Managing public sector assets is a growing challenge. Aging infrastructure, funding gaps, and fragmented systems are putting pressure on cities to deliver essential services while maintaining public trust. ISO 55001 offers a structured approach to address these issues, focusing on transparency, accountability, and risk-based planning. Here’s what you need to know:

- The Problem: U.S. cities face massive maintenance backlogs and funding shortages. For example, Portland’s annual infrastructure funding gap grew to $1 billion in 2025, with 25% of assets in poor condition.

- Why It Matters: Transparency builds trust, while accountability ensures resources are used efficiently. Without it, skepticism grows, and long-term planning takes a backseat to short-term fixes.

- The Solution: ISO 55001 promotes unified asset management strategies, risk-based investment planning, and data-driven decisions, helping agencies prioritize projects and communicate effectively with stakeholders.

This article explores how public organizations can implement ISO 55001 principles to improve governance, integrate risk management, and align investments with long-term goals.

ISO 55001 Adoption What is it, Who is using it, How it benefits us

sbb-itb-5be7949

Building a Governance Framework for Public Sector Asset Management

A governance framework transforms asset management from scattered, department-specific efforts into a unified, transparent system. Without such a framework, asset management often becomes fragmented, making it tough to ensure accountability or align investments with community goals. The main objective is to define clear roles, establish consistent processes, and create decision-making protocols that connect all parts of the organization.

Core Components of an Effective Governance Framework

The foundation of effective governance is a Strategic Asset Management Plan (SAMP). This document outlines the organization’s asset management goals, communicates them to upper management, and simplifies planning across the board [3]. To make this plan work, it needs proper support – adequate staffing, technology, and funding to balance costs, risks, and performance [3].

Leadership also plays a crucial role. Three key positions should be established: a high-level executive lead, a senior management sponsor, and an Asset Management Coordinator. These roles ensure that asset management evolves from a departmental task into an organization-wide strategy. Departments like Finance, IT, and Public Works can then use shared asset data to inform their decisions [4].

Accountability is another critical element. Asset management responsibilities should be clearly defined in staff job descriptions, and governing bodies should receive annual updates on progress, often by July 1st [4]. Transparency is key – publish the asset management policy and plan online for public review [4]. In some cases, such as with Ontario Regulation 588/17, these policies must be reviewed and updated at least every five years to stay relevant [4].

This approach sets the stage for integrating risk management into the organization, ensuring decisions align with both immediate needs and long-term objectives.

Integrating Risk Management into Governance

Risk management shouldn’t be treated as an isolated activity – it needs to be woven into the governance framework. Modern standards distinguish between managing risks and identifying opportunities, using risk as a tool to balance short-term needs with long-term goals [3].

"Risk is defined as the positive or negative effects of uncertainty or variability upon agency objectives." – ISO 31000 [5]

Governance should support integrated risk management, moving beyond project-specific risk analysis. By embedding risk processes at the corporate, program, and project levels, organizations can better protect investments and allocate resources effectively [5][6]. Importantly, the level of analysis and resources allocated to a project should match its risk profile, not just its financial scale [6].

One actionable step is to define risk tolerance levels for the organization, programs, and individual projects. These thresholds help identify financial gaps and guide mitigation strategies, giving decision-makers a clearer picture of when additional investment or alternative solutions are needed [5]. Risk should also be a regular topic in top management discussions, focusing on how risks, opportunities, and predictive actions influence asset performance and organizational goals [3].

"Ultimately, risks should be allocated to those parties best able to manage them at the least cost while serving the public interest." – Province of British Columbia [6]

Implementing Risk-Based Investment Planning

Once governance and risk management are in place, the next step is adopting risk-based investment planning. This approach shifts the focus from reactive spending to proactive, informed decision-making. Instead of relying solely on dollar amounts, investments are evaluated based on risk, lifecycle costs, and alignment with strategic goals. For example, while a $500,000 bridge repair might seem costly, a $100,000 upgrade to a water treatment facility could carry greater risk if it serves a critical population or involves compliance concerns. Public sector agencies need to account for factors like project complexity, past experience with similar efforts, and the technical demands of the work [6]. This method lays the groundwork for prioritizing projects that deliver the greatest impact through systematic assessments.

