or external pressures. Take MGM Resorts International, for instance. In 2021, they teamed up with Schneider Electric to assess over 17,000 assets spanning 100 million square feet. By scoring assets on factors like condition and lifecycle stage, MGM shifted from reactive maintenance to proactive planning, prioritizing investments based on risk, cost, and performance impact [17].

Collaboration across teams is essential for effective prioritization. Finance teams manage budgets, while project management offices provide forecasts and operational insights. Consistent coordination ensures that capital plans align with strategic goals and real-world conditions [16]. A standardized intake process – where every project is evaluated using the same criteria – further promotes consistency and avoids ad hoc decision-making.

Weigh Risk Against Lifecycle Costs

Once you’ve quantified risk scores, take it a step further by factoring in lifecycle costs. While risk scores highlight vulnerabilities, they don’t paint the full financial picture. Smart investment decisions require evaluating the total cost of ownership across the asset’s entire lifecycle – from planning and building to operation. This means considering not just upfront capital expenses (CAPEX) but also ongoing maintenance and the costs of deferring action. Ignoring maintenance often leads to emergency repairs, lost productivity, and higher operating expenses.

Lifecycle cost analysis can also reveal opportunities to extend the life of assets. Instead of automatically replacing equipment at the end of its expected lifespan, compare the costs of refurbishment or targeted upgrades to a full replacement. Incorporating lifecycle costs into your prioritization process ensures you focus on high-risk, high-cost issues while avoiding unnecessary spending on low-risk assets.

Include Carbon Reduction Targets

Carbon reduction is no longer just an environmental goal – it’s a financial priority. To align investment decisions with decarbonization plans, evaluate each project’s contribution to your carbon reduction pathway. Assign a carbon abatement score based on the estimated emissions reduction per dollar spent.

Tools like Marginal Abatement Cost Curves can help rank carbon reduction measures by their cost-effectiveness. Additionally, using Internal Carbon Pricing (ICP) can add a financial layer to your analysis. By setting an internal price per ton of CO₂ – modeled on expected EU ETS levels of $110 to $134 per ton by 2030 [3] – you can adjust hurdle rates and NPV calculations for projects with carbon exposure. This approach makes low-carbon investments more attractive and helps avoid stranded assets as regulations tighten. Combining lifecycle insights with carbon metrics sets a strong foundation for meeting compliance and ISO standards.

Meet ISO 55001 and Regulatory Requirements

Compliance isn’t just about avoiding penalties – it’s an opportunity to improve data quality, build stakeholder trust, and attract capital. ISO 55001 offers a globally recognized framework for asset management, emphasizing systematic, risk-based decision-making and lifecycle cost analysis. Adhering to these standards ensures your capital plans are audit-ready and aligned with global best practices. Compliance also boosts asset value and investor confidence, highlighting the financial rewards of effective asset management.

New regulations, like Europe’s Corporate Sustainability Reporting Directive (CSRD) and similar U.S. frameworks, now require detailed reporting on emissions, climate risks, and decarbonization strategies – on par with financial disclosures. To meet these demands, organizations need precise emissions data that ties directly to cost centers, business units, and product lines [3]. Achieving this level of transparency requires advanced tools for automated data collection, traceability, and approval workflows [3].

"As a carbon accounting expert, I strongly advocate using sustainability software over internal solutions. Unlike cumbersome internal solutions reliant on spreadsheets, advanced software offers efficient data collection, accurate emissions calculations, and enhanced stakeholder transparency." – Johannes Weber, Director of Sustainability Solutions, Plan A [18]

Building an audit-ready infrastructure is critical. While 85% of organizations are focused on reducing greenhouse gas emissions, only 9% can accurately quantify their total emissions [18]. Without reliable data and proper documentation, businesses risk regulatory penalties, reputational harm, and missed investment opportunities. By integrating ISO 55001 and regulatory requirements into your prioritization framework, compliance becomes a natural byproduct of effective asset management. This structured approach will also prepare you for budget testing scenarios in Step 4.

