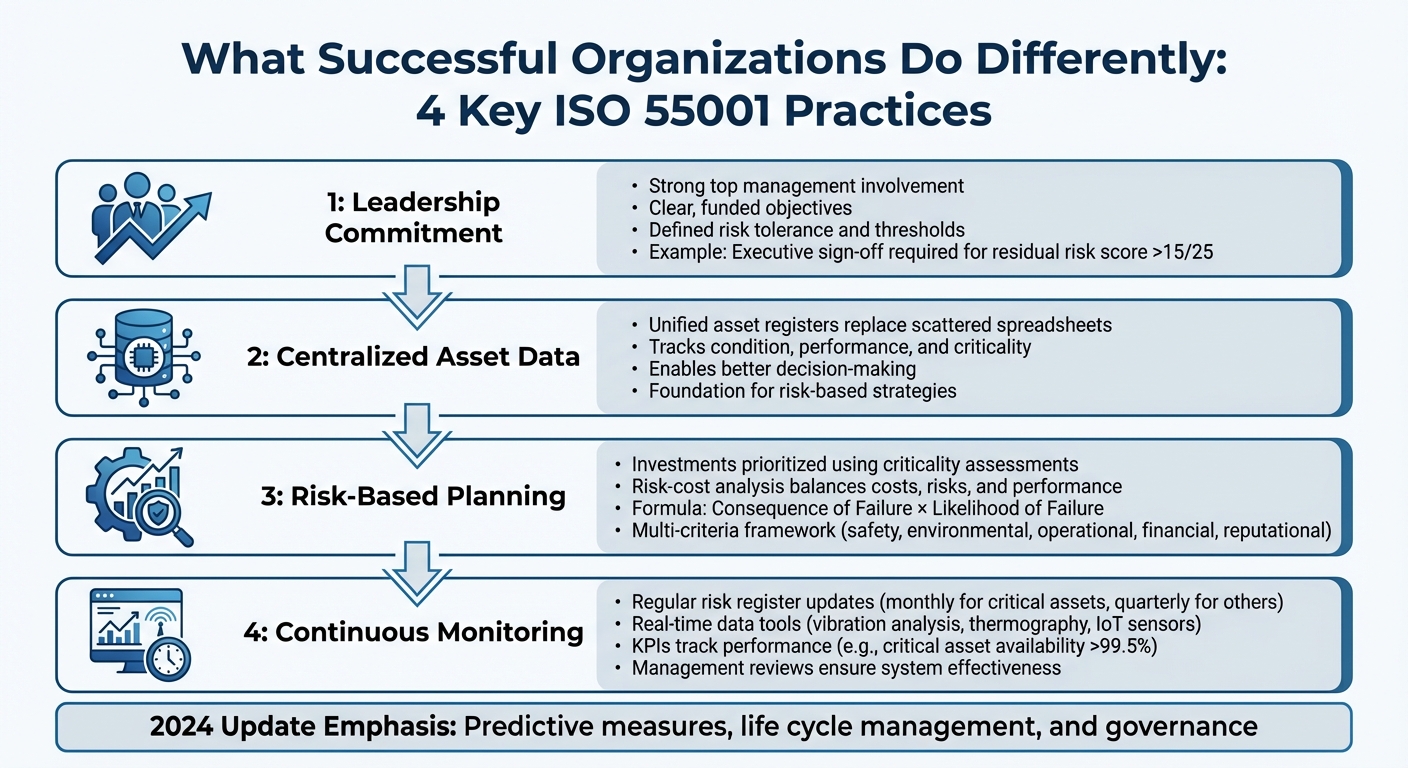

Organizations implementing ISO 55001:2024 for asset management often face challenges like fragmented data and short-term planning. However, successful adopters stand out by focusing on four key practices:

- Leadership Commitment: Strong involvement from top management ensures objectives are clear, funded, and aligned with risk tolerance.

- Centralized Asset Data: Unified asset registers replace scattered spreadsheets, enabling better decision-making.

- Risk-Based Planning: Investments are prioritized using criticality assessments and risk-cost analyses, balancing costs, risks, and performance.