Methods for Prioritizing Asset Investments

With a strong governance framework in place, the next step is setting priorities through strategic risk assessment. This begins with a Strategic Options Analysis (SOA) – a high-level, qualitative review conducted early in the planning process. The SOA identifies risk categories, estimates their likelihood and consequences, and sets relative priorities among competing projects [6]. As planning progresses into the business case phase, the process becomes more detailed. Agencies should move from qualitative judgments to quantifying risks and their economic impacts. A comprehensive risk register helps document these risks, their valuations, and treatment strategies, ensuring that investments focus on delivering the greatest risk reduction [6].

Public sector agencies must weigh multiple factors when prioritizing projects, such as risk exposure, importance to service delivery, regulatory compliance, and long-term impacts. For instance, a wastewater treatment plant nearing the end of its design life might rank high because of potential EPA violations, its critical role in public health, and the opportunity to improve energy efficiency.

| Risk Category | Description | Treatment Examples |

|---|---|---|

| Policy Risks | Potential shifts in government policy or legislation | Assessing how policy changes might affect project outcomes |

| Financing Risks | Challenges in securing funding and financial stability | Evaluating partner credit-worthiness; accounting for rate changes |

| Design/Construction | Risks related to supplier capacity, commissioning, and partnerships | Ensuring materials are available; planning to avoid delays |

| Ownership & Operations | Risks tied to maintenance, obsolescence, and labor | Aligning maintenance plans; addressing risks of asset abandonment |

| Site Risks | Issues with site selection, acquisition, and environmental factors | Evaluating soil contamination; ensuring land is free of disputes |

Using Risk Ratings to Guide Decisions

Risk ratings are essential tools for determining the level of oversight and monitoring a project requires. The concept is simple: the more significant the risk, the more due diligence is needed [6].

"The degree of due diligence applied to a project should be equal with the projects’ risk profile."

- British Columbia Capital Asset Management Framework [6]

These ratings aren’t static. They should be updated regularly throughout a project’s lifecycle to account for changes in risk levels. For example, a road reconstruction project might start as moderate risk but encounter unexpected issues like soil contamination, increasing its risk profile and requiring additional oversight.

Central government agencies can use these ratings to assess portfolio-wide risk exposure and tailor reporting requirements. High-risk projects might need quarterly updates, while medium-risk ones could report semi-annually. By allocating risks to those best equipped to handle them, agencies can balance immediate demands with long-term strategic goals.

Balancing Immediate Needs with Long-Term Goals

One of the biggest challenges is addressing urgent needs while staying focused on long-term objectives. A water main break, for instance, might require immediate attention, even as the Strategic Asset Management Plan (SAMP) outlines a decade-long plan for systematic asset replacement [8]. The SAMP serves as a bridge between high-level goals and detailed management plans, clearly outlining assumptions, dependencies, and the risks tied to delaying investments.

Performance gap analysis helps identify where strategic investment is most needed. By comparing current performance with desired outcomes, agencies can pinpoint areas for improvement. For example, if 85% of structures are in good condition but the community expects 95%, the gap becomes the target for investment.

Long-term financial forecasting (spanning 10–30 years) can reveal opportunities to defer capital expenses through preventive maintenance or resolve inefficiencies with targeted projects [8]. Regularly reviewing assumptions is crucial, as shifting priorities and changing asset conditions can impact plans. Establishing defined review cycles – annually or more often for dynamic portfolios – ensures the investment plan stays relevant and aligned with evolving needs [8].

