ISO 55001 can simplify your compliance with EU building regulations. The updated Energy Performance of Buildings Directive (EPBD) mandates stricter energy efficiency and carbon reduction measures for infrastructure and buildings across the EU, with key deadlines approaching between 2026 and 2030. Here’s how ISO 55001 helps:

- Regulatory Compliance: Aligns asset management with legal requirements, including energy audits, zero-emission standards, and carbon reporting.

- Energy Efficiency: Provides a framework for reducing energy use and emissions, supporting EPBD goals like renovating low-performing buildings.

- Risk Management: Introduces a lifecycle-based, risk-focused approach to investment decisions, ensuring proactive compliance and cost control.

- Data Governance: Ensures accurate, centralized asset data for audits, energy performance certificates, and reporting.

With ISO 55001, organizations can meet EU regulations while improving asset performance and reducing financial risks. Deadlines like the May 29, 2026, EPBD transposition and 2030 zero-emission building standards make early adoption critical.

Key Principles of ISO 55001 Standard

EU Regulations and Compliance Deadlines

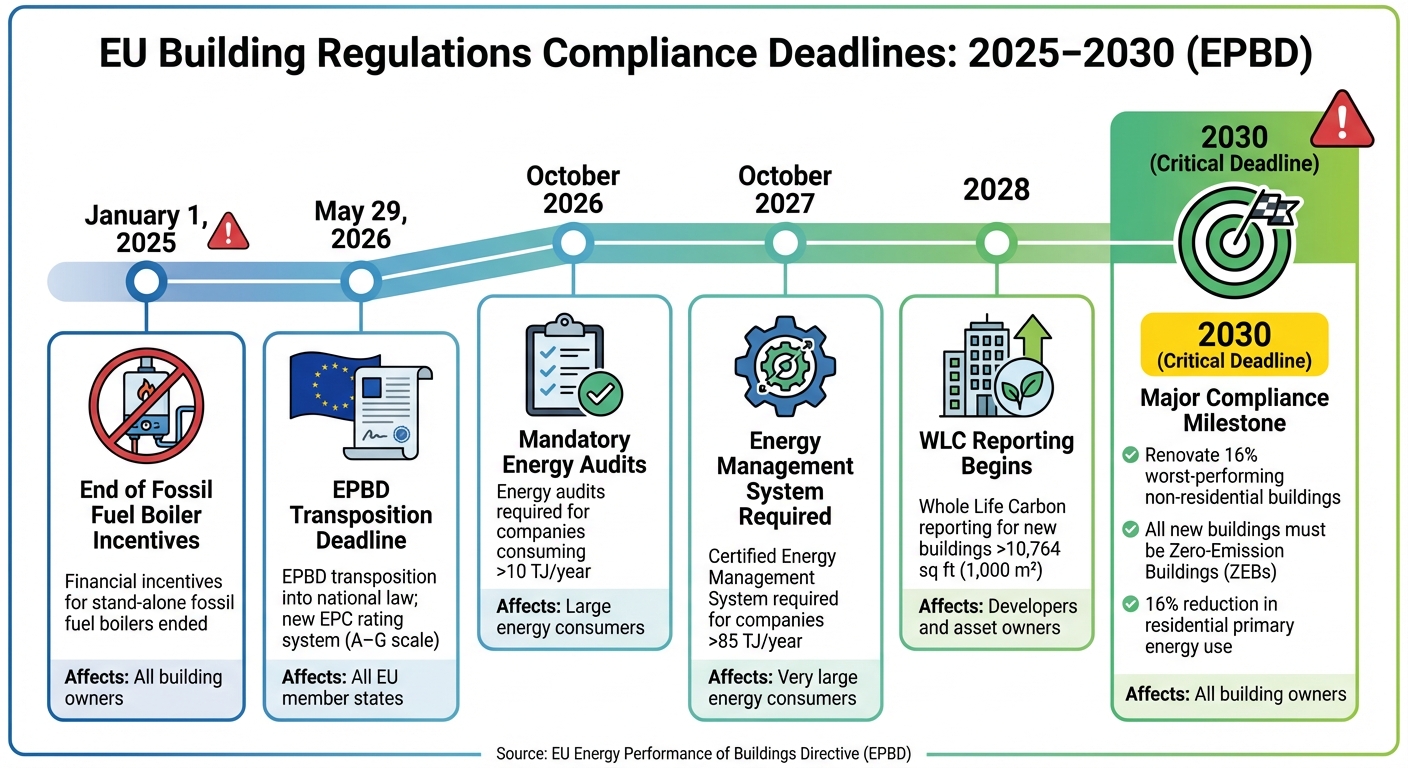

EU Building Regulations Compliance Timeline 2025-2030

EU regulations require prompt action to avoid penalties, financial setbacks, and potential asset devaluation. Enforcement will be managed by national authorities, meaning specific penalties and compliance measures may differ across countries but remain legally binding throughout the EU.

These deadlines emphasize the importance of adopting strong asset management practices. They highlight the need for a structured approach to asset management, aligning with ISO 55001 principles.

Required Actions and Timeline (2026–2030)

Several key deadlines loom on the horizon. Financial incentives for stand-alone fossil fuel boilers ended on January 1, 2025 [2]. By October 2026, companies consuming more than 10 TJ annually must complete independent energy audits. By October 2027, organizations consuming over 85 TJ annually are required to implement a certified energy management system [7].

