ISO 55001 isn’t just about compliance – it’s a tool to reduce costs and improve decision-making around assets. By focusing on the total cost of ownership (TOTEX) rather than upfront expenses, this standard helps organizations balance capital (CAPEX) and operating expenses (OPEX). The 2024 update strengthens its framework, making it easier to align asset management with financial goals.

Key takeaways:

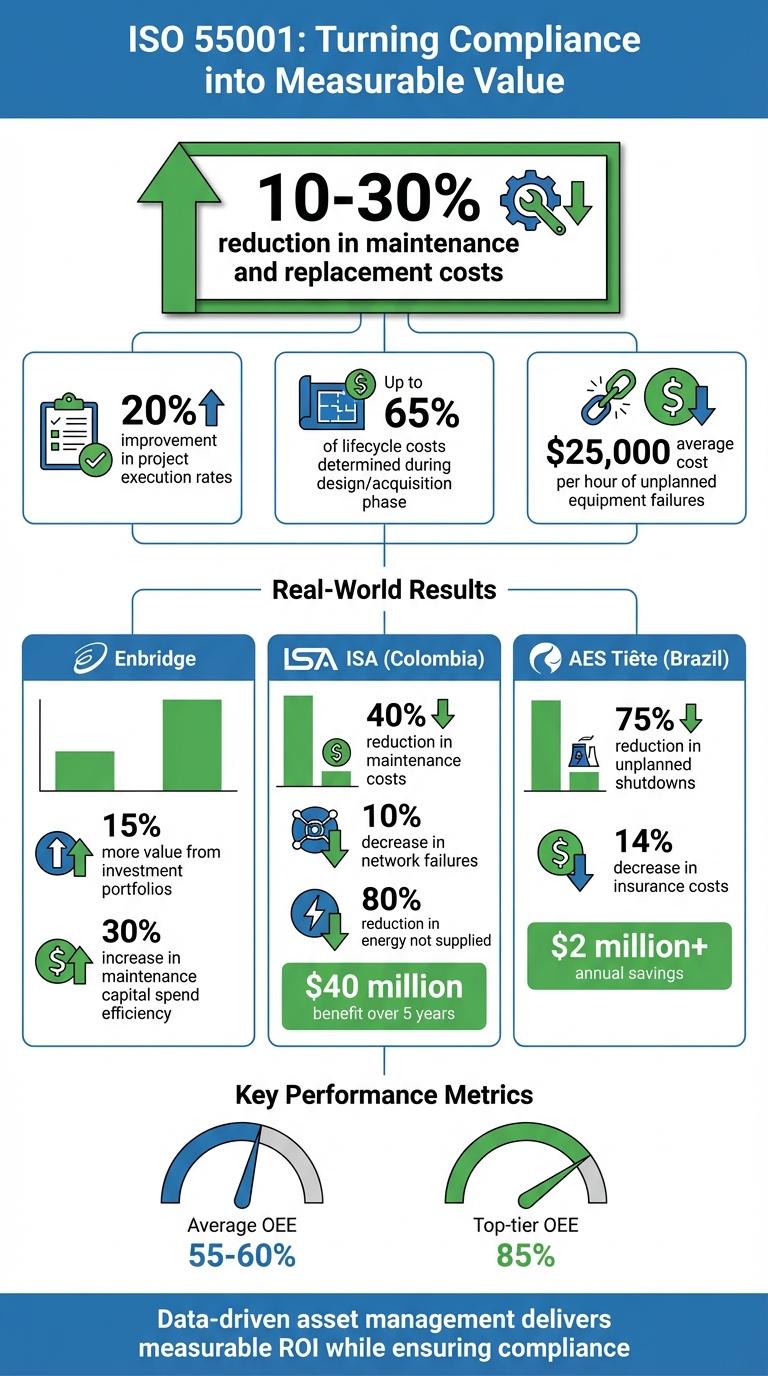

- Cost Savings: Predictive vs reactive maintenance analysis shows that risk-based planning can cut maintenance and replacement costs by 10–30%.

- TOTEX Approach: Focus on lifecycle costs instead of just initial investments.

- Data-Driven Decisions: Structured data collection eliminates inefficiencies and supports better budget planning.

- Gap Analysis: Identifying inefficiencies helps prioritize high-impact improvements.

- Risk-Based Investments: Allocate resources to areas with the highest value and risk mitigation potential.