- Continuous Monitoring: Regular updates to risk registers and real-time data tools ensure systems remain effective and responsive.

The 2024 update emphasizes predictive measures, life cycle management, and governance, making ISO 55001 a powerful tool for aligning strategy with day-to-day operations.

4 Key Practices for Successful ISO 55001 Implementation

A Step by Step Guide to Aligning your Asset Management Practices to ISO 55001

sbb-itb-5be7949

Leadership and Governance: Building the Right Structure

ISO 55001 can easily become just another document collecting dust without a solid governance structure. Organizations that thrive with this standard create frameworks where leadership actively integrates asset management into decision-making. The 2024 update to ISO 55001, particularly in Section 6.2.2, emphasizes the importance of upper management’s involvement and understanding of the asset management process [1].

Strong leadership stands out by clearly defining objectives and ensuring they are properly funded. Martin Kerr, an ISO expert, highlights that "the 2024 version makes it clearer that objectives need to be resourced, not just listed" [1]. Achieving this means allocating budgets, assigning personnel, and investing in technology – not just setting lofty goals. Additionally, leadership must define the organization’s risk appetite and translate it into specific thresholds that guide everyday asset-related decisions [2].

Governance also relies on collaboration across departments. Successful organizations bring together teams from operations, maintenance, engineering, and safety to conduct criticality assessments. This ensures diverse perspectives shape asset priorities. They also establish measurable risk thresholds, like requiring executive sign-off for any asset with a residual risk score above 15 out of 25, to streamline escalation and maintain accountability [2].

Creating Strategic Asset Management Plans (SAMP)

Once strong leadership and governance are in place, the next step is to operationalize the strategy through a Strategic Asset Management Plan (SAMP). This plan bridges high-level organizational goals with specific asset decisions. The 2024 standard highlights the SAMP as a simplified yet essential tool, directly linking asset management objectives to long-term financial targets and sustainability goals [1].

Effective SAMPs define what "value" means for the organization, applying earlier principles to outcomes like minimizing life cycle costs, cutting carbon emissions, or maintaining reliable services. From there, organizations develop scalable decision-making frameworks that consistently apply these values [1]. This approach ensures that cost, risk, and performance are balanced at every level, aligning resource allocation with strategic priorities.

Getting Leadership Involved in ISO 55001

The success of ISO 55001 hinges on senior leadership’s commitment. Engaging executives early in defining consequence scales – such as what qualifies as a "catastrophic" financial or reputational impact – ensures the criticality framework reflects the organization’s true values and risk tolerance [2].

Leadership should also be actively involved in regular management reviews (Section 9.3) to assess risks, explore opportunities, and evaluate decision-making effectiveness. These reviews allow resource allocation to adapt to changing conditions [1]. Organizations that excel in this area present investment proposals with a clear risk-cost ratio, quantifying the risk reduction achieved per dollar spent [2]. This turns asset management into a strategic tool that leadership can use to steer the organization effectively.

"If the [risk] register exists independently of decision-making, it adds no value." – Sakthi Thangavelu, Senior Manager – Cyber Assurance, Glocert International [2]

Data Foundations: Creating a Centralized Asset Inventory

Effective data management is at the heart of risk-based asset investments. Without accurate and consolidated data, ISO 55001 compliance risks becoming a checkbox exercise. Organizations that excel with this standard recognize that dependable asset information drives every strategic decision, from scheduling maintenance to planning capital budgets. The 2024 update to ISO 55001 emphasizes this point by introducing Section 7.6, which highlights data and information configuration as a critical organizational capability [1].

Bringing together scattered spreadsheets, outdated records, and siloed databases into a unified system is essential. This centralized approach tracks asset condition, performance, and criticality, enabling organizations to implement risk-based strategies. It shifts the focus from reactive, time-based maintenance to a more efficient resource allocation model, driven by real-time data. As Sakthi Thangavelu of Glocert International notes:

"Asset criticality assessment is foundational to ISO 55001 – it determines how resources, maintenance strategies, and investment are allocated across the asset portfolio" [2].

