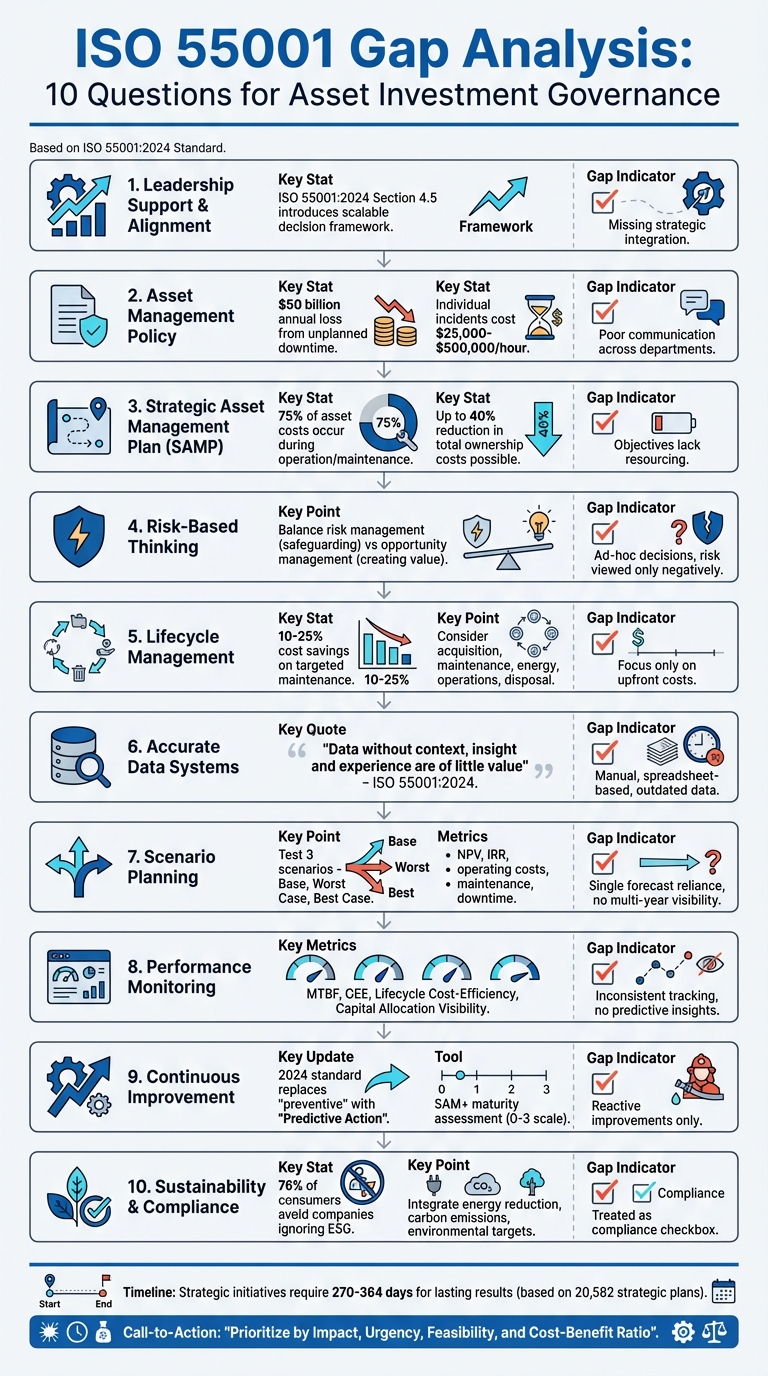

ISO 55001 provides a structured framework for effective asset management, aligning investments with organizational goals, risk management, and lifecycle planning. This article introduces a 10-question gap analysis to help organizations identify weaknesses in their asset investment governance and prioritize improvements.

Key Highlights:

- Leadership’s Role: Investments must align with strategy, risk, and lifecycle management.

- Asset Management Policy: Clear policies, roles, and communication are essential.

- Strategic Asset Management Plan (SAMP): Connects objectives to actionable, resourced goals.

- Risk-Based Thinking: Balances risk and opportunity for informed decisions.

- Lifecycle Management: Focus on total ownership costs, not just upfront expenses.

