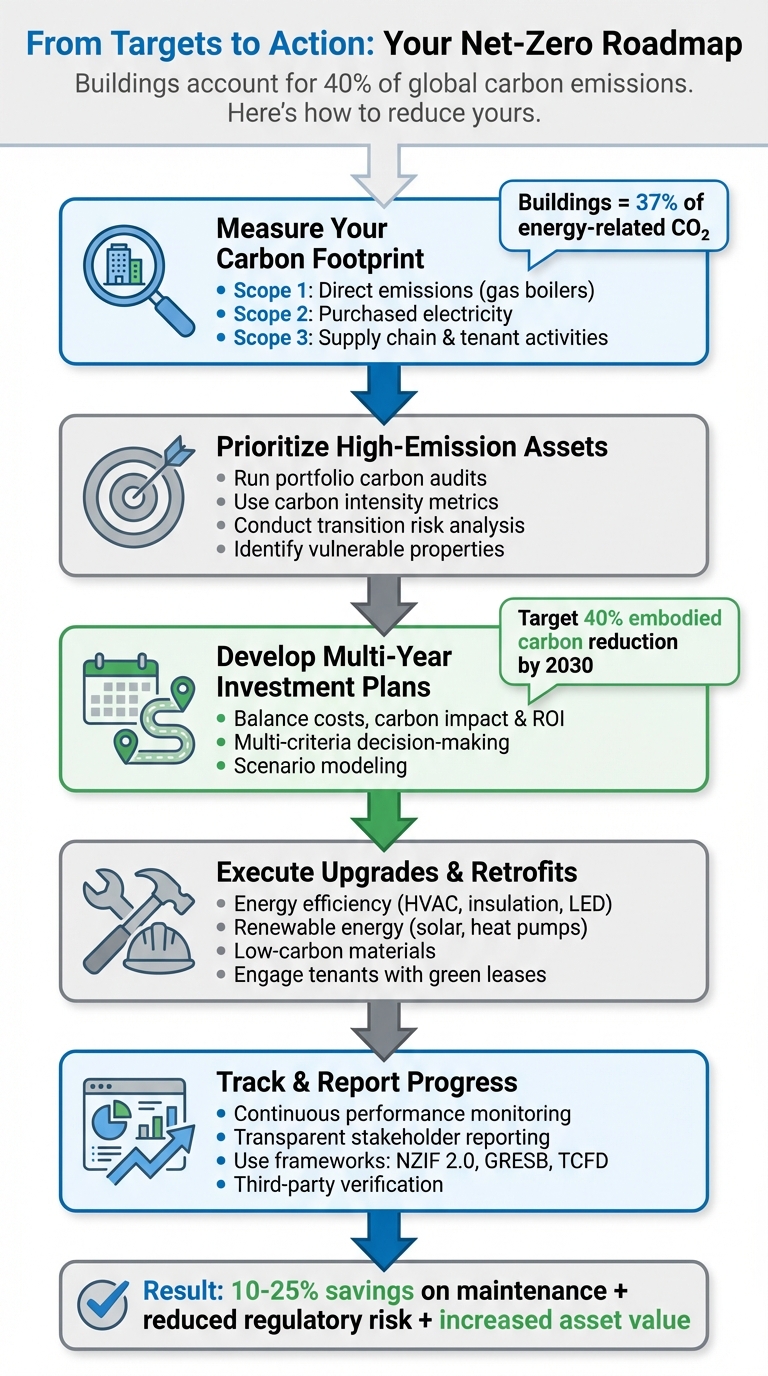

Gebouwen zijn verantwoordelijk voor bijna 401 TP3T van de wereldwijde CO2-uitstoot. Toch beschikt slechts een fractie van de vastgoedportefeuilles over uitvoerbare plannen om netto-nuluitstoot te realiseren. Om ambitieuze doelstellingen om te zetten in meetbare resultaten zijn duidelijke strategieën, nauwkeurige CO2-gegevens en gerichte investeringen vereist. Hieronder vindt u de informatie die u nodig heeft om de uitstoot van uw portefeuille te verminderen:

- Net-Zero gedefinieerdHet elimineren van operationele en intrinsieke koolstofemissies uit de exploitatie en bouw van gebouwen.

