Aging infrastructure in the U.S. faces growing risks from extreme weather events caused by climate change. Roads, energy grids, water systems, and buildings, designed for past conditions, are struggling to cope with today’s challenges. Failing to address these risks leads to higher costs, service disruptions, and safety concerns. The solution? Prioritize investments in high-risk areas like flood defenses, heat-resilient systems, and utility safeguards to reduce damages and ensure long-term functionality.

Key Takeaways:

- Start with risk assessments: Build an inventory of assets, evaluate their vulnerabilities, and rank them using tools like FEMA’s National Risk Index.

- Focus on critical areas: Address flood protection, heat-resilient upgrades, and coastal safeguards first.

- Leverage cost-effective solutions: Nature-based designs, storm-resistant roofing, and grid reinforcements can mitigate risks while offering long-term savings.

- Plan with data: Use risk-based infrastructure asset management frameworks and tools like Oxand Simeo™ to model scenarios, track performance, and optimize spending.

Investing early in climate-resilient upgrades can cut potential damages by up to one-third, saving billions over time. Delaying action only increases costs and risks.

Keeping Drinking Water Safe: Aging Infrastructure and Climate Change

sbb-itb-5be7949

How to Identify High-Risk Aging Assets

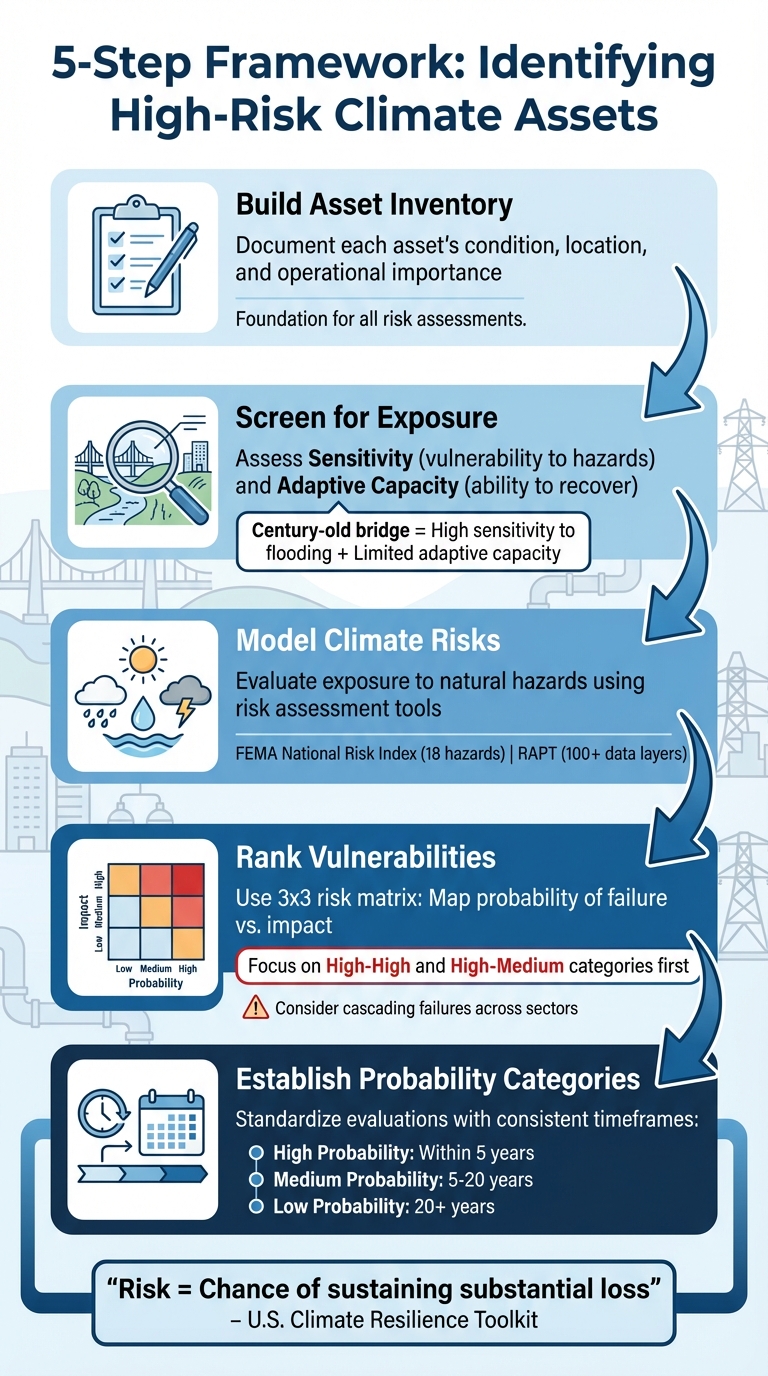

5-Step Framework for Identifying and Prioritizing High-Risk Climate Assets

Start by building a comprehensive asset inventory. This inventory should detail each asset’s condition, location, and importance to your operations. Think of it as your baseline – it’s nearly impossible to make informed investment decisions without this groundwork. Beyond just listing physical assets, include their current state and how critical they are to your organization. This inventory will also serve as the foundation for assessing climate-related risks.

The next step involves screening for exposure. Document every asset, whether you use a simple spreadsheet, a GIS database, or an asset management platform like Oxand Simeo™. For each item, assess its Sensitivity (how vulnerable it is to hazards) and Adaptive Capacity (its ability to recover from impacts) [3]. For instance, a century-old bridge without updated drainage systems would likely have high sensitivity to flooding and a limited ability to adapt.

"Risk is a compound concept that describes the chance of sustaining a substantial loss." – U.S. Climate Resilience Toolkit [3]

Once your inventory is complete, move on to modeling climate risks for each asset. Tools like FEMA’s National Risk Index allow you to evaluate exposure to 18 different natural hazards across your locations [3][5]. Similarly, the Resilience Analysis and Planning Tool (RAPT) provides more than 100 preloaded data layers, covering everything from population statistics to infrastructure and hazard information [5]. For aging HVAC systems in the Southwest, you’d analyze risks related to extreme heat. For coastal facilities, consider flood zones and sea-level rise projections. These insights help you prioritize which assets need attention first.

