ISO 55001:2024 introduces a clear, structured framework to help organizations make well-documented, risk-based asset investment decisions. It ensures every dollar spent aligns with measurable objectives and provides a transparent audit trail. Key updates include:

- Decision-Making Framework: Scalable for any organization size, linking investments to asset outcomes.

- Risk and Opportunity Separation: New sections focus on mitigating risks (6.1.2) and pursuing opportunities (6.1.3).

- Predictive Action: Encourages proactive strategies to address future challenges (10.3).

- Clear Resource Allocation: Investments must outline necessary funding, tools, and personnel (6.2.3).

- Data-Driven Decisions: reliable data supports asset lifecycle and efficiency and performance monitoring (7.6, 8.1).

To stay audit-ready, organizations should focus on robust documentation, integrate asset data into decisions, and ensure teams are trained in these methods. Regular reviews and performance monitoring help refine strategies over time. By following ISO 55001, businesses can balance cost, risk, and performance effectively while meeting regulatory expectations.

Requirements of Asset Management system | ISO 55001 Auditor Training

sbb-itb-5be7949

ISO 55001 Requirements That Impact Investment Decisions

ISO 55001:2024 lays out clear requirements to guide organizations in planning their asset investments. A key focus in Section 4.5 is on decision-making tied directly to asset outcomes, ensuring that every choice adds measurable value [1]. This framework is designed to work across organizations of all sizes, offering a consistent approach regardless of scale.

The standard emphasizes balancing cost, risk, and performance when planning investments [1]. Section 6.2.3 specifically highlights that objectives must be backed by resources, not just written down. As ISO expert Martin Kerr puts it, "The 2024 version makes it clearer that objectives need to be resourced, not just listed" [1]. This means every investment decision must outline the funding, personnel, and tools required to achieve specific results.

Life cycle management (Section 8.1) is central to these decisions, addressing all stages from initial demand to asset delivery and ongoing service [1]. Additionally, the standard differentiates between risk mitigation (Section 6.1.2) and opportunity pursuit (Section 6.1.3). This ensures organizations focus not only on preventing problems but also on seeking investments that deliver value.

How the Risk-Based Approach Works

ISO 55001 requires organizations to evaluate risks and opportunities before setting investment priorities. This process relies heavily on data, replacing guesswork with informed, evidence-based decisions. Section 7.6 emphasizes the importance of using reliable data and configuration management to support all investment planning [1]. This data-driven approach is effective even for infrastructure without real-time IoT sensors.

Under this approach, every dollar spent on asset investments must address either a clearly documented risk or a measurable opportunity. This creates a transparent audit trail, making it clear why specific projects receive funding [1]. Organizations are expected to assess how potential investments will impact their ability to meet asset management goals, balancing risks and opportunities effectively. ISO 55002:2018 underscores this point:

Transparent decision making becomes much clearer and apparent if you have a thorough understanding of the value created by your assets, and know how risk mitigation actions protect and expenditures support that value [3].

The 2024 update adds a new focus on "Predictive action" (Section 10.3), encouraging organizations to move from reactive fixes to proactive strategies. By anticipating risks and opportunities, investment plans can address future challenges rather than simply responding to existing problems.

This structured, risk-based approach helps organizations establish clear, actionable asset management objectives.

Setting Clear Asset Management Objectives

ISO 55001:2024 mandates that asset management objectives align with broader organizational goals and include measurable outcomes [1][2]. The Strategic Asset Management Plan (SAMP) serves as the bridge between high-level business goals and specific asset investments, detailing the necessary resources and strategies [5].

Objectives must clearly define what assets will deliver, when they will deliver it, and how performance will be measured. The standard’s emphasis on resourcing ensures that investment plans are practical and achievable, not just aspirational.

ISO 55002:2018 explains:

Decision-making criteria derived from your organization’s objectives and policies ensure that all decisions are consistent and transparent [3].

Auditors can trace every expenditure back to these documented objectives, verify the supporting data, and confirm that resources were allocated appropriately.

Using Continual Improvement to Stay Audit-Ready

Once objectives are set, ISO 55001’s continual improvement process (Section 10) ensures that investment plans stay relevant as conditions evolve. Regular reviews allow organizations to update objectives, reassess risks, and use performance data to shape future decisions. This approach prevents investment strategies from becoming outdated.

Organizations are required to monitor whether investments deliver the expected outcomes and adjust plans based on real-world performance. This feedback loop integrates lessons learned, ensuring that plans remain effective and audit-ready.

