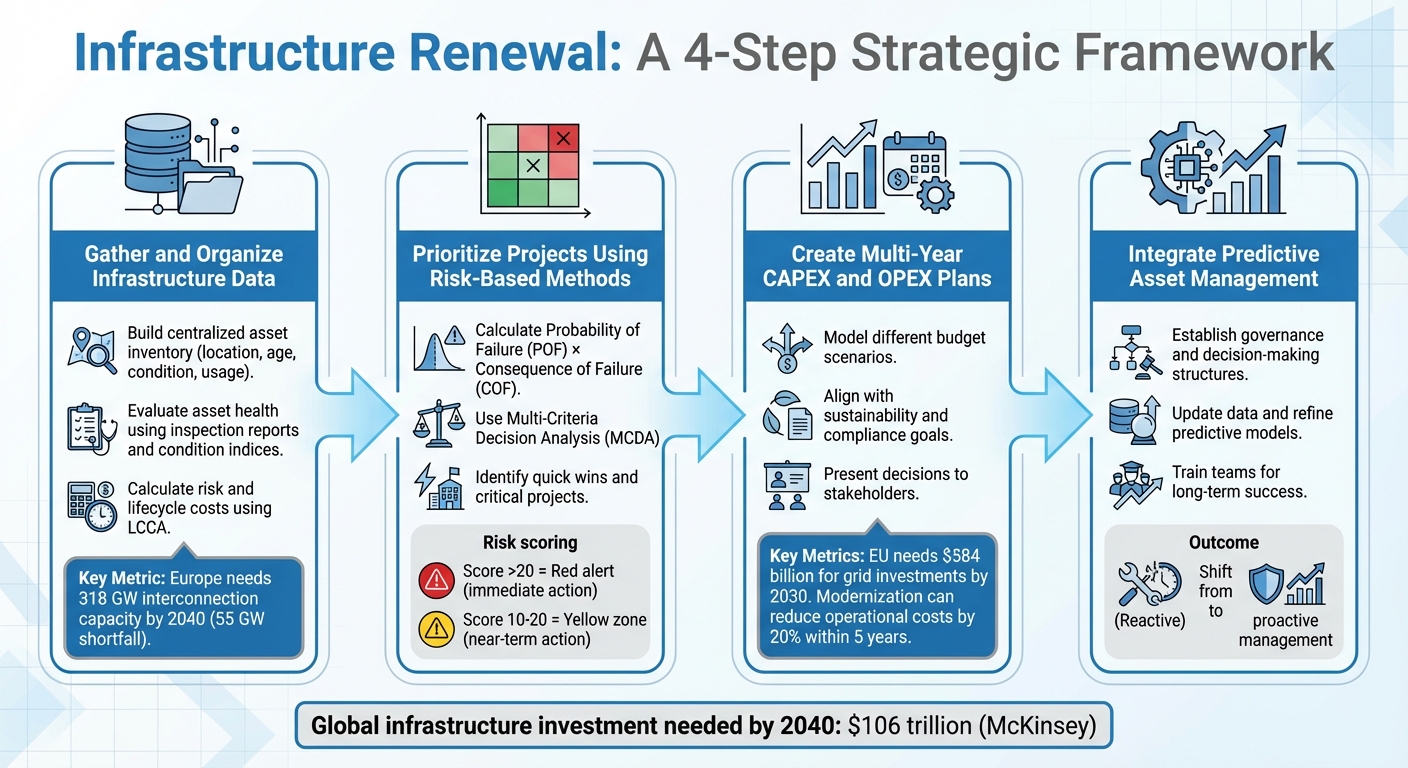

Europe’s infrastructure is aging rapidly, with many critical systems – like roads, bridges, and power grids – operating well beyond their intended lifespans. Limited budgets, growing repair backlogs, and stricter regulations make upgrading these systems a major challenge. Here’s how to tackle it:

- Centralize asset data: Create a detailed inventory of infrastructure, tracking location, age, condition, and usage.

