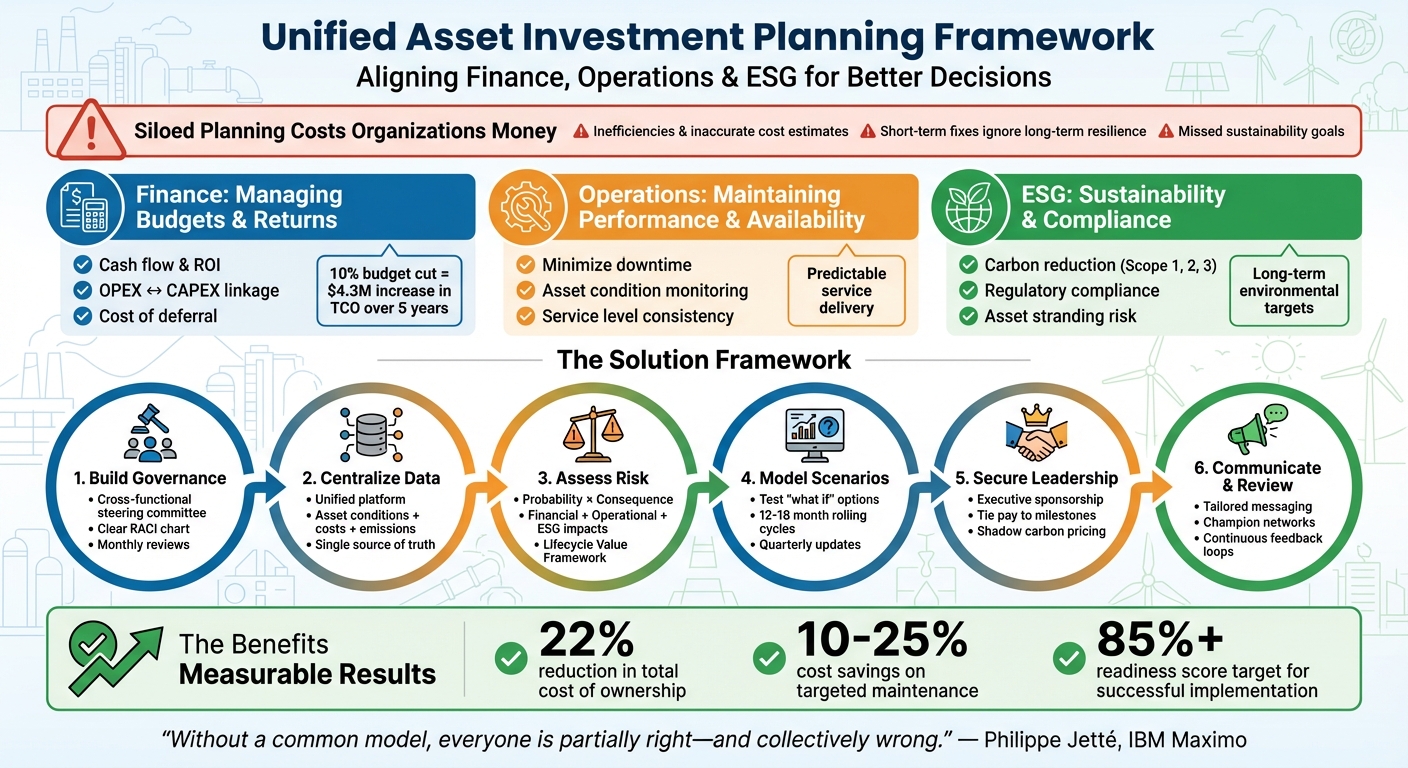

Misaligned teams cost money and delay progress. Finance, operations, and ESG teams often work in silos, leading to poor investment decisions, budget surprises, and missed sustainability goals. Here’s how organizations can fix this:

- The Problem: Siloed planning results in inefficiencies, inaccurate cost estimates, and short-term fixes that ignore long-term resilience.

- The Solution: Use change management to align teams with shared goals, centralized data, and clear governance structures.