Improving Transparency Through Data-Driven Decision-Making

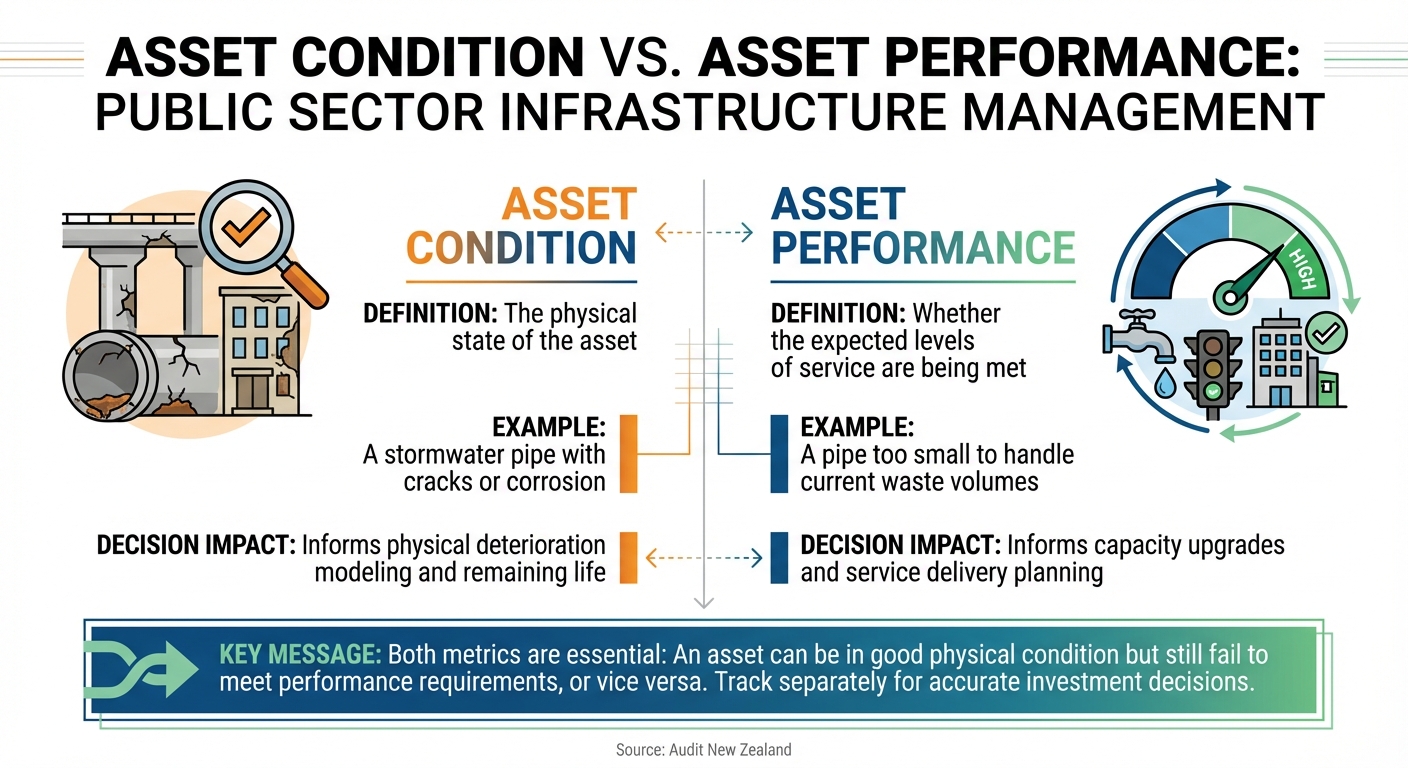

Asset Condition vs Performance: Key Differences for Infrastructure Investment Decisions

Transparency and accountability in public sector asset management rely heavily on accurate, well-organized data. By documenting infrastructure networks with details like value, age, materials, condition, and performance, agencies can create an evidence-based foundation for financial forecasts and audits. This approach turns raw numbers into actionable insights that guide investments and bolster accountability.