- DringendheidHet uitstellen van maatregelen brengt het risico met zich mee van financiële sancties, veroudering van activa en dalende vastgoedwaarden.

- Belangrijke stappen:

- Meet de CO2-voetafdruk van uw portefeuille (Scope 1-, 2- en 3-emissies).

- Geef prioriteit aan activa met een hoge uitstoot door middel van koolstofaudits en risicoanalyses.

- Ontwikkel meerjarige investeringsplannen waarin kosten, CO2-impact en ROI in evenwicht zijn.

- Implementeer energie-efficiëntieverbeteringen, oplossingen voor hernieuwbare energie en koolstofarme materialen.

- Monitor en rapporteer de voortgang op transparante wijze met behulp van tools zoals Oxen en Simeo™.

Door nu actie te ondernemen, voldoet u niet alleen aan de strengere regelgeving, maar positioneert u uw portefeuilles ook zodanig dat ze aantrekkelijk zijn voor beleggers en concurrerend blijven in een klimaatbewuste markt.

Vijfstappenplan om netto-nul te bereiken in vastgoedportefeuilles

Het meten van de huidige CO2-voetafdruk van uw portefeuille

Om een pad naar netto nul uit te stippelen, dient u eerst een duidelijk beeld te hebben van uw uitgangspositie. Het vaststellen van een gedetailleerde basis van broeikasgasemissies in uw hele portfolio is van cruciaal belang. Zonder deze informatie is het onmogelijk om zinvolle doelstellingen vast te stellen en de voortgang bij te houden.

De vastgoedsector is verantwoordelijk voor een aanzienlijk 371 TP3T aan energie- en procesgerelateerde CO₂-uitstoot en meer dan 34% van de wereldwijde energievraag. Een grondige beoordeling van de koolstofvoetafdruk moet het volgende omvatten: Reikwijdte 1 emissies (directe emissies van bronnen zoals aardgasboilers), Reikwijdte 2 emissies (indirecte emissies van aangekochte elektriciteit), en Reikwijdte 3 emissies (indirecte emissies van toeleveringsketens, activiteiten van huurders en bouwmaterialen). Hoewel Scope 3-emissies vaak het moeilijkst te meten zijn, zijn ze essentieel om inzicht te krijgen in de volledige klimaatimpact van uw portefeuille.[5][6][8].

De Whole Life Carbon (WLC)-benadering biedt het meest uitgebreide overzicht door rekening te houden met zowel koolstofuitstoot – emissies afkomstig van materiaalextractie, productie, transport, installatie, onderhoud en verwijdering – en operationele emissies gedurende de gehele levenscyclus van een gebouw[7]. Deze baseline vormt de basis voor gedetailleerde audits en gerichte strategieën om de uitstoot in uw hele portfolio te verminderen.

Uitvoering van koolstofaudits voor portefeuilles

Begin met energie- en koolstofaudits op activaniveau om de huidige prestaties van uw bezittingen te evalueren.[2][1]. Hulpmiddelen zoals Oxand Simeo™-voorraad kan gegevens uit energierekeningen, gebouwbeheersystemen en het verbruik van huurders centraliseren, waardoor de versnippering wordt aangepakt die vaak een belemmering vormt voor beoordelingen van de gehele portefeuille.

Uw audit dient emissiegegevens met betrekking tot energieverbruik, waterverbruik en afval vast te leggen.[5]. Verzamel essentiële gegevens over uw vastgoed, zoals oppervlakte, bouwjaar, HVAC-systemen, isolatiekwaliteit en installaties voor hernieuwbare energie, om de prestaties van uw hele portefeuille te benchmarken. Deze gedetailleerde informatie helpt u vastgoed te identificeren dat afwijkt van de norm en wijst u op activa die onmiddellijke aandacht vereisen.

Uw activa met de hoogste uitstoot identificeren

Zodra uw uitgangssituatie vaststaat, is de volgende stap het bepalen waar u uw inspanningen op moet richten. Door u te richten op activa met een hoge uitstoot kunt u de grootste impact realiseren bij het verminderen van de CO2-voetafdruk van uw portefeuille.

