Balancing CAPEX (Capital Expenditures) and OPEX (Operating Expenditures) is critical for managing assets effectively and reducing long-term costs. CAPEX involves large, upfront investments in assets like machinery or infrastructure, while OPEX covers ongoing costs like maintenance and operations. Mismanaging either can lead to higher expenses, reduced asset performance, or financial strain.

Key insights from the article include:

- Lifecycle Costs: CAPEX typically accounts for 10-40% of an asset’s total lifecycle cost, while OPEX makes up 60-90%.

- Financial Risks: Delaying CAPEX can increase OPEX costs due to frequent repairs or failures. Similarly, cutting OPEX too much can shorten asset lifespan.

- Data-Driven Planning: Using risk-based asset planning can lower lifecycle costs by up to 45% and improve asset availability by 5%.

- Sustainability Goals: Investments in retrofitting or energy-efficient upgrades can reduce carbon emissions and operational costs.

To achieve a balance:

- Use a TOTEX (total expenditure) approach to integrate CAPEX and OPEX decisions.

- Prioritize refurbishments or upgrades over full replacements when possible.

- Shift from static annual budgets to rolling 12-18 month plans that adapt to performance data.

A hybrid strategy that considers both CAPEX and OPEX can extend asset life, reduce costs, and align with financial and environmental goals.

OPEX, CAPEX & TOTEX

Understanding CAPEX and OPEX: Definitions and Why They Matter

Getting a handle on asset spending starts with knowing the difference between CAPEX and OPEX. CAPEX (Capital Expenditures) refers to big, long-term investments in assets like buildings, machinery, infrastructure, or patents – anything that provides value over multiple years. On the other hand, OPEX (Operating Expenditures) covers the everyday costs of running a business, such as salaries, utilities, rent, maintenance, and marketing.

How these expenses are accounted for makes a big difference. CAPEX is recorded on the balance sheet and depreciated over the asset’s useful life, which spreads the cost across several years. OPEX, however, hits the income statement immediately, reducing profit in the same period it’s incurred. From a tax perspective, OPEX is fully deductible in the current year, while CAPEX deductions are spread out over time through depreciation [10][11]. These differences in accounting highlight how each type of expense impacts financial risk.

The cash flow and risk associated with these expenses also vary significantly. CAPEX often requires a large upfront cash investment, tying up capital for years and creating higher risk if the asset underperforms or becomes outdated. In contrast, OPEX involves smaller, recurring payments, offering more flexibility and the ability to adjust spending month-to-month. As one industry expert puts it:

If you overspend one month, adjustments can follow the next.

But with CAPEX, a poor decision can lock you into long-term financial commitments.

These two categories are closely linked. Skimping on CAPEX – like delaying equipment upgrades or building maintenance – can increase OPEX down the line with higher repair costs, more frequent breakdowns, and greater operational risks [2]. On the flip side, cutting OPEX too deeply can lead to premature asset failures, wasting the remaining value of earlier CAPEX investments and forcing unplanned replacements.

Striking the right balance between CAPEX and OPEX is critical. Capital expenditures typically make up just 10% to 40% of an infrastructure asset’s total lifetime costs, while the remaining 60% to 90% comes from long-term operations and maintenance [7]. Organizations that understand this dynamic and plan accordingly can lower lifecycle costs by 20% to 40% [7]. The goal isn’t to minimize one at the expense of the other but to find a balance that extends asset life, reduces risk, and supports sustainable growth.

1. CAPEX (Capital Expenditures)

Let’s dive deeper into CAPEX by exploring its accounting treatment, financial risks, and how it impacts the lifespan of assets.

Definition and Accounting Treatment

Capital expenditures are funds used to acquire, upgrade, or maintain physical assets like buildings, machinery, and equipment. Unlike regular expenses, these costs are recorded as investments and spread out over the asset’s useful life through depreciation. This gradual expense reduces taxable income over time [12].

For example, Apple’s September 2023 financial report highlights this process. The company reported gross property, plant, and equipment (PP&E) of $114.6 billion, with $78.3 billion allocated to machinery, equipment, and internal-use software. After accounting for $70.9 billion in accumulated depreciation, the net book value of these assets stood at $43.7 billion [12]. Similarly, Amazon disclosed $63,645 million in capital expenditures in 2022, primarily for property and equipment purchases, as detailed in the investing activities section of its cash flow statement [13].