The 2030 deadline is particularly critical. Non-residential property owners must renovate the poorest-performing 16% of buildings by that year [2][6]. Residential buildings must achieve a 16% reduction in average primary energy use, with at least 55% of this reduction coming from upgrades to the worst-performing properties [2]. Additionally, all new buildings must meet Zero-Emission Building (ZEB) standards by 2030, while public buildings face a 2028 compliance deadline [9]. Starting in 2028, new buildings over 10,764 square feet (1,000 m²) must report Whole Life Carbon (WLC) emissions, with this requirement expanding to all new buildings by 2030 [6][9].

| Deadline | Requirement | Who It Affects |

|---|---|---|

| January 1, 2025 | End of financial incentives for stand-alone fossil fuel boilers [2] | All building owners |

| May 29, 2026 | EPBD transposition into national law; new EPC rating system (A–G scale) [2][9] | All EU member states |

| October 2026 | Mandatory energy audits for companies >10 TJ/year [7] | Large energy consumers |

| October 2027 | Certified Energy Management System required for >85 TJ/year [7] | Very large energy consumers |

| 2028 | WLC reporting for new buildings >10,764 sq ft (1,000 m²) [6][9] | Developers and asset owners |

| 2030 | Renovate 16% worst-performing non-residential buildings; all new buildings must be ZEBs [2][6][9] | All building owners |

These deadlines provide a clear roadmap for making informed investment decisions and managing asset data effectively, both of which are essential components of a well-executed ISO 55001 strategy.

What Happens If You Don’t Comply

Missing these deadlines can lead to serious consequences. Non-compliance results in heavy fines and operational disruptions. For instance, buildings that fail to meet ZEB standards may face rent restrictions, significantly impacting revenue [2]. Properties that lag behind in energy efficiency risk becoming stranded assets, losing their market value [2].

The European Commission reviews progress every five years. If national efforts fall short, it can issue formal recommendations to member states [5][6]. At an organizational level, non-compliance could lead to fines, restricted market access, or mandatory inspections by national authorities [7][8]. Furthermore, failing to provide valid Environmental Product Declarations (EPDs) or updated Energy Performance Certificates (EPCs) might result in invalid CE markings, which could block opportunities to sell or lease properties [7][8].

