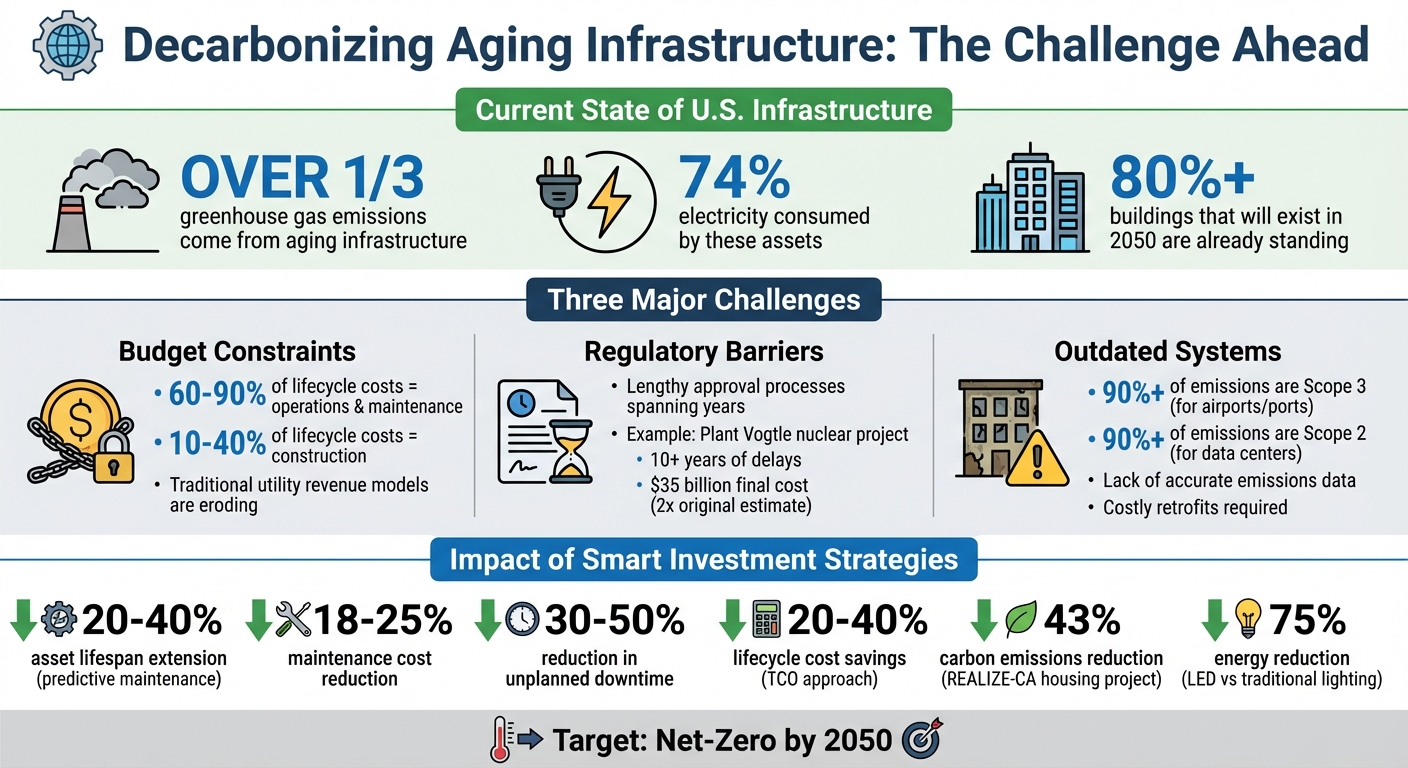

Aging infrastructure in the U.S. contributes over a third of greenhouse gas emissions and consumes 74% of electricity. Decarbonizing these assets is critical to meet net-zero targets by 2050. However, outdated systems, high costs, and regulatory delays make this transition complex. Key challenges include:

- Budget Constraints: 60–90% of life-cycle costs are tied to operations and maintenance. Financing upgrades is difficult as traditional revenue models for utilities erode.

- Regulatory Barriers: Lengthy approval processes and inconsistent policies slow progress.

- Outdated Systems: Older buildings and infrastructure require costly retrofits and lack accurate emissions data.

To address these challenges, infrastructure owners should adopt strategies like risk-based planning, scenario simulations, and centralized data systems. These approaches help prioritize impactful projects, reduce costs, and extend asset lifespans. For example, utilities using predictive maintenance have cut downtime by 30–50% and reduced maintenance costs by up to 25%. Decarbonization is not just necessary – it’s urgent. Taking action now can lower long-term costs and ensure a cleaner future.

