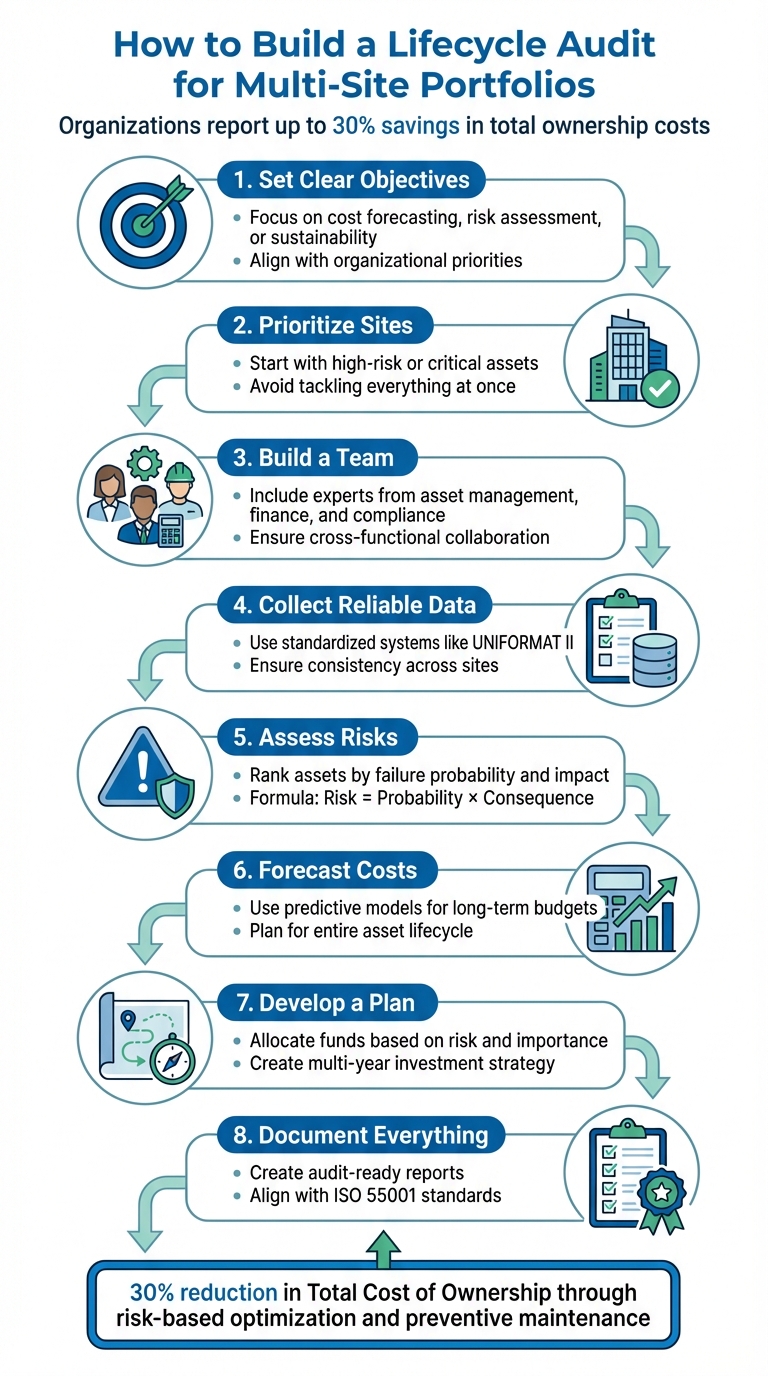

When managing multiple facilities, a lifecycle audit is your go-to method for keeping assets efficient, compliant, and cost-effective throughout their lifespan. This means examining everything from construction to daily use, maintenance, and eventual decommissioning. Here’s what you need to know:

- Why It Matters: Lifecycle audits help prevent costly repairs, improve resource allocation, and align with ESG goals like carbon tracking and regulatory compliance.