- Accurate Data Systems: Reliable data drives better decision-making.

- Scenario Planning: Test investments against multiple outcomes for flexibility.

- Performance Monitoring: Use metrics and reviews to track progress.

- Continuous Improvement: Regular updates ensure governance stays effective.

- Sustainability and Compliance: Integrate environmental and regulatory goals into decisions.

By addressing these areas, organizations can optimize asset performance, reduce costs, and create a clear action plan for improvement.

ISO 55001 Explained: The Ultimate Guide to Asset Management Systems

1. Does Leadership Support Asset Investment Alignment?

Leadership’s role in asset investment governance goes far beyond simply approving budgets. It’s about actively linking each investment decision to the organization’s broader strategy, risk management practices, lifecycle management, and sustainability goals. The updated ISO 55001:2024 standard emphasizes this connection with a new requirement (Section 4.5) that outlines a scalable framework to align decision-making at every level [6]. This marks a shift toward a more structured and resource-backed approach.

One of the key changes is the expectation that leadership must provide tangible resources to support stated objectives. As Martin Kerr explains:

The 2024 version makes it clearer that objectives need to be resourced, not just listed. The planning considerations will help any organization reflect on the required resources, balancing cost, risk, and performance [6].

In other words, asset management objectives shouldn’t just exist on paper – they need to be supported by clear plans for personnel, technology, and financial resources.

Another critical focus is lifecycle management. It’s not just about short-term gains but about considering the total ownership cost of an asset. As the standard highlights:

Life cycle management forms the basis of decision-making from demand through to asset and service delivery [6].

This approach ensures that every investment decision accounts for the full lifecycle of an asset, from initial demand to final service delivery.

The 2024 update also introduces a more nuanced approach to risk and opportunity management. Rather than treating them separately, leaders are encouraged to view them as interconnected. By relying on risk and opportunity assessments, leadership can move from reactive, corrective actions to predictive, proactive strategies. This shift involves leveraging data-driven insights and scenario analyses to account for variables like inflation, regulatory changes, and market trends [6].

To implement these principles effectively, governance structures must be robust. Organizations should consider creating a Senior Sponsor role or an Asset Management Steering Committee to ensure accountability across key areas like finance, engineering, and operations [2]. Regular management reviews (outlined in Section 9.3) are also essential for assessing decision-making effectiveness, identifying risks, and uncovering opportunities [6]. When performance gaps appear, tools like root cause analysis – such as the "Five Whys" technique – can help pinpoint whether issues arise from strategic misalignment or operational shortcomings [7].

2. Is Your Asset Management Policy Defined and Shared?

After leadership sets the tone for aligning investments, the next step is evaluating whether your asset management policy is well-defined and effectively communicated. Tanya Goncalves from Fiix describes an asset management policy as a "guiding compass" that drives consistent, proactive, and objective-focused investment decisions [10].

A strong policy should include a clear purpose, defined scope, and guiding principles like risk-based planning, whole-life costing, and sustainability. It’s also essential to document roles and responsibilities using tools like a RACI matrix. Leadership plays a critical role in assigning these roles and ensuring the policy is enforced [9]. When clearly articulated, this policy becomes the backbone of cohesive asset governance and aligns seamlessly with leadership’s strategic goals.

The financial stakes are enormous. Industrial manufacturers lose up to $50 billion annually due to unplanned downtime, with individual incidents costing anywhere from $25,000 to $500,000 per hour [9].

To ensure everyone is on the same page, make the policy accessible across all levels of your organization. Use tools like your company intranet, concise one-page summaries, engaging short videos, or embed the policy within your CMMS (Computerized Maintenance Management System) guidelines [10].

Incorporating sustainability and lifecycle costing is critical to avoid Capex bias. Why? Because roughly 75% of an asset’s total costs occur during its operation and maintenance phases [11]. By managing assets across their entire lifecycle, you can reduce total ownership costs by up to 40%. And with 76% of consumers turning away from companies that disregard ESG (Environmental, Social, and Governance) factors, integrating these principles isn’t just good governance – it’s good business [12].