A comprehensive asset register should consolidate key data categories, including asset details, condition, performance, consequences, design, and external factors [2]. These elements feed into the criticality calculation – Consequence of Failure × Likelihood of Failure – which determines the level of management attention each asset requires. With such a solid data foundation, organizations can conduct detailed asset verification and proactive risk assessments.

Building a Verified Asset Register

Once the data framework is centralized, verifying asset information ensures consistency and actionable insights. This begins with defining clear asset boundaries. For example, should a pumping station be treated as a single asset, or should its components – like pumps, valves, and motors – be tracked individually? The decision depends on the balance between operational benefits and the effort required for maintenance.

Standardizing condition grading across the asset portfolio is another vital step. A common 1–5 scale is often used, where Grade 1 ("Very Good") represents assets that are nearly new and require minimal maintenance, while Grade 5 ("Very Poor") signals assets on the brink of failure that need immediate attention. This uniform grading ensures comparability across different asset types.

Criticality mapping is a collaborative effort, requiring input from operations, maintenance, engineering, and safety teams. Together, they evaluate the Consequence of Failure across factors such as safety, environmental impact, operational disruption, financial loss, and reputation. For instance, a financial consequence might range from a catastrophic loss exceeding $10 million to a minor impact under $10,000. The asset register must also function as a "living document", updating risk scores automatically as new condition data becomes available. Trigger points – like an asset dropping to Condition Grade 4 – can prompt reviews or heightened monitoring [2].

Using Predictive Models for Risk Assessment

The 2024 ISO 55001 update introduces "Predictive Action" in Section 10.3, emphasizing the importance of data-driven adjustments to manage risks strategically [1]. Predictive models transform the asset register into a proactive tool, identifying potential failures before they occur.

Techniques such as vibration analysis, thermography, and IoT sensors supply real-time data to these models. Failure Mode and Effects Analysis (FMEA) is another key method, pinpointing specific failure mechanisms – like bearing seizure or structural fatigue – and assigning a Risk Priority Number. Likelihood ratings are categorized as "Rare" (less than 1% annual probability), "Unlikely" (1–5%), "Possible" (5–20%), "Likely" (20–50%), or "Almost Certain" (over 50%). As condition monitoring reveals deterioration, the likelihood score rises, increasing the overall risk rating and triggering timely interventions.

Risk-Based Investment Planning: From Data to Decisions

Turning raw data into actionable investment strategies is the cornerstone of effective asset management. Organizations that excel in implementing ISO 55001 don’t just gather data – they use it to craft multi-year CAPEX and OPEX plans that balance risk reduction, budget limits, and sustainability goals. The latest 2024 update to ISO 55001 strengthens this approach with Clause 4.5, which focuses on decision-making and value. This clause introduces a scalable framework designed to connect decisions across all levels of an organization [1].

Risk-based investment planning shifts the focus from short-term affordability to long-term value and risk mitigation. Each project is evaluated using Total Cost of Ownership (TCO), factoring in acquisition, installation, maintenance, failure costs, and environmental impacts [2].

The 2024 standard also highlights Predictive Action in Clause 10.3, which calls for flexible investment strategies that adapt to emerging risks and opportunities. Martin Kerr explains:

"Predictive Action can be anything that seeks to adapt changes internally, externally based on risk and opportunity, services and/or assets" [1].

This adaptability ensures investment plans remain aligned with changing conditions, regulations, and priorities. It also integrates environmental considerations into risk assessments, helping organizations prioritize projects with significant carbon or pollution risks [2]. By leveraging consolidated asset data, this approach transforms information into precise, value-driven investments, paving the way for effective prioritization and budgeting.

How to Prioritize Asset Investments Using Multiple Criteria

A multi-criteria criticality framework helps rank investment proposals by assessing each asset or project across several dimensions, such as safety, environmental impact, operational disruption, financial loss, and reputational damage. Each factor is scored, and when multiplied by the likelihood of failure, it generates a criticality score [2].

The risk-cost ratio further refines decision-making by measuring how much risk reduction is achieved per dollar spent. This enables organizations to objectively compare projects and identify the most efficient use of limited funds [2].