Het gebruik van koolstofintensiteitsmaatstaven biedt een consistente manier om eigenschappen te vergelijken, terwijl een overgangsrisicoanalyse beoordeelt welke gebouwen het meest kwetsbaar zijn voor regelgevende, markt- of fysieke klimaatrisico's[1]. Het screenen van uw portefeuille op fysieke risico's – zoals overstromingen of extreme hitte – en transitierisico's helpt bij het prioriteren van vastgoed dat onmiddellijke actie vereist. Deze risicogebaseerde aanpak zorgt ervoor dat uw investeringen worden gericht op de activa waar mitigatiemaatregelen het meest effectief zullen zijn. Met een duidelijke basis en geprioriteerde doelstellingen kunt u nu nauwkeurig plannen. strategieën voor koolstofreductie.

Strategieën voor het verminderen van de CO2-uitstoot van gebouwen

Zodra activa met een hoge uitstoot zijn geïdentificeerd, is de volgende stap het implementeren van strategieën die operationele verbeteringen combineren met structurele updates. Dit is van cruciaal belang, aangezien de exploitatie van gebouwen meer dan 271 TP3T aan wereldwijde uitstoot bijdraagt.[4].

Het is van belang om een evenwicht te vinden tussen snelle resultaten en langetermijninvesteringen. Maatregelen zoals isolatie en systeemoptimalisatie kunnen energiekosten en emissies verminderen zonder dat er aanzienlijke initiële investeringen nodig zijn.[10]. Ondertussen staat de industrie voor de uitdaging om de koolstofuitstoot tegen 2030 met ten minste 40% te verminderen, met ambitieuze projecten die streven naar een vermindering van 50% om tegen 2050 een netto nuluitstoot te bereiken.[2]. Deze inspanningen vormen de basis voor het opstellen van gedetailleerde, meerjarige investeringsplannen.

Energie-efficiëntie en hernieuwbare energie

Begin met het upgraden van systemen zoals HVAC, isolatie, ledverlichting en slimme regelingen om het energieverbruik te verminderen, voordat u de energievoorziening zelf aanpakt. Het achteraf inbouwen van technologieën zoals warmtepompen, zonnepanelen op daken en batterijopslag in oudere gebouwen wordt steeds populairder, dankzij stimuleringsmaatregelen van de federale en deelstaatregeringen.[11].

Het elektrificeren van verwarmingssystemen is een andere belangrijke stap. Het vervangen van systemen op fossiele brandstoffen door elektrische warmtepompen draagt bij aan het behalen van CO2-doelstellingen, verhoogt het comfort voor huurders en verlaagt de onderhoudskosten. Het elimineren van aardgasboilers vermindert de directe uitstoot, terwijl zonne-installaties op locatie de indirecte uitstoot kunnen verlagen. Zodra de operationele efficiëntie is gerealiseerd, kan de aandacht worden gericht op de CO2-voetafdruk van bouwmaterialen.

Vermindering van de koolstofuitstoot in materialen

Door te kiezen voor "renoveren in plaats van vervangen" kan de koolstofuitstoot aanzienlijk worden verminderd. Bij renovatie blijft de koolstof die al in bestaande structuren is opgenomen behouden en worden de emissies die gepaard gaan met de productie van nieuwe materialen vermeden.[2].

"Om de koolstofuitstoot te verminderen, is een koolstofanalyse van de volledige waardeketen van een bouwproject vereist, van het ontwerp, de bouwmaterialen, de bouwmethoden en de oplevering tot het in gebruik genomen gebouw." – Schroders[2]

Voor projecten waarbij nieuwbouw Bij grote renovaties is een volledige koolstofanalyse van de hele waardeketen van essentieel belang. Kies voor koolstofarme materialen zoals gerecycled staal, teruggewonnen hout en alternatieven voor traditioneel beton. Werk nauw samen met leveranciers om de inkoop te diversifiëren en prioriteit te geven aan duurzame opties.[9][12]. Het integreren van netto-nulstrategieën tijdens renovaties – zoals het installeren van inductiekookplaten om de luchtkwaliteit binnenshuis te verbeteren – kan de kwaliteit van woningen en de gezondheid verhogen zonder dat dit ten koste gaat van de prestaties.[12]. Bovendien zorgt het ontwerpen van gebouwen op basis van hun daadwerkelijke prestaties in gebruik, in plaats van theoretische modellen, ervoor dat de verwachte CO2-reducties worden omgezet in meetbare resultaten.[2].