These accounting practices are essential for understanding the cash flow challenges and risks tied to CAPEX investments.

Cash Flow and Risk Tradeoffs

CAPEX often requires a significant upfront cash commitment, locking businesses into long-term investments that are difficult to reverse due to the specialized nature of capital equipment [13]. To assess these risks, companies use the CF-to-CAPEX ratio. A ratio above 1.0 indicates that a company has sufficient operational cash flow to cover its capital expenditures [12][13].

Impact on Asset Lifecycle

Strategically allocating CAPEX can significantly extend the lifespan of assets while cutting operating costs. For instance, modernization efforts can add up to 30 years to an asset’s life and reduce operating expenses by one-third [8]. Increasing the refurbishment budget by just 10% can lower the total cost of ownership by 22% over time, thanks to fewer failures and reduced maintenance needs [2].

Real-world examples illustrate this impact. In Finland, Kemijoki Oy upgraded key switchgear components, cutting downtime from weeks to just hours while maintaining uninterrupted power for 10,000 homes [8]. Jarkko Virtanen, Vice President of Electrical and Machinery Technology, remarked:

"Compared to a full overhaul of the complete medium voltage switchgear, we saved almost a month of downtime with the retrofit – taking just hours rather than several weeks."

Similarly, Finkl Steel in Quebec replaced two outdated breakers with a VD4-AF1 arc furnace breaker capable of 150,000 operations, reducing maintenance needs for the next decade [8].

Beyond extending asset life and lowering maintenance costs, CAPEX also plays a key role in advancing sustainability.

Role in Sustainability Goals

CAPEX is a critical driver for building greener infrastructure and embracing circular economy practices. Retrofitting assets can reuse up to 50% of high-carbon materials, cutting both costs and environmental impact [8].

Take the Four Seasons Hotel Doha in Qatar, for instance. By replacing 20 air circuit breakers with Emax 2 smart breakers and retrofitting five Ekip UP devices, the hotel achieved a 15% reduction in energy use and a 20% drop in maintenance costs. This was made possible through cloud-based monitoring [8]. With 92% of business leaders concerned about the impact of energy instability on profitability [8], targeted CAPEX investments like this not only improve operational efficiency but also support decarbonization efforts while reducing overall asset lifecycle costs.

sbb-itb-5be7949

2. OPEX (Operational Expenditures)

Let’s take a closer look at OPEX – its accounting treatment, cash flow implications, and how it plays a role in asset management and sustainability efforts.

Definition and Accounting Treatment

Operating expenditures cover the routine costs of running a business, such as utilities, maintenance, salaries, and repairs. These expenses are deducted from revenue in the same period they occur, offering immediate tax benefits [9][3]. Unlike CAPEX, which is spread out over time through depreciation, OPEX is recorded on the income statement, allowing for quicker expense recognition [9][4]. This distinction highlights its flexibility but also introduces potential volatility in cash flow.

Cash Flow and Risk Tradeoffs

OPEX provides businesses with financial flexibility by avoiding the need for significant upfront investments. Models like subscriptions, leasing, and as-a-service arrangements help preserve cash and maintain liquidity [1][3]. However, this flexibility comes with risks. For example, fluctuating costs in utilities, fuel, and labor can create financial uncertainty. A survey found that 92% of business leaders are concerned about how energy price instability could impact profitability [8].

The balance between maintenance and replacement decisions illustrates this challenge. For instance, increasing refurbishment budgets by just 10% reduced total ownership costs by 22% over time by preventing failures and emergency repairs [2]. On the flip side, delaying necessary capital replacements while continuing to spend on maintenance can lead to higher costs in the long run as aging assets demand increasingly frequent and expensive interventions [2]. Philippe Jetté, Product Manager for Asset Investment Planning at IBM, quantified this risk:

"Under a −10% scenario, they would delay replacements, increasing preventive maintenance and end-of-life risks, quantifying an additional $4.3 million in total cost of ownership over five years relative to the flat scenario." [2]

Impact on Asset Lifecycle

Strategic OPEX spending plays a key role in maintaining assets in peak condition throughout their operational lifespan. Proactive maintenance can prevent small problems from escalating into major failures, while targeted upgrades to specific components can extend the life of assets without the need for full system replacements. This approach can add up to 30 years to an asset’s life and cut operating costs by a third [8].