- The Benefits: Organizations can reduce total costs by up to 22%, improve decision-making, and meet financial, operational, and sustainability objectives.

6-Step Framework for Aligning Finance, Operations, and ESG in Asset Investment Planning

Maturing Portfolio Management Strategically Planning and Aligning Portfolios with Enterprise Goals

sbb-itb-5be7949

Understanding the Three Perspectives: Finance, Operations, and ESG

When it comes to asset investment planning, each team – finance, operations, and ESG – approaches the process with its own priorities and language. Engineers focus on failure modes, finance emphasizes cash flow and risk, and operations zero in on service levels. Let’s dive into how these perspectives shape decision-making and the importance of integrating them.

Finance: Managing Budgets and Returns

Finance teams are all about controlling costs, managing cash flow, and ensuring strong returns on investment. They need to understand how cash needs evolve over time, link operating expenses (OPEX) with capital expenditures (CAPEX), and calculate the financial risks of delaying action – what’s called the "cost of deferral." For example, a regional utility found that a 10% budget cut would lead to a $4.3 million increase in total cost of ownership (TCO) over five years due to higher end-of-life risks and emergency maintenance costs. On the flip side, increasing the budget by 10% to fund targeted refurbishments of high-risk assets could reduce TCO by 22% in the long run [1]. These scenarios highlight why finance teams need clear visibility into how asset conditions affect both immediate fiscal needs and future capital planning. Collaboration with other teams is essential to make informed, balanced investment decisions.

Operations: Maintaining Asset Performance and Availability

While finance focuses on the numbers, operations teams are tasked with keeping assets reliable and available. Their priorities revolve around minimizing unplanned downtime, conducting regular inspections to monitor asset conditions, and fine-tuning maintenance strategies. Whether they decide to refurbish, replace, or let assets run to failure, the goal is to ensure consistent and predictable service delivery. With aging infrastructure and tight resources, operations teams must pinpoint which assets pose the most significant risks to service levels. This allows them to plan maintenance during available outage windows while still meeting the expectations of customers and stakeholders. Effective collaboration with finance and ESG teams ensures that operational goals align with broader investment strategies.

ESG: Meeting Sustainability and Regulatory Requirements

ESG teams bring a long-term focus to the table, prioritizing sustainability, carbon reduction, and regulatory compliance. They work to measure environmental and social impacts, achieve carbon targets across Scope 1, 2, and 3 emissions, and address "asset stranding risk" – the possibility that assets become obsolete as environmental standards tighten. Balancing these long-term goals with short-term financial returns is a constant challenge. According to the Umbrex Decarbonization Playbook, real progress happens when investment decisions factor in carbon costs, energy price volatility, and regulatory risks [3]. For ESG teams, collaboration with finance and operations is critical to ensure that sustainability goals are integrated into the overall asset investment plan.

Building Governance Structures for Cross-Functional Collaboration

To successfully integrate financial, operational, and ESG considerations, governance structures are the backbone of effective change management. A clear framework transforms differing priorities into cohesive decision-making. Without it, even the best intentions can get lost in disagreements over priorities or confusion about decision-making authority. Governance is not just bureaucracy; it’s the engine that drives decisions under constraints [6].

Defining Clear Roles and Responsibilities

Uncertainty about roles can bring asset investment planning to a grinding halt. A simple one-page RACI chart can clarify responsibilities for target setting, capital approvals, and data ownership [6]. For instance:

- Finance should embed emissions considerations into capital allocation and oversee internal carbon pricing.

- Operations and engineering should handle energy efficiency initiatives and reliability upgrades.

- IT and data teams must manage the systems – like ERP platforms, asset management tools, and IoT sensors – that ensure emissions data is measurable and auditable [6].

When roles are unclear, decisions get delayed, and investment progress stalls. Asset managers play a critical role here by feeding condition data into capital planning pipelines. They help determine whether refurbishing or replacing aging equipment is the better option [1]. This clarity sets the stage for building effective cross-functional steering committees.