After identifying risks, rank vulnerabilities to determine where immediate action is required. Use a 3×3 risk matrix to map each asset’s probability of failure against the impact it would have. Assets that fall into "High-High" or "High-Medium" categories should be your top priorities [3]. It’s also crucial to think about service disruptions and cascading failures. As the U.S. Climate Resilience Toolkit explains: "If you recognize that damage to a specific asset… could initiate multiple failures across other sectors in your community, consider that asset as a top priority" [3]. For example, a telecommunications hub or a major bridge failure could lead to widespread disruptions far beyond the immediate damage.

Finally, establish consistent probability categories to standardize your evaluations. For example, classify hazards likely to occur within 5 years as "High Probability", those expected once in 5–20 years as "Medium", and those occurring less than once in 20 years as "Low" [4]. This consistency ensures your risk assessments are defensible and helps guide investment decisions. With this structured approach, you can focus on targeted solutions to protect your most vulnerable assets.

Where to Invest First: Climate Adaptation Priorities

After pinpointing your most vulnerable assets, the next step is allocating funds where they’ll make the biggest difference. While the specific risks you face will guide your decisions, focusing on flood protection, heat and storm resilience, and coastal and utility safeguards often delivers strong returns. These areas address today’s most pressing threats. For example, in 2024, 98.6% of U.S. cities reported facing major climate hazards, a sharp increase from 83% the year before [9]. This highlights the urgent need for targeted upgrades in these critical areas.

The numbers are staggering. Over the past 12 years, climate disasters have cost the U.S. $6.6 trillion, and 89% of climate hazards are expected to worsen. Meanwhile, cities are staring at a $40.8 billion funding gap for climate-related projects [9]. When planning investments, don’t just think about resilience. Consider the added perks, like lower operating costs, job creation, and better air quality [9]. For instance, upgrading HVAC systems helps combat extreme heat, while restoring wetlands manages stormwater and improves water quality, all while creating habitats for wildlife.

Certain sectors face immediate risks – human health, water supply, and sewage/waste management – and should be prioritized. By acting decisively now, you can build lasting resilience rather than scrambling to fix problems as they arise.