Creating a Centralized Asset Inventory

A centralized asset inventory acts as the definitive source for all asset-related decisions. Without it, agencies risk basing investments on incomplete or inconsistent data, which auditors often flag as a major issue. This inventory should cover both basic attributes and detailed condition and performance metrics.

Take the Christchurch City Council, for example. They used an Asset Assessment Intervention Framework (AAIF) to integrate condition and criticality data into their Long-Term Plan. By factoring in theoretical lifespan, actual condition, repair history, and failure consequences, they established renewal timelines. Their thorough records and data-driven renewals earned them an unmodified audit opinion.

In contrast, Upper Hutt City Council faced challenges during their 2021-2031 Long-Term Plan audit, receiving an "emphasis of matter" paragraph. Their reliance on asset age instead of condition for three-waters forecasting introduced budget uncertainty, which they transparently acknowledged in their consultation document. Similarly, Wellington City Council received a qualified audit opinion after pipe failures highlighted their reliance on affordability and age-based data rather than actual condition assessments. Auditors deemed this approach risky, citing potential service disruptions and unplanned costs.

"Knowledge of key data at component level should cover physical characteristics, installation date, useful life, asset value, current condition, and performance." – Audit New Zealand [9]

To improve data reliability, agencies can implement data quality ratings. Frameworks like the International Infrastructure Management Manual help assign confidence levels to asset information, aligning data sophistication with asset complexity. For hard-to-inspect assets, such as underground pipes, representative sampling can offer a cost-effective way to estimate condition across the network.

It’s also crucial to differentiate between an asset’s condition and its performance. For example, a stormwater pipe might show physical wear (condition) yet still meet service requirements, while a well-maintained pipe could fail to handle current capacity needs (performance). Tracking these separately ensures that investments address the correct issues.

| Feature | Asset Condition | Asset Performance |

|---|---|---|

| Definition | The physical state of the asset [9]. | Whether the expected levels of service are being met [9]. |

| Example | A stormwater pipe with cracks or corrosion [9]. | A pipe too small to handle current waste volumes [9]. |

| Decision Impact | Informs physical deterioration modeling and remaining life [9]. | Informs capacity upgrades and service delivery planning [9]. |

With a reliable inventory in place, agencies can take the next step: predictive modeling.

Using Predictive Modeling for Risk Analysis

A robust asset inventory lays the groundwork for predictive modeling, which allows agencies to proactively manage risks. Instead of waiting for assets to fail, predictive models simulate how assets will age, deteriorate, and perform over time. This helps prioritize investments based on future projections, ensuring accountability by demonstrating readiness to achieve intended results.

The ISO 55001:2024 standard emphasizes the importance of predictive action (Section 10.3), encouraging organizations to adapt to internal and external changes using risk simulations. This approach incorporates lifecycle cost analysis, risk exposure, and service level impacts, moving beyond simple age-based forecasting.

"Predictive Action can be anything that seeks to adapt changes internally, externally based on risk and opportunity, services and/or assets." – Martin Kerr, ISO Expert [3]

Maturity models also help public sector entities evaluate whether they’re meeting key benchmarks for maximizing community value. For instance, the Queensland Audit Office in 2023 provided local governments with a self-assessment tool to measure their progress in asset management. This effort created tailored maturity models to guide improvement plans.

Predictive tools allow agencies to test multiple scenarios, balancing immediate needs against long-term goals. By analyzing different budget levels, service standards, and other variables, agencies can make informed trade-offs backed by quantitative evidence.

Documenting and Communicating Investment Decisions

Clear documentation turns technical data into stakeholder-friendly communication. The Strategic Asset Management Plan (SAMP) is a key tool for bridging the gap between detailed analysis and decision-making at the leadership level. The 2024 update to ISO 55001 simplified the SAMP to enhance organizational planning and leadership engagement.