- Key Steps:

- Set Clear Objectives: Focus on priorities like cost forecasting, risk assessment, or sustainability.

- Prioritize Sites: Start with high-risk or critical assets instead of tackling everything at once.

- Build a Team: Include experts from asset management, finance, and compliance.

- Collect Reliable Data: Use standardized systems like UNIFORMAT II for consistency.

- Assess Risks: Rank assets by failure probability and impact.

- Forecast Costs: Use predictive models to plan long-term budgets.

- Develop a Plan: Allocate funds based on risk, importance, and lifecycle costs.

- Document Everything: Create audit-ready reports aligned with ISO standards.

Organizations using these audits report up to 30% savings in total ownership costs, thanks to better planning and fewer surprises. By following this process, you can shift from reactive fixes to smarter, long-term asset management.

8-Step Lifecycle Audit Process for Multi-Site Portfolio Management

Whole Lifecycle Perspective in Asset Management

sbb-itb-5be7949

Define the Scope and Objectives of the Audit

Before diving into data collection, it’s crucial to outline clear objectives and boundaries for your audit. Without this clarity, audits can become scattered, wasting both time and resources. Research indicates that around 30% of investments in large-scale deployments go to waste because organizations fail to align their projects with overarching strategic goals [10].

Your audit goals should align with your organization’s priorities, whether that’s regulatory compliance, cost management, or sustainability. Each focus requires distinct methods for data collection and analysis. For example, an audit aimed at condition assessment will focus on evaluating asset degradation and lifespan, while a risk prioritization audit will zero in on identifying threats and assessing the potential fallout of neglecting certain sites [8][10].

"PPM is a mechanism for allocating resources optimally toward an organization’s objectives, factoring in risk, desired returns, scarce resources and the inter-relationships between the investments." – Sandeep Mathur, 2006 [10]

Identify Key Audit Goals

Decide early on whether your audit will target condition assessment, lifecycle cost forecasting, risk prioritization, or a mix of these areas. Each goal calls for specific data and outcomes. For instance:

- A condition-focused audit evaluates the physical state of assets and tracks degradation rates.

- A cost forecasting audit delivers insights on net present value (NPV) and return on investment (ROI) to support long-term capital planning [10].

The quality of your audit depends more on strategic alignment than on the sheer volume of data collected. Organizations that adopt continuous review cycles – conducting audits annually or quarterly – are better equipped to adapt to changing economic conditions and shifting priorities [9]. In fact, 30% of CIO priorities in some industries are tied to project and portfolio management [10].

For organizations with sustainability commitments, conducting a materiality assessment can help pinpoint which Environmental, Social, and Governance (ESG) factors should take precedence. This might include energy consumption, water usage, or embodied carbon, depending on the audit’s focus [2].

To ensure your findings are actionable, establish criteria for collecting relevant, accurate, and standardized data across all sites [9]. This prevents unnecessary data collection and ensures your team’s efforts directly support decision-making. Also, consider your organization’s capacity – whether in terms of budget, personnel, or other resources – when defining the scope [10].

Once objectives are clear, narrow your focus by prioritizing portfolio segments based on risk and criticality.

Determine Portfolio Scope and Prioritization

Auditing every site at once isn’t always feasible or necessary. When resources are tight, prioritize based on site criticality or the potential consequences of neglecting a specific location. This ensures that high-risk or mission-critical assets are addressed first [10].

For larger portfolios, consider grouping sites by factors like regulatory urgency, operational importance, and timelines for addressing deficiencies. For example:

- Critical: Projects requiring action within 12–24 months.

- Future Capital Renewal: Projects planned for 2–5 years.

- Long-term Projects: Initiatives extending up to 10 years [5][9].

A phased approach can help balance thoroughness with cost. Using statistical life-cycle modeling, for instance, can cost less than 20% of a full-field inspection and take 50% less time to deliver results [5]. Many organizations use predictive modeling across their entire portfolio, while conducting detailed inspections on at least 10% of facilities to validate the model’s accuracy. Instead of treating audits as one-time events, consider a three-year rolling cycle to keep baseline conditions updated [5].