- Prioritize projects by risk: Focus on assets with the highest failure risks and consequences.

- Plan multi-year budgets: Factor in costs, timelines, and regulatory goals.

- Integrate into operations: Build governance frameworks and train teams for long-term success.

This risk-based, data-driven approach ensures resources are spent wisely, avoiding costly failures and improving infrastructure reliability.

4-Step Framework for Prioritizing Infrastructure Renewal Under Budget Constraints

Prioritizing Assets Using Risk-Based Planning — Greta Vladeanu, Xylem | WF&M Conversations

Step 1: Gather and Organize Your Infrastructure Data

To manage infrastructure effectively, start by assembling a centralized record of your assets. Many organizations face challenges with scattered data – spreadsheets spread across teams, inspection reports stored in filing cabinets, and incomplete maintenance histories. A centralized inventory serves as the backbone of asset management, supporting risk analysis and helping prioritize decisions.

Build a Centralized Asset Inventory

Develop a detailed inventory that includes key attributes for each asset, such as its location, age, installation date, material, usage, and current condition. For electricity infrastructure, additional data such as interconnection capacity, capital expenditure (CAPEX), project status, investment costs, and Net Transfer Capacity (NTC) inputs is essential [4].

Establish clear governance rules: designate data ownership, set update schedules, and define validation protocols to avoid duplicate records, conflicting information, and gaps. A well-maintained inventory allows you to benchmark asset conditions and monitor them consistently over time.

Evaluate Asset Health and Condition

Once your inventory is complete, assess the condition of each asset. Use inspection reports, condition indices, and monitoring data to systematically grade asset health. For larger systems like electricity grids, tools such as the Ten-Year Network Development Plan (TYNDP) employ power system modeling to identify "System Needs" by comparing current and future transmission infrastructure requirements [4]. For instance, the TYNDP 2024 estimates that Europe needs a total interconnection capacity of 318 GW by 2040, with a shortfall of about 55 GW yet to be addressed [4].

Standardized metrics make these evaluations more effective. For example, the EU interconnection target measures connectivity as the ratio of a country’s electricity import capacity to its installed generation capacity, aiming for 15% by 2030, up from 10% in 2020 [4]. Applying similar metrics to your assets enables consistent tracking of deterioration and performance across your portfolio.

Calculate Risk and Lifecycle Costs

Evaluating asset conditions isn’t just about the present – it’s about anticipating future costs and timing interventions strategically. Life Cycle Cost Analysis (LCCA) provides a comprehensive view of ownership costs, covering acquisition, operation, maintenance, replacement, and disposal [5][6][7]. By converting future costs into present value using a discount rate, you can compare projects with different timelines on equal terms.

Risk assessment further refines this analysis by accounting for uncertainties and potential outcomes over an asset’s lifespan [5][9]. Use degradation curves to model performance decline over time and link these patterns to specific maintenance actions and costs [8]. For example, studies on electricity interconnectors show that by 2040, every euro invested in expanding cross-border transmission capacity can cut generation costs by more than two euros [4]. This type of analysis turns abstract risks into clear, actionable investment priorities.

Step 2: Prioritize Projects Using Risk-Based Methods

Once your asset data is organized, the next step is to prioritize projects based on operational risk. This approach moves beyond the outdated practice of replacing assets solely based on age. Instead, it uses a multifactor strategy that leverages the detailed asset data you’ve already collected, ensuring smarter decision-making.

Set Risk Criteria and Acceptable Thresholds

Start by evaluating the Probability of Failure (POF). This involves scoring factors such as structural condition, maintenance history, material type, and hydraulic capacity on a scale from 1 to 5 [10]. Then, assess the Consequence of Failure (COF) by scoring metrics like repair costs, potential service disruptions, environmental impact, and legal risks – also on a 1 to 5 scale [10].

To calculate the overall risk score, simply multiply the POF by the COF. This gives you a clear risk ranking for each asset. For example:

- Assets scoring above 20 are flagged as red alerts and require immediate attention.