Key Statistics and Challenges in Decarbonizing Aging U.S. Infrastructure

Main Challenges in Decarbonizing Aging Infrastructure

Managing Carbon Goals Within Budget Limits

When it comes to infrastructure, the majority of costs – about 60–90% – are tied up in operations and maintenance, not construction, which only accounts for 10–40% of an asset’s lifecycle [2]. Despite this, many projects are awarded based on low upfront bids, which often lead to hidden costs and the need for early renewals.

The financial strain is further compounded by shifting revenue models. Utilities, for example, traditionally relied on volumetric electricity sales (kWh) for funding. But with energy efficiency measures and distributed generation gaining traction, that model is crumbling. This makes it increasingly difficult to finance the upgrades needed for decarbonization [3]. Attempts to recover these costs through customer rate increases often face public and political backlash [3].

Many decarbonization solutions, such as carbon capture and storage (CCS) or advanced waste-to-energy sorting, are either too expensive or not yet fully developed [5]. However, some organizations are finding ways to cut costs while meeting carbon goals. For instance, a high-speed rail operator saved approximately $5 billion in lifetime costs by adopting a total cost of ownership (TCO) approach, optimizing maintenance, energy use, and renewal schedules [2]. Similarly, a global mining company implemented a TCO framework for $800 million in capital equipment, saving $100 million annually through better asset management and vendor consolidation [2]. These examples highlight the financial hurdles that must be addressed to stay on track with decarbonization targets.

Dealing with Regulatory and Permitting Delays

Regulatory delays are a major roadblock for decarbonization projects. Lengthy approval processes, inconsistent policies across regions, and the absence of mandatory building energy codes can drag projects out for years [7]. A glaring example is the Plant Vogtle nuclear project in Georgia, which faced over a decade of delays and ended up costing more than $35 billion – twice the original estimate – due to permitting and legal challenges [9].

"New energy ventures often unfold at a glacial pace, spanning decades."

– Shelley Welton, Professor, University of Pennsylvania Carey Law School [9]

Navigating compliance adds another layer of complexity. Emerging regulations, like the EU’s Corporate Sustainability Reporting Directive (CSRD) and the Carbon Border Adjustment Mechanism (CBAM), require detailed and verified disclosures that can be particularly challenging for outdated assets [8]. In the U.S., the "Buy America, Build America Act" (BABA) mandates domestically produced materials for infrastructure projects, complicating procurement [11]. Meanwhile, in Hong Kong, the Buildings Energy Efficiency (Amendment) Bill 2025 will require regular energy audits for most government buildings starting in 2026 [10].

Overcoming Outdated Systems and Missing Data

Beyond regulatory delays, outdated systems and incomplete data make decarbonization even harder. Establishing an accurate carbon baseline requires a clear understanding of emissions across Scopes 1, 2, and 3. For infrastructure like airports and ports, Scope 3 emissions – those from third-party suppliers and customers – can account for over 90% of total emissions [5]. However, tracking and reducing these emissions is tough without reliable data, which is often missing.

Older infrastructure was never designed with carbon efficiency in mind. Unlike modern systems, which integrate carbon-efficient technologies from the outset, aging assets require costly retrofits to meet today’s standards [5]. For example, outdated electricity distribution networks may struggle to support the rapid adoption of electric vehicles (EVs). Without accurate data to manage local distribution capacity and load diversity, these limitations could slow the transition to electrified transportation [6]. Similarly, for "hidden emitters" like data centers and transmission and distribution grids, Scope 2 emissions – stemming from purchased electricity – make up over 90% of their carbon footprint [5]. Yet many organizations lack the data needed to optimize energy use effectively.

These hurdles underscore the importance of targeted investments to modernize infrastructure and build a decarbonized future.

Decarbonization and Net-Zero Strategies for Large Facilities in 2025 | Affiliated Engineers

Investment Strategies for Decarbonizing Aging Infrastructure

To tackle the challenges of aging infrastructure, owners need to shift from quick fixes to long-term, risk-aware investments that incorporate carbon reduction from the start. Budget limitations, regulatory hurdles, and outdated systems demand a more integrated approach. With the right tools and a solid data foundation, organizations can make decisions that yield both financial and environmental benefits.

Risk-Based Multi-Year CAPEX and OPEX Planning

The first step is to establish a clear baseline of carbon emissions and energy use. This involves analyzing utility data, assessing building system performance, and identifying fuel sources for essential operations [13][14]. Considering that over 80% of the buildings expected to exist in 2050 are already standing, understanding the current state of these assets is critical [14].

Once a baseline is in place, focus on operational improvements before diving into major capital projects. Small changes, like optimizing equipment schedules, can immediately reduce emissions by 5%–10% [13]. These savings can then fund larger projects, such as upgrading HVAC systems or improving building envelopes.

"Energy optimization is the lowest-cost, highest impact first step towards decarbonization." – EH&E [13]

A risk-based framework helps prioritize projects that deliver the most impact. Tools like Oxand Simeo™ allow infrastructure owners to simulate asset deterioration and evaluate the financial and carbon implications of potential upgrades. For instance, switching to LED fixtures can cut energy use by up to 75% compared to traditional lighting systems [14].

