Key Takeaways:

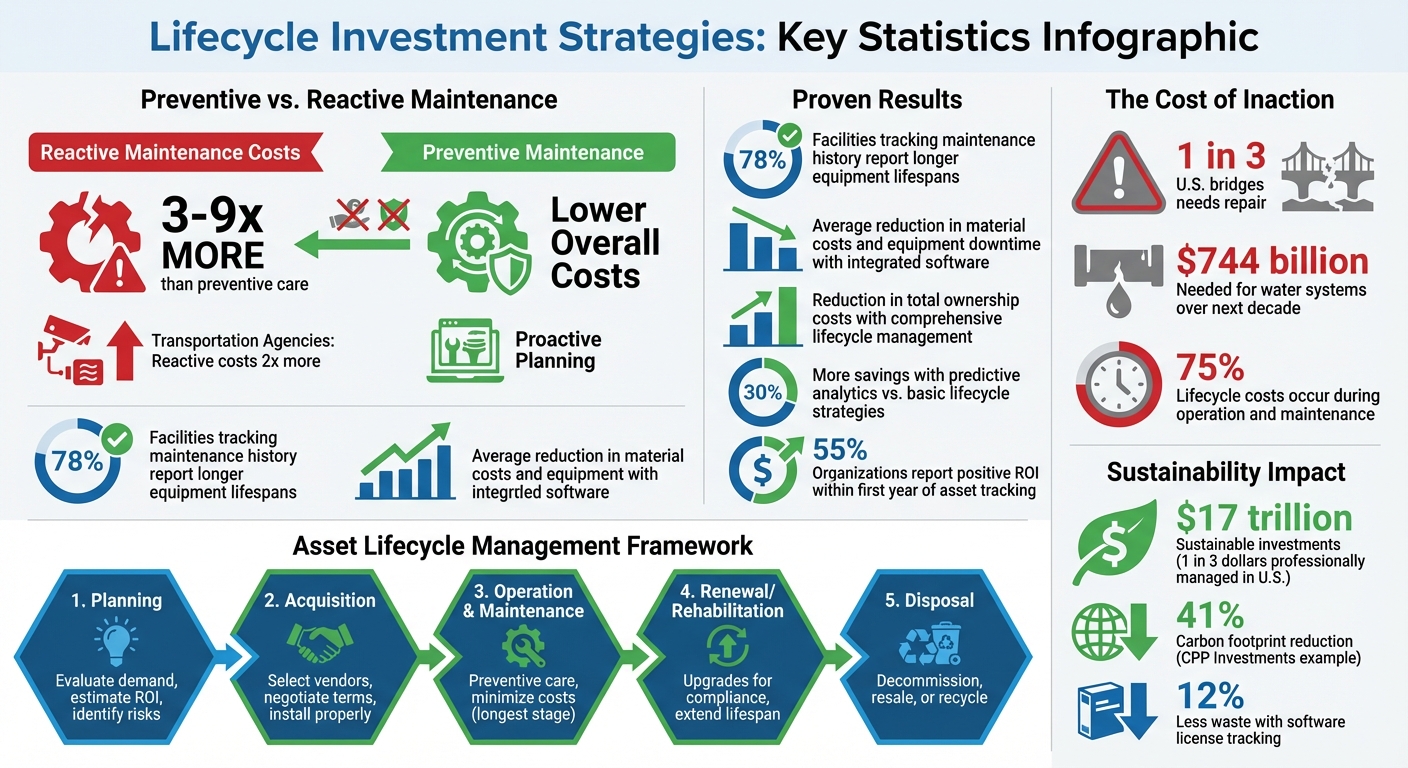

- Aging infrastructure is costly: 1 in 3 U.S. bridges needs repair, and water systems need $744 billion in funding over the next decade.

- Proactive planning saves money: Preventive maintenance costs 3–9 times less than reactive fixes.

- Lifecycle management works: Focus on planning, acquisition, maintenance, upgrades, and disposal to maximize value and reduce risks.

- Data-driven decisions matter: Tools like risk assessments, IoT sensors, and digital twins cut costs and improve performance.

- Sustainability aligns with savings: Extending asset life reduces waste, energy use, and emissions.

By balancing costs, risks, and energy use, organizations can extend asset life, meet compliance goals, and avoid financial shocks.