3. Do You Have a Strategic Asset Management Plan?

Once your asset management policy is in place, the next step is to determine whether you have a Strategic Asset Management Plan (SAMP). This plan is essential for aligning your investment priorities with your broader strategy. Think of it as the bridge that connects high-level objectives to actionable goals, ensuring your corporate strategy translates effectively into operational decisions [4][13]. A well-crafted SAMP lays the groundwork for informed, measurable, and risk-aware investments.

With a solid SAMP, your organization transitions from inconsistent, manual planning to a proactive, risk-focused, multi-year strategy. This shift not only provides executive leadership with a clear view of capital allocation but also ensures that every investment decision is transparent, justified, and aligned with your long-term vision [13]. By integrating risk-based planning, lifecycle cost analysis, and sustainability into one framework, the SAMP becomes a powerful tool for guiding investment decisions.

Why It Matters

Here’s what a SAMP brings to the table:

"Executive Leadership: Gain full visibility into governance performance and capital allocation, ensuring decisions are transparent, justified, and aligned with organisational strategy." – Oxand [13]

To keep your SAMP relevant, it’s crucial to establish a formal review process. This allows you to adapt the plan as regulations, market dynamics, and organizational priorities evolve. Tools like the IAM‘s Self-Assessment Methodology (SAM+) [3] and stakeholder workshops can help refine the plan, ensuring it addresses current responsibilities and challenges [4]. Additionally, creating clear, board-ready roadmaps simplifies executive decision-making by clearly outlining capital allocation criteria [13].

Leveraging Modern Tools

Modern SAMPs go beyond traditional planning by incorporating automated data collection, predictive modeling, and scenario simulations. These technologies help forecast the long-term impact of various investment strategies, reducing the risk of costly missteps. By keeping field activities aligned with corporate goals, this approach ensures consistency and prepares your governance framework for ongoing performance monitoring and continuous improvement.

4. Do You Use Risk-Based Thinking for Investment Decisions?

Risk-based thinking transforms how you manage assets, replacing guesswork with a more precise, data-driven approach. It’s about evaluating the likelihood of asset failures, the consequences of those failures, and their overall impact on your organization. Without this kind of structured analysis, investment decisions often rely on instinct rather than solid evidence, leading to inefficient use of resources.

The updated ISO 55001:2024 framework makes an important distinction between risk management (focused on safeguarding value) and opportunity management (focused on creating value). Both are essential, and they need to work in harmony [6]. By balancing cost, risk, and performance throughout an asset’s lifecycle, you establish a transparent framework that ties every dollar spent directly to measurable organizational goals [6][14]. This mindset lays the groundwork for using practical tools to quantify and manage risk, which we’ll explore next.

Building a Risk-Based Framework

Adopting risk-based thinking requires more than just ticking boxes on a checklist. Tools like a Mission Dependency Index (MDI) or an Asset Priority Index (API) can help quantify how critical each asset is to your operations [15]. These tools rely on probability and severity matrices to assess relative importance, rather than simply labeling assets as "high risk" or "low risk." The choice between MDI and API depends on your operational environment: dynamic systems benefit from MDI, while stable portfolios are better suited for API [15].

"Risk management is essential in developing asset management objectives and plans, and ensuring decision making is in line with organizational objectives and stakeholder requirements." – ISO 55002 [15]

Having accurate, up-to-date data is critical. Outdated or incomplete information can undermine even the most sophisticated risk models [15]. That’s why many organizations are moving from paper-based systems to computerized management platforms. These systems enable scenario modeling and lifecycle planning, helping you make informed decisions. For instance, tools like Oxand Simeo™ use proprietary aging models and maintenance rules to simulate asset deterioration, projecting long-term investment outcomes without relying heavily on complex IoT networks [website].

The 2024 standard also introduces Predictive Action, which replaces the older concept of preventive action. Predictive Action emphasizes adapting to both internal and external changes through risk and opportunity modeling [6]. This dynamic approach ensures that your governance framework remains flexible, aligning today’s investment strategies with the realities of tomorrow’s market conditions.