For example, Finkl Steel in Quebec upgraded its electrical cabinet with a VD4-AF1 arc furnace breaker. This eliminated the need for frequent quarterly maintenance cycles and provided a decade of maintenance-free operation [8]. Such targeted OPEX investments can achieve results similar to large CAPEX projects but with lower upfront costs and less risk.

Role in Sustainability Goals

OPEX decisions aren’t just about managing costs – they can also drive sustainability efforts. Retrofitting existing equipment reduces the carbon footprint tied to manufacturing new components. In fact, up to 50% of electrical equipment, like metal cabinets and busbars, can be reused indefinitely with regular upgrades [8]. Additionally, digital monitoring systems funded through OPEX budgets can identify energy inefficiencies in real time, while predictive maintenance prevents environmental hazards.

Remote assistance tools, such as augmented reality, further cut environmental impact by reducing travel-related emissions by as much as 60% [8]. ABB highlights the broader benefits:

"Modernization programs can also reduce operational costs and carbon emissions, helping organizations meet environmental standards and improve their Environmental, Social and Governance (ESG) outcomes." [8]

For buildings, which contribute 39% to 42% of global emissions annually [14], strategic OPEX investments in energy management and predictive maintenance directly support decarbonization goals while also improving financial performance.

Advantages and Disadvantages of CAPEX and OPEX

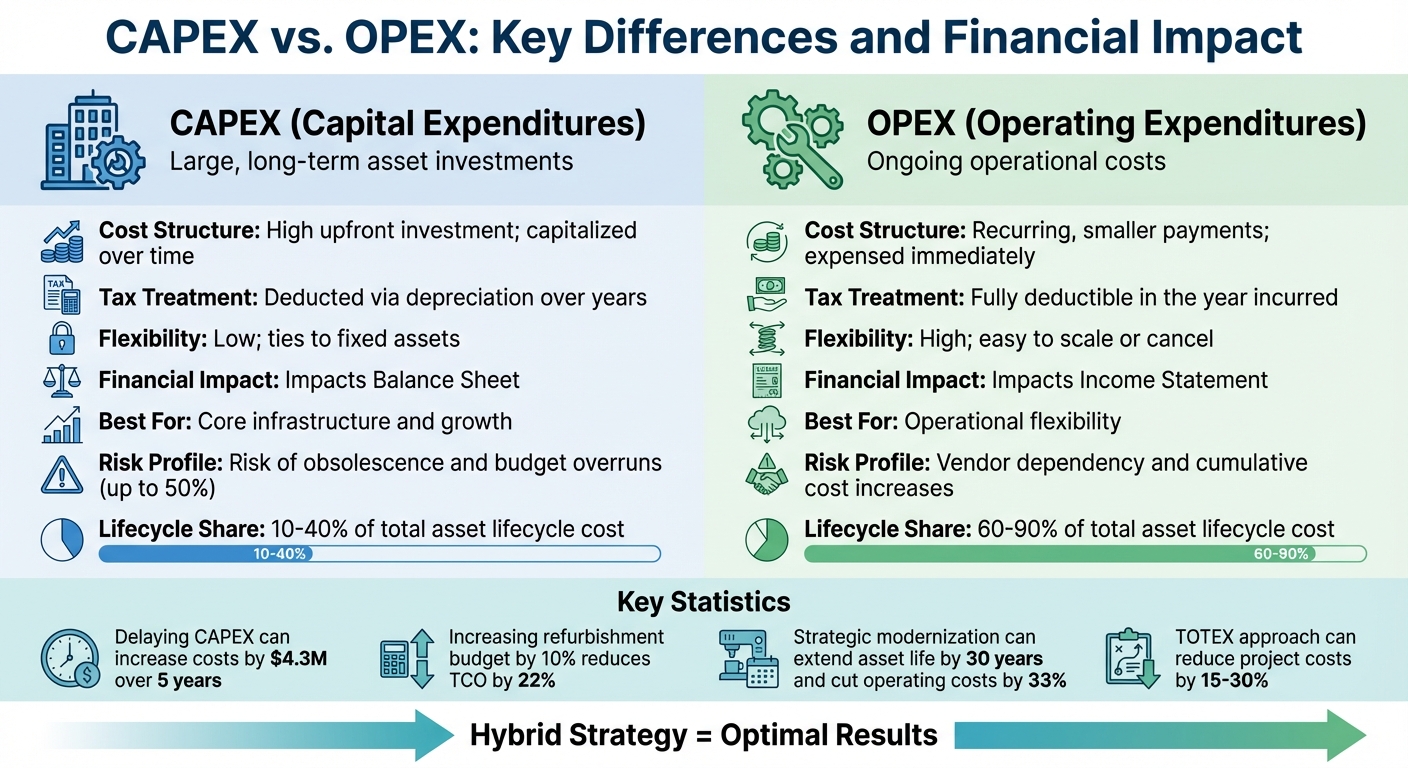

CAPEX vs OPEX: Key Differences and Financial Impact Comparison

CAPEX and OPEX each come with their own set of tradeoffs, influencing how organizations plan assets and manage risks. Let’s break down their benefits and potential challenges.

CAPEX requires a large upfront investment, which can put pressure on cash flow. However, it offers long-term ownership and control over assets. These expenditures are recorded as assets on the balance sheet and depreciated over time, supporting long-term growth and enhancing productive capacity. On the flip side, CAPEX ties organizations to fixed assets, reducing flexibility and committing them to significant long-term obligations. Additionally, large capital projects often exceed budgets and timelines – by as much as 50% in some cases [5].

OPEX, meanwhile, involves smaller, recurring payments that are deducted from taxable income in the year they occur. This provides immediate tax benefits and helps maintain short-term cash flow. OPEX also allows organizations to adjust spending more easily to meet operational needs. However, over time, the cumulative cost of operating expenses can surpass the cost of outright ownership. Companies may also become dependent on vendors, facing risks like unpredictable cost increases.