Samenwerken met huurders en belanghebbenden

Het betrekken van huurders is een cruciaal onderdeel van elke strategie voor CO2-reductie. Communiceer duidelijk over duurzaamheidsdoelstellingen en geef voorlichting over het verminderen van energie-, afval- en waterverbruik. Groene huurovereenkomsten kunnen prikkels op elkaar afstemmen door besparingen op nutsvoorzieningen te delen, terwijl workshops en prestatiedashboards huurders op de hoogte houden en betrekken. Deze samenwerkingsverbanden helpen om ambities op het gebied van klimaatneutraliteit om te zetten in uitvoerbare, investeringsklare plannen.

Meerjarige investeringsplannen opstellen

Zodra u uw strategieën voor CO2-reductie heeft ontwikkeld, is de volgende stap het omzetten van die ideeën in een gedetailleerd meerjarig investeringsplan. Dit proces omvat een gestructureerde aanpak die kosten, risico's en CO2-impact in uw gehele portefeuille in evenwicht brengt. Door de focus te verleggen van gebouwniveau naar portefeuilleniveau ontstaat er meer flexibiliteit, worden gestrande activa voorkomen en worden de inspanningen voor decarbonisatie kostenefficiënter.[14].

Begin met het analyseren van de kosteneffectiviteit in verschillende scenario's die aansluiten bij uw kapitaalplannen en vermogensbeheer doelstellingen[13]. Een multi-objectieve optimalisatiebenadering is hier bijzonder nuttig, omdat deze de netto contante waarde (NPV) vergelijkt met de CO₂-uitstoot gedurende de levenscyclus voor elke renovatieoptie.[14]. Deze methode is schaalbaar, van individuele gebouwen tot uw volledige vastgoedportefeuille, en helpt u te bepalen welke investeringen de grootste CO2-reductie opleveren voor elke geïnvesteerde euro.

Prioriteiten stellen is van essentieel belang. Gebruik besluitvorming op basis van meerdere criteria om projecten te rangschikken op basis van factoren zoals risicoblootstelling, levenscycluskosten, CO₂-impact en wettelijke vereisten. Grondige renovaties – met name vroege upgrades van de gebouwschil – leveren vaak het hoogste rendement op lange termijn op. De timing en volgorde van deze investeringen zijn echter net zo belangrijk als de upgrades zelf.

Oxand Simeo™ gebruiken voor investeringsplanning

Oxand Simeo™ vereenvoudigt het proces van het creëren van meerjarige CAPEX- en OPEX-plannen door te simuleren hoe gebouwen in de loop van de tijd verouderen, presteren en energie verbruiken. Met meer dan 10.000 eigen verouderingsmodellen en meer dan 30.000 onderhoudsregels voorspelt het platform toekomstige prestaties in verschillende scenario's, waardoor beslissingen over wanneer en waar te investeren worden gestuurd.

Het platform modules over duurzaamheid en energietransitie u in staat stellen om trajecten voor CO2-reductie in uw hele portefeuille te modelleren. Het laat zien hoe verschillende investeringssequenties van invloed kunnen zijn op uw voortgang naar netto-nuldoelstellingen. In tegenstelling tot benaderingen die sterk leunen op dichte IoT-sensornetwerken, maakt Simeo™ gebruik van een modelgestuurde methode gebaseerd op bestaande enquêtes, inspecties en activagegevens. Dit maakt het praktisch voor portefeuilles van elke omvang of gegevensrijpheid.

Beleggingen rangschikken op basis van impact

Niet alle projecten voor CO2-reductie zijn gelijk. Prioritering op basis van meerdere criteria ondersteunt u bij het evalueren van concurrerende vereisten door projecten te beoordelen op basis van risico, kosten, CO2-impact en naleving van regelgeving. Deze methode gaat verder dan alleen terugverdientijden en beoordeelt hoe elke investering de algehele prestaties van uw portefeuille beïnvloedt.