5. Is Lifecycle Management Part of Your Governance?

When making investment decisions, many organizations focus almost entirely on upfront costs. But here’s the thing: acquisition costs are just the tip of the iceberg. The real financial impact of an asset reveals itself over time – through maintenance, operations, energy usage, and eventual disposal. Without factoring in the entire lifecycle, decisions can fall short, potentially leading to unplanned downtime, which costs industrial manufacturers up to $50 billion annually [9]. This makes a strong case for embedding lifecycle management into your governance strategy.

A well-rounded governance framework should demand business cases that go beyond the purchase price. It needs to account for acquisition, maintenance, energy consumption, operational costs, and decommissioning. By doing so, organizations can significantly reduce total ownership expenses. In fact, those that adopt this comprehensive approach often achieve 10–25% cost savings on targeted maintenance activities by strategically planning interventions across the asset’s lifespan.

"The asset planning and acquisition process should consider the whole-life costs and benefits of the assets, as well as the environmental, social, and regulatory impacts." – FasterCapital [17]

Clear roles and responsibilities at every lifecycle stage are another cornerstone of effective governance. Who is responsible for the asset? Who oversees daily operations? Who decides whether to repair or replace? Defining these roles ensures accountability and smooth operations [17]. Tools like the RACI matrix can help clarify these responsibilities [9]. Once roles are established, attention should shift to the final phase of the lifecycle: asset disposal.

The disposal phase is often overlooked but is just as critical as the earlier stages. Governance policies must include rules for safe decommissioning, material recovery, and addressing environmental, social, and regulatory impacts. These aren’t just compliance measures – they’re financial decisions that directly influence total ownership costs. Skipping proper end-of-life planning can lead to hefty unexpected expenses and even regulatory penalties [9].

6. Do You Maintain Accurate Asset Data and Information Systems?

Accurate and reliable data is the backbone of effective asset management. Without it, planning becomes a guessing game, plagued by scattered spreadsheets, outdated records, and incomplete asset registers. These challenges highlight why having a robust Asset Management Information System (AMIS) is so important [6].

A well-designed AMIS brings everything together – hardware, software, data, procedures, standards, and the right team. It should maintain a comprehensive asset register that includes clear breakdown structures, condition monitoring, performance metrics, and criticality ratings [13][18]. This system not only tracks asset performance but also helps identify risks, providing a clearer picture of where to focus resources.

"Data and Information without context, insight and experience are of little value." – ISO 55001:2024 [6]

Equally important is how often data is updated. For high-risk assets like bridges or critical infrastructure, frequent monitoring is essential because their deterioration can directly affect safety and performance [19]. Update schedules should be tailored to ensure you’re collecting only the data that supports cost-effective decisions [19]. Many organizations are moving away from manual, spreadsheet-based reporting and embracing automated data collection and real-time tracking systems [13].

Beyond data collection, integration is key. Combining financial and operational data ensures consistent and reliable decision-making [16]. Modern AMIS platforms should also enable scenario planning and "what-if" analyses, helping justify capital allocation decisions. Automated audit trails further enhance transparency and give leadership the confidence to greenlight major investments [13][16].

sbb-itb-5be7949

7. Are Investment Plans Based on Multiple Criteria and Scenarios?

Relying on a single forecast or decision criterion can leave you unprepared for unexpected outcomes. Effective asset investment governance involves testing your plans against multiple scenarios before committing funds. This method not only highlights the most probable outcomes but also prepares you for shifts in conditions. It’s an extension of earlier risk-based decision-making practices.

To get started, create three key scenarios:

- Base Case: Represents the most likely outcome.

- Worst Case: Accounts for severe conditions with the highest costs.

- Best Case: Envisions ideal conditions.

Each scenario should adjust important variables like discount rates, growth assumptions, tax rates, and operational costs to reflect plausible future states. Unlike sensitivity analysis – which tweaks one variable at a time – scenario analysis provides a broader view by changing multiple factors simultaneously [21][22].

"Scenario analysis is only as good as the inputs and assumptions made by the analyst." – Investopedia [20]

When evaluating these scenarios, don’t limit yourself to simple payback periods. Metrics like NPV (Net Present Value) and IRR (Internal Rate of Return) are essential, but also consider factors such as operating costs, maintenance expenses, financing interest, and potential downtime during transitions [21][22]. And don’t overlook the "cost of inaction." Sometimes, doing nothing can mean losing market share or facing regulatory fines [22].