Forming Cross-Functional Steering Committees

A steering committee with representatives from finance, operations, and ESG can streamline investment planning and resolve conflicts before they escalate. The committee should be chaired by an executive with authority over capital – typically the COO or CFO – to ensure decisions are binding [6]. Members should include leaders from operations, finance, procurement, R&D, IT, and risk/compliance.

To manage conflicts effectively, establish a three-tier escalation process:

- Level 1: Handles day-to-day execution.

- Level 2: Resolves team-level conflicts.

- Level 3: The steering committee addresses enterprise-level tradeoffs.

Hold monthly meetings to review key performance drivers, initiative progress, and resource conflicts. Weekly program routines can support these efforts. For escalations, use a concise one-page decision packet that outlines the decision required, available options (including "do nothing"), and the potential financial, operational, and emissions impacts [6].

Using Centralized Data for Better Decisions

Once governance structures are in place, centralized data becomes crucial for informed, agile decision-making. Shared data platforms solve the problem of teams relying on inconsistent spreadsheets or assumptions. A unified system consolidates data such as asset conditions, failure history, intervention costs, and emissions metrics into a single, reliable source. This transparency allows:

- Finance teams to evaluate how asset conditions impact cash flow.

- Operations teams to see how budget constraints affect service levels.

- ESG teams to monitor progress toward carbon reduction goals [1].

Focus on the data that drives most of the decision-making impact. For example, if environmental factors account for 80% of asset deterioration, prioritize refining that data before addressing less significant variables [1].

"Without a common model, everyone is partially right – and collectively wrong." – Philippe Jetté, Product Manager, IBM Maximo [1]

Centralized platforms also enable scenario modeling. Teams can test "what if" scenarios – like adjusting budgets or accelerating equipment replacements – to evaluate tradeoffs between cost, risk, and sustainability in real-time [1].

Risk-Based Prioritization: Balancing Costs, Risks, and Sustainability

Once solid governance and centralized data systems are in place, the next logical step is prioritizing assets based on risk. This method offers a structured way to weigh competing investments by balancing the probability of failure, financial implications, operational disruptions, and sustainability goals.

Evaluating Risk Across All Teams

Risk is essentially a combination of two factors: the likelihood of failure and its potential consequences [1]. The likelihood depends on things like the asset’s condition, its operating environment, usage patterns, and age. Consequences, on the other hand, reflect impacts such as reliability issues, safety concerns, regulatory compliance, and environmental objectives. Each team views risk through its own lens: finance focuses on cost exposure, operations on service interruptions, and ESG teams on regulatory deadlines and carbon reduction goals.

A Lifecycle Value Framework organizes this evaluation into six steps: defining goals and metrics, assessing asset risk, treating risk as a cost, exploring options like refurbishment or replacement, conducting scenario optimization, and setting up feedback loops for execution [1]. This approach shifts organizations from simple age-based asset replacement to more dynamic models that connect asset condition and importance to financial and operational outcomes.

"Asset investment planning is the ongoing practice of deciding, over a medium to long-term horizon, how to allocate capital and resources to minimize total lifecycle costs and risks." – Philippe Jetté, Product Manager, Asset Investment Planning, IBM [1]

It’s important to move beyond just financial impacts when assessing risk. The Integrated Capitals Assessment broadens the scope to include natural, social, human, and produced capital, which builds resilience over the long term [4]. For instance, understanding how asset failures could affect water availability, community safety, or workforce health is just as critical as estimating repair costs. Tools like heatmaps summarize exposure to nature-related risks – such as water use or pollution – across asset portfolios, while asset tagging uses detailed data to assess risk levels for individual assets [7]. These methods ensure that financial, operational, and ESG factors are integrated into a single, unified risk model.

This comprehensive framework paves the way for scenario modeling, where potential strategies are tested to find the right balance between cost, risk, and sustainability.