Richt u op projecten die gericht zijn op activa met een hoge uitstoot, die regelgevingsrisico's verminderen en die het serviceniveau verbeteren. Deze moeten prioriteit krijgen. Het doel is om maatregelen te identificeren die meetbare CO₂- en energiebesparingen en tegelijkertijd de totale eigendomskosten te verlagen. Volledig geïmplementeerde investeringsplannen resulteren vaak in besparingen van 10–25% op gerichte onderhoudsonderdelen. Nadat u uw opties hebt gerangschikt, simuleert u verschillende scenario's om uw investeringsstrategie te verfijnen.

Testscenario's en het optimaliseren van budgetten

Voordat u kapitaal investeert, scenariomodellering is een vereiste. Test verschillende budgetbeperkingen, serviceniveaus en tijdschema's voor decarbonisatie om afwegingen en afhankelijkheden te ontdekken die van invloed kunnen zijn op het succes van toekomstige renovaties. Vergelijk bijvoorbeeld de resultaten van agressieve vroege investeringen met gefaseerde benaderingen, of analyseer hoe budgetniveaus van invloed zijn op uw vermogen om de doelstellingen voor 2030 en 2050 te halen.

U kunt tot de conclusie komen dat het uitstellen van bepaalde renovaties aan de gebouwschil de effectiviteit van toekomstige HVAC-renovaties kan belemmeren. Of u kunt ontdekken dat het vooraf prioriteren van installaties voor hernieuwbare energie betere financieringsvoorwaarden oplevert. Door scenario's te simuleren, maakt u van investeringsplanning een nauwkeurig, datagestuurd proces. Met geoptimaliseerde budgetten en beproefde strategieën bent u klaar om uw netto-nul-investeringsplannen te implementeren en te monitoren.

sbb-itb-5be7949

Implementatie en monitoring van netto-nul-investeringsplannen

Duurzaamheid integreren in de dagelijkse bedrijfsvoering is essentieel voor het behalen van decarbonisatiedoelstellingen. Dit vereist consistente samenwerking tussen verschillende afdelingen, waarbij monitoring en rapportage grondig en transparant moeten zijn naarmate uw plan vordert.

Duurzaamheid integreren in het bestuur

Bij de waardering van activa dient de koolstofprestatie naast financiële maatstaven te worden geëvalueerd.[2]. Dit houdt in dat de winst wordt geanalyseerd na verrekening van de milieueffecten, en niet alleen daarvoor. Bij de aanschaf van nieuwe activa of het plannen van kapitaalverbeteringen dient de koolstofprestatie een belangrijk criterium te zijn. Richt u op renovatiestrategieën die de bestaande koolstofopslag behouden en ontwerp renovaties voor gebouwen zoals ze in het echte leven worden gebruikt, en niet alleen op papier.[2].

Benoem duurzaamheidskampioenen en zorg voor toezicht op bestuursniveau met toegewijde middelen.[9]. Het opnemen van sociale impact in uw netto-nulstrategie kan de ESG-resultaten versterken, wat leidt tot stabielere markten, hogere vastgoedwaarden (vaak aangeduid als de groene premie) en grotere belangstelling van investeerders.[12].

Monitoring van prestaties en naleving

Verzamel volledige en actuele energie- en CO2-gegevens voor volledige gebouwen, inclusief het energieverbruik van huurders.[1][3]. Geautomatiseerde meters, groene leasevoorwaarden en toegang tot gegevens van derden kunnen helpen om hiaten in gegevens op te vullen. Stel een basisinventaris op van Scope 1-, Scope 2- en belangrijke Scope 3-emissies, werk deze jaarlijks bij en maak deze op transparante wijze openbaar.[9].

Hulpmiddelen zoals Oxen en Simeo™ kan u helpen door de werkelijke prestaties continu te vergelijken met uw gemodelleerde scenario's. Zo kunt u afwijkingen van de verwachte CO2-reductietrajecten snel identificeren en aanpakken. De monitoring moet zowel CO2-reducties als financiële rendementen omvatten, zodat uw investeringsplan zijn duurzaamheidsdoelstellingen bereikt en tegelijkertijd een solide ROI oplevert. Door regelmatig te controleren of u voldoet aan de lokale wetgeving inzake energieverslaglegging en de federale normen, blijft u de regelgeving voor. Door voortdurende monitoring krijgt u het vertrouwen dat nodig is voor een nauwkeurige, op gegevens gebaseerde rapportage aan belanghebbenden.