Preventive vs Reactive Maintenance Cost Comparison and ROI

Core Principles of Lifecycle Investment Planning

The 5 Stages of Asset Lifecycle Management

Every asset goes through five key stages that influence its long-term performance and cost-effectiveness. The journey begins with planning, where organizations evaluate demand, estimate returns on investment (ROI), and identify potential risks such as outdated technology or limited resources before committing funds [5][6]. Following this is the acquisition phase, which includes selecting vendors, negotiating terms, and ensuring proper installation to prevent costly emergency repairs down the line [3][4]. The operation and maintenance stage is the longest, emphasizing preventive care to minimize operational costs and catch early signs of wear [1]. Next comes renewal or rehabilitation, where upgrades are made to ensure compliance or extend the asset’s lifespan [1]. Finally, disposal occurs when maintaining the asset is no longer cost-effective, leading to decommissioning, resale, or recycling, all while adhering to environmental and regulatory requirements [4][6]. By understanding these stages, it’s clear why proactive and planned maintenance plays such a vital role in asset management.

Planned vs. Reactive Maintenance

The cost difference between planned and reactive maintenance is striking. Reactive maintenance can cost 3–9 times more than preventive care [4]. Organizations that wait for assets to fail often face unexpected downtime, inflated emergency repair costs, and a shorter lifespan for their equipment. On the other hand, planned maintenance schedules are designed to align with production needs rather than reacting to equipment breakdowns. According to FMX, 78% of facilities that track maintenance history and prioritize preventive care report longer equipment lifespans [4]. Planned maintenance not only keeps costs predictable but also avoids the financial shocks associated with reactive strategies [2]. These savings and operational efficiencies highlight the broader benefits of adopting a full lifecycle approach.

Benefits of Lifecycle Planning

Taking a lifecycle approach offers more than just cost savings – it delivers a range of tangible benefits. Proactive monitoring helps extend the lifespan of assets and lowers total ownership costs by addressing potential issues before they escalate. This includes tracking factors like fuel consumption, energy use, downtime, and vendor-related expenses throughout the asset’s life [1]. Reliability also improves, as early detection of potential failures ensures smoother operations [1]. Additionally, organizations align more effectively with ESG goals by extending the life of assets, which reduces the environmental impact of manufacturing replacements. Real-time energy monitoring further supports carbon reduction efforts. Plus, maintaining detailed digital records throughout the lifecycle can boost resale value during the disposal phase, allowing companies to recover a significant portion of their initial investment [1].

How to Prioritize Investments Using Risk-Based Frameworks

Assessing Risk and Criticality

When deciding where to allocate investment dollars, the first step is understanding the cost of failure. A thorough risk assessment considers four critical factors: economic impact, environmental consequences, operational disruption, and safety risks [8]. It’s equally important to assess the likelihood of failure. Different assets fail in different ways – electrical components might fail without warning, while structural elements tend to degrade gradually over time [8].

Operational criticality plays a major role in determining priorities. For instance, a communication system failure at a minor site might just be inconvenient, but the same issue at a critical hub could jeopardize safety and bring operations to a standstill [8]. Obsolescence risk also factors into the equation. If software is no longer supported, replacement parts are scarce, or repair costs exceed the price of a modern upgrade, those assets naturally climb higher on the priority list [8].

A great example of this method in action comes from the Virginia Department of Transportation (VDOT). Since 2018, VDOT has inspected ancillary structures like cantilevers, foundations, and poles every four years, assigning them ratings from "Good" to "Failed." This data informs separate prioritization strategies for structural components versus the technology they support [8]. By evaluating risk comprehensively, agencies can rank projects more effectively across their portfolios.

Using Multiple Criteria to Rank Projects

Once risks are assessed, the next step is ranking projects to guide investment decisions. Single-point estimates won’t cut it – you need to evaluate projects using weighted criteria that reflect organizational goals. Factors like cost, risk exposure, sustainability considerations, and compliance requirements should all influence the decision-making process.

One effective tool is a risk-adjusted ratio of Net Present Value (NPV) to investment. This method provides a clearer picture of which projects are likely to deliver value under real-world conditions [9]. To streamline this process, consider dividing your portfolio into three categories: fast-track projects that clearly exceed your benchmarks, projects to decline immediately because they don’t meet your cost of capital, and a middle tier that requires deeper analysis and trade-offs [9].