Modern investment governance also demands sustainability and ESG (Environmental, Social, and Governance) transparency. Your scenarios should assess carbon emissions, energy efficiency, and long-term environmental responsibilities alongside financial returns [23]. Increasingly, organizations are aligning investment decisions with both financial goals and broader value creation [23].

Lastly, validate every assumption. It’s common to overestimate revenues and underestimate costs, so a thorough review is crucial to ensure your scenarios are as realistic as possible [22].

8. Does Your Governance Include Performance Monitoring?

Once you’ve laid out your strategic plans and assessed risks, performance monitoring becomes the next essential step. It ensures your investment decisions are on track to achieve their intended goals. But how do you confirm whether these decisions are yielding the desired results? Performance monitoring acts as a feedback loop, allowing you to fine-tune your investment strategy as you go [13].

By tying performance monitoring to your scenario planning, you can verify if your strategic investments are hitting their targets. The 2024 update to ISO 55001 emphasizes this by requiring management reviews to cover decision-making effectiveness, risk management, and continuous improvement [6].

Start by identifying the right metrics to measure success. Here are some examples:

- Mean Time Between Failures (MTBF): Evaluates the effectiveness of your maintenance strategies [24].

- Overall Equipment Effectiveness (OEE): Assesses how efficiently your assets are being utilized [24].

- Lifecycle Cost-Efficiency: Tracks total ownership costs against the value generated [24].

- Capital Allocation Visibility: Ensures every dollar spent can be tied back to a strategic objective [13].

These metrics can seamlessly integrate into your broader governance framework, helping you stay aligned with your goals.

The focus is shifting from reactive to proactive management. Modern tools like Power BI and Tableau replace outdated spreadsheets with real-time dashboards, offering instant performance insights [13]. Additionally, specialized asset investment planning software can automatically produce audit-ready documentation, saving significant time during reviews [13][24]. Pay special attention to high-risk, critical assets, as monitoring these can help you take immediate corrective actions when needed [1].

9. Have You Built in Continuous Improvement Processes?

Even the most well-structured governance framework can weaken over time without regular updates and refinements. Continuous improvement ensures that your planning methods, data quality, and decision-making stay aligned with your organization’s shifting needs. The 2024 update to ISO 55001 emphasizes this by introducing "decision-making" and "improvement" as key elements in management reviews, creating a formal feedback loop to keep your system evolving [6].

To pinpoint where your governance framework needs adjustment, practical assessment tools are invaluable. Maturity assessments, for example, can provide a clear picture of your current capabilities. Tools like the IAM’s Self-Assessment Methodology+ (SAM+) rate your governance on a scale of 0 to 3, helping you identify specific areas for improvement [3]. One CTO at Oxand shared:

"As asset leader, I’m aware of the need to challenge our practices and be at the top level of operation and maintenance practices. Within this context, we want as a first step to perform a Maturity Assessment of our Asset Management practices." [13]

The 2024 standard also replaces the concept of preventive actions with Predictive Action (Clause 10.3). This shift moves organizations from reactive problem-solving to proactive adaptation. Predictive Action involves forecasting potential changes and adjusting processes accordingly, whether the focus is on risk, opportunity, or asset performance [6].

Capturing your team’s tacit knowledge – essentially, their accumulated expertise and insights – is another cornerstone of continuous improvement. The updated standard acknowledges that this knowledge forms a critical part of your competitive edge [6]. Without formal processes to document and preserve this expertise, you risk losing valuable context when team members retire or leave. Establishing clear, repeatable methods for capturing and applying this knowledge ensures your practices remain relevant and effective [13].

Automation can further streamline your continuous improvement efforts. Modern asset investment planning software, for instance, can automatically generate audit-ready documentation, creating traceable evidence trails that simplify reviews and provide actionable insights into governance performance [13]. By eliminating the need for manual, spreadsheet-based reporting, these tools free up your team to focus on analysis and strategy, feeding directly into the refinement of your governance processes.