Resultaten rapporteren aan belanghebbenden

Transparante rapportage is essentieel voor het opbouwen van vertrouwen bij medewerkers, klanten, investeerders en toezichthouders.[9]. Gebruik gestandaardiseerde kaders zoals de Net Zero Investment Framework (NZIF 2.0), GRESB-beoordeling van vastgoed, TCFD, en de Protocol voor broeikasgassen voor consistente en geloofwaardige rapportage[15][17][18]. Stem uw emissiereductiedoelstellingen af op wetenschappelijk onderbouwde trajecten, die zowel kortetermijndoelstellingen (5-15 jaar) als langetermijndoelstellingen (netto nul over 15 jaar) omvatten, bij voorkeur gevalideerd door organisaties zoals SBTi[16][17].

Richt u op het gebruik van feitelijke gegevens in plaats van schattingen en zorg voor onafhankelijke verificatie door derden om de geloofwaardigheid te vergroten.[17]. Indien CO2-compensaties onderdeel uitmaken van uw strategie, verzoeken wij u duidelijk te vermelden hoe deze worden toegepast. Het wordt aanbevolen om prioriteit te geven aan daadwerkelijke emissiereducties en CO2-compensaties te reserveren voor resterende emissies.[16][17]. Platforms zoals Oxen en Simeo™ kan produceren ISO 55001Conforme, auditklare rapporten die uw voortgang en implementatiestrategieën aantonen en bruikbare inzichten bieden voor investeerders.[17][18]. Geef een duidelijk overzicht van de trajecten, aannames en eventuele beperkingen achter uw doelstellingen om transparantie te waarborgen voor belanghebbenden.[9][3].

Conclusie: Net-Zero realiseren

Om netto-nul te bereiken in vastgoedportefeuilles is het niet alleen belangrijk om ambitieuze doelen te stellen, maar ook om die doelen om te zetten in concrete acties. Voor deze transformatie zijn drie elementen van cruciaal belang: nauwkeurige CO2-gegevens, strategische prioritering en voortdurende monitoring. Deze instrumenten helpen bij het identificeren van belangrijke activa en het afstemmen van inspanningen op de eerder besproken audits en prioriteringskaders.

De werkelijke uitdaging? De overgang van strategie naar uitvoering. Dit vereist het ontwikkelen van meerjarenplannen die een evenwicht vinden tussen CO2-reductie en rendement op investering (ROI), effectief budgetbeheer en bescherming van de waarde van activa. Met toenemende regelgeving en veranderende verwachtingen van investeerders is de urgentie om actie te ondernemen groter dan ooit.

Datagestuurde tools zijn essentieel om de kloof tussen planning en implementatie te overbruggen. Platforms zoals Oxand Simeo™ combineren ESG- en financiële gegevens om realtime inzicht in portefeuilles te bieden, de impact van grootschalige renovaties te simuleren en prioriteiten te stellen voor investeringen op basis van het potentieel voor CO2-reductie en het rendement op investering. [20][21]. Deze tools elimineren de noodzaak van tijdrovende, individuele audits per activum en maken benchmarking mogelijk aan de hand van wetenschappelijk onderbouwde normen, zoals CRREM en SBTi [20].