"Data and Information without context, insight and experience are of little value." – ISO 55001:2024 (Section 7.7) [3]

Data becomes meaningful only when paired with context and insights. Agencies should explain not just what decisions were made, but why they were made, what alternatives were considered, and how these choices align with strategic goals.

Standardized reporting plays an essential role in reducing compliance burdens while proving to funders and insurers that rigorous systems are in place. Regular management reviews should cover decision-making, risks, and opportunities to maintain transparency at the leadership level. When presenting plans to stakeholders, objectives should be linked directly to the resources needed to achieve them.

In February 2016, the Victorian Department of Treasury and Finance introduced the Asset Management Accountability Framework (AMAF) for the public sector, aligning it with ISO 55001. This framework outlines mandatory requirements and guidance to ensure asset management supports service delivery goals, setting a strong example of how standardized documentation can improve accountability.

For public utilities working with external partners, structured frameworks enhance both communication and efficiency. Integrating asset management documentation with environmental, information security, and health and safety systems provides a more comprehensive view of risks and opportunities, reinforcing transparency across the board.

Integrating Sustainability into Asset Management Strategies

Blending risk-based investment planning with data-driven transparency, sustainability integration ensures that asset investments align with long-term goals for both communities and the environment. Public sector organizations face the challenge of aligning infrastructure investments with climate objectives while navigating tight budgets. The real task is not about choosing between fiscal responsibility and environmental goals – it’s about achieving both through lifecycle planning informed by data and aligned with government mandates.

Balancing Budget Constraints with Sustainability Targets

Shifting toward Sustainable Service Delivery requires a fresh perspective on cost evaluation. This approach ensures that current services are delivered in ways that are socially, economically, and environmentally responsible, without jeopardizing the needs of future generations [10]. Instead of focusing solely on upfront costs, agencies need to consider total lifecycle expenses, factoring in energy use, carbon emissions, and long-term operational impacts.

"Sustainable Service Delivery ensures that current community service needs, and how those services are delivered (in a socially, economically and environmentally responsible manner), do not compromise the ability of future generations to meet their own needs." – Asset Management BC [10]

One way to integrate sustainability is by incorporating natural assets into inventories. For instance, wetlands or green infrastructure can serve as cost-effective drainage solutions, offering ecological benefits at a lower lifecycle cost compared to traditional infrastructure [10]. Recognizing the measurable value these environmental assets bring can also support carbon reduction goals.

Another strategy involves using a Low Carbon Resilience (LCR) framework, which enables municipalities to simultaneously consider climate adaptation and carbon reduction [11]. This dual-purpose approach ensures limited budgets address multiple sustainability objectives. Programs like the Federation of Canadian Municipalities’ "Adaptation in Action" provide funding – up to $1 million – for community climate adaptation projects, helping municipalities implement such initiatives [11].

Interestingly, about 65% of a facility’s lifecycle costs are determined during the design and acquisition stages, not during maintenance [12]. This highlights the importance of embedding sustainability considerations early in the planning process, where decisions can have the most lasting impact. These early evaluations set the stage for more detailed lifecycle and policy alignment analyses.

Using Lifecycle Cost Analysis for Sustainable Decisions

Lifecycle cost analysis (LCCA) shifts the focus from initial acquisition costs to the total cost of ownership over an asset’s lifespan. This includes construction, operations, maintenance, energy use, and eventual disposal. Proactively applying LCCA can reduce service disruptions and lower overall costs compared to a reactive approach [10].

Standards like ISO 15686-5 (Buildings and Constructed Assets – Service Life Planning) offer a structured method for conducting lifecycle cost evaluations [1].

"Asset management is not about the asset, but about the value generated by the asset." – ISO 55000 [15]

To make LCCA effective, agencies should adopt robust data standards that create a feedback loop. This means decision-making objectives guide data collection, and improved data quality enhances future decisions [15]. Updating financial accounting systems to align with facility management functions can also improve transparency around sustainability-related expenditures.