Examples show organizations saving millions through better asset management. ISO 55001 turns compliance into a cost-saving strategy while improving asset performance.

ISO 55001 Financial Benefits and Cost Reduction Statistics

ISO 55001 Basics: Structure and Financial Benefits

Main Elements of ISO 55001

ISO 55001 is structured to help organizations manage their assets efficiently while delivering measurable financial benefits. At its core is the Asset Management System (AMS), which acts as the backbone for managing assets throughout their lifecycle. Think of it as the operating system that ties together data collection, risk assessment, and investment decisions into a unified framework [4].

At the strategic level, the Strategic Asset Management Plan (SAMP) translates overarching business goals into actionable plans for assets. This document connects organizational objectives directly to asset-level actions and budget needs. The 2024 update made this process even clearer, simplifying the SAMP to ensure a more direct alignment between high-level goals and specific asset management activities [2].

Another key feature is the Decision-Making Framework (Section 4.5), which ensures that every decision contributes to value creation. It emphasizes critical areas like risk (Section 6.1.2) and opportunity management (Section 6.1.3), while also prioritizing data (7.6) and knowledge (7.7). This setup fosters a cycle of continuous improvement, shifting the focus from merely preventing issues to proactively predicting and addressing them (Section 10.3) [2].

Together, these components not only improve asset management but also pave the way for more accurate and effective budget planning.

How ISO 55001 Improves Budget Planning

ISO 55001’s structured approach transforms how organizations approach budget planning, especially for assets. By managing assets throughout their entire lifecycle – from procurement to operation and eventual disposal – the standard encourages a shift from focusing solely on upfront costs to considering the total cost of ownership [2][4].

This lifecycle perspective is paired with a strong emphasis on data collection and consistent evaluation methods. By eliminating the guesswork that often arises from siloed departments, ISO 55001 ensures alignment between financial planning and operational needs. This integration allows organizations to turn compliance requirements into measurable financial gains [3].

"Understanding value is hugely important if you try to explain your organizations’ activities in relation to its strategic goals." – ISO TC251 [3]

One of the standout updates in the 2024 edition is the requirement that objectives must be "resourced" rather than simply listed. In other words, asset management goals must have real budget allocations to back them up [2]. This ensures a balanced approach where costs, risks, and performance are all considered, preventing both underfunding critical maintenance and overspending on unnecessary replacements. Organizations adopting ISO 55001 have reported maintenance and replacement cost reductions ranging from 10% to 30% [4].

The decision-making framework also improves the timing of investments. Instead of relying on fixed schedules or reacting to failures, organizations can use condition data and risk criteria to determine the best time for interventions. This approach ensures that assets receive the right treatment at the right time, stretching CAPEX budgets further while reducing emergency OPEX spending on reactive repairs.

sbb-itb-5be7949

Gap Analysis: Finding Cost Reduction Opportunities

How to Run an ISO 55001 Gap Analysis

A gap analysis is a practical way to evaluate your current asset management practices against ISO 55001 standards, helping you pinpoint areas of inefficiency. Start with a readiness assessment to check for missing foundational documents like an asset management policy, SAMP (Strategic Asset Management Plan), and individual asset management plans. This initial step gives you a sense of how far you are from compliance and highlights what needs immediate attention.

After this, dive into the details of your documentation and data. Assess how information flows between your financial and operational teams. For example, are procurement decisions based on the total cost of ownership, or is the focus only on upfront costs? Ensuring your asset data is accurate and decision-ready can help avoid unnecessary spending on maintenance or replacements.

Engage asset managers through interviews to formalize informal processes. This step can uncover hidden inefficiencies and pave the way for cost-saving measures.

Finally, evaluate each ISO 55001 section against your current practices. Pay close attention to the updated 2024 requirements, such as the decision-making framework (Section 4.5) and predictive action capabilities (Section 10.3). These areas are critical in shifting from reactive spending to a more strategic approach. Prioritize critical assets first to achieve quick, impactful results.

Once you’ve identified the gaps, the next step is to zero in on specific sources of waste and risk.

Spotting Waste and Risk Exposure

A thorough gap analysis can uncover areas where costs are unnecessarily high. One common problem is poor lifecycle management (Section 8.1). Research shows that up to 65% of an asset’s total lifecycle costs are determined during the design and acquisition phases because organizations often focus solely on the upfront price [5]. Without factoring in the total cost of ownership, long-term expenses can spiral out of control.