Flood-Resistant Infrastructure Upgrades

Flooding remains the most frequent and expensive climate hazard, particularly for aging infrastructure. Traditional systems like concrete channels and underground pipes often fall short when faced with today’s more intense storms. Instead, solutions that work with natural systems are proving far more effective.

Start with stormwater system improvements, such as upgrading outdated drainage networks with permeable surfaces that allow water to seep into the ground rather than overwhelming sewer systems. Many cities are adopting "sponge city" designs, which restore forests and enhance drainage to mimic natural waterways [12].

Nature-based solutions are another smart move. Restoring floodplains and preserving wetlands not only manage stormwater but also provide bonus benefits like cleaner water and healthier ecosystems [8]. Globally, a $1.8 trillion investment in early warning systems, resilient infrastructure, and mangrove protection is projected to return $7.1 trillion in benefits – a nearly 4-to-1 payoff [12]. For assets near rivers, stabilizing riverbanks can prevent erosion that weakens foundations.

If your facilities are in flood zones, consider stormwater deflection measures. For example, adding deflection separation units to aging sewer systems can keep debris from clogging water treatment facilities [6]. These targeted upgrades can protect infrastructure without requiring a complete overhaul. When funding these projects, look for grants, especially for nature-based solutions in underserved communities [8].

Once your flood defenses are in place, turn your attention to heat and storm resilience.

Heat and Storm-Resistant Retrofits

As extreme heat and severe storms grow more intense, many buildings and infrastructure systems are struggling to keep up. Older designs simply weren’t built for today’s conditions. For example, every one degree Celsius of warming could slash net farm income in the U.S. by 66%, and similar challenges affect infrastructure performance [7].

HVAC upgrades are a must, particularly in areas dealing with record-breaking heat. Older systems often fail during heat waves, leading to operational disruptions, health risks, and expensive emergency repairs. Modern, climate-ready systems can prevent these issues, making them a top priority in heat-prone regions like the Southwest.

Roofing improvements are equally critical. Replace outdated materials with options that can handle heavier snow, resist wind-driven rain, and reflect heat. In hurricane-prone areas, storm-resistant roofing can significantly reduce damage [11]. For flat roofs, adding structural reinforcements can prevent collapse during extreme weather events.

"Physical damage to buildings, supplies, and equipment due to flooding or other extreme weather events can be costly. These catastrophic events can disrupt business and supply chains by halting manufacturing or making it impossible for employees to get to work." – Emily Thomas, Head of Impact Investing, Morgan Stanley Wealth Management [7]

Structural reinforcements also play a key role in extending the life of older buildings. Focus on windproofing entry points, strengthening load-bearing walls, and upgrading windows to impact-resistant glass. Between 2000 and 2019, natural disasters increased by 74.5% compared to the previous two decades [11]. It’s time to move beyond outdated building codes and embrace performance-based design standards that anticipate future climate conditions [1].

Coastal and Utility Protection

Coastal assets and utilities are particularly vulnerable, and damage to these systems can lead to widespread failures. For instance, disruptions to electricity grids often ripple through hospitals, water treatment plants, and telecommunications networks [10]. That makes protecting these assets a top priority.

Invest in sea walls and elevated utilities to shield coastal facilities from sea-level rise and storm surges. Raising street levels and critical equipment above projected flood elevations is another smart move. Updated freeboard requirements recommend elevating public facilities at least 4 feet above the base flood level [6], but for older assets, even higher elevations may be necessary.

Mangrove restoration provides a natural defense against storm surges and rising seas, often at a fraction of the cost of traditional infrastructure [12]. For coastal facilities, combining natural "green" solutions like mangroves with engineered "grey" infrastructure, such as reinforced foundations, offers the best protection [12].

As extreme weather puts more strain on aging electrical systems, grid reinforcements are becoming essential. Microgrids and distributed renewable energy systems can keep facilities running during outages [6]. Early warning systems are another cost-effective measure, with benefits up to 10 times their initial investment [12]. For utilities, adopting 72-hour resilience standards ensures facilities have enough power, supplies, and storage to operate during and immediately after a disaster [6].