sbb-itb-5be7949

Step 4: Test Budget and Carbon Reduction Scenarios

Once you’ve ranked your projects and confirmed compliance, it’s time to put your assumptions to the test. Scenario planning tools allow you to simulate various futures – tight budgets, ambitious carbon targets, or sudden regulatory changes – before committing resources. Instead of banking on a single forecast, you can evaluate your strategy across multiple conditions to identify investments that perform well no matter the scenario. This approach shifts the focus from mere prediction to strategic preparedness. By building on your prioritized project list and risk assessments, you can test different budget and carbon reduction scenarios to ensure your capital planning is solid.

AI platforms can analyze investment combinations, helping you pinpoint projects that maximize returns while meeting specific carbon reduction targets. For instance, Oxand Simeo™ provides decision-makers with tools to adjust variables like carbon tax rates or available capital during planning, instantly showing how these changes affect long-term plans. This type of "what-if" analysis helps distinguish between "core plays" – investments that work across all scenarios – and "hedges", which protect against risks like sudden decarbonization mandates. According to surveys, 90% of CFOs at leading companies now use at least three scenarios in their planning cycles [20]. This shift in methodology sets the stage for the detailed scenario analyses outlined below.

Run "What-If" Scenarios

Scenario modeling allows you to weigh the trade-offs between budget constraints and sustainability goals by testing different combinations of capital allocation, carbon pricing, and regulatory conditions. One effective method is using a 2×2 matrix with key uncertainties – such as Capital Availability and Regulatory Stringency – to create four possible future scenarios. This helps you identify which projects remain viable under all conditions and which depend on specific circumstances.

To refine your analysis, incorporate proxy carbon costs into your calculations. Adjust metrics like net present value (NPV) and hurdle rates to account for stricter regulations. For example, applying a shadow price for carbon – estimated at $110 to $134 per ton by 2030 – can make low-carbon investments more appealing while avoiding long-term reliance on high-emission assets.

Define signposts, such as changes in carbon policies or advancements in clean technology, to monitor which scenario is becoming reality. These indicators allow you to pivot quickly as conditions evolve. The goal isn’t to predict the future perfectly but to build a portfolio capable of adapting to various speeds of the energy transition.

Balance CAPEX and OPEX Allocations

Balancing capital expenditures (CAPEX) and operational expenses (OPEX) within budget constraints requires a close look at the long-term financial impact of upfront investments versus ongoing maintenance. Testing different CAPEX and OPEX mixes helps you understand trade-offs and pinpoint the optimal allocation.

Techniques like sensitivity analysis can be used to vary inputs – such as material costs, labor rates, or carbon prices – by a set percentage (e.g., 10%) to see how these changes affect your budget and carbon goals [16]. This approach identifies projects most vulnerable to cost fluctuations and highlights those that remain financially viable even under adverse conditions. Additionally, Monte Carlo simulations, which run thousands of randomized scenarios, can quantify risks and provide a clearer picture of financial uncertainty. These methods offer a more realistic view of potential outcomes than static, single-point estimates.

A critical consideration is whether your planned CAPEX will lock in high emissions for decades or support low-carbon solutions. For instance, investing in a natural gas boiler might seem cost-effective now but could become a stranded asset if carbon regulations tighten in the near future. Scenario modeling helps you avoid such pitfalls by testing your asset portfolio’s resilience against varying greenhouse gas (GHG) reduction pathways. Once budget allocations are settled, the next step is to assess the carbon reduction impact of each investment.

Compare Carbon Reduction Pathways

Exploring different carbon reduction strategies allows you to identify investments that deliver the greatest CO₂ savings for your dollar. Define multiple pathways, such as an orderly transition (early, gradual policy changes), a disorderly transition (delayed or inconsistent policies), and a hot house world (minimal global action), and evaluate how your capital plan performs under each scenario. This process reveals which investments remain effective regardless of how quickly or slowly the energy transition unfolds.