10. Are Investment Decisions Aligned with Sustainability and Regulations?

A governance framework falls short if it sidelines sustainability and regulatory compliance. To be truly effective, it must integrate goals like energy reduction, carbon emissions control, and environmental targets with financial and operational metrics. The 2024 update to ISO 55001 emphasizes that decision-making at all levels should align with organizational value, which includes adhering to legal, regulatory, and sustainability standards [6]. This builds on earlier strategies for monitoring risk and performance, tying everything together into a cohesive framework.

The transition from reactive compliance to Predictive Action (see Section 10.3) is reshaping how organizations handle emerging regulations. Instead of scrambling to meet new mandates, a well-designed governance framework anticipates regulatory changes and adapts proactively. As stated in ISO 55001:2024:

"Predictive Action can be anything that seeks to adapt changes internally, externally based on risk and opportunity, services and/or assets." [6]

This forward-thinking approach turns sustainability regulations into opportunities for creating value. The 2024 revision also distinguishes between actions aimed at addressing risks (Section 6.1.2) and those focused on opportunities (Section 6.1.3), ensuring both are given equal weight [6]. These updates reinforce the importance of embedding sustainable investments into core decision-making processes.

When making investment decisions, it’s critical to evaluate whole lifecycle costs rather than focusing solely on initial acquisition budgets. This approach captures both long-term financial and environmental impacts. For example, federal facility renewal strategies are required to account for the entire lifecycle costs of assets under their scope [15].

To implement these principles effectively, accounting systems need to be updated to compare planned versus actual performance. Funds earmarked for energy reduction or carbon reduction targets should be tracked, audited, and used as intended [15].

Gap Analysis Summary Table

ISO 55001 Asset Investment Governance: 10-Question Gap Analysis Framework

This table is designed to help you evaluate your organization’s asset investment governance. By assessing each question, you can pinpoint weaknesses and outline actionable steps aligned with your strategic priorities. Often, bottlenecks arise from gaps in data systems or scenario planning, so addressing these areas first can yield quick wins. Below, you’ll find a consolidated overview of key elements and suggested actions to guide your improvement efforts.

| Question | Current State | Identified Gap | Recommended Action |

|---|---|---|---|

| 1. Does Leadership Support Asset Investment Alignment? | Leadership involvement is limited to annual budget approvals, lacking strategic integration. | No scalable decision-making framework connecting all organizational levels [6]. | Implement a decision-making framework (ISO 55001:2024, Section 4.5) that bridges strategy and operations across all levels [6]. |

| 2. Is Your Asset Management Policy Defined and Shared? | Policy exists but isn’t communicated beyond the asset management team. | Policy lacks visibility and stakeholder engagement across departments. | Establish formal communication channels and integrate the policy into onboarding, training, and performance reviews. |

| 3. Do You Have a Strategic Asset Management Plan? | The SAMP is theoretical; objectives are listed without clear resourcing [6]. | Strategic objectives are not actionable or adequately resourced. | Simplify the SAMP to align directly with resourced objectives, making it a practical tool [6]. |

| 4. Do You Use Risk-Based Thinking for Investment Decisions? | Decisions are ad-hoc; risk is viewed only as negative [13][6]. | No distinction between managing risks (negative) and opportunities (positive). | Apply ISO 31000 principles to separate risk and opportunity management for a more proactive approach [13][6]. |

| 5. Is Lifecycle Management Part of Your Governance? | Focus is on short-term maintenance rather than full lifecycle costs [6]. | Lifecycle costs are not factored into decision-making. | Use aging models and performance mapping to inform lifecycle-based investment decisions [13]. |

| 6. Do You Maintain Accurate Asset Data and Information Systems? | Data collection is manual and spreadsheet-based; information is often outdated [13]. | Data lacks context, insight, and competitive value [6]. | Introduce automated data collection and AIP software to build reliable data systems [13]. |

| 7. Are Investment Plans Based on Multiple Criteria and Scenarios? | CAPEX decisions remain siloed with poor long-term visibility [13]. | No multi-year Master Plans or scenario simulations to evaluate investment strategies. | Adopt AIP software like Oxand Simeo™ to simulate multi-year scenarios and generate audit-ready documentation [13]. |