Risk-based asset planning highlights the importance of balancing these approaches. For example, delaying CAPEX replacements can increase failure risks and drive up total costs. One analysis showed a $4.3 million increase in total cost of ownership (TCO) over five years due to deferred replacements [2]. On the other hand, increasing a budget for targeted refurbishments by 10% was projected to lower TCO by 22% over the long term [2]. These findings emphasize the need for a strategy that balances short-term operational flexibility with long-term asset stability.

| Feature | CAPEX | OPEX |

|---|---|---|

| Cost Structure | High upfront investment; capitalized over time | Recurring, smaller payments; expensed immediately |

| Tax Treatment | Deducted via depreciation over years | Fully deductible in the year incurred |

| Flexibility | Low; ties to fixed assets | High; easy to scale or cancel subscriptions |

| Financial Impact | Impacts Balance Sheet | Impacts Income Statement |

| Long-term Goals | Ideal for core infrastructure and growth | Ideal for operational flexibility |

| Risk Profile | Risk of obsolescence and budget overruns | Risk of vendor dependency and higher costs |

A real-world example shows how a hybrid approach can be effective. A UK water company combined CAPEX and OPEX by purchasing wastewater monitors for $525,000 (CAPEX) while paying $72,000 annually for maintenance (OPEX). This strategy reduced their five-year costs from $2,880,000 to $885,000 [15]. By owning the assets but outsourcing maintenance to experts, the company achieved both cost savings and operational flexibility.

Conclusion

Smart asset investment planning isn’t just about saving money – it’s about extending the life of your assets and aligning with long-term sustainability goals. By linking asset condition, risk, and cost to broader objectives, organizations can make more informed, impactful decisions.

One of the biggest barriers to efficiency is the disconnect between maintenance and capital planning teams. By integrating short-term operational spending with long-term capital strategies, you can avoid unnecessary costs, like performing maintenance on equipment that’s about to be replaced [6]. Taking a TOTEX (total expenditure) approach can lead to significant savings – organizations have seen project costs drop by 15% to 30% through better portfolio management [5]. This kind of integration transforms planning into actionable, cost-effective improvements.