How to Use ISO 55001 for Regulatory Compliance

Aligning your asset management strategies with ISO 55001 can simplify regulatory compliance and reduce risks. The framework bridges high-level regulatory goals with daily operational decisions across teams in maintenance, finance, and leadership. A key update in the 2024 version (Section 4.5) introduces a scalable decision-making process to support this alignment [3].

To embed compliance into your operations, integrate it directly into your Strategic Asset Management Plan (SAMP). According to Section 6.2.1 of the standard, you need to document how your asset management objectives support your broader organizational goals [3][10]. For example, under EU regulations, this could mean setting clear targets like reducing energy consumption or improving building efficiency. Be specific about the assets, budgets, and timelines required to achieve these targets. This approach naturally leads to the next step: creating effective governance policies.

Setting Up Governance and Asset Management Policies

Start by defining asset value in terms of energy efficiency, longevity, and risk management. ISO 55002:2018 highlights the importance of understanding the value your assets provide and how expenditures protect that value:

"Transparent decision making becomes much clearer and apparent if you have a thorough understanding of the value created by your assets, and know how risk mitigation actions protect and expenditures support that value." – ISO 55002:2018 [10]

When crafting your asset management policy, address sustainability requirements explicitly. The updated 2024 standard separates "Risk" (Section 6.1.2) from "Opportunity" (Section 6.1.3), emphasizing the need to manage both climate-related threats and emerging opportunities, such as renewable energy integration or carbon credit access [3]. Establish a governance structure with clear roles for tracking regulatory deadlines, managing energy data, and coordinating efforts across finance, engineering, and sustainability teams.

Data governance is another critical component. Section 7.6 of the standard calls for standardized asset information, which is essential for meeting EU reporting requirements like whole-life carbon assessments. This means consistently documenting details such as asset characteristics, energy usage, renovation history, and component conditions across your portfolio.

Making Risk-Based Investment Decisions

ISO 55001 emphasizes lifecycle management (Section 8.1) as the cornerstone of decision-making, covering everything from acquisition to disposal [3]. This approach aligns with EU directives by prioritizing long-term durability and circular economy principles over short-term cost savings.

Use the standard’s risk framework to guide investment decisions, focusing on regulatory requirements and financial exposure. For instance, identify high-risk buildings that need immediate attention and quantify the financial impact of delaying necessary actions. Treating end-of-life risks as financial liabilities can help justify targeted refurbishments. Research shows that such refurbishments can reduce total ownership costs by 22% compared to age-based replacement strategies [12].

"Make tradeoffs explicit, quantify total cost of ownership and take a risk-based approach to prioritization – not simply one based on age or condition." – Philippe Jetté, Product Manager, Asset Investment Planning, IBM [12]

Incorporate Climate Vulnerability and Risk Assessment (CVRA) methodologies into your planning process, as recommended by EU technical guidance [11]. Conduct scenario analyses to evaluate different investment strategies and their ability to meet regulatory and sustainability requirements. The 2024 standard’s "Predictive Action" requirement (Section 10.3) encourages proactive planning to adapt to evolving risks and opportunities [3]. These informed decisions can lead to more efficient expenditure planning throughout the asset lifecycle.

Optimizing CAPEX and OPEX Over the Asset Lifecycle

ISO 55001 promotes balancing capital (CAPEX) and operational (OPEX) expenses by ensuring that asset management objectives are properly resourced to achieve the best mix of cost, risk, and performance [3]. This balance is key for meeting ongoing EU energy management requirements.

"When we talk about minimizing lifecycle costs, we’re including risks as well." – Philippe Jetté, Product Manager, Asset Investment Planning, IBM [12]

Integrate financial and operational data to align spending with regulatory goals [10]. While deferring replacements might save money upfront, it can lead to higher preventive maintenance costs and increased risks over time [12].