This planning process should align with existing capital planning cycles and sequence actions over time. A phased approach offers flexibility to adapt to evolving technologies and regulations [13][14]. Since a significant portion of an asset’s lifetime costs – 60% to 90% – is tied to operations, maintenance, and renewals, focusing on lifecycle costs is essential [2]. This structured approach also sets the stage for deeper analysis using scenario simulations.

Using Scenario Simulation for Better Decisions

Scenario simulation builds on phased planning by offering a clearer view of trade-offs. Before committing funds, infrastructure owners can evaluate different investment pathways. These simulations balance immediate, cost-effective initiatives – like energy efficiency improvements – with high-cost projects such as heat pump installations or carbon capture systems [13][5]. By testing various budget, risk, and sustainability scenarios, owners can identify project combinations that meet carbon goals without exceeding financial limits.

Simulation models also encourage cross-vertical thinking, helping organizations understand how interconnected sectors influence long-term investments. For example, expanding a data center requires coordination with power grid upgrades and water cooling systems [12]. Between mid-2023 and mid-2024, 75% of infrastructure capital raised was directed toward such cross-vertical strategies [12].

Advanced asset investment planning can significantly reduce costs and improve asset availability. Organizations that adopt this approach often see a 30% reduction in ownership costs and a 10% boost in asset availability [15]. Running "what-if" simulations before making decisions minimizes risk and builds confidence in the chosen path. These simulations also highlight the need for a strong data foundation to guide decision-making.

Creating a Centralized Asset Data Foundation

A reliable data foundation is key to implementing these strategies. Fragmented data often leads to short-term solutions and obscures long-term liabilities, making it harder to account for decarbonization and maintenance costs [2]. A centralized repository for lifecycle cost and condition data is essential for effective planning.

Tools like Simeo Inventory can capture detailed condition and risk data at the component level, feeding into broader planning platforms [15]. This creates a "single source of truth" that enables continuous portfolio optimization [2].

"We needed a tool that would allow us to consolidate the fragmented data we had and project it in a way that could be clearly presented to our elected officials, who are the decision-makers." – Chief Executive Officer (General Director of Services), Oxand [15]

The data foundation should also account for "effective age" using indicators like vibration, oil analysis, temperature, and inspection ratings [16]. This approach provides a more accurate picture of an asset’s condition and supports predictive models for forecasting deterioration and carbon impact.

To improve data quality efficiently, apply the 80/20 rule. Focus on the factors that drive 80% of the results. For example, if the operating environment has a greater impact on condition than age, prioritize collecting environmental data over installation dates [16]. By making total cost of ownership a central metric, planners can achieve lifecycle cost reductions of 20% to 40% [2].

sbb-itb-5be7949

Case Studies: Decarbonization Strategies in Practice

These examples highlight how risk-based planning and predictive maintenance can drive measurable reductions in carbon emissions. Let’s take a closer look at two instances where tailored investment strategies extended asset lifespans and cut emissions.

Extending the Life of Aging Energy Infrastructure

Combining predictive maintenance with risk-aware CAPEX and OPEX planning allows utilities to lower carbon emissions while safeguarding infrastructure against climate-related risks. Transitioning from fixed maintenance schedules to condition-based predictive maintenance has proven to extend asset lifespans by 20–40%, cut maintenance costs by 18–25%, and reduce unplanned downtime by 30–50% [17]. For example, well-maintained pumps consume 5–10% less energy, while misaligned ones can use 10–15% more power [17].

The stakes are high: for 29 major utilities, carbon-related risks could threaten earnings equivalent to 71% of their 2021 EBIT [1]. As Deloitte aptly put it:

"Carbon-proofing generation, transmission, and distribution has two mirror goals: removing carbon from the grid; while protecting the grid from carbon already locked into the atmosphere." – Deloitte [1]

Focusing on high-criticality assets – where the cost of downtime is three times that of monitoring – yields the strongest returns. Starting with a pilot program involving 15–25 critical assets can demonstrate ROI and build trust among technicians before scaling operations [17].

Similarly, risk-based strategies are making a significant impact in public housing decarbonization efforts.

Decarbonizing Public and Social Housing

Public housing faces unique challenges, such as aging infrastructure, tight budgets, and stricter carbon compliance rules. The REALIZE California (REALIZE-CA) initiative, running from 2017 to 2025, offers a blueprint for addressing these hurdles. By retrofitting over 350 units across four apartment complexes in Corona, Richgrove, Fresno, and East Palo Alto – spanning more than 300,000 square feet – the program achieved a 43% reduction in carbon emissions and a 21% drop in electricity use for electrified applications [18].

