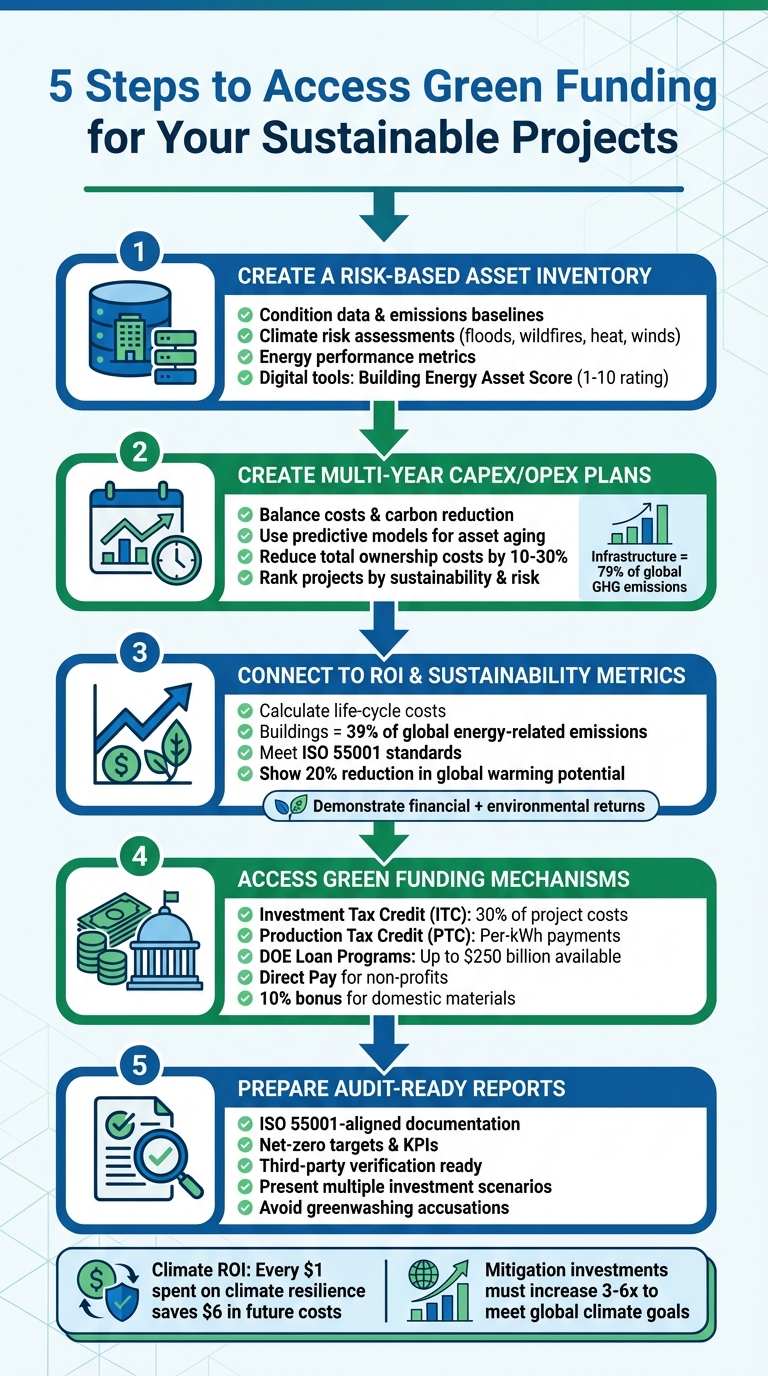

Want to access green funding for your projects? Start with a solid investment plan.

To secure financing for low-carbon initiatives, you need a clear, data-driven strategy that aligns with financial and emissions reduction goals. Here’s how you can do it:

- Build a detailed asset inventory: Include condition data, emissions baselines, and climate risk assessments.

- Create multi-year CAPEX/OPEX plans: Balance costs and carbon reduction using predictive tools to prioritize investments.