- Scores between 10 and 20 fall into the yellow zone for near-term action [10].

As the Trimble Resource Center explains:

"Not all failure is created equal, either. Some assets may be highly critical to a system’s operation, while others are not. Certain types of assets may be critical in one system location but not in another. Each system must carefully examine its own assets to determine which are critical and why." [10]

Once risk scores are established, integrate them with broader decision-making factors to refine your prioritization process.

Use Multi-Criteria Decision-Making

While risk scores provide a solid foundation, they don’t tell the whole story. That’s where Multi-Criteria Decision Analysis (MCDA) comes in. This method helps you balance risk with other important considerations like lifecycle costs, compliance, and long-term goals [12]. Techniques such as Multi-Attribute Utility Theory or the Simple Multi-Attribute Rating Technique allow you to assign weights to these factors and systematically evaluate each project.

For instance, governments across Europe are increasingly using MCDA to guide the development of infrastructure that is equitable, resilient, and aligned with future needs. This approach addresses the shortcomings of relying solely on financial metrics [11].

Find Quick Wins and Critical Projects

Once you’ve quantified risks and set priorities, identify which projects are urgent and which offer strategic opportunities. Critical projects typically involve high-risk assets that are essential to system operations – like aging infrastructure where failure would lead to severe disruptions or safety risks [14].

On the other hand, quick wins can often be uncovered through a Value of Information (VoI) analysis. This technique highlights low-cost actions that can delay expensive interventions [13]. For example, a relatively inexpensive inspection might reveal that a costly repair can be postponed, freeing up resources for more pressing needs.

Additionally, look for chances to coordinate projects across related infrastructure. For instance, if you’re resurfacing a road, it might make sense to replace water mains beneath it at the same time. Such coordinated efforts can reduce overall costs and create benefits that standalone projects wouldn’t achieve [14].

sbb-itb-5be7949

Step 3: Create Multi-Year CAPEX and OPEX Plans

Once you’ve prioritized risks, the next step is to secure funding through detailed, multi-year financial planning. With your list of projects in hand, the goal is to develop investment plans that span several years. This requires modeling different budget scenarios, incorporating sustainability goals, and presenting a clear strategy to gain stakeholder backing.

Model Different Budget Scenarios

Start by allocating resources based on your strategic goals. Evaluate your current financial position and determine how to distribute funds to align with priorities and maximize potential returns [16]. Be sure to account for all expenses, including both direct and indirect costs [15].

Prepare for uncertainties by building contingency plans for factors like economic fluctuations, inflation, supply chain disruptions, technological advancements, and regulatory changes. Use "what if" scenarios to assess the impact of challenges such as reduced budgets, rising costs, or unexpected asset failures.

Adaptability is crucial; as market conditions and organizational objectives shift, your financial strategies should evolve to stay effective [16]. For instance, companies that invest in modernization often see operational cost reductions of up to 20% within five years [15]. This demonstrates how careful planning can lead to significant long-term savings while aligning with broader sustainability and regulatory needs.

Align Plans with Sustainability and Compliance Goals

Ensure your investment plans support both economic resilience and environmental goals. Multi-year plans should focus on projects that drive long-term progress [18]. These might include initiatives like cross-border electricity grids, hydrogen infrastructure, green innovation, and environmental conservation [17][18].

For example, the EU’s Grids Package establishes the legal and regulatory framework needed for grid expansion, modernization, and digitalization – key components of decarbonization [3]. The EU estimates that $584 billion will be required for grid investments by 2030, with projections surpassing $1 trillion by 2050 [3].

Take the Biscay Gulf interconnector, a $3.1 billion project linking France and Spain. In 2017, it received $600 million from the Connecting Europe Facility for Energy and a $1.6 billion loan from the European Investment Bank [4]. Similarly, the Aurora Line interconnector between Finland and Sweden secured over $131 million from the CEF-E, covering nearly half its construction costs, and is expected to increase energy transfer capacity by at least 800 MW [4]. These examples highlight how aligning investments with sustainability goals can meet regulatory demands while unlocking public funding.