For portfolios spanning multiple facilities, group assets by sector and country to maintain precise and relevant benchmarking [2].

Build a Cross-Functional Audit Team and Governance Framework

Conducting a thorough lifecycle audit requires insights from multiple departments. Without this collaboration, you risk missing critical details. As ISO 55000 explains:

"Asset management is not about the asset, but about the value generated by the asset" [11].

This value becomes clear only when diverse perspectives come together.

Assemble the Audit Team

The first step is to identify stakeholders whose roles align with your mission. For instance, the U.S. Air Force uses a Mission Dependency Index (MDI), which applies a risk matrix to evaluate the importance of functional capabilities at specific locations based on probability and severity [11]. Similarly, the National Park Service employs an Asset Priority Index (API) to consider factors like resource preservation, visitor use, and asset substitutability when identifying key stakeholders [11].

Your team should include representatives from asset management, finance, compliance, and data integrity [11][14]. According to APPA:

"To be successful, a facilities condition assessment program requires the support and involvement of senior administrators to ensure the credibility of findings and conclusions, thus enhancing the probability that financial resources will be allocated" [5].

Appoint a team leader who can effectively communicate technical insights to senior management [5]. For improved safety and accuracy, inspections should be conducted in pairs [5]. Ensure all team members receive formal training on inspection protocols and data entry to maintain consistency [5].

Once your team is ready, the next step is to establish a governance framework that supports effective decision-making.

Establish Governance and Decision-Making Policies

With the team structure in place, a solid governance framework becomes essential. Develop an integrity logic loop to align your decision-making objectives with the data inputs required to achieve them [13]. As the National Academies of Sciences explains:

"Decision-making objectives are established by the facility asset management system. Decision-making capabilities are limited by data made available by the facility asset management system" [13].

To ensure transparency in decision-making, align financial and operational data as per ISO 55010 [13]. This might involve updating accounting conventions to include object class codes that correspond to specific facility management functions. These updates allow for clear planned-versus-actual budget comparisons [13]. For organizations managing multiple sites, standardize data collection using classification systems like UNIFORMAT II (Levels 1 through 3), which organizes information on building elements such as substructure, shell, and services [5].

Establish emergency protocols by training team members to report and address any urgent safety issues identified during audits [5]. Additionally, create a scoring system based on materiality to prioritize Environmental, Social, and Governance (ESG) issues relevant to your assets [6][3]. For instance, GRESB Infrastructure Assessments, which encompass $8.8 trillion in Assets Under Management, reveal that Governance indicators typically contribute around 60–61% of the total management score [6][3].

Conduct Asset Inventory and Data Collection

Once governance is established, the next step is to build a reliable, centralized asset inventory. This inventory serves as the backbone for all future decisions. Without accurate and consistent data, even the most advanced planning tools can lead to flawed outcomes. As PIARC aptly states:

"In general, the greater the confidence in the data available, the greater the confidence in the lifecycle plan" [16].

This level of confidence begins with creating a centralized asset register and ensuring the data collected meets high-quality standards.

Create a Centralized Asset Register

The asset register should act as the definitive source of truth for all your sites. Start by organizing assets into a clear hierarchy, categorizing them by group, service, and component [15][14]. Include key details such as location, dimensions, materials, construction dates, performance scores, maintenance history, and potential treatment options with associated costs [16]. For portfolios spanning multiple locations, use either Linear Location Referencing or GPS-based spatial referencing to ensure precise tracking and manage assets effectively [14].

Centralized asset management, combined with aggregated performance data, allows for more meaningful comparisons across your portfolio [17][3]. When analyzing maintenance labor costs, calculate Full-Time Equivalent (FTE) units by comparing hours worked to a standard 40-hour workweek [3].