A practical example comes from AECOM, which began collaborating with the Environment Agency (EA) in January 2022 to manage the Net Zero Carbon Capital Roadmap Project. The project team, including Carbon Technical Specialists, developed tools and plans to achieve the EA’s target of a 45% reduction in total carbon emissions by 2030. By 2024/25, the focus will shift to implementing project controls and live carbon reporting for new workstreams [21]. This demonstrates how scenario modeling can turn ambitious climate goals into actionable plans with measurable results.

Standardized tools like PACTA (Paris Aligned Capital Transition Assessment) can help evaluate how well your capital plans align with different climate scenarios [9]. Incorporating a "fully burdened cost of supply" that includes proxy carbon costs ensures your investment decisions account for future carbon pricing and regulatory shifts, not just current conditions.

"A company’s capital asset mix is the centerpiece of its current climate performance, and its capital plan – and particularly its CapEx – is the key to understanding a company’s climate future." – Ilmi Granoff, Senior Fellow, Sabin Center for Climate Change Law [9]

To ensure flexibility, design a capital plan that balances "must-dos" (compliance), "options" (innovation), and "hedges" (risk mitigation). This diversified approach keeps your portfolio resilient, allowing you to adapt to changing conditions while staying on track with both financial and carbon reduction goals.

Step 5: Build a Carbon-Aligned Capital Plan

Once you’ve tested scenarios and weighed the trade-offs, it’s time to finalize an investment plan that combines risk management, budget discipline, and carbon reduction. This step turns your analysis into a clear, data-backed roadmap for allocating capital over the next 5 to 30 years. A carbon-aligned capital plan serves as a strategic guide, organizing investments by their emissions reduction potential, setting precise timelines, and linking every dollar spent to decarbonization goals and asset safety.

This phase builds on the risk modeling and data analysis you’ve already completed, translating those insights into actionable, long-term plans. Companies that excel in this area see real results: as of 2023, 25% of companies have a 1.5°C-aligned climate transition plan – a 44% increase from the previous year [23]. However, only 140 companies out of thousands reporting to CDP met all 21 key indicators for a credible climate transition plan [23]. This highlights the importance of crafting a plan that’s both ambitious and ready for scrutiny.

Match Projects to Decarbonization Goals

Using your tested scenarios and risk assessments, sort capital projects by their potential to reduce emissions. Not all investments are created equal, so it’s vital to pinpoint those that deliver the most impact per dollar spent. Align these projects with specific financial tools and climate strategies:

- Green bonds for initiatives like solar installations or energy-efficient HVAC systems.

- Sustainability-linked bonds for broader corporate goals tied to environmental targets.

- Transition bonds for funding in hard-to-decarbonize sectors such as heavy infrastructure or industrial operations [10].

To structure this, use a three-stage alignment process. First, rank projects based on their readiness for carbon transition – how quickly they can be implemented and how much they cut emissions. Second, build portfolios using forward-looking metrics like projected CO₂ savings or alignment with a 1.5°C pathway. Third, engage stakeholders to refine climate policies and ensure your plan meets both internal goals and external regulations [10][22].

One practical example is Enel. In July 2022, J.P. Morgan Asset Management recognized Enel as a standout candidate for carbon transition portfolios. Despite its historically high emissions from coal, Enel committed all essential capital expenditures to renewables and set a 1.5°C target approved by the Science-Based Targets initiative (SBTi) [10]. This shows how a strong commitment to decarbonization can reshape a company’s capital plan, even if it starts from a high-emission baseline.

Set interim targets to monitor progress and manage short-term fluctuations. For example, five-year cumulative carbon reduction goals can help smooth out the effects of commodity price swings or currency changes that might distort annual metrics [10].

Use Lifecycle Cost Analysis

Building on earlier risk assessments, lifecycle cost analysis (LCCA) evaluates projects based on their total cost of ownership – including upfront costs, maintenance, energy use, and end-of-life expenses. This approach helps identify investments that might have higher initial costs but yield significant long-term savings through lower energy bills, reduced maintenance, or avoided carbon taxes.