A rolling planning cycle of 12 to 18 months, with quarterly updates based on real-world data like failure rates and energy performance, can help keep your investment plans aligned with both budgetary limits and evolving EU regulations [12]. The European Commission’s technical guidance also highlights the importance of circular economy principles and material durability for climate resilience [11]. When evaluating CAPEX options, consider not just the initial cost but also factors like the asset’s lifespan, repairability, and end-of-life disposal. This approach ensures you meet sustainability goals while optimizing long-term costs.

Creating a Centralized Asset Data System

When working within ISO 55001’s risk-based approach, having a centralized asset data system becomes a cornerstone of compliance. To meet EU requirements, you need a clear understanding of your assets – what they are, their current condition, and how they perform. Without such a system, creating reports, conducting risk assessments, and justifying investments to regulators can become a major challenge. ISO 55001:2024 emphasizes the importance of data configuration as a critical decision-making tool [3]. A robust asset management system should integrate the planning, coordination, and improvement of asset-related activities [1].

However, building this system isn’t just about collecting random data. It demands standardized, organized information that connects technical, financial, and performance insights. ISO 55001 breaks this into two categories: raw data (Section 7.6) and the insights drawn from it (Section 7.7), which also include the expertise your teams have accumulated over time [3]. This distinction is crucial because compliance audits require both documented evidence and the reasoning behind your operational decisions.

Asset Data Required for EU Compliance

EU regulations call for more than just a traditional asset register. They demand detailed information, including climate risk assessments and energy/emissions metrics [13]. Start by conducting climate vulnerability and risk assessments to evaluate how well your buildings can withstand climate change [13]. This includes compliance with European structural design standards and resilience ratings, which aid in risk-based investment planning.

The second key area is energy and emissions data. Accurate records of energy efficiency, emissions, and performance metrics are necessary to align with EU reduction targets [13]. For buildings governed by the Smart Readiness Indicator (SRI), organize data into technical domains such as heating, cooling, ventilation, lighting, electricity, and electric vehicle charging [14]. Each domain requires detailed functionality levels for systems like emission control, energy storage, generation, and monitoring.

The SRI methodology also allows you to use Building Information Models (BIM) or digital twins to determine smart readiness scores. These scores, expressed as a percentage, measure the ratio between a building’s current smart capabilities and its maximum potential [14]. Your centralized data system should also monitor impact criteria, including energy efficiency, maintenance and fault prediction, comfort, health, and energy flexibility [14].

| EU Regulatory Data Category | Required Data Points |

|---|---|

| Heating & Cooling | Emission control, energy storage, and generation efficiency [14] |

| Ventilation | Occupancy-based air flow control, air quality sensor data [14] |

| Electricity | Monitoring renewable energy generation, storage capacity [14] |

| EV Charging | Grid connectivity, charging status updates [14] |

| Building Automation | System interoperability, monitoring capabilities [14] |

These requirements set the groundwork for leveraging digital tools to simplify data collection and management.

Digital Tools for Collecting and Managing Asset Data

Several organizations have implemented advanced tools to centralize and manage asset data effectively. For instance, IPTO in Greece introduced an Asset Performance Management System in 2023, transitioning from time-based to condition-based maintenance by using monitoring systems to assess asset criticality and potential failure points [15]. Similarly, RTE in France launched ReLife in 2022, an open-source Python library that calibrates statistical models to predict failure probabilities and optimize asset management plans, balancing costs and risks [15]. In Slovenia, ELES established its Diagnostics and Analytics Centre in 2018, integrating big data, advanced analytics, and digital twins to enhance vegetation management and predictive maintenance for high-voltage infrastructure [15]. These examples highlight how centralized systems can meet the asset data requirements while aligning with ISO 55001 principles.

When selecting tools, prioritize interoperability. Your system should support data exchange formats like COBie (Construction Operations Building information Exchange) and APIs to ensure seamless data sharing across suppliers [17]. Use unique identification methods such as barcodes or tags for precise asset tracking and linking to maintenance histories [17]. Adopting industry-standard classifications like Uniclass or RICS NRM 3 ensures consistency across departments and software platforms [17].