- Show financial and environmental returns: Highlight ROI through cost savings and emissions reductions.

- Tap into U.S. funding options: Focus on tax credits (e.g., ITC, PTC) and loan programs like the Department of Energy’s LPO.

- Prepare audit-ready reports: Meet ISO 55001 standards to prove your project’s feasibility and compliance.

With the right tools and documentation, you can unlock funding and future-proof your projects while meeting decarbonization goals.

5-Step Process to Access Green Funding for Sustainable Projects

Funding Your Green Projects: Federal & Incentive Updates

sbb-itb-5be7949

Step 1: Create a Risk-Based Asset Inventory

To access green funding, the first step is understanding your assets and their current state. A centralized asset inventory that includes condition data, physical risk assessments, and energy performance metrics is essential. This inventory acts as the backbone of any solid investment strategy. Without it, meeting the documentation standards set by lenders and regulators becomes nearly impossible.

Your inventory should go beyond a simple list of assets. It needs to include baseline emissions data, predictive climate risk models (covering threats like floods, wildfires, extreme heat, and high winds), and energy performance ratings. This comprehensive approach allows you to assess your portfolio more effectively. You can identify which assets are most vulnerable, pinpoint high energy consumers, and determine where investments will make the biggest difference. It also highlights areas with limited decarbonization options, helping you develop specialized funding strategies for those sectors. Once this robust inventory is in place, digital tools can centralize and validate the data for seamless management.

Using Digital Tools to Centralize Asset Data

Digital platforms simplify the task of collecting, validating, and organizing asset information. Tools like Oxand Simeo Inventory consolidate all your asset data into a single, reliable source, minimizing errors and standardizing metrics for condition, risk, and energy performance across your portfolio. This eliminates the data management headaches that can derail investment planning.

For a free and standardized assessment of energy efficiency, the U.S. Department of Energy provides the Building Energy Asset Score. This tool evaluates the physical and structural energy efficiency of commercial and multifamily buildings, generating a 1-10 rating based on factors like the building envelope, HVAC systems, and lighting. Since these elements are independent of tenant behavior, the score helps pinpoint specific upgrade opportunities and provides measurable data to support applications for transition funding [3].

Adding Risk and Energy Performance Data

Once your inventory is established, the next step is layering in risk and energy performance data. Platforms like ClimateCheck use 26 internationally recognized climate models to provide hazard ratings for risks such as precipitation, drought, heat, wildfires, and floods. Covering over 140 million properties across North America, this data gives a clear picture of climate vulnerabilities [2]. Meanwhile, First Street takes it further by employing physics-based models to simulate potential building damage and downtime caused by climate events. This enables you to calculate financial risks for individual properties [4].

Incorporating Energy Performance Certificate ratings can also help you track asset improvements – like advancing from a ‘C’ to an ‘A’ rating – showing measurable progress toward decarbonization goals. This data is critical when applying for green bonds, sustainability-linked loans, or federal grants. It provides the evidence needed to prove that your projects will achieve measurable carbon reductions and cost savings, making your case for funding much stronger.

Step 2: Create Multi-Year CAPEX/OPEX Plans with Sustainability Goals

Once you’ve mapped out your asset inventory, the next step is to craft a multi-year CAPEX (Capital Expenditure) and OPEX (Operational Expenditure) plan. This plan should strike a balance between reducing carbon emissions and keeping costs under control. By using your centralized asset data, you can create forward-looking strategies that demonstrate both financial responsibility and environmental commitment – key factors when seeking sustainable funding. Predictive models play a crucial role here, helping you prioritize investments based on factors like carbon impact, risk reduction, and lifecycle costs.

Using Predictive Models to Forecast Asset Aging

Predictive models take the uncertainty out of predictive vs reactive maintenance planning. These models analyze factors like asset condition, usage patterns, and environmental exposure to simulate how assets will age over time. This insight helps you schedule interventions – whether it’s preventive maintenance, replacing components, or a complete overhaul – at the right time.