A criticality matrix is often used to categorize assets into management tiers:

- Critical Assets (16–25 score): Require intensive management, continuous monitoring, and capital renewal priority.

- High-Priority Assets (10–15 score): Need active management, regular condition monitoring, and prioritized resources.

- Moderate-Priority Assets (5–9 score): Managed with scheduled preventive maintenance.

- Low-Priority Assets (1–4 score): Typically managed with reactive maintenance [2].

When presenting CAPEX proposals to leadership, it’s essential to highlight the expected reduction in residual risk scores if the investment is approved. This transparency not only helps executives see the value of each proposal but also creates a clear audit trail linking criticality assessments to the risk register and capital plan – key evidence for ISO 55001 auditors [2].

Testing Investment Scenarios and Optimizing Budgets

After prioritizing investments, the next step is to refine budget allocations through scenario testing. With a solid risk-cost analysis in place, organizations can explore different budgeting approaches to determine the most cost-effective way to meet performance targets and risk thresholds, even under tight budget constraints [2].

For instance, an organization might model several scenarios:

- Baseline Scenario: Maintains current service levels.

- Accelerated Renewal Scenario: Reduces risk more quickly.

- Deferred Maintenance Scenario: Extends asset life while accepting higher risk.

Each scenario is evaluated using key metrics like total cost, residual risk, service availability, and carbon emissions. This allows leadership to weigh trade-offs and make informed decisions about competing priorities.

Calibration workshops play a crucial role in ensuring consistency in applying the criticality framework across various sites and teams. By bringing together experts from operations, maintenance, engineering, safety, and environmental departments, these workshops align how consequence and likelihood scales are interpreted [2].

Finally, it’s essential to set measurable risk tolerance thresholds. For example, an organization might require a documented risk acceptance plan for any asset with a residual risk score above 15 [2].

Continuous Improvement: Monitoring and Adjusting Over Time

Achieving ISO 55001 certification is just the start of an ongoing process of refinement. Organizations that thrive in asset management view their systems as adaptable structures, evolving to address shifting risks, regulations, and business goals. Clause 9.1 of ISO 55001 emphasizes the importance of monitoring, measuring, and evaluating risk performance as a fundamental part of the asset management system [2].

To stay ahead, effective organizations update risk registers frequently – monthly for critical assets and quarterly for others. These updates incorporate data from incidents, condition assessments, and emerging risks [2].

Real-time health monitoring is also key. Tools like vibration analysis, thermography, oil analysis, ultrasonic testing, and IoT sensors help organizations keep a close eye on asset conditions. Standardized grading systems with predefined thresholds ensure swift action when needed, whether it’s a risk review or immediate maintenance [2].

Clause 9.3 requires management reviews to evaluate risk-related performance against established goals. During audits, reviewers sample critical assets to trace the process from initial criticality assessments to risk register entries, maintenance strategies, and capital planning decisions [2]. These reviews help organizations set measurable targets and achieve consistent performance through well-defined KPIs.

Setting Up Key Performance Indicators (KPIs)

Top-performing organizations rely on KPIs to measure risk tolerance and track the completion of risk treatment plans. For instance, many set a benchmark requiring critical asset availability to stay above 99.5%. If risks threaten this level, corrective actions are triggered immediately. A standardized five-grade condition system is often used to assess asset health consistently across teams and locations [2].

| Condition Grade | Description | Indicative Action |

|---|---|---|

| 1 – Very Good | As new, no visible defects | Continue routine maintenance |

| 2 – Good | Minor deterioration, no performance impact | Monitor degradation |

| 3 – Fair | Moderate deterioration | Plan intervention within the planning period |

| 4 – Poor | Significant deterioration, performance impaired | Prioritize intervention; increase monitoring |

| 5 – Very Poor | Severe deterioration, failure imminent | Immediate intervention or emergency replacement |

Financial metrics also play a crucial role. Metrics like the risk-cost ratio – measuring the risk reduction achieved per dollar spent – and Total Cost of Ownership (TCO) tracking ensure that spending decisions reflect the full lifecycle impact of assets, not just upfront costs [2]. Additionally, tracking the completion rate of risk treatment plans reveals whether risks are being actively addressed. These KPIs not only assess asset performance but also guide strategic investment by pinpointing areas that demand immediate attention.