For context, GRESB’s infrastructure benchmark includes over 700 infrastructure funds, representing $6.4 trillion in assets under management [17]. Additionally, a survey on asset management maturity found that only 46% of organizations described their maintenance approach as "somewhat proactive", while 6% relied solely on reactive maintenance [15]. This highlights the importance of accurate inventory data in transitioning to predictive vs reactive maintenance strategies.

Ensure Data Quality and Validation

The quality of your data directly influences the reliability of lifecycle audits and investment plans. Before finalizing long-term strategies, assess the data for reliability, completeness, and sufficiency [16][14].

Standardized classification systems, like UNIFORMAT II (Levels 1 through 3), can help ensure consistency in data collection across various sites and asset types [5]. This system organizes building elements into categories such as substructure, shell, interiors, services, equipment, and sitework, making it easier to compare conditions and costs.

Training is another critical component. Whether your team consists of internal staff or external consultants, proper training in data entry methods and inspection protocols ensures consistency [5]. Statistical life-cycle modeling, which costs less than 20% of full-field inspections and requires 50% less time, can be a valuable tool. However, these models must be validated through field inspections of at least 10% of the facilities [5].

APPA suggests conducting a baseline survey of all facilities and regularly updating this data through a Computerized Maintenance Management System (CMMS). They also recommend a comprehensive third-party survey every 3 to 5 years to prevent data from becoming outdated [5]. Additionally, surveying building occupants before inspections can help uncover issues that might not be visible during a walkthrough [5].

It’s essential to update lifecycle plans and asset registers promptly as new data or treatment performance results become available [16]. As APTA underscores:

"Investment in capital assets must be systematic and data-driven. Collecting regular condition and performance data to better focus scarce resources on coaxing greater reliability from aging assets is central to being good stewards of public funds" [12].

With validated and up-to-date data, you’ll be ready to move on to risk assessment and lifecycle cost forecasting.

Analyze Risks and Forecast Lifecycle Costs

Once you have clean, validated data, it’s time to figure out which assets pose the biggest risks and what it will cost to keep them functioning over time. This step transforms raw inventory data into actionable investment decisions. The aim? To move away from reactive maintenance and adopt a strategy that focuses resources where they matter most.

Apply Risk-Based Assessment Frameworks

Start by using the formula: Risk Exposure = Probability of Failure × Consequence of Failure [15]. This approach helps prioritize which assets need immediate attention and which can wait. For organizations managing multiple sites, it’s critical to evaluate both the physical state of each asset and its importance to operations.

Tools like the Mission Dependency Index (MDI) and Asset Priority Index (API) can help assign scores to assets. The MDI is particularly useful for organizations in fast-changing environments, as it quantifies criticality and supports cost forecasting. On the other hand, the API works well for organizations like the National Park Service, where asset management tends to be more stable [13]. Both tools assess failure probability alongside impact severity.

For more challenging assets – like buried utilities or geotechnical slopes – risk assessments can lean on other factors such as traffic volume, the likelihood of vehicle impacts, and past incident data [18]. For instance, the Colorado Department of Transportation has been using this method since 2013 to manage 50 to 70 geotechnical emergencies each year, allocating around $10 million annually based on "Risk Exposure" scores.

Technology assets bring their own complexities. In 2018, the Nevada Department of Transportation introduced a risk framework for ITS equipment like cameras and sensors. They categorized these assets into four risk levels based on their age relative to the manufacturer’s recommended service life: Good (less than 80% of service life), Low Risk (80–100%), Medium Risk (100–125%), and High Risk (more than 125%) [18]. This system enabled them to plan maintenance over a decade, saving an estimated $1.1 million compared to reactive maintenance [18].

These risk scores play a key role in predicting lifecycle costs in the next step.