LCCA is especially useful for spotting stranded asset risks – when an asset could lose value or require early retirement due to environmental regulations or market shifts. By modeling these risks during the planning phase, you can avoid locking in high emissions for decades and instead prioritize low-carbon solutions that remain viable under different regulatory scenarios [1][9].

"A company’s capital asset mix is the centerpiece of its current climate performance, and its capital plan – and particularly its CapEx – is the key to understanding a company’s climate future." – Ilmi Granoff, Senior Fellow, Sabin Center for Climate Change Law [9]

To use LCCA effectively, incorporate climate scenarios into your financial models. Predictive analytics can simulate resource shortages (like water scarcity in production regions) or carbon tax scenarios, allowing you to adjust net present value (NPV) calculations accordingly [1][5]. Also, consider the financial impact of circular economy practices – such as remanufacturing, extending product lifecycles, or adopting product-as-a-service models – to assess their long-term cost benefits and resource security [1].

Platforms like Oxand Simeo™ streamline lifecycle cost analysis by integrating it directly into capital planning, enabling comparisons based on total ownership costs, energy performance, and CO₂ impact. This ensures every investment decision is grounded in robust data that reflects both financial and environmental factors.

Prepare an Audit-Ready Plan

An audit-ready plan is essential for meeting disclosure requirements under frameworks like the Task Force on Climate-related Financial Disclosures (TCFD), the Corporate Sustainability Reporting Directive (CSRD), and ISO 55001 [18][25][19]. It should detail project selection, carbon targets, and progress tracking.

Start by ensuring your data is accurate and verifiable. Use software platforms with tamper-proof data storage, automated audit trails, and SOC 2 compliance to securely share information with stakeholders and regulators [18][25]. For example, one organization adopted a Carbon Management Platform that streamlined data collection, reducing the time spent on data entry by 80%. With customizable dashboards, they identified emission hotspots and set a goal to cut Scope 1 and 2 emissions by 50% by 2025 [18].

Adopt an "implement or explain" approach to provide transparency on why certain targets were or weren’t met [22]. Validate your plan with third-party data from groups like the Science-Based Targets initiative (SBTi) or the Transition Pathways Initiative to ensure targets align with credible climate science [10].

Finally, integrate your capital planning tools with enterprise resource planning (ERP) systems, such as SAP or Oracle. This ensures data consistency and financial accountability, making it easier to produce comprehensive reports that meet regulatory standards and build trust with investors, regulators, and the public [18][26].

Track Results and Maintain Long-Term Success

After implementing your carbon-aligned capital plan, the next step is to track its performance and keep the framework relevant. This isn’t just about meeting compliance requirements – it’s about proving that your investments are delivering both the financial returns and emissions reductions you aimed for. Regularly evaluating your plan ensures that your approach to managing risk, budgets, and carbon reduction remains effective over time. Companies that consistently monitor financial and carbon outcomes tend to outperform those that treat sustainability as a one-off effort. This process helps ensure your investments continue to align with both financial goals and carbon reduction commitments.

Calculate Financial and Carbon Savings

Shift your focus from looking at past greenhouse gas (GHG) footprints to tracking future-focused capital expenditures (CapEx). While GHG inventories tell you what happened last year, CapEx reveals what you’re investing in for the next decade and whether those investments support or hinder the transition to a low-carbon future [9]. Incorporate environmental, social, and governance (ESG) factors into traditional financial metrics like net present value (NPV), internal rate of return (IRR), and equivalent annual annuity (EAA) to show that sustainability efforts can also deliver measurable financial returns.