Close collaboration between financial and operational teams is essential for maintaining accurate data throughout this process [3]. By aligning financial and asset management functions, organizations can ensure that investment decisions reflect both operational priorities and financial constraints. Regular reviews keep investment portfolios adaptable to changing business needs and regulatory demands.

Creating an Audit-Ready Investment Framework

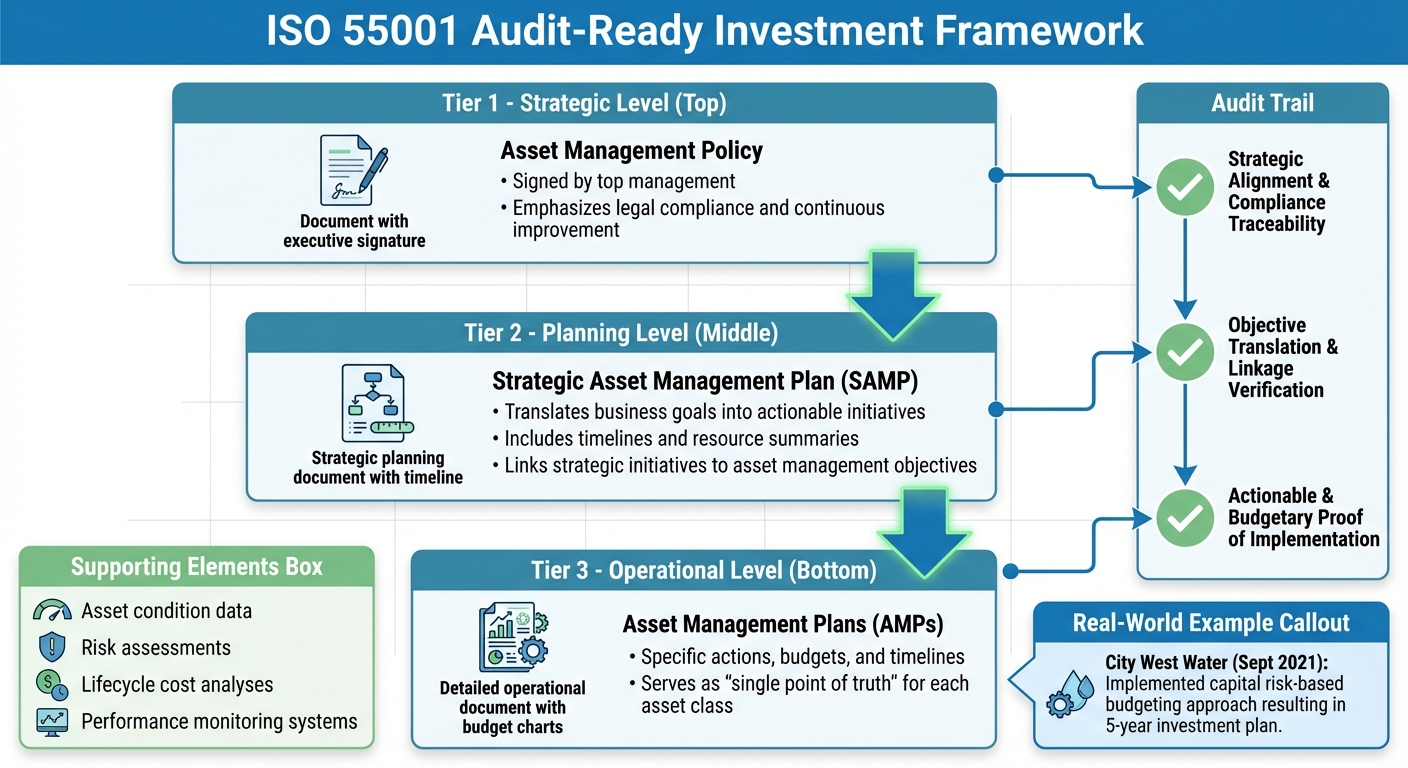

ISO 55001 Audit-Ready Investment Framework: 3-Tier Documentation Structure

If you want your risk-based asset investments to be ready for an audit, your framework needs to connect strategic documents, data analytics, and traceable decision-making processes. To achieve this, focus on three essential documents: a concise Asset Management Policy signed by top management, a Strategic Asset Management Plan (SAMP) that translates business goals into actionable initiatives, and individual Asset Management Plans (AMPs) that outline specific actions, budgets, and timelines. For instance, City West Water implemented a capital risk-based budgeting approach in September 2021, resulting in a 5-year investment plan aligned with its Asset Management Accountability Framework [8]. This structure lays the foundation for the detailed documentation and data integration discussed below.

