Investing in assets without a clear governance model can cost organizations over 1% in annual returns. With increasing regulatory demands and ESG considerations, investment decisions need to move from reactive fixes to structured, long-term planning. A governance framework ensures investment choices align with business goals, regulatory standards, and sustainability targets, while also improving accountability and transparency.

Key Takeaways:

- Why Governance Matters: Weak governance reduces returns and complicates compliance with evolving regulations.

- Core Elements: Align investments with priorities, build a strong data foundation, and document decisions transparently.

- Steps to Build a Model:

- Form an investment committee with clear roles and responsibilities.

- Develop a governance framework that separates oversight from execution.

- Use tools like ISO 55001 for audit-ready processes.

- Tools and Support: Platforms like Oxand Simeo™ simplify planning by turning data into actionable investment strategies, integrating risk, cost, and sustainability goals.

Bottom Line: Strong governance isn’t just about compliance – it’s about making smarter, more efficient investment decisions that drive long-term value.

Integrated Asset Management Framework

Core Elements of an Effective Governance Model

In today’s landscape of increasing regulatory and market pressures, having a solid governance model is no longer optional – it’s essential. When it comes to asset investment decisions, three key pillars form the backbone of a strong governance framework: strategic alignment, reliable data, and transparent documentation. These elements work together to shift investment planning from a reactive, short-term process to a disciplined, forward-thinking approach that prioritizes long-term value. Organizations that embrace these principles are better equipped to handle regulatory demands while making smarter, more efficient use of their resources. These pillars serve as the groundwork for the strategies explored in the sections ahead.

Aligning Investment Plans with Organizational Priorities

Investment decisions should reflect your organization’s mission, risk appetite, and sustainability goals. To achieve this, translate your strategic objectives into a Strategic Asset Management Plan (SAMP) – a tool designed to guide daily decision-making [4]. Depending on your organization’s maturity and needs, you can adopt one of two approaches:

- A policy-based approach, which sets long-term priorities using historical data and lifecycle analysis.

- A performance-based approach, which focuses on real-time targets and metrics [5].

The right approach depends on your operating environment and organizational goals, but either way, every investment decision should carefully balance costs and benefits while addressing multiple objectives, such as economic efficiency, environmental considerations, and safety [5].

Here’s a practical example: investing $1 in proactive pavement maintenance can save up to $6 in future rehabilitation costs [5]. This highlights the value of lifecycle thinking – making decisions with an eye toward long-term impacts rather than isolated, short-term fixes. By extending the service life of infrastructure, organizations can not only cut down on costs but also reduce carbon emissions and improve overall sustainability [6].

Building a Reliable Asset Data Foundation

Good decisions rely on good data. A strong data foundation is critical for making informed, risk-based choices, and it should include four core components: condition assessments, maintenance history, performance metrics (including energy and environmental data), and financial lifecycle costs. These components help assess key factors like:

- Condition: The physical state of assets.

- Functionality: How well assets meet operational requirements.

- Availability: The uptime of assets.

- Utilization: How effectively assets are being used [8][9].

"Data used must be held to integrity standards determined by the facility asset management system’s decision-making needs." – National Academies of Sciences, Engineering, and Medicine [9]

To ensure data integrity, organizations should assign clear data stewardship roles and follow structured inspection workflows aligned with industry standards like ISO 55001 [7][8]. Automated tools can further enhance data quality by identifying outliers, addressing gaps, and standardizing formats across large datasets [10]. The ultimate goal is to create a single, unified source of truth that eliminates silos and supports sound decision-making [11]. Without this foundation, decisions are often based on flawed or incomplete information, leading to suboptimal outcomes over the asset’s lifecycle [6].

Creating Audit-Ready Processes and Documentation

Transparent reporting isn’t just about compliance – it’s a strategic asset. Clear, well-documented processes demonstrate to stakeholders that decisions are both defensible and risk-based. This "glass box" approach fosters trust by making the decision-making process visible and understandable [5].

"Alignment or certification with an internationally recognised ISO standard can provide governance and executive management with more confidence that an effective asset management system is in place." – Āpōpō [4]

ISO 55001 offers a framework for creating audit-ready processes [4]. Organizations should document not just final decisions but also the alternatives considered, risk assessments conducted, and trade-offs analyzed. This level of transparency not only supports risk management but also helps identify opportunities that align with stakeholder priorities [2]. When combined with strategic alignment and reliable data, transparent documentation strengthens stakeholder confidence and fosters continuous improvement throughout the investment lifecycle.