| 8. Does Your Governance Include Performance Monitoring? | Performance tracking is inconsistent; there are no regular review cycles. | Focus is on lagging indicators, with no predictive insights. | Define KPIs tied to strategic goals and use dashboards for real-time performance monitoring. |

| 9. Have You Built in Continuous Improvement Processes? | Improvement efforts are reactive; emphasis is on "preventive" action only [6]. | There’s no "Predictive Action" to address changes proactively [6]. | Implement Predictive Action (ISO 55001:2024, Section 10.3) to tackle emerging risks and opportunities [6]. |

| 10. Are Investment Decisions Aligned with Sustainability and Regulations? | Sustainability is treated as a compliance checkbox rather than a core decision factor. | Lifecycle costs and environmental impacts are not integrated into investment decisions. | Update accounting systems to track energy and carbon reduction targets; embed sustainability metrics into decision frameworks. |

To make progress, focus on addressing performance gaps through root cause analysis. Apply SMART criteria to each recommended action and assign clear accountability to ensure ownership and follow-through [25][8].

Conclusion

Strong asset governance isn’t just a checkbox – it’s a way to create value, manage risks effectively, and set your organization up for long-term success. ClearPoint Strategy offers a powerful perspective on this:

"You don’t know where you’re going until you know where you are. A gap analysis not only highlights the gap between your dreams, but also forces your organization to truly assess your past and present." [7]

A gap analysis serves as a reality check. It reveals where your investment strategies might be falling short – whether it’s misaligned leadership, underperforming data systems that limit scenario planning, or neglecting sustainability. By identifying these gaps, you can take focused, strategic actions to address them.

To prioritize improvements, use the four key factors from the summary table: impact, urgency, feasibility, and cost-benefit ratio [8]. Start with a root cause analysis, like the "5 Whys" method, to get to the heart of the problem [7][25]. Make sure roles are clearly defined, assign accountability, and monitor progress with visual tools that keep everyone on the same page [7].

Research examining 20,582 strategic plans shows that meaningful initiatives aren’t quick fixes – they often require a yearlong commitment, with projects typically taking 270 to 364 days to deliver lasting results [7]. Regular evaluations ensure your organization stays resilient and maintains its competitive edge [5][8].

FAQs

How can leaders align asset investments with their organization’s goals?

Leaders hold a key responsibility in making sure that asset investments align with their organization’s objectives. This starts with establishing a clear framework for decision-making that prioritizes value creation. It means weaving asset management into the organization’s broader mission, with an emphasis on long-term value, risk management, and sustainability.

To make this happen, leadership must outline roles and responsibilities in a way that leaves no room for confusion. They should champion the development of strong asset management strategies and policies while ensuring decision-makers have access to reliable, accurate data. Regular evaluations are also crucial – they help uncover gaps and highlight areas that need attention, keeping the organization in step with its priorities and industry standards.

When leaders encourage a culture of openness and a commitment to ongoing improvement, they can make better use of resources, track asset performance effectively, and ensure investments deliver value throughout their lifecycle. This approach not only optimizes operations but also reinforces the organization’s larger goals.

What are the key benefits of having a Strategic Asset Management Plan (SAMP)?

A Strategic Asset Management Plan (SAMP) ensures that an organization’s asset management efforts are directly aligned with its broader business objectives. With a SAMP in place, you can focus on improving asset performance, making smarter investment decisions, and handling risks with greater efficiency.

This framework also encourages sustainable, long-term value by driving informed decision-making and fostering responsible asset management practices. In essence, a well-crafted SAMP serves as a roadmap for guiding investments and enhancing overall governance.

Why should sustainability be a key factor in asset investment decisions?

Incorporating sustainability into asset investment decisions is key to building long-term value while minimizing risks. By factoring in environmental, social, and governance (ESG) considerations, organizations can align their investments with societal priorities and meet the expectations of regulators and stakeholders alike.

This approach helps address challenges like climate change, resource shortages, and evolving market dynamics, ensuring assets maintain their relevance and worth over time. Beyond that, it strengthens resilience and builds trust with stakeholders, enhancing the organization’s reputation and credibility.