For regulatory reporting, platforms like the GRESB Portal offer frameworks to comply with the EU Sustainable Finance Disclosure Regulation (SFDR) and Principal Adverse Impacts (PAIs). These tools manage datasets valued at nearly $9 trillion across thousands of real estate portfolios and infrastructure assets [16]. Establish change control procedures with documented logs for any modifications to asset data, ensuring your system remains audit-ready [17]. Also, ensure you retain ownership of your asset data, even if a third-party supplier manages it, so you have real-time access during audits [17].

"Configuration is a key capability for any organization and a basis for decision-making, data and information support both." – ISO 55001:2024 [3]

sbb-itb-5be7949

Building Multi-Year Investment Plans That Meet Carbon and Risk Goals

A solid multi-year investment strategy is essential for converting regulatory requirements into actionable steps, and it all starts with leveraging your centralized asset data. This data can guide the development of long-term plans aimed at cutting emissions, addressing climate risks, and maintaining service standards. Unlike annual budgets, EU regulations demand multi-year strategies that clearly outline how you’ll achieve these goals.

Shift your focus from reactive spending to strategic lifecycle planning. Consider the entire journey of your assets – from acquisition to disposal – by factoring in both initial costs and long-term expenses. Create a roadmap that aligns with regulatory and performance expectations.

How to Prioritize Investments Under EU Requirements

Begin with a Climate Vulnerability and Risk Assessment (CVRA) to pinpoint buildings and infrastructure at the highest risk from climate-related events [11][13]. This assessment helps prioritize which assets need immediate upgrades for resilience and which can be deferred. EU technical guidance emphasizes using CVRA methodologies to ensure your budget is directed toward the most critical needs first [11].

When prioritizing investments, aim for projects that tackle multiple goals at once. For instance, upgrading HVAC systems can enhance energy efficiency, lower carbon emissions, and improve climate resilience. Incorporate circular economy principles by choosing durable materials that extend asset lifespans while minimizing carbon impact over time [11].

Adopt a risk-based decision-making approach to rank projects by their criticality. Focus on assets with a high likelihood of failure and severe consequences, even if they’re not the oldest or most noticeable. This method, central to ISO 55001, allows you to base budget requests on measurable risk data instead of subjective opinions [4].

Testing Budget Scenarios and Their Impact

Modeling budget scenarios is crucial for understanding trade-offs. Lifecycle cost analysis plays a key role here – look beyond upfront costs and evaluate the total cost of ownership [19]. A lower initial investment might lead to higher operational expenses and greater carbon emissions in the long run, while a larger upfront spend could reduce both operational costs and environmental impact.

Use the Five Core Questions Method to structure your scenario testing: What assets do you have? What condition are they in? What service levels are required? What actions are necessary? What budget is available? [19]. This systematic approach helps identify gaps between current asset conditions and performance goals, enabling you to assess how different funding levels bridge those gaps.

For compliance with EU regulations, align your scenario modeling with Principal Adverse Impact (PAI) indicators under the Sustainable Finance Disclosure Regulation (SFDR) [16]. These indicators – such as greenhouse gas emissions, carbon footprint, and energy performance – allow you to measure and compare the environmental impact of various budget options. Evaluate each scenario against both financial outcomes and carbon reduction targets to strike the right balance.

Once your budget scenarios are defined, integrate sustainability measures directly into your capital planning.

Adding Renewable Energy and Carbon Reduction to Your Plan

Incorporate renewable energy and carbon reduction initiatives into your Strategic Asset Management Plan (SAMP) [18]. Treat sustainability goals with the same level of importance as maintenance and replacement schedules. This approach complements your lifecycle strategy by aligning renewable energy projects with asset durability and resilience objectives. Start with a resource-gap analysis to identify the funding, personnel, and equipment needed for renewable energy transitions [18].