How to Build a Governance Model for Asset Investment

3-Step Framework for Building an Asset Investment Governance Model

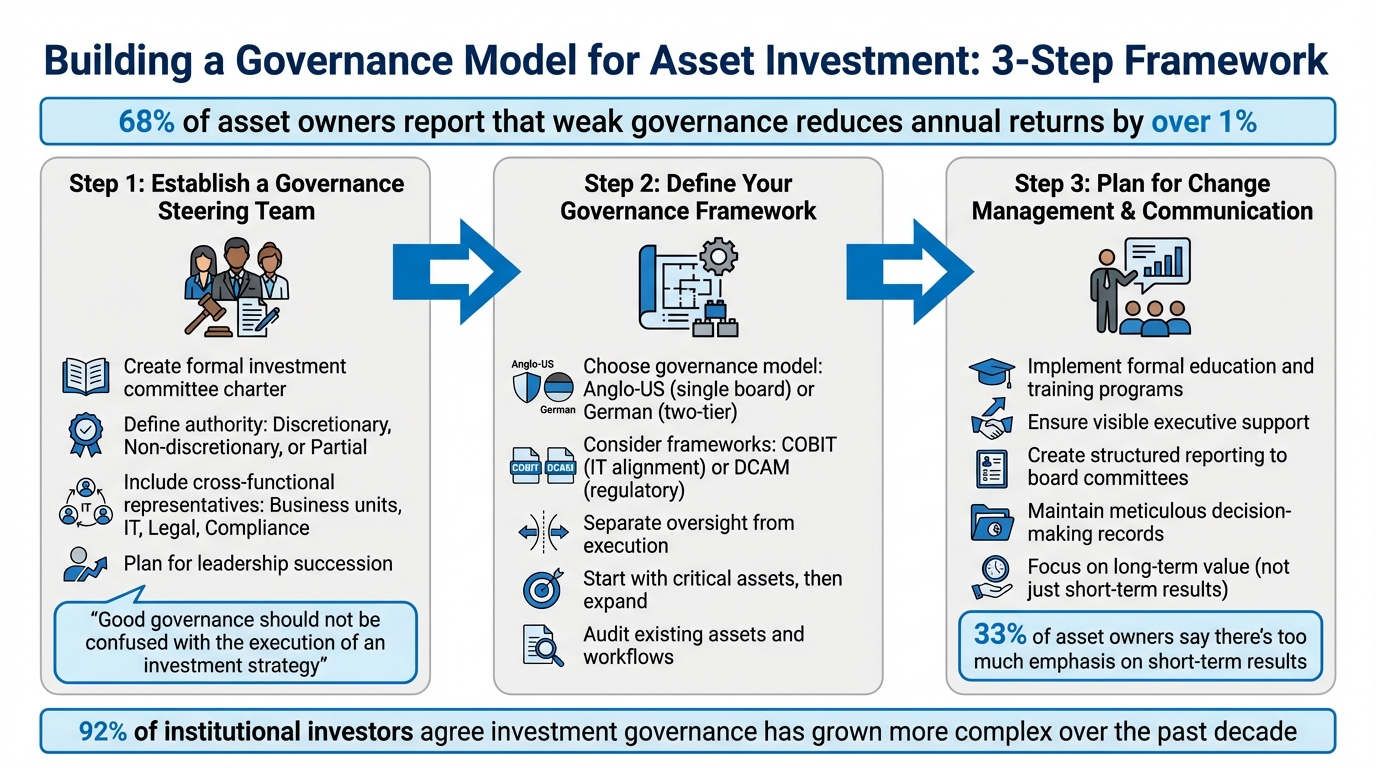

Building an effective governance model for asset investment requires a structured approach grounded in the right people, clear authority, and well-defined processes [12]. It’s no small task – 92% of institutional investors agree that investment governance has grown more complex over the past decade, and 68% of asset owners believe that weak governance frameworks can reduce annual returns by more than 1% [3]. By following a systematic approach, you can navigate this complexity and avoid costly mistakes.