Forecast Lifecycle Costs

Accurate lifecycle forecasting means relying on predictive models rather than just inspector judgment [19]. The best forecasts combine three data sources: field inspection results (covering condition and age), standardized reference data, and desktop analyses of asset importance and value [19]. Statistical lifecycle modeling can be a cost-efficient solution, as long as field inspections validate at least 10% of the facilities [5]. Advanced tools can even predict replacement costs and remaining life for up to 100 years [19].

Forecasting should cover the entire asset lifecycle, including construction, operational, and end-of-life costs. According to ISO 15686-5, this means analyzing construction expenses, maintenance and operational costs, and disposal costs [13]. For portfolios with a wide range of assets, parametric cost models based on historical data can provide accurate predictions of future funding needs [13]. These models improve as they incorporate updated data from completed work orders [19].

The benefits of precise forecasting are clear. In 2018, the Ohio Department of Transportation conducted a lifecycle analysis and discovered that flat revenues and rising costs would lead to worsening conditions. By pivoting to a preventive maintenance strategy – focused on treatments like chip seals – they managed to free up $50 million annually for other priorities while maintaining the network’s condition [18].

To keep forecasts accurate, update asset data as soon as work orders are completed [19]. The quality of your predictions hinges on the reliability of condition grades and the expertise of your assessors [19]. As highlighted by the National Academies of Sciences, Engineering, and Medicine:

"Decision-making capabilities are limited by data made available by the facility asset management system. To improve decision making, the facility asset management system must continually improve the data made available by it and for it." [13]

Use these insights to guide investment decisions in your upcoming multi-year plans.

Prioritize Investments and Develop a Multi-Year Plan

Once you have risk scores and lifecycle forecasts, the next step is deciding how to allocate funds and when to do so. This requires juggling several priorities: addressing immediate safety concerns, meeting long-term performance objectives, adhering to regulations, and achieving environmental goals. The aim? Craft a multi-year investment plan that aligns with your organization’s mission while staying realistic about budget constraints.

Use Multi-Criteria Prioritization Methods

Managing a diverse portfolio calls for a framework that accounts for multiple factors such as risk, cost, criticality, and environmental considerations. By integrating risk assessments and lifecycle forecasts, you can turn audit results into actionable plans. Two established methods stand out for prioritization: the Mission Dependency Index (MDI) and the Asset Priority Index (API).

- Mission Dependency Index (MDI): Ideal for organizations in dynamic, response-driven environments. For example, in 2018, the U.S. Air Force adopted an MDI approach to align facility management with mission-critical objectives. Using a risk matrix, they calculated MDI values for specific functions at various locations, enabling them to prioritize maintenance and projects based on the likelihood and severity of mission failure [11].

- Asset Priority Index (API): Best suited for long-term preservation-focused missions. The National Park Service uses API to allocate resources by ranking assets based on factors like resource preservation, visitor needs, and asset substitutability. This structured method helps balance financial and non-financial considerations, especially for portfolios with steady service delivery goals [11].

The ISO 55000 standard captures the essence of this approach:

"Asset management is not about the asset, but about the value generated by the asset." [11]

When designing your prioritization framework, evaluate assets through four key lenses: Condition, Functionality, Availability, and Utilization [11]. For environmental goals, incorporate ESG (Environmental, Social, and Governance) scoring to ensure decisions reflect the most relevant factors for each asset [3]. Across OECD nations, 79% now use non-financial performance as an auditing criterion for infrastructure operations, and 58% include lifecycle costs in project evaluations [1].

By applying these models, you create a foundation for testing and refining your investment strategy through scenario analysis.

Simulate Scenarios for Decision-Making

Once priorities are set, simulation tools can help fine-tune your funding strategy. Scenario modeling allows you to explore how different funding levels impact long-term outcomes and identify the approach that minimizes total lifecycle costs.