When planning renewable energy installations, use ISO 50001 (Energy Management Systems) alongside ISO 55001 to create a unified framework for managing both energy efficiency and asset performance [4]. This ensures that capital investments improve reliability while simultaneously cutting energy use and carbon emissions.

In 2015, Dong Energy (now Ørsted), the world’s largest offshore wind company, became ISO 55001 certified for its offshore wind assets. The certification helped standardize asset management workflows, ensuring optimal long-term use and enabling risk-based decision-making for renewable energy infrastructure [18]. As Dong Energy explained:

"Standardising its asset management workflows and processes will ensure them optimal long-term asset utilization and enable risk-based decision-making" [18].

Set clear milestones for renewable energy projects within your multi-year plan [18]. Use performance indicators to track "Planned vs. Actual" results in energy savings and carbon reduction [18]. This proactive monitoring helps identify performance gaps early, allowing you to adjust strategies before missing regulatory deadlines. Finally, establish preventive measures to address potential issues that could disrupt your carbon reduction timeline [18].

Getting Ready for Audits and Regulatory Reports

EU audits are a given, so it’s essential to have an asset management system that can clearly demonstrate your carbon targets, risk controls, and the data driving your investment decisions.

Creating Audit-Ready Documentation

A solid starting point is your Strategic Asset Management Plan (SAMP). This document needs to clearly define what’s part of your Asset Management System and what isn’t. It should also explain how your asset objectives align with your organization’s broader policies [18][10]. To satisfy auditors, you’ll need at least three months of operational history, including internal audits and management reviews [22].

Your documentation should cover critical areas like context, leadership, planning, support, operations, performance, and improvement [18][22].

Ensure your financial and non-financial data align. For instance, if your CAPEX records show $2 million spent on HVAC upgrades, your energy savings reports should reflect the expected drop in kWh usage and carbon emissions. Auditors will be looking for this consistency to confirm your decisions are both transparent and defensible [10]. As ISO 55002 points out:

"The ability to make informed decisions quickly, rigorously and with the appropriate performance evaluation is the core of asset management" [10].

For large infrastructure portfolios, investing in automated data collection systems can save you a lot of time. A great example is Montenegro’s 2021 deployment of the Smart Grid Manager application at its national dispatching center. This system automatically collects and archives data from sources like power generation and meteorology, creating a ready-to-use audit trail for reporting and analyzing events [15].

When submitting extensive documents for regulatory review, include evidence cover pages. These should clearly index where specific evidence can be found, complete with page numbers and publication dates. For documents in other languages, provide a detailed English summary with clear references to how regulatory requirements are addressed [21].

Once your documentation is ready for audits, the next step is ensuring your energy and carbon reporting meets regulatory expectations.

Reporting Energy and Carbon Progress to Regulators

Your reports should directly connect investment decisions to measurable energy and carbon outcomes. Track the "Planned vs. Actual" performance for each energy and carbon reduction project [18]. For example, if a building retrofit was expected to cut energy use by 15% but only achieved 10%, document the reasons for the shortfall and outline corrective actions.

The updated ISO 55001:2024 standard places a strong emphasis on "Data and Information" (Section 7.6), which serves as the backbone for decision-making. A well-organized repository for energy and carbon metrics ensures everyone is working with verified data, making regulatory reporting much simpler. The standard also introduces "Predictive Action" (Clause 10.3), requiring documentation on how you’re responding to changes like evolving EU carbon regulations, using risk and opportunity data [3].

For ESG reporting frameworks such as GRESB, which covers $8.8 trillion in assets under management, standardized reporting aligned with management system principles is crucial [21]. Your reports should clearly separate risks (like carbon taxes) from opportunities (like renewable energy incentives) in management reviews to show a proactive approach to compliance [3].

Obtaining third-party certification to ISO 55001 adds an extra layer of credibility to your reports. According to DNV:

"Certification to ISO 55001 by an independent third-party verifies how your asset management system is performing and demonstrates your work in applying effective management principles" [20].