The numbers can be eye-opening. For example, a North American oil company analyzed its portfolio and found only a 5% chance of meeting base-case performance projections. They also discovered just a 5% chance of covering capital needs before the fourth year of a project [9]. Similarly, a Middle Eastern oil company evaluated a proposal with only a 25% chance of hitting baseline targets but a more than 90% chance of breaking even [9]. These insights shift conversations from simple yes-or-no decisions to meaningful discussions about managing risks and setting priorities.

Using Data to Improve Decisions

Effective prioritization hinges on integrating diverse data sources into predictive models. Combining historical performance records, manufacturer specifications, and real-time condition assessments leads to more accurate and informed forecasts [8]. This approach moves decision-making away from guesswork and toward evidence-based planning.

In 2019, the Nevada Department of Transportation demonstrated the power of data-driven strategies. They compared a proactive, interval-based maintenance approach for Dynamic Message Signs against a reactive "worst-first" method. The reactive strategy ended up costing nearly three times more per device annually [8]. Similarly, in 2018, Caltrans implemented a Transportation Management Systems Inventory Database. This tool tracks assets statewide, using installation dates and deterioration rates to predict when assets will shift from "Good" to "Poor" condition, enabling better replacement planning [8].

Building Information Modeling (BIM) takes data management a step further by standardizing as-built records. Contractors are required to submit detailed digital records, including manufacturer details, warranty periods, and maintenance recommendations. This standardized approach ensures agencies maintain accurate, long-term data to guide investment decisions [8].

| Approach | Activation Trigger | Ideal Use |

|---|---|---|

| Condition-Based | Performance monitoring/Condition triggers | Long-lifecycle assets (e.g., structural poles) |

| Interval-Based | Specific time intervals (Age-based) | Assets with predictable wear (e.g., batteries, filters) |

| Reactive | Asset failure or event | Low-risk assets or high-cost data environments |

| Reliability-Centered | Consequence of failure analysis | Complex integrated systems (e.g., communications) |

Managing Budget Limits While Maximizing Long-Term Returns

Creating Multi-Year Investment Plans

Crafting a multi-year investment strategy helps balance immediate priorities with long-term goals. A smart way to do this is through scenario modeling, which allows organizations to test various approaches. For example, you could explore the impact of increasing preventive maintenance spending by 10%, postponing a major replacement by two years, or speeding up energy efficiency upgrades.

When making these decisions, it’s important to focus on Total Cost of Ownership (TCO) rather than just the upfront price of new equipment. TCO takes into account factors like fuel or energy consumption, downtime, and specialized repair costs [2][10]. Organizations that use asset management software to track depreciation gain a clear signal for when it’s more economical to replace an aging asset rather than continue maintaining it [12]. The goal is to pinpoint the optimal moment – when the asset’s value is maximized, but before maintenance costs outweigh its usefulness [2][10].

Companies that leverage integrated software for asset, inventory, and maintenance management often see an average 20% reduction in both material costs and equipment downtime [10]. Regular audits can further identify underutilized assets, cutting unnecessary capital expenses [10]. This proactive, data-driven approach transforms budgeting into a strategic process that aligns spending with organizational priorities, setting the stage for comparing the costs of planned maintenance versus emergency repairs.

Preventive Maintenance vs. Emergency Repairs: Cost Comparison

Preventive maintenance is consistently more cost-effective than emergency repairs. Studies across multiple transportation agencies have shown that reactive maintenance typically costs twice as much as proactive strategies for assets like CCTV cameras and flow detectors [8].

"The longer a machine is out of service, the more it puts your project at risk." – Daniel Corbett, Equipment Manager, Lancaster Development [10]

Preventive maintenance minimizes disruptions by scheduling downtime in advance and reducing material costs. On the other hand, emergency repairs often lead to production delays and higher expenses for labor and parts [10]. Organizations with well-structured preventive maintenance programs benefit from longer equipment lifecycles and improved energy efficiency [11]. Automation plays a critical role here – using software to trigger maintenance alerts based on actual usage hours or mileage ensures timely interventions, avoiding errors that come with manual tracking [11].

Presenting Investment Options to Decision-Makers

The cost savings from preventive maintenance can be a strong foundation for presenting investment plans to stakeholders. To make a compelling case, focus on three critical aspects: ROI, risk reduction, and sustainability outcomes. Executives need to understand both the financial justification for spending and the risks of delaying action. These insights are essential for maintaining asset performance within tight budgets, which is a cornerstone of lifecycle investment strategies.