"CapEx shows where a company is headed, what emissions it’s enabling, and whether it’s supporting or delaying the transition with its balance sheet." – Ilmi Granoff, Senior Fellow, Sabin Center for Climate Change Law [9]

With 80% of institutional investors now factoring ESG into their decisions, demonstrating these metrics builds trust with stakeholders, including funders and boards [1]. Predictive analytics can help you project the long-term financial benefits of practices like material recovery or refurbished product revenue streams, comparing them to traditional linear business models [1]. For example, Starbucks saved nearly $60 million annually across its U.S. "Greener Stores" by 2022, cutting water and energy use by 30% through standardized, energy-efficient appliances [2].

To ensure your spending aligns with climate commitments, track the ratio of "green" versus "high-carbon" CapEx. In 2024, global investments in low-carbon energy systems reached an estimated $2 trillion [9]. However, as of 2023, only 6% of Fortune 500 companies had set climate targets for 2030 or earlier, even though 33% had longer-term goals [9]. Tools like the Paris Aligned Capital Transition Assessment (PACTA) can help you benchmark your capital plans against 1.5°C or 2°C pathways, ensuring your investments match your stated objectives [9].

Maintain Regulatory Compliance

Regulations evolve quickly, so staying on top of compliance is critical. Frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) can help standardize your emissions reporting, such as tons of CO₂ equivalent per million dollars of revenue [10]. Clear distinctions between operational spending and capital investments enhance transparency, which is especially important under frameworks like Canada’s 2025 Capital Budgeting Framework. In Canada, annual capital investment is expected to nearly double from $32.2 billion in 2024-25 to $59.6 billion by 2029-30 [24].

Set interim milestones, such as five-year carbon reduction targets, to track progress and account for the long-term nature of capital assets [10]. Conduct annual budget reviews to ensure spending aligns with your objectives, allowing you to make adjustments if needed [8]. External validators like the Science-Based Targets initiative (SBTi) or the Transition Pathways Initiative can verify your climate commitments and strengthen your audit readiness [10].

"A carbon budget framework transforms an aspirational net-zero emissions target into near-term, actionable milestones." – Aishah Mohd Isa, SSG [8]

Centralized risk dashboards can help you report on non-financial, investment, and compliance risks, ensuring alignment with your organization’s risk appetite [27]. For financial institutions, following the Basel Committee‘s three-pillar approach – Pillar 1 (capital requirements), Pillar 2 (risk management), and Pillar 3 (market transparency) – can help maintain accountability and stay ahead of regulatory changes [7].

Update the Framework as Conditions Change

As markets and regulations shift, your framework must evolve too. Regular updates ensure your capital plan reflects new data, risks, and opportunities. Capital planning isn’t a one-and-done task – it’s a continuous process that adapts to emerging technologies and changing conditions. Integrated capital planning software can streamline this process, replacing spreadsheets with unified platforms that handle budgeting, forecasting, and real-time data updates [26]. Predictive tools can forecast asset aging, maintenance costs, and project risks, helping you plan ahead instead of reacting to problems [26][18].

Consider adopting Internal Carbon Pricing (ICP) to assign a monetary value to GHG emissions, such as shadow pricing. This approach integrates the "future carbon bill" into long-term investment analyses, helping finance teams grasp the true cost of high-carbon investments and justify spending on low-carbon alternatives [3][4]. Scenario analysis tools can simulate different funding levels, carbon reduction pathways, and budget adjustments to show how they impact your goals [26][18].

"The greenhouse gas emissions within a business’s portfolio now come with real financial risks… The ‘future carbon bill’ will eventually come due. Companies need to plan for it now." – Engie Impact [4]

Climate risk analytics platforms can provide detailed, forward-looking assessments of physical and transition risks up to 2100, helping you future-proof your assets [28]. For example, AMPECO used a Carbon Management Platform to save 80% of the time spent on data entry while staying on track to cut Scope 1 and 2 emissions by 50% by 2025 [18]. Similarly, Repsol committed to shifting 45% of its total CapEx to renewable energy sources over five years to align with net-zero goals [2].