Agencies can start small – for example, by applying lifecycle costing to a limited set of assets – then expand as data improves. Take energy-efficient HVAC systems: analyzing their performance over a 20-year lifespan compared to standard models can reveal cost and carbon savings that justify a higher initial investment. Tools like the NIST Life Cycle Costing Manual (Handbook 135), updated in 2022, are particularly useful for federal agencies evaluating energy and water conservation projects [13][14].

Aligning Investments with Government Priorities

Sustainability efforts must align with broader government goals. ISO 55011 provides guidance for developing public policies – like laws, regulations, and incentives – that connect government levels with Environmental, Social, and Governance (ESG) objectives [2].

"Good asset management is a key enabler for those seeking to balance investment between immediate needs and long-term goals." – ISO/TC 251 [2]

Tools like the Mission Dependency Index (MDI) or Asset Priority Index (API) can help agencies prioritize lifecycle investments based on their mission and sustainability objectives [1]. Additionally, integrating Asset Management Plans (AMPs) with Long-Term Financial Plans (LTFPs) creates a clearer picture of funding gaps for sustainability initiatives [10].

Conclusion

Public sector organizations have the opportunity to reshape asset management by embedding risk-based planning, data-driven transparency, and sustainability into their everyday practices. Moving from reactive maintenance to predictive strategies – adjusting to risks and opportunities as they arise – marks a major shift in how agencies handle infrastructure decisions [3]. This proactive approach not only ensures public resources are used efficiently but also upholds regulatory standards while promoting transparency and accountability, as outlined throughout this guide.

Practical tools like the SAMP (Strategic Asset Management Plan) help bridge overarching policies with day-to-day operations. By aligning organizational goals with specific asset-level activities, SAMP ensures resources are allocated effectively. Adding lifecycle cost analysis to the mix strengthens accountability by creating clear audit trails for stakeholders and regulatory bodies [3][16].

"Developing and deploying public policy in a way that promotes good asset management is important to align different levels and sections of governments… to make the best use of resources while maximizing social and financial return on investments." – ISO/TC 251 [2]

Queensland’s Asset Management Maturity Model offers a real-world example of how risk-driven strategies can lead to measurable improvements. Updated in December 2024, this model was designed to meet modern standards and was informed by a 2023 self-assessment questionnaire distributed to local governments. It serves as a tailored tool for state and local entities, helping them unlock the full potential of their asset bases while delivering value to their communities [7]. Such maturity assessments are a practical starting point for identifying areas of strength and opportunities for growth.

FAQs

Where should we start to improve asset management governance?

To lay the groundwork, begin with well-structured public policies and organizational frameworks. Make sure external regulations align seamlessly with your internal asset management strategies to ensure they support your long-term objectives. Build an asset management system that prioritizes clear decision-making, effective risk management, and maximizing value. These efforts work together to establish a governance structure that promotes transparency, accountability, and adherence to industry best practices.

How do we prioritize projects using risk instead of cost?

When deciding which projects to tackle first, focusing on risk can be a smart strategy. This means looking at how likely something is to fail and what the consequences would be if it did. The goal is to address the most pressing risks – those that could jeopardize safety, compliance, or essential services. By analyzing the chances of failure and the potential fallout, organizations can zero in on projects that reduce these risks the most. This ensures that resources are used wisely, aligning with big-picture goals and keeping operations running smoothly.

What asset data do we need for audit-ready transparency?

To ensure transparency that meets audit standards, organizations must maintain detailed and trustworthy asset data. This includes specifics like physical characteristics, installation dates, useful life, value, condition, and performance metrics. It’s equally important to evaluate the reliability of this data, especially for critical or complex assets, by assigning confidence ratings.

Key details such as location, maintenance history, and depreciation records should be meticulously tracked. To support accurate reporting and compliance, organizations should implement clear policies that prioritize data accuracy, consistency, and regular updates. These practices not only streamline decision-making but also reinforce accountability in asset management.