Testing Trade-Offs with Scenario Modeling

Once risks are clearly defined, scenario modeling allows teams to explore trade-offs between budget constraints, risk exposure, and sustainability objectives. This process helps visualize how different budget adjustments or operational decisions impact overall goals.

Scenario modeling works best with a rolling 12-to-18-month planning cycle, updated quarterly to reflect actual failures, completed work, and resource availability [1]. Teams can test "what if" scenarios, like speeding up equipment replacements or postponing low-risk interventions, to find the best balance. It also helps quantify less tangible goals, such as achieving net-zero emissions or improving community resilience, by translating them into comparable financial or risk metrics [8].

Implementing Change Management for Long-Term Success

Governance frameworks and risk models can fall apart if users don’t fully understand or embrace the new systems. Achieving lasting change requires committed leadership, open communication, and regular reviews that adapt to evolving needs.

Securing Leadership Support

Leadership plays a critical role in driving change, especially when it comes to integrating governance and risk insights. Interestingly, only 22% of corporate directors believe ESG initiatives positively impact the bottom line [2]. This often pits sustainability efforts against traditional priorities. The solution? Reframe sustainability and asset investments as opportunities for revenue growth, cost savings, and better risk management – not just compliance expenses [2].

To ensure alignment, form a cross-functional Steering Committee led by a high-ranking executive, like the CFO or COO, who has authority over capital allocation. This group should meet monthly to review progress, eliminate roadblocks, and approve necessary changes [6]. Scenario modeling can be a powerful tool here, helping to quantify the long-term benefits of proactive asset management [1]. For instance, standardized one-page decision summaries – highlighting emissions, financial impacts, and operational considerations – can speed up executive approvals and reduce delays [6].

"Governance is not paperwork; it is the mechanism by which the organization makes decisions under constraint." – Umbrex [6]

To keep leaders accountable, tie part of their variable pay to specific milestones and data-quality improvements, rather than broad "net metrics" that can be manipulated through boundary adjustments [6]. Another effective tactic is using internal shadow carbon pricing during investment evaluations, making the financial risks of emissions more transparent [3].

Communicating Clearly with All Teams

Change efforts often fail when employees don’t understand the reasons behind them or how they’ll be impacted. Avoid generic messaging by tailoring communications to 5–8 audience personas, such as AP Specialists, Business-Unit CFOs, or Operations Leads. This approach helps address different perspectives and overcomes change fatigue [9]. Develop a core narrative that explains the external drivers for change, the envisioned future state, tangible benefits (like cost savings or reduced risks), and a clear call to action.

Identify early adopters and informal leaders to act as "Champions." These individuals can test new tools, share testimonials, and lead local discussions to make the transformation feel relatable [9]. Champions serve as a bridge between senior leaders and frontline staff, turning abstract goals into something more tangible. Establish "You Said, We Did" feedback loops by conducting regular pulse surveys and sharing how feedback has influenced the strategy [9].

"A brilliant roadmap will flounder if the people asked to live it never understand, believe, or embrace the change." – Umbrex [9]

Incorporate training into communication strategies by guiding employees from awareness campaigns into role-specific learning paths. Use in-app tooltips, virtual labs, and micro-learning modules to help staff build confidence in new processes [9]. Measure readiness with a composite score that evaluates knowledge, skills, and mindset. Aim for at least 85% accuracy in pulse surveys about the "why, what, and when" of the change before fully rolling it out [9].

This thoughtful communication strategy sets the stage for ongoing monitoring and agile adjustments.

Reviewing and Adjusting Over Time

Once a framework is in place and communication is clear, continuous review ensures the model stays relevant. Change management isn’t a one-and-done effort. Establish a predictable review schedule: weekly program routines for real-time analytics and sentiment checks, monthly Steering Committee meetings to address resource conflicts and portfolio progress, and quarterly updates to the Change Impact Assessment (CIA) to reflect shifts in scope or external conditions [6][9].