In 2015 alone, natural disasters cost the U.S. $26.4 billion [1], and those costs are only climbing. Protecting coastal and utility infrastructure not only reduces direct damage but also minimizes the broader economic fallout from prolonged outages and service disruptions.

Using Risk-Based Frameworks to Guide Investment Decisions

After identifying where to allocate resources through vulnerability assessments, risk-based frameworks help refine the "how much" of the equation. These frameworks allow you to weigh multiple factors – like upfront costs, long-term savings, risk reduction, and carbon impact – so your decisions are well-rounded and defensible to boards, regulators, and investors. This approach moves away from gut instincts and offers a structured way to make smarter, data-backed choices.

Instead of sticking with basic "low, medium, high" risk ratings, a more detailed quantitative analysis can provide sharper insights. By using geospatial data and property values, you can reduce uncertainty and better prioritize complex systems. Tools like quantitative risk matrices also help account for cascading failures, where damage to one critical asset – like a bridge or communication hub – can ripple across multiple sectors.

Advanced platforms like Oxand Simeo™ take this a step further. They combine risk modeling with multi-criteria decision-making, allowing you to simulate budget scenarios, test strategies over 5–30 years, and compare the lifecycle costs of resilient infrastructure against the costs of inaction. With over 10,000 proprietary aging and performance models, these tools predict how assets will fare under future climate conditions, enabling proactive planning rather than reactive responses.

This data-driven approach lays the groundwork for creating tailored investment strategies.

Balance Risk, Cost, and Sustainability Metrics

Smart investment decisions require balancing multiple factors – CAPEX (capital expenses), OPEX (operating expenses), risk reduction, and carbon impact. It’s not just about choosing the cheapest option or the one that minimizes risk the most; the goal is to maximize value across all priorities.

Start with a cost-benefit analysis (CBA) to weigh current costs against the benefits of adaptation. As the National Academies of Sciences, Engineering, and Medicine explains:

"CBA should help agencies navigate the spectrum of decisions from mitigation and greenhouse gas reduction to adaptation: where does investing public funds generate the most public good?" [13]

For aging infrastructure, this means comparing the costs of repairs, energy use, and potential service disruptions with the benefits of adaptation, such as avoiding damage and reducing operating expenses. For instance, climate-related damage to paved roads could cost up to $20 billion by the end of the century, but adapting critical infrastructure could cut those costs by up to one-third [2].

Don’t overlook transition risks either. These include the costs tied to reducing greenhouse gas emissions and potential revenue losses, such as declining fuel tax income as infrastructure shifts to sustainable alternatives. A structured framework that uses scoring methodologies can help balance these competing priorities, weighing exposure levels against the risks to critical systems [2].

Test Investment Scenarios for Long-Term Planning

Testing different investment scenarios helps clarify priorities and timing, especially when budgets are tight or climate risks evolve faster than expected. Scenario testing allows you to explore "what if" situations before committing to specific actions.

With Oxand Simeo™, you can model various budget and adaptation scenarios over a 5–30 year period. For example, you might compare the outcomes of making significant upfront investments in flood defenses versus spreading those investments over a decade. The platform uses over 30,000 maintenance laws and probabilistic models to simulate asset aging, failure, and energy use under each scenario, providing a clear view of trade-offs.

This approach is particularly valuable for infrastructure concession holders. During the tender phase, risk-based investment scenarios can optimize concession offers and justify lifecycle costs. In the operational phase, scenario testing can help cut maintenance-related costs by 10–15% and even extend maintenance cycles, potentially reducing costs on key components by up to 25%. At the end-of-concession phase, it ensures accruals are appropriately sized, avoiding over-maintenance or insufficient upkeep.

Unlike tools heavily reliant on IoT data, Oxand’s model-driven PredTech approach works with existing surveys, inspections, and asset data. While IoT data can be integrated if available, it’s not a requirement, making this method more accessible.

Generate ISO 55001-Compliant Plans

When it comes to climate adaptation, having a plan isn’t enough – it needs to be audit-ready and traceable. Boards, regulators, and investors want assurance that your investment decisions are grounded in reliable data and align with recognized standards like ISO 55001.