Take Oxand Simeo as an example. Its predictive tools forecast asset performance over several years without requiring extensive IoT sensor networks. Instead, it uses data you already have, like inspection records and condition assessments. By anticipating how and when assets might fail, you can act before small issues turn into costly problems. This proactive approach not only extends asset lifespans but can also cut total ownership costs by 10–30% in the long run.

Ranking Projects by Sustainability and Risk

Not all investments offer the same benefits when it comes to cutting emissions or mitigating risks. The challenge lies in comparing these diverse outcomes. That’s where multi-criteria prioritization comes in. By evaluating projects across multiple dimensions – such as environmental impact (Scope 1, 2, and 3 emissions), climate resilience, lifecycle costs, and compliance needs – you can rank them objectively.

For context, infrastructure accounts for 79% of global greenhouse gas emissions, and strategic investments in the right projects can help achieve 92% of Sustainable Development Goal targets [5]. Using standardized frameworks like FAST-Infra or Envision, you can transform complex sustainability metrics into clear, comparable scores. This makes it easier to show lenders and regulators that your plan focuses on high-impact initiatives. As the Climate Policy Initiative explains:

"To take your dollars further, it’s critical to leverage multiple forms of capital, and in coordination with one another." [1]

Another effective ranking tool is internal carbon pricing. By assigning a dollar value to each ton of CO₂ reduced, you can directly compare the carbon impact of various projects. This allows you to prioritize investments that deliver the most significant emissions reductions per dollar spent [1].

Testing Scenarios for Sustainability Planning

Before locking in your investment strategy, it’s wise to test different scenarios. Scenario modeling lets you explore various budget levels, decarbonization timelines, and risk mitigation strategies to find the best balance. This helps you navigate competing priorities, like staying within budget while meeting ambitious carbon reduction goals, and prepares you for potential policy or market changes.

Tools like Oxand Simeo make it easy to compare multiple scenarios side by side. For instance, you could evaluate a baseline scenario that maintains current spending against an aggressive decarbonization plan that invests heavily in energy-efficient upgrades upfront. By quantifying trade-offs – such as higher initial costs versus long-term savings – you can make informed decisions that align with your goals. As the Climate Policy Initiative notes:

"Understand your goals, and the tradeoffs you’re willing to make. There’s no ‘silver bullet’ when it comes to climate finance." [1]

This process also generates detailed, audit-ready documentation that highlights the return on investment, carbon savings, and risk reduction for each scenario. Such transparency can make your case for sustainable funding much stronger.

Step 3: Connect Investment Plans to ROI and Sustainability Metrics

To secure funding that lasts, your investment plan needs to show both financial returns and environmental benefits. Investors and lenders want proof of cost savings and positive environmental impact. By addressing both, your plan becomes more than just a compliance task – it turns into a persuasive case for green financing.

Calculating ROI through Cost Savings and Carbon Reduction

A solid ROI analysis should include life-cycle costs like energy use, maintenance, and regulatory risks. Considering that buildings contribute 39% of global energy-related carbon emissions [6], even small improvements in efficiency can lead to noticeable savings.

Start by creating a baseline. Document your current energy use, maintenance costs, and carbon emissions. This "Point A" serves as the starting point to compare against the potential improvements ("Point B") that strategic investments could achieve. For instance, meeting sustainability benchmarks could reduce global warming potential by 20% [6], while also cutting operational costs.

Using internal carbon pricing can help tie carbon reductions directly to financial benefits. David MacLean, Founder of P3I.GLOBAL, emphasizes the importance of trust in this process:

"Change happens at the speed of trust. And trust depends on how data is collected, who collects it, and whether it’s third-party verified – all of which are essential to building credible systems that reflect real value." [6]

This approach helps demonstrate the value of your plan and sets the foundation for aligning with international standards.