Using tools like risk-adjusted NPV ratios can help categorize projects into fast-track, decline, or middle-tier options for clear decision-making [9]. Including data on depreciation and condition assessments can highlight when assets are nearing the end of their economic life, making a strong argument for replacement over continued repairs [12].

Offer decision-makers multiple scenarios with varying budgets and timelines. For instance, show how a 5% budget increase could reduce emergency repair costs or how delaying a replacement by 18 months might affect overall lifecycle expenses. Interestingly, 55% of organizations that use asset tracking technologies report a positive ROI within the first year [10].

sbb-itb-5be7949

Connecting Asset Investments to Sustainability Goals

Tracking Energy Performance and Carbon Reduction

Incorporating energy performance metrics and carbon footprint modeling into asset investment strategies begins with pinpointing where the most impact occurs. Did you know that 75% of lifecycle costs – and the majority of environmental impact – happen during operation and maintenance? [13] This means decisions about repairs, upgrades, or replacements directly influence both budgets and carbon emissions.

Enter digital twin technology – a game-changer that allows you to simulate energy use and environmental effects before making any financial commitments [7]. Imagine creating a virtual model of a building’s HVAC system to test efficiency scenarios and forecast ROI before spending a dime. Pair this with IoT sensors that track temperature, vibration, and energy consumption, and you’ll have real-time data to identify inefficiencies before they snowball [19][7].

Taking a comprehensive approach to asset lifecycle management can slash total ownership costs by as much as 40% [13]. Organizations using predictive analytics to guide asset decisions report saving up to 30% more compared to those sticking to basic lifecycle strategies [13]. The secret? Tying energy data to your investment timeline. Knowing which assets guzzle energy and when they’ll need replacement helps prioritize upgrades that cut costs and emissions. This real-time focus on energy data lays the groundwork for meeting strict international standards.

Meeting ISO 55001 and ESG Requirements

Once you’ve gathered insights into energy performance, aligning your investments with global standards like ISO 55001 takes sustainability to the next level. This framework helps balance cost, risk, and performance while embedding sustainability into asset operations [20][6]. By adopting ISO 55001, organizations optimize asset management in a way that’s both financially and environmentally responsible. For businesses under growing scrutiny from investors and regulators, this alignment is no longer a "nice-to-have." Consider this: sustainable investments now account for one in every three dollars professionally managed in the U.S., amounting to approximately $17 trillion [14].

A standout example is CPP Investments. Between fiscal 2020 and June 2025, they integrated sustainability across their asset lifecycle, cutting their portfolio’s carbon footprint by 41%. They guided 28 portfolio companies – representing 25% of their emissions – through decarbonization assessments. Additionally, they exercised governance rights, casting 854 votes against directors who didn’t meet climate expectations during a three-year period ending June 2025 [16].

"We believe companies that effectively anticipate and manage material sustainability-related factors are better positioned to be more profitable and resilient over the long term." – Richard Manley, Chief Sustainability Officer, CPP Investments [16]

Meeting ESG requirements also involves tracking Scope 3 emissions, particularly in areas like "end-of-life treatment of sold products" and "purchased goods and services." Companies using software license tracking as part of their asset management strategies generated 12% less waste compared to those relying solely on reactive methods [6]. Adopting a reuse hierarchy – focusing on redeployment, resale, donation, and recycling – helps minimize landfill waste and lowers the carbon footprint tied to producing new equipment.

Weighing Sustainability Against Cost and Risk

Adding sustainability to the mix of cost and risk considerations requires a balanced approach. A weighted-scoring model can help integrate sustainability into the same decision-making framework used for financial and operational priorities [15]. For example, ask yourself: Does upgrading to energy-efficient lighting lower both utility bills and carbon emissions? Will delaying a boiler replacement lead to higher emergency repair costs and wasted energy?

Practices rooted in the circular economy – like repurposing, upcycling, and refurbishing – can extend the life of assets while reducing the need for new investments [17][18]. Retrofitting existing infrastructure with energy-efficient components often results in lower overall costs compared to full replacements, all while achieving meaningful carbon reductions [17]. For instance, the U.S. Department of the Interior, which manages a real property portfolio valued at $400 billion as of FY 2023, aims to stabilize infrastructure funding by increasing its operations and maintenance budget to 2% of the Current Replacement Value [20].

Sustainability investments deliver a triple win: reduced operating costs, minimized risks, and compliance with evolving regulations like the EU’s Corporate Sustainability Reporting Directive (CSRD) and Ecodesign rules. By adopting predictive maintenance and lifecycle planning, organizations not only extend the lifespan of assets but also ensure they’re ready to meet regulatory demands without scrambling for last-minute solutions.