ISO 55001, the global standard for asset management, requires organizations to show that their plans are built through a systematic and defensible process. This includes documenting how risks were identified, alternatives evaluated, and projects prioritized, all while ensuring alignment with broader goals such as sustainability and financial performance.

Oxand Simeo™ simplifies this by generating ISO 55001-compliant plans directly from the same data and scenarios used in decision-making. This means you don’t need to create separate reports for auditors or regulators – the platform produces audit-ready documentation that links each decision to its supporting data. This not only saves time but also reduces the risk of inconsistencies that could raise red flags during audits.

For organizations in Europe, this capability is especially critical given strict EU regulations on energy performance and decarbonization. Many jurisdictions now demand detailed reports on climate adaptation efforts. A traceable, compliant plan not only helps meet these requirements but also makes it easier to communicate progress toward sustainability goals to stakeholders, including boards, investors, and the public.

How to Execute Climate Adaptation Plans

Turning a well-thought-out climate adaptation plan into action requires a clear focus on high-risk areas, careful budget management, and continuous tracking of results. This step involves prioritizing investments, monitoring progress, and staying flexible as conditions evolve. It directly builds on the investment prioritization discussed earlier.

Sequence Investments for Maximum Impact

Start by targeting "High-High" or "High-Medium" asset-hazard pairs from your risk matrix. These are the critical assets whose failure could lead to widespread disruptions across multiple sectors [3][4]. Think of things like bridges, telecommunications hubs, or utility substations – if these fail, the ripple effects can be significant.

To make this process more seamless, integrate climate adaptation into existing financial frameworks like Capital Improvement Plans (CIP), State Transportation Improvement Plans (STIP), or annual CAPEX cycles [2]. Using a scoring system can help ensure that funding decisions are based on objective assessments of risk and exposure levels [2].

Of course, the financial reality can’t be ignored. Adapting infrastructure comes with a hefty price tag. For instance, upfront costs could hit $10 billion for roads and nearly $1 trillion for water systems by 2025 [2]. To manage these costs, tap into a variety of funding sources – federal resilience grants, infrastructure-specific debt options, or state and local capital reserves. By spreading investments over time, you can tackle the most urgent vulnerabilities first without overwhelming budgets.

Track Performance and ROI After Implementation

Once you’ve prioritized and sequenced investments, tracking their performance is crucial to ensure your adaptation strategy is effective. After implementing measures, evaluate their success by calculating "avoided loss" – the costs, both financial and social, that would have occurred if the adaptation hadn’t been in place [3].

Start by establishing a baseline. Gather historical data on hazard frequency and recovery costs in your area over the past decade or more [3]. This baseline will serve as a benchmark for measuring improvements and proving the value of your investments.

Leverage quantitative geospatial data to monitor how your efforts are reducing vulnerability and risk [3]. Tools like risk maps can visually show how investments are moving assets out of "High-High" risk zones and into safer categories. This kind of evidence can be incredibly persuasive for stakeholders like boards, regulators, and investors.

It’s also important to recognize that climate risks are not static. As hazards grow more frequent or severe, the expected ROI of your investments might shift [3]. To stay ahead, set up a regular review schedule. As Fatima Yousofi and Mollie Mills from The Pew Charitable Trusts emphasize:

"Because environmental conditions are continually changing, states should develop a routine and transparent process for ongoing review and assessment of climate impacts and adaptation efforts" [2].

Conclusion

Preparing aging infrastructure for the challenges of climate change isn’t just a choice – it’s a necessity for both financial security and operational continuity. The numbers are stark: infrastructure investors could see up to 50% of their portfolios wiped out by 2050 if no action is taken to address extreme weather risks [14]. On the brighter side, every $1 spent on climate adaptation can yield $2–10 in economic returns [14].

The key to success lies in using data to guide decisions and build resilience over the long term. A smart approach focuses on "High-High" asset-hazard pairs – critical assets like telecommunications hubs or heavily trafficked bridges that, if compromised, could cause widespread disruptions across various sectors [3]. By shifting from reactive fixes to proactive, strategic planning, you can address vulnerabilities more effectively. Once these insights are in place, prioritizing and sequencing investments becomes the logical next step.