An Asset Management Strategy serves as your decision-making blueprint, while the SAMP specifies the actions to be taken – complete with timelines and resource summaries – to ensure decisions align with the established criteria [5][8].

Creating and Maintaining Required Documentation

These core documents form the backbone of any audit-ready process. Start with an Asset Management Policy signed by senior leadership. This document should emphasize high-level principles like legal compliance and continuous improvement rather than operational specifics [6].

Engaging top management through workshops can reinforce their understanding and commitment to these principles.

The SAMP takes a more detailed approach. To ensure strong audit traceability, directly link every strategic initiative to a specific asset management objective. As outlined in ISO 55002:2018:

The SAMP details the asset management objectives, explains their relationship to the organizational objectives, and the framework required to achieve the asset management objectives [7].

Include clear summaries of operating and capital expenses to support each objective [1]. Regular reviews will help keep these documents aligned with the organization’s evolving needs [11].

Connecting Asset Data to Investment Choices

Once your documentation is in place, the next step is integrating robust data systems to connect asset performance with investment decisions. Asset condition data, risk assessments, and lifecycle cost analyses provide the evidence needed to justify each decision [1]. Use this data to identify performance gaps and document the budgets required in your AMPs [10]. When evaluating investment options, make sure your analysis covers the entire asset lifecycle – from acquisition to disposal [1][3].

Risk assessments should address threats and opportunities separately. The 2024 standard emphasizes distinct actions to minimize negative impacts while capturing opportunities that add value [10][1]. For each investment, clearly document the specific risk being mitigated or the opportunity being pursued, creating a transparent audit trail.

Scenario modeling can help you compare different investment paths. Be sure to document the selection criteria, which should align with your organizational objectives and policies. As ISO 55002:2018 notes:

Decision-making criteria derived from your organization’s objectives and policies ensure that all decisions are consistent and transparent [3].

Ensure financial systems and asset management systems are aligned, with close collaboration between finance and operations to maintain consistency [3]. This integration ensures that decisions are grounded in data and traceable from top-level objectives down to individual investments.

Making Investment Decisions Traceable

To create a clear and traceable decision-making process, establish a hierarchy where organizational objectives flow into the strategic asset management objectives outlined in your SAMP, which then inform the specific actions detailed in your AMPs [10][5]. Each level should explicitly reference the one above it, forming a seamless chain of justification.

For every investment, document the related asset management objective, the specific risk or opportunity being addressed, the lifecycle cost analysis, decision criteria, and allocated resources.

Using standardized formats and templates across all documents ensures consistency and simplifies audits. A compliance matrix can also help auditors quickly access information organized according to ISO 55001 requirements [9].

Maintain a "single point of truth" for each asset class by ensuring the AMP serves as the central repository for current performance data, identified risks, and required budgets [10]. This approach allows auditors to trace any expenditure back to a clearly defined organizational objective through a transparent documentation trail.

Resource Planning and Team Training for Compliance

To make audit-ready investment decisions, you need more than just thorough documentation – you also need capable teams and enough resources. The ISO 55001:2024 standard emphasizes this point, stating that achieving asset management objectives requires proper resourcing. Martin Kerr explains:

The planning considerations will help any organization reflect on the required resources which aligns to achieving a balance of cost, risk and performance. [1]

Your Asset Management Policy should include a clear commitment from top management to allocate the necessary funding, personnel, and technology. Without these resources, even the most well-documented plans can falter in an audit. Let’s explore how to assess and allocate resources effectively.

Providing Adequate Resources for Asset Management

Start by identifying the resources required to meet your asset management goals. The 2024 standard outlines five key resource categories:

- Human resources: Skills, expertise, and knowledge.

- Information: Data systems and their configuration.

- Financial: Both operating and capital budgets.

- Technological: Tools, software, or outsourced services.

- Organizational: Governance frameworks and decision-making structures [1].

A gap analysis can help you pinpoint where your organization falls short. For instance, if your team lacks tools for lifecycle cost optimization or if finance and operations rely on inconsistent data, these gaps need to be addressed to ensure audit readiness [3]. Closing these gaps not only strengthens your audit trail but also boosts operational efficiency.