Adopt a rolling 12-to-18-month planning horizon, recalibrating investments quarterly based on real-world data like failures, work history, and current resource availability [1]. This approach allows teams to correct course early, preventing minor issues from escalating. Real-time analytics – such as sentiment surveys, system telemetry, and training completion rates – can signal when adjustments are needed, like switching communication formats if engagement drops [9].

After implementation, use performance data to refine assumptions and strengthen governance [1][3]. If a measure underperforms, revisit the assumptions in the investment model. Create clear escalation paths with a three-level model (Initiative Owner → Program Lead → Steering Committee) and set time limits for resolving cross-functional issues [3][6]. Maintain momentum through gamification, like leaderboards and badges, and publish annual transformation reports that combine storytelling with data [9].

"Change fatigue peaks when spotlights fade. Sustain energy through… an annual transformation impact report – glossy, story-rich, and data-credible." – Umbrex [9]

Conclusion: Building Unified Asset Investment Planning

Bringing finance, operations, and ESG teams together through structured change management turns asset investment planning into a cohesive, data-driven process. When these groups operate with a shared decision-making model and language, organizations gain the clarity needed to balance competing goals – like reducing lifecycle costs, maintaining service levels, and achieving sustainability objectives – without compromising one for another.

The benefits are tangible. Organizations that embrace integrated planning frameworks report 10–25% cost savings on targeted maintenance efforts and can lower total ownership costs by 22% through strategic refurbishments rather than reactive replacements [1]. Beyond financial savings, this method safeguards critical resources – such as water, stable climates, and community support – that are essential for long-term value creation [5].

"A data‑driven, long‑term AIP process addresses all four challenges by linking asset condition and criticality to financial risk and service outcomes." – Philippe Jetté, Product Manager, Asset Investment Planning, IBM [1]

Risk-based prioritization, enhanced by scenario modeling and rolling 12-to-18-month planning cycles, empowers teams to evaluate trade-offs before committing resources. Finance gains insights into phased cash requirements and the costs of deferral, operations benefits from more predictable service with fewer emergencies, and ESG teams get a clear roadmap to meet decarbonization goals – all within a unified governance framework [1]. This approach replaces "scenario blindness" with adaptability, allowing for quarterly adjustments based on actual performance data.

Ultimately, successful change management isn’t about achieving perfect data or flawless execution from the start. It’s about building a feedback loop where leadership remains engaged, communication stays open, and the framework evolves alongside organizational needs. When finance, operations, and ESG teams align under a shared strategy, the entire organization is positioned to move forward with clarity and confidence.

FAQs

What’s the fastest way to break down silos between finance, operations, and ESG?

To move quickly, organizations need to set up a clear governance structure that weaves ESG and decarbonization into their core decision-making processes. This means defining who makes decisions, outlining roles, and assigning responsibilities to promote teamwork and accountability across departments. Centralized systems – like sustainability command centers – can help streamline metrics and enhance communication. By integrating ESG into planning and daily operations, companies can bring financial, operational, and sustainability goals together in a seamless way.

What data should we centralize first for asset investment planning?

To get started, bring together reliable asset condition and performance data. This should include details like condition assessments, maintenance records, defect logs, energy performance metrics, and lifecycle schedules. By consolidating this information, you’ll have a solid base for smarter investment decisions, cost forecasting, and risk management.

For even better results, include lifecycle assessment data that covers embodied, operational, and end-of-life impacts. This approach helps align financial goals with operational needs and ESG objectives, making it easier to collaborate across teams and make decisions based on solid evidence.

How do we quantify ESG and resilience trade-offs in investment decisions?

Quantifying trade-offs in ESG (Environmental, Social, and Governance) and resilience requires weighing both financial outcomes and the broader, non-financial advantages of sustainability and resilience initiatives. Tools like decoupled net present value (DNPV) and methodologies such as the Physical Climate Risk Appraisal Methodology (PCRAM) play a key role here. These approaches incorporate climate-related risks directly into financial assessments, offering insights into areas like risk reduction, improved valuations, and insurability. By leveraging these tools, organizations can better align their financial objectives with long-term resilience and ESG priorities in a balanced and integrated way.