Decarbonisatie is geen individuele inspanning – het vereist samenwerking in de hele waardeketen. Van het betrekken van huurders bij groene huurovereenkomsten tot het waarborgen van toezicht op duurzaamheid op bestuursniveau, elke belanghebbende speelt een rol. Koolstofprestaties moeten ook worden geïntegreerd in investeringsbeslissingen. Zoals Oliver Pin, Chief Product Officer bij Deepki, legt uit:

"Het belangrijkste aandachtspunt voor onze klanten is momenteel het bepalen van de meest efficiënte investeringsstrategie die winstgevendheid en decarbonisatie combineert. Zij moeten dit soms doen voor zeer grote portefeuilles en vaak zonder voldoende interne expertise. Met behulp van AI-ondersteunde fysische modellen voert onze investeringsplanfunctie virtuele retrofits uit en helpt hen weloverwogen, strategische beslissingen te nemen om kapitaal te investeren waar dat het meest nodig is, waardoor de waarde van activa en het rendement op investeringen worden verbeterd en de weg naar netto nul op portefeuilleniveau wordt versneld." [20]

Het bereiken van netto nul is een langetermijnverplichting die consistentie vereist. Activa die zich niet aanpassen, lopen het risico verouderd te raken, hun aantrekkingskracht voor verhuur te verliezen en een daling van de huur- en activawaarden te ondergaan. [1]. Aan de andere kant bieden renovaties die meetbare resultaten opleveren een concurrentievoordeel en het potentieel voor sterkere rendementen op de lange termijn. [19]. Door gebruik te maken van de kracht van data, geavanceerde tools en samenwerking tussen belanghebbenden kunnen netto-nuldoelstellingen uitgroeien tot zinvolle en winstgevende investeringsstrategieën.

FAQs

Hoe kan ik de CO2-voetafdruk van mijn vastgoedportefeuille effectief meten?

Om een duidelijk beeld te krijgen van de CO2-voetafdruk van uw portefeuille, is het essentieel om een koolstofbenadering gedurende de gehele levensduur. Dit houdt in dat gebruik wordt gemaakt van beproefde schattingsmodellen en -instrumenten, waarbij gedetailleerde gegevens op activaniveau worden geïntegreerd. Belangrijke factoren die hierbij moeten worden meegenomen, zijn energieverbruik, emissiefactoren en specifieke eigenschappen van onroerend goed. Door deze elementen te combineren, kunt u een grondige en betrouwbare evaluatie van de milieu-impact van uw portefeuille realiseren.

Wat zijn de meest effectieve methoden om zowel de operationele als de intrinsieke CO2-uitstoot in gebouwen te verminderen?

Het verminderen van de CO2-uitstoot in gebouwen – zowel operationeel als intrinsiek – vereist een combinatie van doordachte strategieën.

Aanpakken operationele koolstof, Begin met het stimuleren van energie-efficiëntie. Dit kan onder meer het verbeteren van de isolatie, het plaatsen van energiezuinige ramen en het moderniseren van HVAC-systemen omvatten. Deze maatregelen kunnen het energieverbruik met 40-60% verminderen. Overstappen op elektrisch aangedreven systemen en gebruikmakend van energie uit hernieuwbare bronnen, zoals zonne- of windenergie, vermindert de uitstoot nog verder.

Met betrekking tot koolstofuitstoot, Richt u op het gebruik van materialen met een lagere milieu-impact. Opties zoals gerecycled staal, koolstofarm beton en verantwoord geproduceerd hout zijn uitstekende keuzes. Efficiënte bouwpraktijken kunnen ook helpen door afval en uitstoot tijdens het bouwproces te verminderen. Voor een langetermijneffect kunt u overwegen om ter plaatse hernieuwbare energiesystemen te integreren en gebouwen te ontwerpen die de energieprestaties op lange termijn maximaliseren. Deze maatregelen dragen niet alleen bij aan de vermindering van de CO2-uitstoot, maar kunnen ook voldoen aan wettelijke normen en op termijn financiële voordelen opleveren.

Hoe kan ik prioriteiten stellen bij investeringen in mijn vastgoedportefeuille om de CO2-uitstoot effectief te verminderen?

Om een aanzienlijke vermindering van de CO2-uitstoot te realiseren, dient u zich te richten op eigendommen die beschikken over uitstekende energie-efficiëntie, weinig klimaatgerelateerde risico's lopen en een veelbelovende langetermijnwaarde hebben. Werk nauw samen met vastgoedbeheerders om de transparantie van gegevens te verbeteren en gedegen renovatieplannen op te stellen. Richt u op activa die voldoen aan regelgevingsnormen en aansluiten bij de netto-nuldoelstellingen van investeerders om zowel milieu- als financiële voordelen te realiseren.