Lifecycle planning (LCP) is particularly useful here. It predicts an asset’s future performance under various investment and maintenance scenarios. As PIARC (World Road Association) explains:

"Lifecycle planning describes the approach to maintaining an asset from construction to disposal. It involves the prediction of future performance of an asset, or a group of assets, based on investment scenarios and maintenance strategies." [7]

To refine your strategy, use sensitivity analysis to test how changes in key variables – like inflation, asset deterioration rates, or regulatory shifts – affect total ownership costs [21]. For complex portfolios, Monte Carlo simulations can provide a clearer picture of financial risks by modeling a range of possible outcomes for different mitigation strategies [21]. When data is limited, focus on high-value or critical assets, such as major structures or strategic roads, to maximize impact [20][7].

Develop three demand scenarios – low, medium, and high – based on historical data and drivers like population growth [15]. Compare "steady state" funding (which maintains current conditions) with scenarios aimed at higher performance targets or lower lifecycle costs [7]. This approach makes it easier to communicate trade-offs to stakeholders, showing how different funding levels impact risk, service quality, and environmental outcomes.

Generate Audit-Ready Documentation and Compliance Reports

Once you’ve finalized your multi-year investment plan, the next step is demonstrating its effectiveness to auditors, regulators, investors, and internal teams. Audit-ready documentation ensures a clear, transparent record that connects asset decisions to your organization’s goals and expected outcomes. This phase builds directly on your investment plan, validating your strategy for all stakeholders.

Prepare ISO 55001-Aligned Reports

Using your risk-based infrastructure asset management strategies as a foundation, create documentation that captures every decision point. The 2024 update to ISO 55001 highlights the Strategic Asset Management Plan (SAMP) as a key artifact. This simplified document outlines asset management objectives and aligns them with your organization’s broader planning efforts [22]. Your reports should clearly tie individual asset decisions to overall performance goals, using a scalable decision-making framework that works for both small facilities and large portfolios [22].

Organize your reports by key performance areas: Condition, Functionality, Availability, and Utilization [11]. As noted by the National Academies of Sciences, Engineering, and Medicine:

"Data used must be held to integrity standards determined by the facility asset management system’s decision-making needs." [11]

For portfolios spanning multiple sites, include detailed information such as entity characteristics (legal name, ownership structure, start dates), economic metrics (Gross Asset Value, annual revenue, Full-Time Equivalent employees), and facility-specific details (geographic coordinates, sector classification, lifecycle stage) [3]. Align your ESG performance reporting with global standards like TCFD, GRI, and PRI [3]. This is particularly important as over 170 institutional investors, managing more than $51 trillion in assets, now rely on standardized ESG data to evaluate investments [2].

A centerpiece of your documentation should be the lifecycle plan. This document forecasts future performance, outlines investment scenarios, details maintenance strategies, and calculates funding requirements [7].

Maintain Continuous Audit Readiness

Audit readiness isn’t a one-time task – it’s an ongoing process. To stay prepared, you need to update and validate data regularly throughout the asset lifecycle. The 2024 ISO 55001 standard emphasizes continuous data management (Section 7.6) to support informed decision-making [22]. Establish a process where decision-making objectives guide data requirements, ensuring your system evolves to provide reliable, actionable data [11].

Standardize your approach with centralized templates and consistent cover pages to make evidence easy to validate [2]. For portfolios with multiple entities, use these templates to ensure uniform, error-free indicator responses [2]. Implement a one-month review process to analyze preliminary results and address any discrepancies before final submission [2][3]. This practice, already adopted by frameworks managing over 800 infrastructure funds worth $8.6 trillion, helps catch errors early and ensures data reliability [2].

The ultimate goal is to create a system where compliance documentation updates automatically as asset data changes. This eliminates the last-minute scramble to prepare reports when auditors arrive and reinforces your commitment to sustainable, risk-based asset management practices.

Conclusion

A well-executed lifecycle audit does more than just reduce risks – it transforms asset management into a forward-thinking, efficient process. For multi-site portfolios, this approach shifts the focus from reactive fixes to proactive, evidence-driven planning. By setting clear goals, assembling diverse teams, gathering reliable data, assessing risks, and prioritizing investments, organizations can significantly lower unplanned maintenance costs while aligning asset strategies with broader business objectives [4][5]. Strong data practices and team collaboration further cement this alignment.