Conclusion: Building a Cost-Effective Asset Strategy

Key Lessons from Lifecycle Investment Strategies

Extending the life of your assets doesn’t have to break the bank. By focusing on planned management, prioritizing risks strategically, and aligning with environmental goals, you can save significantly. Reactive maintenance, for instance, can cost anywhere from 3 to 10 times more than preventive measures – so planning ahead pays off [21].

A risk-based approach is essential. Direct your investments toward critical assets by assessing their operational importance, likelihood of failure, and overall cost of ownership. At the same time, keep sustainability front and center. By tracking energy usage and carbon emissions, you can meet ESG goals while cutting costs. The trick is finding the sweet spot between cost, risk, and environmental considerations for every decision.

How to Get Started

Putting these strategies into action starts with a clear plan.

First, conduct a portfolio audit. This involves collecting data on asset usage, maintenance history, performance, and current condition [21]. This inventory helps identify assets that are outdated, overly expensive to maintain, or ripe for optimization. With this information, you can pinpoint where targeted interventions will make the most impact and integrate risk and sustainability metrics into your strategy.

Next, use a risk framework to evaluate your assets. Tools like digital twins can simulate potential scenarios, helping you assess criticality and the impact of failures [2]. For critical assets, IoT sensors can provide real-time monitoring and enable predictive maintenance [2].

Finally, centralize all your data in a CMMS or Enterprise Asset Management platform. Moving away from manual spreadsheets ensures everyone involved has access to up-to-date information about asset health, maintenance costs, and investment priorities. A centralized system also streamlines operations – automating procurement alerts, standardizing maintenance schedules based on OEM guidelines, and generating audit-ready reports that comply with ISO 55001 and ESG standards. These steps not only safeguard your assets but also deliver measurable savings and efficiency gains.

Enabling Long-term Decisions: Asset Lifecycle Management

FAQs

How can organizations manage asset lifecycles to balance costs and sustainability effectively?

Organizations can manage costs effectively while supporting sustainability by taking a thoughtful approach to asset management. This starts with choosing equipment that’s well-suited for its specific purpose, sticking to manufacturer-recommended maintenance schedules, using high-quality spare parts, and ensuring operators are properly trained. These practices help avoid early equipment failures, cutting down on waste and unnecessary spending.

Leveraging data-driven tools, like asset management software, allows teams to shift from reactive fixes to preventive and predictive maintenance. This shift helps reduce emergency repair costs, prolongs the life of assets, and decreases environmental impact. Another key strategy is developing a risk-based replacement plan, which focuses on upgrades based on factors like total cost of ownership, expected service life, and environmental advantages. Regularly tracking costs and fine-tuning strategies ensures that organizations can meet their long-term sustainability goals without overstepping their budget.

How do digital twins and IoT sensors improve asset management while reducing costs?

Digital twins combined with IoT sensors give asset managers real-time data on equipment performance, making it easier to tackle potential problems – like unusual vibrations or temperature surges – before they escalate into expensive breakdowns. This approach not only cuts down on unplanned downtime but also reduces emergency repair costs and helps extend the lifespan of assets, saving money in the long run.

By creating a virtual model of physical assets, digital twins let managers test scenarios, forecast how long equipment will last, and fine-tune maintenance schedules. This results in better budget accuracy and fewer unnecessary replacements, striking a balance between reliability and cost control. On top of that, these tools empower managers to make risk-informed decisions and contribute to sustainability efforts by cutting down on waste and conserving resources.

What are the cost and lifespan differences between preventive and reactive maintenance?

Preventive maintenance (PM) offers a smarter, more cost-efficient way to manage assets compared to waiting for things to break down. By scheduling regular check-ups, routine servicing, and small fixes before problems escalate, PM keeps repair costs in check, reduces unexpected downtime, and ensures your workforce is used efficiently. Plus, it helps avoid sudden breakdowns, keeping operations running smoothly over the long haul.

On the flip side, reactive maintenance – fixing things only after they fail – can lead to hefty repair bills, extended downtime, and even compliance headaches. While it might seem like a cheaper option at first, the costs of emergency repairs and the wear and tear on assets can quickly add up, cutting into their lifespan. Taking a proactive approach not only saves money in the long run but also boosts asset reliability and performance.