Establish a Governance Steering Team

The first step is forming a dedicated investment committee with a formal charter. This document should clearly outline the committee’s authority, purpose, responsibilities, membership criteria, and meeting protocols [12]. A well-crafted charter ensures accountability and transparency. It should also specify how decision-making authority is allocated – whether it’s discretionary (delegated to third parties), non-discretionary (handled internally), or partial (a combination of both) [12].

To make informed and balanced decisions, the committee should include representatives from key areas like business units, IT, legal, and compliance. This ensures that investment strategies align with the organization’s broader priorities [14].

"Good governance should not be confused with the execution of an investment strategy. This distinction is a cornerstone of good governance." – Cambridge Associates [12]

Diversity in thought and expertise is critical. Teams that embrace varied perspectives tend to excel in risk assessment and innovation [3]. Additionally, it’s essential to plan for leadership continuity through succession planning [12].

Define Your Governance Framework

Once your steering team is in place, the next step is to establish a governance framework that guides decision-making. This framework should align with your organization’s culture and operational needs. For example, you might choose the Anglo-US model, which emphasizes shareholder interests through a single board, or the German model, which uses a two-tier system to balance the interests of multiple stakeholders [13].

For organizations managing significant assets, frameworks like COBIT (to align IT with business goals) or DCAM (for regulatory benchmarking in heavily regulated industries) can serve as structured guides for capability development [14].

A strong framework separates governance (oversight, strategy, and planning) from management (execution of investment programs) [12]. Using a checklist approach can help standardize decisions. Start by focusing on assets that are critical to operations or compliance, and then expand the process as the organization matures [14]. Before rolling out new procedures, conduct an audit of your existing assets, workflows, and gaps to establish a baseline for improvement [14].

Plan for Change Management and Communication

The best governance models can falter without effective change management. To avoid this, implement formal education and training programs that help employees understand their compliance responsibilities and ethical obligations [1]. Regular communication is key to reinforcing the connection between daily operations and long-term goals.

Leadership plays a pivotal role here. Visible support from executives, combined with clearly defined roles for risk managers, ensures accountability throughout the organization [1]. Structured reporting processes to board-level committees provide transparency into governance activities [1]. For smaller teams, concise, focused reports on key decisions can suffice [3].

It’s worth noting that 33% of asset owners believe there’s too much emphasis on short-term results at the expense of long-term sustainability [3]. Your communication strategy should highlight how the governance model supports long-term value creation. Additionally, meticulous record-keeping of decision-making processes builds trust and provides clarity for both internal stakeholders and external advisors [12]. These measures will prepare your organization for the risk-based scenarios explored in the next section.

sbb-itb-5be7949

How Oxand Simeo™ Supports Governance and Investment Planning

Turn your governance goals into actionable investment strategies. Oxand Simeo™ is a platform designed to transform asset data into detailed, multi-year CAPEX and OPEX plans. With 20 years of expertise, a database of 10,000 aging models, and 30,000 maintenance laws, it empowers organizations to make informed decisions about what to invest in, when to act, and how to allocate budgets – all while balancing energy and carbon reduction targets.

Building Risk-Based Investment Scenarios

Focus your investments where they matter most by evaluating asset condition and mission-critical needs. Oxand Simeo™ uses two key metrics: the Facility Condition Index (FCI), which compares deferred maintenance to replacement value, and the Capital Asset Priority Index (API), which measures mission dependency. Together, these tools highlight which assets need immediate attention and which can be divested [15].

The platform’s predictive modeling capabilities let teams explore different budget scenarios, service outcomes, and sustainability paths in real time. Multi-criteria tools evaluate risk exposure, lifecycle costs, regulatory compliance, and CO₂ impacts. These insights often lead to a 10–25% reduction in targeted maintenance costs and help extend asset lifespans. The detailed risk models also serve as a foundation for thorough documentation.

Generating ISO 55001-Aligned Reports

Accountability and transparency are essential in governance. Oxand Simeo™ simplifies the process of producing audit-ready reports that align with ISO 55001 standards. These reports clearly connect asset data, risk evaluations, and investment plans, making it easy to demonstrate to auditors, boards, and regulators that decisions are based on objective, data-driven insights.

By automating the creation of consistent, standardized documentation, the platform eliminates the need for manual spreadsheets and presentations. Teams can generate reports directly from the same datasets and scenarios used during planning, ensuring alignment across all governance materials. This streamlined reporting process also supports broader sustainability objectives.