This phased approach tackled decarbonization step by step: first by reducing energy loads through envelope improvements, then recovering wasted heat, and finally advancing toward electrification. Aligning these upgrades with capital cycles, such as equipment replacement or refinancing, helped reduce costs and strengthen the business case [18][20].

At Roosevelt Village Senior Affordable Housing, a 2024 project took decarbonization a step further with a grid-interactive design. This approach ensured critical loads could be sustained during power outages and eliminated grid electricity use during peak hours (4–9 pm daily). While this added a 5% cost premium, it demonstrated that advanced sustainability goals are achievable with careful planning and phased investments [19]. This case serves as a testament to the potential of thoughtful strategies in achieving ambitious carbon reduction targets.

Conclusion: Planning for a Lower-Carbon Future

A clear way forward emerges when we consider the strategies discussed earlier. Decarbonizing aging infrastructure requires balancing ambitious carbon reduction goals with tight budgets and regulatory challenges. The key is to move away from short-term fixes and embrace proactive, data-driven planning that treats carbon reduction and operational efficiency as interconnected priorities.

The investment strategies highlighted – such as risk-based multi-year CAPEX and OPEX planning, scenario simulation, and centralized asset data management – have shown measurable benefits. Organizations that adopt these methods often achieve lifecycle cost savings of 20% to 40% by focusing on long-term value instead of chasing the lowest upfront costs [2].

"Infrastructure is built to serve generations. It’s time that planning, construction, and management practices embody that same long-term vision." – Boston Consulting Group [2]

This long-term perspective demands immediate and decisive action.

The stakes couldn’t be higher. Climate-related damage to infrastructure is expected to cost billions, yet the expense of making the grid resilient to carbon challenges is far less than the cost of inaction across all regions [4][21]. Tools like Oxand Simeo™ play a critical role in achieving these objectives. By leveraging over 10,000 proprietary aging models and 30,000 maintenance laws developed over two decades, Oxand enables organizations to cut targeted maintenance costs by 10–25% while adhering to ISO 55001 standards and European energy and decarbonization regulations.

The time to act is now. Start by building a strong data foundation, prioritize initiatives with the highest value, and use scenario simulations to guide capital investments. With the right tools and strategies, infrastructure owners can extend the life of their assets, cut emissions, and leave a cleaner, more sustainable world for future generations.

FAQs

What are the biggest financial challenges in reducing carbon emissions from aging infrastructure?

Decarbonizing older infrastructure comes with hefty financial hurdles, largely because of the massive initial costs and uncertainties over time. Owners of infrastructure need to pour significant resources into upgrading or retrofitting assets like transit networks, energy grids, and buildings – all while ensuring these efforts align with sustainability goals.

The financial demand is staggering. Estimates indicate that achieving carbon reduction goals globally will require trillions of dollars. Complicating matters further are risks like stranded assets, shifting regulations, and market unpredictability, which make it tough to justify spending now for benefits that may only materialize years down the line. Striking a balance between these costs, operational budgets, and sustainability priorities remains a major challenge for both public and private entities.

What challenges do regulations pose to decarbonizing aging infrastructure?

Regulations can often complicate efforts to decarbonize older infrastructure, creating hurdles that slow progress. Many existing regulatory frameworks are outdated or rigid, making it harder to implement cleaner energy solutions like electrification or renewable technologies. For instance, traditional utility regulations may fail to fully accommodate the integration of low-carbon technologies or modern approaches like predictive maintenance and energy efficiency improvements.

On top of that, changing carbon regulations introduce uncertainty and additional administrative challenges for infrastructure owners. These evolving policies often come with shifting compliance requirements, which can drive up costs and make long-term planning more difficult. Tackling these regulatory challenges is essential to encouraging innovation, attracting investment, and enabling a smoother shift toward sustainable infrastructure.

Why is having a centralized data system important for decarbonizing aging infrastructure?

A centralized data system plays a crucial role in reducing carbon emissions from aging infrastructure. It offers a unified, detailed view of asset conditions and emission sources, helping infrastructure owners pinpoint areas that need attention. With this clarity, they can craft precise carbon-reduction strategies, make smarter decisions, and extend the life of their assets – all while working toward sustainability goals.

Bringing together data from various asset types and operational stages allows organizations to stay ahead of changing regulations, adopt predictive maintenance practices, and identify ways to improve energy efficiency. This kind of system provides transparency, ensures data accuracy, and delivers actionable insights, making decarbonization efforts more focused and better suited to long-term infrastructure demands.

Related Blog Posts

- Aging Infrastructure in Europe: How to Prioritise Renewal Under Budget Constraints

- Bridges, Tunnels and Roads: A Risk-Based Investment Playbook for Critical Infrastructure

- Climate Change Adaptation for Aging Assets: Where to Invest First

- Funding Challenges: Innovative Solutions for Revitalising Outdated Infrastructure