Another red flag is over-reliance on reactive maintenance. If your gap analysis reveals limited use of predictive action (Section 10.3), it’s likely you’re stuck in a costly cycle of emergency repairs. Planned maintenance is almost always more economical than dealing with breakdowns as they happen.

"Transparent decision making becomes much clearer and apparent if you have a thorough understanding of the value created by your assets, and know how risk mitigation actions protect and expenditures support that value." – ISO 55002:2018 [3]

You should also look for misalignments between financial and operational data. When these two areas don’t align, budgets often fail to reflect actual asset needs, leading to inefficiencies. Your analysis should confirm that asset management objectives are backed by real budget allocations, not just theoretical goals.

Lastly, examine how decisions are made across departments. Redundancies and conflicting priorities can waste CAPEX and create bottlenecks. A well-executed gap analysis brings these inefficiencies to light, allowing you to address them in a structured way.

ISO55001:2024 (Why, What and How) – Martin Kerr

Using ISO 55001 for Risk-Based Investment Planning

ISO 55001 provides a solid framework for turning identified gaps into a structured investment plan that balances capital expenditures (CAPEX) and operational expenditures (OPEX). By focusing on asset condition, risk, and priorities, this approach helps organizations move away from reactive spending. Instead, it supports crafting long-term investment strategies that align with business objectives.

The core principle here is to use risk as the common factor. As assets age and their condition deteriorates, the likelihood of failure and associated risks increase. Investment plans should focus on addressing these risks before they become critical [6]. By tying financial decisions to actual asset data and risk profiles, organizations can clearly justify investments and allocate resources where they will deliver the most value. This risk-centric planning is the foundation for creating multi-year investment strategies.

Building Multi-Year CAPEX and OPEX Plans

The Strategic Asset Management Plan (SAMP) serves as the essential link between an organization’s goals and its specific asset management actions. More than a compliance document, the SAMP is a practical guide for developing long-term investment plans that reflect business priorities [2][3]. It outlines the necessary steps to meet asset management objectives and shows how these actions support broader business goals [7]. For example, the SAMP should specify details such as asset upgrades, timelines, and budgets to enhance operational performance.

To create effective multi-year plans, lifecycle management must be part of the decision-making process. ISO 55001:2024 highlights the importance of considering the entire lifecycle of an asset – from its acquisition and operation to maintenance and eventual disposal [2]. This perspective shifts the focus from just upfront costs to the total cost of ownership.

The 2024 update also emphasizes resourced objectives (Section 6.2.3), ensuring that asset management goals are supported by realistic budgets. This balance between cost, risk, and performance enables better predictive scenario modeling and aligns financial planning with strategic asset requirements.

Using Predictive Tools for Budget Scenarios

Predictive tools play a key role in refining multi-year investment strategies. These tools allow organizations to model different budget scenarios, prioritize investments, and assess outcomes based on risk and asset condition data.

For example, Oxand Simeo™ uses extensive data – over 10,000 proprietary aging models and 30,000+ maintenance laws – to simulate how assets will degrade over time. Instead of relying heavily on IoT sensors, it leverages existing asset data, inspections, and probabilistic modeling to forecast performance.

With Simeo™, you can compare various budget scenarios over multiple years. This might include testing different CAPEX and OPEX allocations to understand their impact on asset performance in the long run. The platform ranks investments based on factors like risk, lifecycle costs, and criticality.

This approach aligns with ISO 55001:2024’s new focus on Predictive Action (Section 10.3), which encourages proactive management. Rather than reacting to asset failures, organizations can adjust their investment plans using data on risks and opportunities [2]. As Martin Kerr, an expert from ISO/TC 251, explains:

"Predictive Action can be anything that seeks to adapt changes internally, externally based on risk and opportunity, services and/or assets" [2].

The outcome is a well-justified plan that balances immediate budgets with long-term asset performance. Organizations leveraging data-driven decision-making in asset management have reported reducing maintenance and replacement costs by 10% to 30% [4]. Additionally, by monitoring and optimizing plans on a monthly or quarterly basis, project execution rates can improve by up to 20% [6].