Integrating Energy and Carbon Reduction Goals

Sustainability is no longer optional – it’s a core part of governance and investment planning. Oxand Simeo™ incorporates energy performance targets and carbon reduction strategies into its planning process, aligning with global ESG standards like GRESB Infrastructure Assessments. The platform tracks energy usage and greenhouse gas emissions, while materiality-based scoring helps prioritize investments that address the most relevant ESG challenges for your assets, industry, and location.

This approach ensures every investment decision supports sustainability goals, with reporting aligned to frameworks such as the Task Force on Climate-Related Financial Disclosures (TCFD) and the Global Reporting Initiative (GRI) [16]. By integrating these considerations, Oxand Simeo™ helps embed sustainability into the core of your governance and investment strategy.

Practical Guidance and Common Mistakes to Avoid

Centralized vs. Decentralized Governance: Which Model Fits Your Portfolio?

Choosing the right governance structure depends on your organization’s size, complexity, and regulatory needs. Centralized governance is ideal for smaller portfolios or industries with strict regulations, as it ensures consistent standards. In this model, a core team sets guidelines and oversees asset management, maintaining uniformity across operations. On the other hand, decentralized (or federated) governance works well for large, global organizations or those with diverse divisions. Here, individual business units manage their assets within a framework of central guidelines, allowing for flexibility while maintaining accountability [17].

Most organizations fall somewhere in the middle. For example, a national portfolio with distinct regional needs might struggle with centralized governance due to bottlenecks. Conversely, a single-campus operation might find decentralized governance unnecessarily complex.

| Governance Model | Best For | Key Advantage | Main Challenge |

|---|---|---|---|

| Centralized | Smaller portfolios, regulated sectors | Consistent standards and oversight | Can slow decision-making in diverse organizations |

| Decentralized/Federated | Global or multi-divisional setups | Flexibility for regional needs | Risk of fragmentation without strong guidelines |

Once your governance structure is decided, securing strong leadership is critical to ensure smooth implementation and adherence.

Getting Stakeholder Support and Executive Buy-In

No governance model can succeed without strong stakeholder and executive support. Leadership and cross-departmental alignment are essential to turn strategy into action. Start by assembling a cross-functional team that includes experts from finance, operations, compliance, and asset management. This ensures that governance goals align with the organization’s broader mission. Engage department leaders early in the process to foster a sense of ownership rather than resistance.

"Data governance is effective only if people understand its purpose and value and support the program" [17].

To gain buy-in, demonstrate how governance addresses specific pain points. For instance, show how unified governance can simplify budget reconciliation or reduce compliance risks. Position governance as a tool that makes their work easier, not as an additional bureaucratic hurdle.

Additionally, ensure you have the necessary resources – budget, labor, and technology. Implementing governance without proper funding or tools, such as CMMS or GRC software, can doom the initiative. Executive sponsors must not only approve the plan but also back it with tangible support, including dedicated budgets and staff time.

Measuring Performance and Refining Your Model

Effective governance is not a one-and-done project. It requires ongoing measurement and refinement. Using transparent processes and unified data, track performance continuously. ISO 55001 Section 9.1 outlines three key areas to evaluate: asset performance, asset management performance (both financial and non-financial), and the overall effectiveness of your management system [18]. Each KPI should be tied to your Strategic Asset Management Plan (SAMP), with clear data sources, performance criteria, and action plans for addressing any deviations [18].

Balance leading indicators (predictive measures like completed preventive maintenance tasks) with lagging indicators (outcomes like equipment uptime or deferred maintenance backlogs) [18]. For example, if your goal is 95% uptime to meet production targets, monitor both scheduled maintenance completion rates (leading) and actual downtime hours (lagging).

The RIMS Risk Maturity Model offers a valuable benchmark, assessing governance capability across five maturity levels with 68 readiness indicators and 25 competency drivers [19]. Regularly review KPIs and adjust strategies to align with shifting risks and business needs. Tools like performance quadrants can help visualize asset priorities, such as the Asset Priority Index (API) and Facility Condition Index (FCI) matrix. For instance, the National Institutes of Health Bethesda Campus uses this approach to identify high-priority assets requiring immediate attention and low-priority assets that could be divested [15].