"The risk register should directly inform investment prioritisation, maintenance planning, and resource allocation. If the register exists independently of decision-making, it adds no value."

– Sakthi Thangavelu, Senior Manager – Cyber Assurance, Glocert International [2]

Conducting ISO 55001 Audits and Governance Reviews

Building on insights from KPIs, audits and governance reviews ensure the asset management system adapts based on performance assessments. Internal audits focus on verifying traceability – ensuring there’s a clear link from criticality assessments to risk registers, maintenance strategies, and investment decisions [2].

Calibration workshops bring consistency to the process. These sessions gather experts from operations, maintenance, engineering, safety, and environmental teams to align on the interpretation of consequence and likelihood scales [2].

Management reviews dig deeper than simple compliance checks. They assess whether the criticality framework is applied consistently, risk tolerance thresholds remain appropriate, and investment decisions align with identified priorities. In many organizations, capital investment requests directly reference the risk register, ensuring budgets address documented risks [2].

Audits also confirm that predefined thresholds are working as intended. For example, if a critical pump’s vibration exceeds a set limit, a risk review or maintenance intervention is triggered immediately – preventing delays until the next scheduled inspection [2]. This proactive approach ensures that the system remains forward-looking, even as assets age and conditions change.

Successful organizations also monitor the closure rate of internal audit findings as a governance KPI. This metric shows whether identified gaps are being systematically resolved, ensuring that ISO 55001 compliance drives real progress rather than just maintaining certification [2].

Conclusion: What to Take Away from Successful ISO 55001 Implementations

To align with long-term ROI and broader goals, successful ISO 55001 implementations focus on four key practices: strong leadership, reliable asset data, risk-based investment planning, and continuous improvement.

Leadership plays a pivotal role by defining risk tolerance and ensuring asset management objectives are well-resourced. The 2024 standard highlights the need to balance objectives with cost, risk, and performance, making executive support critical from the outset.

Reliable asset management depends on centralized registers and consistent grading systems. High-quality data, combined with skilled teams, forms the backbone of effective decision-making.

Risk-based planning ensures resources are allocated where they’re needed most. By using criticality assessments, organizations can prioritize investments efficiently. For critical assets, risk data is updated monthly, while less critical ones are reviewed quarterly, keeping decisions focused on immediate threats and opportunities for improvement.

Continuous improvement ties everything together. Top-performing organizations track KPIs, host regular calibration workshops, and conduct management reviews to adapt to evolving conditions. Auditors value a clear, traceable link between criticality assessments and investment decisions – and successful companies consistently deliver this level of transparency.

FAQs

What’s the fastest way to get leadership buy-in for ISO 55001?

To get leadership on board quickly, focus on how ISO 55001 ties directly to key organizational priorities like boosting long-term ROI, meeting compliance requirements, and supporting sustainability efforts. Use concrete examples to illustrate its advantages, such as better asset performance, reduced costs, and lowered risks. Sharing compelling case studies can help paint a clear picture of its impact, while highlighting how a structured approach to asset management enhances strategic decision-making. This approach can instill confidence and clearly showcase the value of adopting ISO 55001.

What data must an asset register include to support risk-based decisions?

An asset register needs to capture essential details like asset condition, failure modes, criticality, risk assessments, condition monitoring information, and incident records. Including these elements helps support informed, risk-based decision-making and ensures more effective asset management.

How do you set risk thresholds that actually drive CAPEX and maintenance?

To establish risk thresholds for guiding CAPEX and maintenance decisions, begin by assessing asset criticality and conducting risk evaluations. Look at the likelihood of failures and their potential consequences in areas like safety, operations, finances, reputation, and environmental impact. Incorporate real-time data, such as condition monitoring, to fine-tune these thresholds. This approach helps prioritize investments, aligns decisions with your risk tolerance and strategic objectives, and ensures resources are used effectively to support long-term returns.