Meeting ISO 55001 and Other Standards

Once you’ve calculated returns, tying your plan to established standards like ISO 55001 can further boost its credibility. This standard offers a framework that connects your sustainability goals to specific asset management actions. For example, it requires a Strategic Asset Management Plan (SAMP), which outlines decision-making processes and resource needs. For green financing, this means showing lenders how your plan turns organizational goals – like achieving net-zero emissions – into actionable steps.

The SAMP should include clear criteria for making decisions. For sustainability-focused plans, this means prioritizing projects based on both financial returns and environmental impact, such as CO₂ reductions, improved energy efficiency, and climate resilience. This transparency reassures stakeholders that your plan is systematic and data-driven.

ISO 55001 also ensures your plan stays relevant by requiring regular updates, either annually or when significant changes occur. Its focus on detailing resource requirements – like funding and personnel for each initiative – helps lenders see the feasibility and scope of your proposals. When paired with predictive financial modeling, these elements turn your plan into a credible and fundable strategy, ready to attract serious investment.

Step 4: Access Green Funding Mechanisms in the United States

Once your investment plan is in place, the next step is to secure funding for your sustainable projects. Here’s how to navigate the green funding landscape in the U.S.

US Green Funding Opportunities

The funding environment in the United States has shifted in recent years. As of July 4, 2025, the Greenhouse Gas Reduction Fund, including the "Solar for All" program, was repealed, and its $27 billion allocation was rescinded [10]. This means asset owners now need to focus on tax credits and loan programs rather than grants.

The Inflation Reduction Act (IRA) remains the cornerstone of green funding, offering two major tax credits:

- Investment Tax Credit (ITC): Covers 30% of eligible project costs for technologies like solar panels, energy storage systems, and microgrids.

- Production Tax Credit (PTC): Pays based on the amount of energy generated, making it particularly suitable for wind and utility-scale projects.

Starting January 1, 2025, these tax credits transitioned into technology-neutral "Clean Electricity" credits, labeled 48E (ITC) and 45Y (PTC) [7].

For larger projects, the Department of Energy’s Loan Programs Office (LPO) offers debt capital, stepping in when private lenders decline. The Energy Infrastructure Reinvestment (EIR) program, for example, supports efforts to retool or replace outdated energy infrastructure, with up to $250 billion in loan authority. By August 2023, the LPO had received 167 active applications, amounting to $143.9 billion in requested loans [8].

Other mechanisms include "Direct Pay", which allows local governments and non-profits to convert tax credits into immediate subsidies, and "Transferability", enabling taxable entities to sell their credits for quick cash [7].

Matching Funding Sources to Your Investment Goals

It’s essential to align funding options with your project’s structure. For instance:

- Upfront capital needs: Projects like solar panel installations or battery storage systems benefit from the ITC.

- Long-term revenue generation: Projects like wind farms or other energy generation systems are better suited for the PTC.

Projects exceeding 1 MW AC must comply with prevailing wage and apprenticeship standards to qualify for the full 30% tax credit. Otherwise, the credit drops to 6% [7]. Additionally, projects can earn a 10% bonus credit if they use domestic materials or are located in designated "energy communities", such as former coal sites.

For tax-exempt organizations with limited tax liability, leveraging the 13 federal tax credits offering Direct Pay can significantly improve cash flow [9]. Owners of large-scale infrastructure should explore the EIR program, particularly for projects on brownfield sites or at decommissioned facilities. The Department of Energy provides free pre-application consultations to help assess project feasibility before formal submission [8].