To ensure accuracy, map emission sources directly to financial structures like cost centers and business units. Use software that integrates data from ERP and procurement systems [3]. Adjust financial benchmarks, such as lowering IRR targets or extending payback periods, for projects with long-term sustainability benefits. Quantify the "cost of inaction" by calculating potential revenue losses from climate disruptions or future regulatory penalties, creating urgency and strengthening the case for sustainability investments [2].

Platforms like Oxand Simeo™ combine predictive asset management, lifecycle cost analysis, and carbon reduction planning into one system. These tools let you model risks in real time, test scenarios, and adapt your capital plan to meet changing budgets, asset conditions, and decarbonization goals.

Conclusion: Finding Balance in Capital Planning

Blending risk management, budget considerations, and carbon reduction efforts isn’t just a responsible move – it’s a smart financial strategy. According to recent data, 90% of companies surveyed by BCG report financial gains from decarbonization efforts. Even more impressive, 25% of these companies have seen returns equal to or exceeding 7% of their revenues, with an average net benefit of $200 million annually [2]. These numbers highlight how sustainability and profitability can align when guided by a well-structured approach.

Leading organizations are weaving climate considerations into their financial frameworks. For example, they’re tweaking decision-making rules by integrating sustainability metrics into Internal Rate of Return (IRR) and Net Present Value (NPV) calculations. Others are extending payback periods for projects that deliver high sustainability value [2][3]. Additionally, many companies are implementing internal carbon pricing that reflects anticipated regulatory levels, enabling them to account for future emissions costs in today’s investment decisions.

This shift in the market underscores the financial advantages of prioritizing sustainable practices. A staggering 75% of the world’s largest companies now include sustainability information alongside financial disclosures [2]. Firms with strong ESG practices not only outperform competitors but also enjoy better financing terms. On the flip side, companies with poor environmental track records often face higher borrowing costs and loan interest rates [29]. These trends reinforce the earlier strategies discussed, proving that financial discipline and climate-conscious actions can go hand in hand.

"Sustainability isn’t a mere altruistic endeavor; it’s a smart financial move. Companies with robust ESG practices tend to outperform their peers." – Karl Orrling, Founder, Fairway Sustainability Partners [1]

FAQs

How does predictive modeling support balancing carbon reduction goals with budget limitations?

Predictive modeling plays a crucial role in planning by simulating different future scenarios to assess possible risks and outcomes. This approach helps decision-makers pinpoint budget-friendly investments that meet carbon reduction targets without exceeding financial limits.

By examining data and identifying patterns, predictive modeling supports better project prioritization. It ensures resources are used wisely, balancing environmental goals with financial planning for lasting results.

What are the main advantages of using a centralized asset register for capital planning?

A centralized asset register offers a streamlined way to manage capital planning by giving you a clear and organized overview of all your assets. This clarity empowers you to make smarter, data-informed decisions. It helps you prioritize projects, allocate resources effectively, and evaluate risks, ensuring your investments align with financial limits and broader goals.

By incorporating carbon reduction targets and long-term asset management strategies, such a register helps you stay compliant with evolving regulations while maximizing the value of your assets. This method simplifies decision-making and balances financial outcomes with environmental accountability.

How can scenario testing help strengthen a capital plan against future uncertainties?

Scenario testing plays a crucial role in reinforcing a capital plan by simulating possible future challenges, like climate-related events or shifts in regulations. This method helps organizations pinpoint vulnerabilities, assess risks, and create strategies to tackle them head-on.

By considering different scenarios, leaders can make informed decisions about where to invest, how to allocate resources efficiently, and ensure their assets can withstand future uncertainties. This not only helps preserve long-term value but also keeps businesses aligned with changing sustainability goals and regulatory expectations.

Related Blog Posts

- Infrastructure Asset Management: A Risk-Based Approach for Multi-Year CAPEX Planning

- Strategic CAPEX Planning for Highway Concessions: Balancing Grantor Compliance and Profitability at End-of-Term

- Aging Infrastructure in Europe: How to Prioritise Renewal Under Budget Constraints

- Achieving Net-Zero in Real Estate Portfolios: From Targets to Investment Plans