Tracking Results and Maintaining Compliance

ISO 55001 emphasizes the importance of tracking changes and ensuring the effectiveness of asset management systems. To achieve this, organizations must focus on metrics that demonstrate how their CAPEX and OPEX decisions lead to measurable outcomes.

Metrics for Measuring CAPEX and OPEX Performance

ISO 55001 highlights the "triple constraint" of cost, risk, and performance [2][1]. This means looking beyond budgets to understand how spending impacts asset conditions and overall operations.

- Financial metrics: These should cover the total cost of ownership over an asset’s lifecycle, not just initial CAPEX. Key indicators include maintenance costs per asset, which factor in labor, materials, contracted services, and software subscriptions. Data-driven asset management has helped organizations cut maintenance and replacement costs by 10% to 30% [4][8].

- Performance metrics: These measure how well assets perform. For example, asset availability compares uptime to the required operating schedule, directly influencing production revenue [8]. Metrics like Mean Time Between Failures (MTBF) optimize maintenance schedules to reduce OPEX, while Overall Equipment Effectiveness (OEE) – a combination of availability, performance, and quality – provides a comprehensive view of efficiency. Many manufacturers average 55–60% OEE, yet top-tier performance reaches around 85% [8].

- Risk metrics: These assess how well investments protect value. Indicators such as risk reduction percentages, non-conformities, and audit success rates offer actionable insights. For instance, unplanned equipment failures can cost companies an average of $25,000 per hour, making it essential to measure how predictive actions mitigate these events [8].

The 2024 ISO 55001 update underscores the importance of tracking "predictive actions" to adapt to evolving risks and opportunities [2].

| Metric Category | Specific KPI Examples | Financial Impact |

|---|---|---|

| Asset Performance | Asset uptime, OEE, MTBF | Reduced unplanned outage costs |

| Cost Optimization | Total Cost of Ownership, maintenance cost/unit, CAPEX vs. OPEX ratio | 10–30% reduction in maintenance/replacement costs [4] |

| Risk & Compliance | Risk reduction %, non-conformities, audit success rate | Lower failure and regulatory penalty costs |

| Lifecycle Value | Residual value at disposal, asset life extension | Improved ROI and resource utilization |

Real-world examples demonstrate the power of these metrics. For instance, Enbridge, under Carmen Benoit’s leadership, used decision analytics aligned with ISO 55001 to extract 15% more value from investment portfolios while increasing maintenance capital spend by 30% [10]. Similarly, ISA, Colombia’s power transmission operator, achieved a 40% reduction in maintenance costs, a 10% drop in network failures, and an 80% decrease in energy not supplied, resulting in a $40 million benefit over five years [10]. AES Tiête, a hydroelectric operator in Brazil, cut unplanned shutdowns by 75% and insurance costs by 14%, saving over $2 million annually [10].

These metrics create a feedback loop that supports proactive asset management and continuous improvement.

Continuous Improvement for Long-Term Savings

Using these performance metrics as a foundation, organizations can adopt continuous improvement strategies to achieve lasting savings and maintain compliance. The 2024 ISO 55001 update strengthens Management Reviews (Section 9.3) by requiring evaluations of risk, opportunity, and decision-making effectiveness [2].

By leveraging condition data and predictive models, companies can establish leading indicators that allow for proactive adjustments before failures occur [4]. This shift from reactive to predictive maintenance is a key focus of the 2024 standard [2].

The updated standard also mandates that asset management objectives be supported with adequate budgets and manpower (Section 6.2.3) [2]. Ensuring data quality is another priority – reviewing logs for inconsistencies, using standardized failure codes, and relying on tools like Computerized Maintenance Management Systems (CMMS) and IoT sensors minimizes errors and provides real-time insights [8][9].

Benchmarking against industry standards is another effective way to identify gaps and drive improvement [4]. Comparing your metrics with those of similar organizations can reveal opportunities for enhancement.

Data and information management are also emphasized in the 2024 update. Section 7.6 treats data as a critical capability, while Section 7.7 highlights the importance of "Knowledge" – the experience and context that turn raw data into actionable insights [2]. As ISO/TC 251 explains:

"Data and Information without context, insight and experience are of little value." [2]

Tools like Oxand Simeo™ offer practical solutions for continuous improvement by enabling regular monitoring and optimization of investment plans. With a library of over 10,000 aging models and 30,000 maintenance laws, it transforms raw asset data into meaningful performance insights.