Comparing Green Funding Options

| Funding Mechanism | Best For | Key Benefit | Primary Requirement |

|---|---|---|---|

| Clean Electricity ITC (48E) | Solar, storage, microgrids, fuel cells | 30% of project costs [7] | Zero GHG emissions; wage standards for projects >1 MW AC |

| Clean Electricity PTC (45Y) | Wind, biomass, geothermal, hydroelectric | Per-kWh payment over project life | Zero GHG emissions; consistent energy generation required |

| Advanced Energy Project Credit (48C) | Industrial facility upgrades | Tax credit for manufacturing/recycling | Must reduce GHG emissions by ≥20% [9] |

| EIR Program (Section 1706) | Retooling aging energy infrastructure | Up to $250 billion in loans [8] | Must replace or improve energy infrastructure; fossil projects require carbon controls |

| Title 17 Loan Guarantees | Innovative energy projects | Access to debt capital | Requires "innovative" technology or backing by a State Energy Financing Institution [8] |

"LPO fills this gap in commercial deployment by serving as a bridge to bankability for innovative and high-impact energy technologies, providing them with access to needed loans and loan guarantees when private lenders cannot or will not."

- U.S. Department of Energy [8]

To make the most of these opportunities, confirm the availability of funding and ensure your investment plan is backed by thorough, audit-ready documentation. With increased federal oversight, maintaining detailed and defensible records is more critical than ever [10].

Step 5: Prepare Audit-Ready Reports to Secure Financing

After laying the groundwork with solid investment planning and scenario testing, the next step is to prepare audit-ready reports. These reports play a crucial role in securing sustainable funding. With federal oversight tightening, lenders now require transparent, data-backed documentation that aligns with established standards. Even the most promising projects can lose financing if they lack this level of rigor.

In today’s financial landscape, transition finance demands forward-looking documentation. As the OECD explains:

"Transition finance focuses on the dynamic process of becoming sustainable, rather than providing a point-in-time assessment of what is already sustainable" [12].

This means your reports must not only reflect your current position but also outline a credible path forward. This includes setting clear targets, establishing governance frameworks, and ensuring mechanisms are in place to avoid becoming locked into carbon-intensive practices during the transition.

Creating ISO 55001-Aligned Documentation

ISO 55001 is widely regarded as the benchmark for financial institutions and regulators. This framework outlines the requirements for an asset management system that aligns with your organization’s goals [11]. Meeting this standard reassures lenders that you have a systematic approach to managing assets and making investment decisions.

To comply with ISO 55001, your documentation should include:

- Net-zero and interim climate targets

- Quantifiable metrics and KPIs

- Governance and accountability structures

- Evidence of readiness for third-party verification [12]

Your reports should also demonstrate how sustainability objectives tie into your broader business and financial strategies [12]. For example, if your investment plan focuses on replacing outdated HVAC systems to cut energy use by 20% over five years, your ISO 55001 documentation should detail the governance process for approving these upgrades (as outlined in your multi-year CAPEX/OPEX plans). It should also specify the KPIs you’ll monitor – like kWh savings and carbon reductions – and outline measures to prevent reverting to less sustainable options.

This structured approach not only meets regulatory expectations but also ensures your case is clearly communicated to stakeholders.

Presenting Investment Scenarios to Stakeholders

Once your reports are finalized, the next step is presenting your investment plan to boards, investors, and public stakeholders in a way that inspires confidence and gains their support. A strong presentation connects your investment strategies to tangible, measurable outcomes.

Begin by showcasing multiple investment scenarios that are part of your risk-based plan. These scenarios should illustrate how varying budget levels, timelines, or project priorities impact both financial performance and sustainability goals. For instance, you could compare a baseline scenario that maintains current spending with an accelerated approach that prioritizes renewable energy projects for faster sustainability gains. Use visual tools like dashboards and summary tables to highlight these differences. Make sure to emphasize co-benefits – such as job creation, better public health, or enhanced community resilience – that strengthen your case [13].

Lastly, ensure your reports are prepared for external verification. As the OECD points out:

"Credible corporate climate transition plans are necessary to provide confidence to investors that corporates raising transition finance are on a credible path to net zero" [12].

Third-party audits add a layer of credibility and help safeguard against accusations of greenwashing, especially for projects in sectors that are harder to decarbonize.

Conclusion: Using Data-Driven Plans to Access Sustainable Funding

Securing funding for the green transition isn’t just about good intentions – it’s about creating risk-based, carbon-aligned investment plans that resonate with both lenders and regulators. By following a clear, data-driven roadmap, your organization can position itself to bridge the growing climate finance gap effectively.