Here’s how to start: Focus on the 80/20 rule – don’t wait for perfect data to take action [2]. Shift from static annual budgets to a rolling 12-to-18-month planning cycle, updating quarterly based on real-world performance [2]. And before jumping to full replacements, consider retrofitting. Upgrading key components can trim operating costs by a third and extend asset life by up to 30 years [8]. In fact, recent retrofitting projects have proven to significantly reduce downtime and operational expenses.

Setting clear sustainability targets is just as crucial. For example, delaying necessary replacements can add $4.3 million in costs over five years, while a focused 10% boost in refurbishment budgets can cut total ownership costs by 22% over time [2]. Smart upgrades, like installing digital monitoring systems and energy-efficient devices, not only reduce energy use and maintenance costs but also help meet sustainability goals.

This is about more than just cutting costs – it’s about creating a long-term vision. By using scenario optimization, you can see how small budget adjustments affect risk, costs, and carbon emissions over time. This strategic approach ensures every dollar spent delivers both financial returns and sustainability benefits. When done right, asset investment planning shifts from being reactive to becoming a powerful strategic tool – one that drives measurable results while paving the way for a greener, more efficient future.

FAQs

What is the TOTEX approach, and how does it help balance CAPEX and OPEX?

The TOTEX (total expenditure) approach merges capital expenditures (CAPEX) and operational expenditures (OPEX) into a single, comprehensive cost metric. Instead of treating these as separate budgets, TOTEX looks at the full lifecycle cost of ownership – factoring in upfront investments, ongoing maintenance, operational expenses, and eventual decommissioning.

This approach gives organizations a clearer way to evaluate options by balancing long-term benefits, like energy efficiency or savings from predictive maintenance, against initial costs. By focusing on the full financial picture, decision-makers can make smarter spending choices, reduce overall costs, extend the life of assets, and align their strategies with both financial and sustainability objectives.

TOTEX also simplifies budgeting and risk analysis by consolidating costs into one number. This makes it easier to plan scenarios, such as shifting between CAPEX-heavy and OPEX-heavy strategies, while instantly understanding the impact on cash flow, total expenses, and risk. In essence, it provides a solid, data-driven basis for making smarter and more sustainable investment decisions.

What financial risks can arise from delaying CAPEX investments?

Delaying CAPEX investments might feel like a smart way to conserve cash in the short term, but it often creates bigger financial headaches down the road. Holding off on upgrades or replacements can lead to aging equipment that breaks down more often, racks up higher repair bills, and increases the likelihood of unexpected failures. Take this example: a utility company postponed replacing transformers and ended up facing an extra $4.3 million in costs over five years due to more frequent maintenance and unplanned outages.

But the impact doesn’t stop there. Putting off capital projects can also take a toll on a company’s return on invested capital (ROIC). Skipping timely, impactful investments can hurt long-term profitability and shareholder value, especially when ROIC edges too close to the cost of capital. Over time, these delays can erode financial performance and make it tougher to hit key strategic objectives.

How does smart OPEX spending support sustainability goals?

Smart OPEX spending allows organizations to get more out of their existing assets while cutting energy use, lowering carbon emissions, and extending the life of their equipment. By focusing on predictive maintenance, digital upgrades, and energy-efficient processes, businesses can sidestep unnecessary capital expenses, reduce waste, and improve overall asset performance.

Take lighting systems or HVAC controls, for instance – upgrading these or integrating cloud-based analytics can lead to noticeable drops in energy consumption and greenhouse gas emissions. These changes don’t just save money; they also help companies align with environmental regulations and hit their sustainability goals. With a thoughtful approach, OPEX spending can transform routine expenses into opportunities for greener operations and long-term cost savings.

Related Blog Posts

- Infrastructure Asset Management: A Risk-Based Approach for Multi-Year CAPEX Planning

- Strategic CAPEX Planning for Highway Concessions: Balancing Grantor Compliance and Profitability at End-of-Term

- Asset Investment Planning 101: How to Decide What to Invest in, When and How Much

- Aging Infrastructure in Europe: How to Prioritise Renewal Under Budget Constraints