Present Decisions to Stakeholders

To gain stakeholder approval, clearly communicate the financial, societal, and environmental advantages of your plans [4][3]. Strong project prioritization, backed by thorough analysis, can lead to assets that are equitable, resilient, and future-ready, building public trust and meeting diverse expectations [11].

When presenting your multi-year CAPEX and OPEX plans, address the needs of all stakeholders, including private investors who play a critical role in closing funding gaps. This involves ensuring regulatory certainty, competitive pricing, and effective risk-sharing mechanisms [3]. At the same time, acknowledge challenges like limited public budgets, complex regulations, and inherent project risks [3].

To attract private capital, focus on creating a favorable regulatory environment. Simplify and harmonize permitting processes across regions to build investor confidence. Use de-risking tools like public guarantees, credit enhancements, and first-loss mechanisms to reduce risks and appeal to institutional investors [3].

Finally, establish a clear and well-organized project pipeline to support strategic planning for both governments and investors [3]. A transparent approach, combined with a stable regulatory framework, fosters the confidence needed for long-term investments.

Step 4: Integrate Predictive Asset Management into Operations

Once your multi-year plans are in place, it’s time to weave predictive asset management into daily operations. This step shifts your focus from reacting to emergencies to proactively planning for long-term renewal and improvement. The idea is to ensure that predictive insights guide every decision, creating systems that keep your investment strategy effective even as conditions evolve.

Establish Governance and Decision-Making Structures

Clear roles and responsibilities are key to making predictive asset management work. Set up governance frameworks that connect teams, systems, and practices across all stages of operations. This helps increase efficiency, reduce waste, and ensure everyone is working toward the same goals. For example, define who manages asset data, who approves investments, and how departments collaborate.

In today’s infrastructure projects, public–private partnerships are playing a larger role. Formalizing roles and responsibilities at the outset ensures all partners are aligned and share risks equally. A great example is the 2023 Waaban Crossing project in Kingston, Ontario. It was the first bridge in North America built using the Integrated Project Delivery (IPD) model, which brought together all stakeholders – from design to construction – and shared risks from the beginning. Aligning your governance approach with standards like ISO 55001 can also help meet industry expectations and regulatory requirements.

With governance structures in place, it’s important to continually refine your data and predictive models to adapt to changing needs.

Update Data and Refine Predictive Models

The quality of your predictive models depends entirely on the data you feed them. Regularly update data on key factors like traffic patterns, vehicle loads, and climate impacts to improve accuracy and better predict asset wear and tear. AXA XL highlights how equipping infrastructure with sensors and cameras can enhance monitoring and coordination [19]. Similarly, connecting infrastructure networks to smart-city control centers can improve oversight and planning [19].

To ensure data reliability, develop clear policies for data collection, storage, and usage. Establish feedback loops between field operations and maintenance teams to refine your models continuously [19][2]. Regular updates are essential to account for new data, shifts in environmental conditions, usage trends, and policy goals like the European Green Deal and the Net-Zero Industry Act [20][2]. As the European Environment Agency puts it:

"A key component in promoting a comprehensive green industrial policy is to have a proper functioning governance structure in place" [20].

Finally, equipping your teams with the knowledge to use these insights is critical for long-term success.

Train Teams for Long-Term Success

To make predictive asset management a lasting part of your operations, invest in building internal expertise. Train your teams to interpret predictive models, use risk-based tools, and make informed, data-driven decisions. This shared understanding strengthens collaboration across all levels, from field technicians to executives.

Dedicate resources to ongoing research and development of new technologies and their integration into your asset management systems [20]. As teams gain experience, they’ll uncover ways to refine processes, improve data quality, and adapt to new challenges. Regular training ensures that the predictive strategies you’ve implemented remain effective over time, turning this approach into a sustained advantage for your organization.