Conclusion: Using ISO 55001 to Control Costs

ISO 55001 provides a structured approach for organizations looking to manage costs effectively while staying compliant. By emphasizing the balance between cost, risk, and performance, the standard encourages a shift from reactive problem-solving to strategic, lifecycle-based planning. This transition can have a measurable impact on both CAPEX and OPEX, with data-driven decisions under the ISO 55001 framework often reducing maintenance and replacement costs by 10–30% [4].

The 2024 update enhances this approach with the addition of Section 4.5, which focuses on "Asset management decision-making and value" [2]. This section requires that all investment decisions deliver measurable results aligned with organizational goals. It also emphasizes the importance of allocating appropriate resources – both budgets and manpower – to meet these objectives [2].

To apply these principles, revisit your gap analysis and refine your Strategic Asset Management Plan (SAMP) to align with budget scenarios [2][4]. Shift your focus to lifecycle costs rather than just upfront expenses, and prioritize predictive measures over simple preventive actions to address evolving risks and opportunities [2].

Tools like Oxand Simeo™ can support this transformation by turning asset data into detailed, multi-year CAPEX and OPEX plans. With access to over 10,000 aging models and 30,000 maintenance rules, it delivers predictive insights that help prioritize investments based on risk, lifecycle costs, and sustainability goals – all while adhering to ISO 55001 standards. This approach fosters a forward-thinking mindset.

Organizations that treat compliance as a strategic tool gain a competitive edge. By embedding ISO 55001 principles into your decision-making processes, you create a framework that continuously identifies opportunities to cut costs, protect asset value, and meet regulatory requirements. This turns compliance into a powerful mechanism for long-term cost control.

FAQs

How does ISO 55001 help organizations optimize capital and operational expenses?

ISO 55001 provides a clear framework for managing assets, helping organizations make the most of their capital expenditures (CAPEX) and operational expenditures (OPEX). By emphasizing long-term value and careful risk management, it allows businesses to align asset strategies with broader goals. The result? Better resource allocation and lower costs throughout an asset’s lifecycle.

The standard promotes a forward-thinking approach, encouraging organizations to integrate risk assessments into their decision-making. This helps identify potential problems early, preventing them from escalating into expensive setbacks. The benefits include smarter investment planning, less waste, and improved efficiency in daily operations. ISO 55001 transforms compliance into a strategic advantage, helping organizations balance costs while maximizing asset performance to deliver lasting value.

What are the main advantages of adopting a TOTEX approach in asset management?

Using a TOTEX (Total Expenditure) approach in asset management allows organizations to manage both capital expenditures (CAPEX) and operational expenditures (OPEX) more effectively. Instead of focusing on one aspect of spending, this method emphasizes the total lifecycle costs of assets, aligning decisions with long-term operational and financial goals.

Benefits of the TOTEX Approach

- Cost Efficiency: By carefully balancing upfront investments with ongoing operational expenses, businesses can avoid unnecessary spending and make the most of their resources. It’s about finding the sweet spot between initial costs and long-term savings.

- Lower Risk Exposure: TOTEX encourages proactive planning, which helps reduce the likelihood of asset failures or surprise costs. This forward-thinking approach minimizes disruptions and keeps operations running smoothly.

- Smarter Decisions: With a focus on the entire lifecycle of assets, TOTEX supports data-driven strategies. This means decisions are based on long-term value rather than short-term gains, leading to more sustainable and impactful outcomes.

Incorporating a TOTEX approach into asset management not only enhances financial performance but also ensures compliance and maintains the reliability of critical assets. It’s a strategy that balances efficiency with sustainability, helping organizations stay ahead in the game.

How do predictive tools help improve investment planning with ISO 55001?

Predictive tools are a game-changer for investment planning under ISO 55001, offering data-driven insights into how assets perform and progress through their lifecycle. These tools empower organizations to foresee potential failures, fine-tune maintenance schedules, and cut down on unexpected downtime. The result? Lower operational costs paired with more reliable assets.

With predictive analytics, businesses can craft long-term investment plans with greater precision. These tools enhance the ability to forecast asset needs and risks, aligning perfectly with ISO 55001’s focus on risk-based decision-making. This approach ensures organizations can prioritize investments wisely, striking the right balance between CAPEX and OPEX. Compliance, then, becomes more than just a requirement – it’s an opportunity to save costs and achieve consistent and efficient asset performance.