Avoid common pitfalls, such as relying on outdated data, creating overly complex processes, or managing risks in isolation. Start small – focus on one critical asset domain, prove success, and then scale gradually [17].

"Establishing sound and reliable governance practices is integral for every organisation… the presence of strong governance can no longer be viewed as a reactive process." [2]

This highlights the importance of proactive, data-driven governance that evolves over time to deliver measurable business value.

Conclusion

Having a solid governance framework is key to ensuring that asset investments align with both your organization’s risk tolerance and long-term objectives [12]. This type of structure separates oversight from execution, minimizes bias through formalized decision-making, and keeps every investment decision tied to strategic goals [12]. The numbers speak for themselves: 92% of institutional asset managers acknowledge that investment governance has grown more complex over the last decade, and 68% of asset owners believe poor governance frameworks can drag annual returns down by over 1% [3]. Clearly, the demand for disciplined and transparent processes has never been more pressing.

"A well-defined governance framework is what drives an investment strategy and increases a family’s ability to formulate investment goals and execute on them over time. Without clear governance, families and their advisors will find it harder to engage in effective decision making."

- Cambridge Associates [12]

Strong governance moves organizations from reactive decisions to proactive risk management. It fosters audit-ready processes, breaks down operational silos, and creates the visibility needed to make sound investment choices while staying within budget, regulatory, and sustainability limits [1][2]. By setting clear decision-making roles, establishing investment committees, and tracking performance continuously, governance becomes more than a compliance requirement – it becomes a tool for long-term value creation.

Platforms like Oxand Simeo™ help bring these governance principles to life. The platform transforms governance into actionable results by enabling risk-based investment planning, producing ISO 55001-compliant reports for regulatory needs, and embedding energy and carbon reduction goals into the planning process. With a database of over 10,000 predictive models and more than 30,000 maintenance laws developed over two decades, Oxand Simeo™ provides the tools and data needed to make governance practical and impactful.

FAQs

What are the key components of a strong governance model for asset investment decisions?

A strong governance framework for asset investment decisions is built on a few essential components that ensure choices are strategic, transparent, and aligned with an organization’s goals. It all starts with a clear investment policy – this sets the stage by outlining objectives, risk boundaries, and the criteria for evaluating potential opportunities. Next, a structured decision-making process, often managed by an investment committee, brings accountability and oversight into the equation.

Equally important are risk management and due diligence, which involve analyzing critical factors like market trends, cash flow projections, and regulatory requirements to minimize potential pitfalls. Lastly, performance monitoring and reporting tie everything together, offering transparency by connecting everyday asset data with long-term organizational priorities.

When these components – policy, governance structure, risk evaluation, and performance tracking – work together, they form a solid foundation for making well-informed, responsible, and forward-thinking investment decisions.

How does Oxand Simeo™ help with governance and investment planning?

Oxand Simeo™ equips organizations with tools to make smarter, risk-aware decisions about their asset investments. By aligning investment strategies with organizational goals, regulatory requirements, and sustainability targets, it ensures a process that’s clear, accountable, and effective.

With this platform, users can seamlessly link daily asset data to long-term investment goals, streamline resource allocation, and establish governance frameworks that are ready for audits. This approach not only improves decision-making efficiency but also enhances compliance, delivering stronger results for managing infrastructure and real estate assets.

Why is it essential to align investment plans with organizational goals?

Aligning investment plans with a company’s goals ensures that every dollar spent directly supports its mission, core priorities, and compliance standards. This strategy creates a clear link between everyday financial decisions and the organization’s long-term vision, promoting both transparency and accountability.

By tying investment decisions to key objectives, projects can be assessed based on how well they contribute to these goals, their total lifecycle costs, and the risks they carry. This approach leads to smarter use of resources, boosts stakeholder trust, and ensures better alignment with regulatory standards and broader sustainability efforts.

In the end, this alignment helps cut down on waste, lowers risks, and sets the stage for sustained success.

Related Blog Posts

- Infrastructure Asset Management: A Risk-Based Approach for Multi-Year CAPEX Planning

- Asset Investment Planning 101: How to Decide What to Invest in, When and How Much

- Storytelling with Numbers: How to Present Your Asset Investment Plan to the Board

- Building Multi-Year Investment Scenarios in Days, Not Months