To address immediate risks without straining your budget, consider integrating climate adaptation into existing Capital Improvement Plans or annual CAPEX cycles. This ensures that urgent vulnerabilities are addressed in a manageable way.

After implementation, tracking performance is essential to measure progress and refine strategies. Regular reviews help confirm that investments are delivering results. Leveraging geospatial data can provide a clear picture of how assets are being moved out of high-risk zones. As NOAA Research advises:

"Stay focused on assets that are most vulnerable and at risk" [3].

Because climate risks evolve over time, it’s critical to establish a schedule for ongoing reviews to keep your strategy aligned with changing conditions.

FAQs

How should I prioritize investments to adapt aging infrastructure for climate change?

To effectively allocate resources for climate adaptation in aging infrastructure, start by building a risk-based inventory of your assets. This means cataloging each asset’s condition, age, and susceptibility to climate threats like flooding, extreme heat, or rising sea levels. Assess the potential consequences of damage, including impacts on public safety and economic activity, to prioritize assets based on their risk levels.

Begin with high-risk assets – those showing significant deterioration or nearing critical failure. Create a multi-year investment plan that aligns with climate adaptation objectives and available funding. Focus on projects that offer the greatest risk reduction for the cost, such as retrofitting bridges, raising flood-prone roads, or using materials designed to withstand extreme heat. Predictive analytics tools can also be invaluable for optimizing maintenance schedules and extending the lifespan of critical assets, freeing up funds for additional improvements.

Keep your asset inventory current and revisit risk assessments as climate data evolves. By tying your investments to resilience goals and funding opportunities, you can make the most of your budget while ensuring infrastructure stays safe and operational in the face of a changing climate.

What are the best ways to protect aging assets from flooding and extreme heat?

The first step in safeguarding aging assets from risks like flooding and extreme heat is figuring out which ones are most at risk. Start with a formal risk assessment to rank assets based on their vulnerability to flooding, storm surges, and high temperatures. This way, resources can be allocated where they’ll make the biggest difference.

For flood protection, upgrades can include modernizing stormwater systems – think larger culverts, permeable pavements, or detention basins. Elevating critical equipment above potential flood levels and sealing building foundations to block water intrusion are also effective. Waterproofing roofs and façades with specialized membranes can guard against heavy rain and wind-driven damage.

When it comes to heat protection, replacing outdated HVAC systems with high-efficiency models designed for extreme conditions is a smart move. Applying cool roof coatings or reflective finishes helps reduce heat absorption, while adding external shading can lower indoor temperatures. Smart maintenance tools that track equipment performance and flag overheating risks can also help prevent breakdowns. These measures not only shield assets from damage but also boost their longevity and operational performance.

How can I prioritize climate adaptation investments for aging infrastructure?

To make smarter investments in preparing for climate challenges, start by compiling a centralized inventory of your assets. Include key details like their location, age, condition, and lifecycle costs. Next, layer in climate hazard data – factors like flood risks, heatwave trends, or rising sea levels – to pinpoint which assets are most vulnerable to climate-related impacts. Use risk benchmarks, such as those outlined in ISO 55001, to calculate risk scores and anticipate potential failures or repair costs. This approach allows you to identify high-risk areas and prioritize improvements like flood-resistant measures, energy-saving upgrades, or enhanced cooling systems.

Once you’ve set your priorities, build a strong business case by quantifying the benefits of these investments. For example, highlight potential savings from reduced maintenance costs or lower energy consumption. You can also explore federal programs and guidelines, such as the Disaster Resiliency Planning Act, to secure funding and align with broader goals like sustainability and equity. By continuously updating your data with fresh inspections and evolving climate scenarios, you create a dynamic system that not only protects your infrastructure but also ensures a solid return on investment.

Related Blog Posts

- Infrastructure Asset Management: A Risk-Based Approach for Multi-Year CAPEX Planning

- Aging Infrastructure in Europe: How to Prioritise Renewal Under Budget Constraints

- Achieving Net-Zero in Real Estate Portfolios: From Targets to Investment Plans

- Bridges, Tunnels and Roads: A Risk-Based Investment Playbook for Critical Infrastructure