The urgency of action is undeniable. To meet global climate goals, mitigation investments need to increase by 3 to 6 times their current levels[14]. Back in 2017, the energy sector alone faced a financing gap of 76% of the total required investment[14]. And here’s a compelling stat: for every $1 spent on climate resilience, $6 is saved in future costs[15]. These numbers highlight why predictive tools and transparent metrics are no longer optional – they’re essential for achieving both financial returns and carbon reduction targets.

But having the right investment plan is only part of the equation. The way you approach funding is equally critical. According to the Climate Policy Initiative:

"To take your dollars further, it’s critical to leverage multiple forms of capital, and in coordination with one another. Strategically match financing approaches to the appropriate climate initiative to advance one integrated strategy." [1]

Organizations that act now – by developing data-driven, scenario-tested investment plans – stand to gain significant advantages. Not only can they access the growing pool of sustainable capital, but they can also reduce total ownership costs by 10–30%. On the flip side, delaying action could mean higher costs and exposure to risks like stranded assets and carbon lock-ins.

FAQs

How can I make sure my investment plan aligns with ISO 55001 standards?

To align your investment plan with ISO 55001 standards, integrate it into a structured asset management system. Start by diving into the ISO 55000 series, which covers the basics (ISO 55000), system requirements (ISO 55001), and practical guidance (ISO 55002). Match the key parts of your plan – like objectives, risk evaluations, and performance indicators – to ISO 55001’s main requirements, such as planning, leadership, and performance evaluation.

Create a Strategic Asset Management Plan (SAMP) that ties your investment goals directly to your organization’s broader asset management strategy. Keep the SAMP straightforward and actionable, focusing on strategic objectives, governance structures, and performance benchmarks. Clearly document decision-making processes, responsibilities, and monitoring systems to ensure clarity and accountability.

Regular internal audits are essential to verify compliance with ISO 55001, identify and address any shortcomings, and refine the plan as needed. Track and document progress on critical metrics, such as ROI and reductions in carbon footprint, to show alignment with sustainability goals. This can also help secure green funding opportunities. By continuously reviewing and updating your plan, you’ll stay compliant and ready to adapt to changing market and regulatory demands.

What’s the difference between the Investment Tax Credit (ITC) and the Production Tax Credit (PTC)?

The Investment Tax Credit (ITC) and Production Tax Credit (PTC) are two major federal programs designed to support clean energy projects, but they target different stages of a project’s value.

The ITC is a capital-based credit that helps offset a portion of the upfront costs for eligible energy equipment, such as solar panels, wind turbines, or energy storage systems. This credit applies when the equipment is installed and operational. For organizations like tax-exempt entities or government bodies, the ITC can even be claimed as a cash payment through a direct-pay option.

In contrast, the PTC is a production-based credit that rewards renewable energy facilities based on the electricity they generate and sell. It offers a fixed dollar amount for each kilowatt-hour of electricity produced, encouraging consistent energy output over time rather than focusing on initial investment costs.

In essence, the ITC reduces the initial financial burden of clean energy projects, while the PTC promotes steady revenue generation by incentivizing long-term energy production.

How can predictive models support sustainable investment planning?

Predictive models offer a powerful, data-driven approach to understanding how climate-related risks and opportunities could influence the financial performance of your assets. This kind of analysis can make your sustainability plans more convincing and attractive to potential investors and funders.

By examining factors like future emissions scenarios, carbon pricing trends, and the projected returns of low-carbon projects, these models help asset owners craft investment strategies that align with sustainability objectives. This detailed planning not only demonstrates your dedication to reducing carbon footprints but also reassures lenders, regulators, and other key stakeholders that profitability remains a priority.

Using predictive models in your planning process does more than just bolster your case for green financing – it also ensures your investment strategy aligns with global efforts to meet net-zero goals.