Conclusion: A Roadmap for Infrastructure Renewal Under Budget Constraints

Renewing aging infrastructure within the limits of tight budgets requires a clear and systematic strategy. The key steps? Centralize your asset data, prioritize projects using risk-based strategies, develop multi-year investment plans, and incorporate predictive management into daily operations. This approach shifts the focus from reactive problem-solving to proactive, data-informed decision-making. Plus, it’s supported by evidence showing measurable cost savings and operational efficiencies.

According to McKinsey, meeting global infrastructure demands will require a staggering $106 trillion in investment by 2040 [1]. With limited budgets, every dollar spent must count.

Prioritizing maintenance is critical to avoiding costly failures and making the most of available resources. This involves consistently tracking and reporting your maintenance backlog, adopting lifecycle cost accounting practices, and implementing performance-based maintenance systems for core networks [21]. The goal isn’t just to repair what’s broken; it’s to prevent failures before they occur and to channel resources to areas where they will have the most impact.

Emerging technologies like AI and IoT provide real-time monitoring and insights, helping optimize network performance and offering valuable data on asset health and future needs [1]. When these tools are paired with strong governance – such as strategic prioritization, effective budget planning, and alignment among stakeholders – they ensure resources are allocated efficiently while supporting long-term objectives [22][23][24]. This integrated approach not only stretches your budget further but also strengthens long-term planning and resilience.

FAQs

What are the best ways to use predictive maintenance technologies in aging infrastructure systems?

Predictive maintenance technologies can seamlessly fit into existing infrastructure by using data-driven tools to monitor performance and anticipate potential issues. The process begins with installing sensors and IoT devices to gather real-time data on critical factors like temperature, pressure, or vibration. This information is then processed with advanced algorithms and machine learning to detect patterns and predict when maintenance will be required.

Focusing on high-risk or high-value assets allows you to allocate resources wisely, reducing downtime and avoiding unnecessary disruptions. Pairing predictive maintenance with a risk-based investment strategy ensures that budgets are spent where they matter most. Practical steps include performing a cost-benefit analysis to assess return on investment and adhering to regulatory standards, all while extending the life of your infrastructure.

What factors should be considered when prioritizing infrastructure projects with limited budgets?

When deciding which infrastructure projects to prioritize under tight budgets, it’s essential to focus on a few critical factors. Start by assessing the current condition of assets, evaluating risk levels, and identifying opportunities to extend the lifespan of existing infrastructure. Taking a close look at lifecycle costs can help ensure smarter spending over time, while projects that address safety issues or fulfill regulatory requirements should naturally take precedence.

Beyond that, think about ways to incorporate energy efficiency upgrades, ensure alignment with broader strategic objectives, and consider the impact on stakeholders. By weighing these elements carefully, decision-makers can allocate funds wisely, mitigate risks, and get the most value out of every investment.

How can multi-year CAPEX and OPEX plans help prioritize infrastructure renewal within budget constraints?

Multi-year CAPEX (capital expenditure) and OPEX (operating expenditure) plans offer a clear framework for managing infrastructure upgrades by distributing costs over several years and aligning spending with broader, long-term objectives. These plans enable decision-makers to focus on the most pressing projects, guided by factors like asset condition, risk assessment, and regulatory demands, ensuring that the most urgent needs are tackled first.

By projecting expenses and allocating resources wisely, these plans help organizations save money, extend the life of assets, and minimize unexpected breakdowns. They also strike a balance between addressing immediate concerns and planning for the future, ensuring compliance with regulations while making the most of limited budgets.

Related Blog Posts

- Infrastructure Asset Management: A Risk-Based Approach for Multi-Year CAPEX Planning

- End-of-Concession Management for Highways: Strategic CAPEX Planning to Meet Grantor Requirements and Ensure Profitability

- Strategic CAPEX Planning for Highway Concessions: Balancing Grantor Compliance and Profitability at End-of-Term

- Aging Infrastructure & Lifecycle Management