The 2024 update also introduces a new focus on Knowledge (Section 7.7), recognizing that expertise within your team is a valuable asset [1]. To safeguard against the loss of knowledge due to staff turnover, plan for knowledge capture and transfer. Document decision-making criteria, create decision trees for recurring scenarios, and integrate individual expertise into your organizational processes. As Kerr points out:

Data and Information without context, insight and experience are of little value. The new section on Knowledge reminds organizations that tacit knowledge in individuals supports organizational knowledge. [1]

It’s also a good idea to reserve budget and workforce capacity for unexpected work, guided by risk assessments and historical data on adverse events [13].

Training Teams in Investment Planning Methods

Having resources is only part of the equation – your teams need the skills to use them effectively. Training should be tailored to different roles within the organization.

- Top management: Leaders need a foundational understanding of asset management principles to shape policies and make strategic decisions. Courses like the Institute of Asset Management‘s (IAM) Course A2 are designed for senior leadership [6].

- Technical staff and asset managers: These teams benefit from deeper training in areas like lifecycle cost optimization, risk analysis, and decision-making frameworks.

- Finance and procurement teams: Training should focus on aligning financial and non-financial data to support transparent, well-informed investment decisions [1][3].

- Operational teams: These teams should be trained in predictive action, a new concept in the 2024 standard that replaces preventive action, helping them adapt to risks and opportunities [1].

Training should be hands-on and interactive. For example, workshops can involve top management in developing the Asset Management Policy, ensuring they demonstrate real leadership and commitment [6]. A well-trained team, paired with strong documentation, is essential for audit readiness. Include the policy and its practical implications in onboarding programs so new employees understand how strategic goals influence daily operations.

External training programs, such as ISO 55001 implementation courses, provide additional support. These courses, priced at approximately $2,047.50 for comprehensive training and $1,075.50 for foundational sessions, help standardize knowledge across your organization while generating training records that can serve as audit evidence [6].

Monitoring Performance and Improving Investment Decisions

Once you’ve allocated resources and trained your teams, the next step is keeping a close eye on how those investments perform. ISO 55001:2024 emphasizes the importance of regularly reviewing risks, opportunities, and how effective your decisions have been [1][12]. By monitoring performance, you can identify what’s working and what isn’t, which helps shape better decisions moving forward. The 2024 standard introduces a shift from "preventive action" to "predictive action" (Clause 10.3). This means using data about risks and opportunities to refine your strategies, rather than simply reacting to failures [1][12]. To make this happen, you’ll need tracking systems that not only measure outcomes but also identify their causes.

Setting Up Performance Monitoring Systems

To effectively monitor performance, an Asset Management Information System (AMIS) can be invaluable. It integrates data from tools like CMMS, ERP, and EAM systems, ensuring that financial and operational data are aligned [3]. This alignment is crucial because auditors will scrutinize any inconsistencies between financial reports and operational records. Misalignment can raise serious concerns during audits.

Focus on metrics that directly tie to your asset objectives. Key examples include uptime, unplanned maintenance rates, and health indicators for critical assets. These metrics can reveal patterns before failures occur. For instance, if unplanned maintenance is rising for a particular asset class, it may signal the need to rethink your investment strategy for those assets.

The 2024 standard also places a strong emphasis on decision-making as a core capability (Clause 4.5). Your monitoring system should not only track asset performance but also evaluate the outcomes of your investment decisions. For example, did a $500,000 HVAC upgrade deliver the energy savings you expected? Did a new maintenance schedule actually extend the life of your equipment? Documenting these results shows that your organization is capable of making informed, data-driven decisions. As ISO 55002:2018 points out:

The ability to make informed decisions quickly, rigorously and with the appropriate performance evaluation is the core of asset management. [3]

To ensure your performance metrics are meaningful, define what "value" means for your stakeholders early in the process, following ISO 55002 guidelines. For example, a transit authority might prioritize passenger safety and punctuality, while a manufacturing plant might focus on maximizing production uptime and energy efficiency. By aligning metrics with strategic goals, you create a clear connection between performance data and decision outcomes, which sets the stage for actionable audit feedback.

Using Audit Feedback to Improve Planning

Audit feedback is a powerful tool for refining your asset management framework. When auditors identify gaps – whether in data quality, documentation, or decision-making processes – use those findings to strengthen your system. The aim is to create a data feedback loop, where audit insights continually improve the data and processes that inform your investment decisions [14].

One effective method is conducting a planned-versus-actual reconciliation. This compares budgeted costs with actual facility operations to uncover any discrepancies [14]. For instance, if maintenance costs are consistently higher than expected for a specific asset class, dig deeper to find the root cause. Is it due to poor initial estimates, insufficient preventive maintenance, or even data entry errors?