The numbers back this up: Organizations implementing lifecycle audits report a 30% reduction in Total Cost of Ownership, thanks to risk-based optimization and preventive maintenance [25]. Predictive lifecycle modeling also provides actionable insights quickly and cost-effectively, avoiding the need for extensive, full-scale inspections [5].

At the heart of this success are data quality and cross-functional teamwork. These elements create a unified source of truth that supports accurate forecasting and bridges gaps between strategic planning and day-to-day operations [24][23]. When maintenance plans align with capital investment strategies, every dollar works harder, delivering stronger ROI.

The benefits are clear and measurable. Within just 6–12 months, organizations can see improved CAPEX planning and reduced risks – all within a single budget cycle [25]. By viewing assets as enablers of business success rather than mere expenses, companies can boost infrastructure resilience, uncover energy-saving opportunities, and ensure long-term performance across their portfolios [5][1].

FAQs

What are the advantages of performing a lifecycle audit for a multi-site portfolio?

Performing a lifecycle audit for a multi-site portfolio offers a range of practical benefits. It provides a clear picture of asset conditions across all locations, helping organizations make informed decisions about maintenance, upgrades, and replacements. This approach minimizes the chance of unexpected failures and avoids the high costs of emergency repairs, while also boosting overall reliability.

Another advantage is the ability to predict long-term costs, such as operations, maintenance, and capital investments. With this insight, businesses can allocate resources more effectively, improve financial planning, and align their efforts with sustainability objectives. Plus, a lifecycle audit ensures compliance with regulations by offering well-documented proof of responsible asset management.

By tackling challenges like aging infrastructure and meeting sustainability targets, a lifecycle audit aids in strategic planning, extends the lifespan of assets, and strengthens resilience across the entire portfolio.

How can organizations prioritize sites effectively during a lifecycle audit?

Organizations can manage site prioritization during a lifecycle audit by focusing on risk-based factors like asset condition, performance, and importance to operations. Start by examining the current state of assets, pinpointing performance issues, and identifying risks that might disrupt operations or lead to expensive setbacks.

Using lifecycle cost analysis alongside regular performance monitoring allows organizations to spot assets that are declining or carry greater risks. This approach ensures resources are allocated to the most critical sites, delivering maximum value while supporting long-term goals. By concentrating on high-impact assets and aligning efforts with broader objectives, organizations can make smarter, more effective investment choices.

Who should be part of a cross-functional team for a lifecycle audit of a multi-site portfolio?

To conduct a thorough lifecycle audit for a multi-site portfolio, assembling a team with diverse expertise is crucial. Each role contributes unique insights that ensure all aspects of the audit are covered effectively.

- Facilities or asset managers: They bring practical knowledge of day-to-day operations and maintenance needs, offering a ground-level view of asset performance.

- Engineers or technical specialists: These professionals evaluate the physical condition of assets and assess their long-term functionality.

- Financial analysts: Their expertise lies in examining lifecycle costs, budgeting, and ensuring financial feasibility.

- Compliance experts: They focus on regulatory requirements, ensuring the audit aligns with relevant laws and standards.

Other valuable team members include project managers, who coordinate efforts across departments, and sustainability specialists, who prioritize environmental objectives and risk management. Adding input from procurement, safety, and legal teams strengthens the audit further, addressing procurement strategies, risk mitigation, and legal compliance. This well-rounded, multidisciplinary approach ensures the audit supports both immediate and long-term asset management goals.

Related Blog Posts

- Infrastructure Asset Management: A Risk-Based Approach for Multi-Year CAPEX Planning

- Asset Investment Planning 101: How to Decide What to Invest in, When and How Much

- ISO 55001 Essentials: Making Asset Investment Decisions Audit-Ready

- How ISO 55001 Helps You Meet EU Infrastructure and Building Regulations