This certification remains valid for three years, with annual surveillance audits and a recertification process every three years [22]. It confirms your compliance with legal, operational, and regulatory requirements, giving regulators confidence that your reported progress is supported by verified processes [18].

Conclusion

ISO 55001 provides a structured approach to help organizations meet EU compliance requirements while achieving both financial savings and environmental benefits. By aligning investment choices with regulatory goals, the standard helps reduce carbon emissions, extend the lifespan of assets, and maintain audit-ready documentation. As stated in the standard:

"This International Standard is primarily intended for use by… internal and external parties to assess the organization’s ability to meet legal, regulatory and contractual requirements" [3].

The 2024 update builds on this framework, introducing practical enhancements. For instance, the new focus on data and information management (Section 7.6) ensures reports are backed by verified evidence. Additionally, the inclusion of predictive action (Section 10.3) empowers organizations to anticipate and address regulatory changes before they escalate into compliance issues [3].

Organizations already implementing these principles have seen tangible results. AES Tiête in Brazil, for example, reduced unplanned shutdowns by 75% and cut insurance costs by 14%. Similarly, ISA in Colombia achieved a 40% reduction in maintenance expenses and an 80% drop in energy not supplied, translating into $40 million in benefits over five years [24]. These successes highlight how effective asset management not only supports compliance but also enhances financial performance.

The framework’s scalability is another key advantage. Whether you’re managing a single facility or a nationwide infrastructure network, ISO 55001 provides a consistent method to balance cost, risk, and performance throughout the asset lifecycle [10]. For organizations already certified under ISO 55001:2014, the deadline to transition to the 2024 version is May 1, 2027 [25].

For those new to the standard, it offers a straightforward roadmap: develop a Strategic Asset Management Plan (SAMP), organize and align critical data, and connect organizational goals to asset management decisions [23]. This structured approach ensures compliance, minimizes risk, and supports sustainable, long-term success.

FAQs

How does ISO 55001 help meet EU energy efficiency requirements for buildings?

ISO 55001 provides building owners and managers with a clear framework to align with the EU’s Energy Performance of Buildings Directive. It focuses on optimizing energy use, managing risks effectively, and planning investments wisely across the entire lifecycle of an asset.

By applying the principles of ISO 55001, organizations can develop data-backed strategies to lower energy usage, prolong the life of their assets, and meet regulatory requirements. This approach helps strike the right balance between operational performance and long-term sustainability, all while ensuring readiness for audits.

What are the key deadlines for complying with EU building regulations, and how can ISO 55001 help?

The European Climate Law and the 2030 climate targets are shaping the timelines for EU building regulations. These initiatives aim to cut carbon emissions and drive sustainability efforts. While exact deadlines can differ depending on the country or specific projects, the primary objectives are clear: make significant strides by 2030 and achieve net-zero emissions by 2050.

One tool that can help organizations meet these ambitious goals is ISO 55001. This framework provides a structured approach to asset management, focusing on key areas like risk-based planning, lifecycle management, and continuous improvement. By implementing ISO 55001, building and infrastructure owners can better optimize their assets, anticipate compliance requirements, and stay aligned with regulatory timelines – all while contributing to long-term sustainability efforts.

How does ISO 55001 improve asset data management for EU regulatory compliance?

ISO 55001 plays a key role in helping organizations manage asset data effectively by introducing structured and dependable practices. These practices are designed to ensure compliance with EU regulations, focusing on the need for accurate, complete, and reliable data, which is critical for fulfilling reporting obligations.

The standard pushes organizations to establish clear procedures for data quality, governance, and security. It incorporates risk-based decision-making frameworks, ensuring that asset information remains transparent, easily accessible, and aligned with regulatory expectations. This method not only makes audits smoother but also simplifies adherence to EU infrastructure and building regulations.