Management reviews should incorporate audit findings to adjust strategies based on both risks and opportunities. The 2024 standard highlights that risks and opportunities are mutually supportive – addressing one often impacts the other [1]. Use audit feedback to fine-tune your Strategic Asset Management Plan (SAMP), ensuring it includes clear, actionable objectives that are fully resourced rather than theoretical wish lists [1].

A real-world example comes from the United States Air Force, which implemented a Mission Dependency Index (MDI) solution in 2018. By using an operational readiness risk matrix, they calculated MDI values for various functions at specific locations. This allowed them to prioritize maintenance and investment projects based on mission-critical needs, ensuring that decisions were directly tied to operational priorities [14].

Audit feedback also helps shift your approach from reactive to predictive. Martin Kerr explains:

Predictive Action can be anything that seeks to adapt changes internally, externally based on risk and opportunity, services and/or assets. [1]

For instance, if audits show that certain assets consistently fail earlier than expected, update your aging models and adjust replacement schedules. This proactive approach not only boosts asset performance but also demonstrates your organization’s commitment to continuous improvement.

Conclusion

The principles of ISO 55001 reshape how organizations make asset investment decisions by ensuring every expenditure is transparent, consistent, and aligned with strategic goals [1][3]. The 2024 edition’s emphasis on separating risks from opportunities further refines this process, enabling investments that both address potential threats and unlock new avenues for growth [1][12].

By documenting decision-making criteria, organizations create a clear, traceable record that links strategic objectives to project approvals – offering more than just audit compliance. As ISO 55002:2018 explains:

Decision-making criteria derived from your organization’s objectives and policies ensure that all decisions are consistent and transparent. [3]

This approach is not just theoretical; it has been successfully applied in practice. For example, Network Rail manages alignment with ISO 55001 across its vast infrastructure – 20,000 miles of track and 30,000 bridges – through a unified asset modeling system. This system ensures that strategic decisions are directly tied to expenditure, providing a solid foundation for proactive, rather than reactive, management [4].

The 2024 standard’s shift toward predictive action marks a significant evolution in asset management. Instead of focusing solely on preventing failures, organizations are now encouraged to leverage data to refine strategies in response to emerging risks and opportunities. When combined with thorough documentation and lifecycle management, this forward-thinking approach establishes a sustainable framework that delivers value over the long term while meeting regulatory demands [13]. It seamlessly connects strategic planning with day-to-day operations, reinforcing the core principles discussed throughout.

Structured investment frameworks, when paired with a predictive mindset, go beyond optimizing budgets. They help reduce avoidable expenses, improve service reliability, and ensure that every dollar spent directly supports the organization’s strategic objectives [13]. Aligning with ISO 55001 creates a resilient decision-making system that not only withstands scrutiny but also drives continuous improvement.

FAQs

How does ISO 55001:2024 help improve asset investment decisions?

ISO 55001:2024 offers a structured, risk-focused framework designed to align asset investment decisions with an organization’s goals and long-term value objectives. By separately assessing risks and opportunities, it enables more informed and transparent choices.

Adopting ISO 55001:2024 helps organizations boost asset performance, lower lifecycle costs, and meet regulatory and audit standards. This approach promotes accountability at all levels, supports sustainable practices, and ensures investments deliver maximum value.

How does predictive action enhance decision-making in ISO 55001 asset management?

Predictive action plays a crucial role in enhancing decision-making under ISO 55001 by spotting risks and opportunities before they arise. This forward-thinking strategy allows organizations to foresee potential challenges, fine-tune maintenance processes, and make informed investment choices. All of this aligns seamlessly with the standard’s emphasis on risk-based decision-making and ongoing improvement.

When companies adopt predictive actions, they can cut down on downtime, save on costs, and extend the useful life of their assets. Beyond meeting audit requirements, this approach contributes to long-term reliability and efficiency, creating a resilient asset management system that supports sustainable operations.

How can organizations prepare their asset management systems for audits?

To get your asset management systems audit-ready, it’s crucial to build a solid framework that aligns with ISO 55001 principles. Start by clearly defining your asset management goals, processes, and responsibilities. This ensures operations are both transparent and consistent. Also, detailed documentation – like policies, strategies, and procedures – plays a vital role in showcasing compliance and readiness for audits.

Adopting a risk-based decision-making approach is another key step. This means identifying potential risks and opportunities related to asset performance and addressing them proactively. Such an approach not only meets audit requirements but also supports better management practices. Regular internal audits and a focus on continuous improvement will further enhance compliance and help you optimize asset performance while managing lifecycle costs effectively.