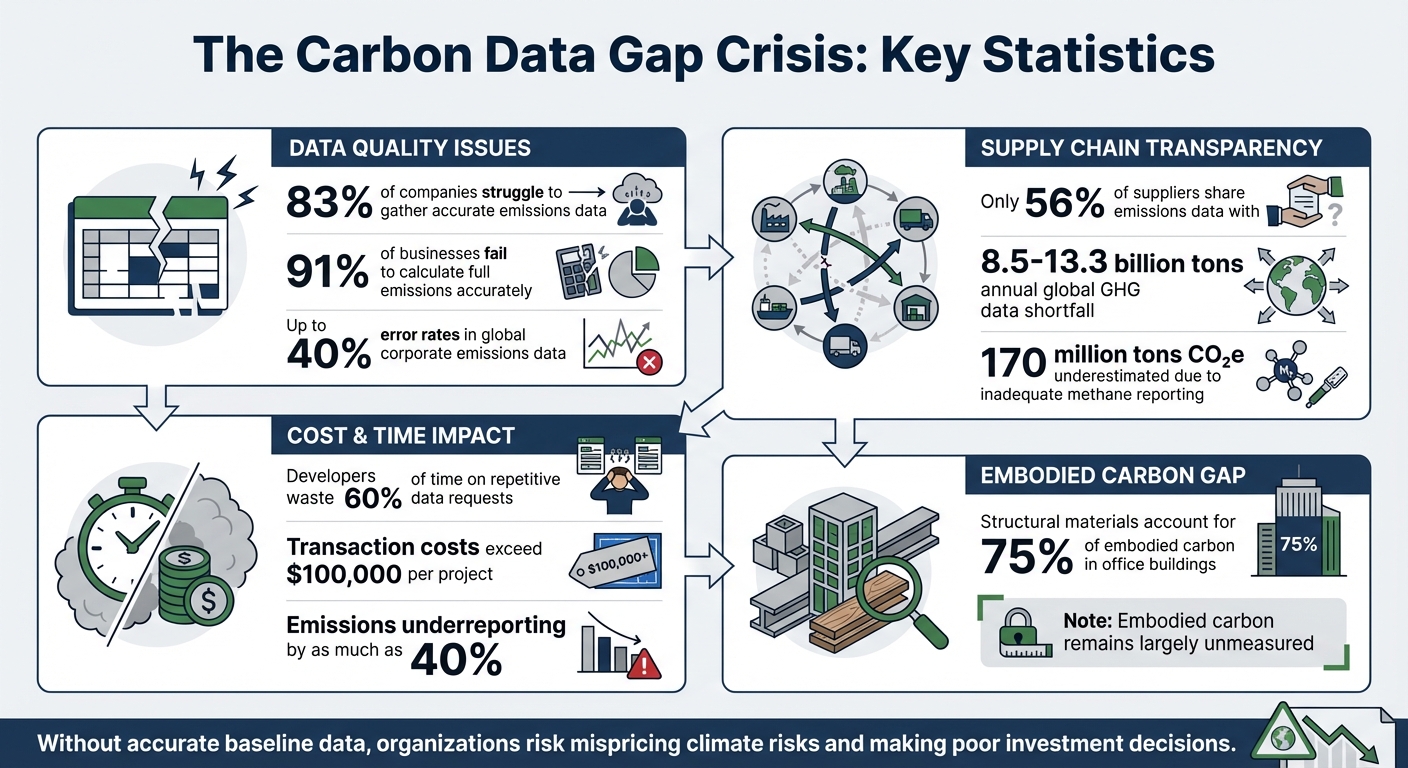

Making smart investment decisions in real estate and infrastructure requires dependable carbon data. But today, gaps in carbon metrics create major challenges:

- Incomplete data: Many companies rely on outdated methods like spreadsheets, leading to errors and inconsistencies.

- Unreliable reporting: Scope 3 emissions (from supply chains) are often untracked, and embodied carbon (from materials) is largely ignored.

- High costs: Developers waste up to 60% of their time on repetitive data requests, with transaction costs exceeding $100,000 per project.

- Regulatory gaps: Flexible standards and a lack of third-party verification result in emissions underreporting by as much as 40%.

Without accurate baseline data, organizations risk mispricing climate risks, delaying decarbonization goals, and making poor financial decisions.

The Solution: Centralized, Predictive Carbon Tracking

To fix these issues, companies need to:

- Centraliseer activagegevens: Consolidate information like material specs and energy usage into a single, standardized system.

- Gebruik voorspellende modellen: Simulate future emissions and identify cost-effective ways to reduce them.

- Align with regulations: Follow frameworks like ISO 55001 en de EPA’s guidelines to ensure compliance and transparency.

- Maintain data quality: Update baselines regularly, train staff, and implement strong governance across teams.

By closing the carbon data gap, organizations can improve risk assessments, lower costs, and align financial strategies with sustainability goals.

Carbon Data Gaps: Key Statistics and Challenges in Real Estate Investment

Powering the future of carbon management with asset-grade data

Problems with Traditional Carbon Data Collection Methods

Traditional carbon tracking methods may appear thorough, but they often obscure critical gaps that can lead to flawed investment decisions. Below, we explore some of the key challenges that make these methods less reliable.

Inconsistent Supply Chain Reporting

Supply chains are a major contributor to carbon emissions, but tracking emissions across multi-tier supply chains often falls short. A staggering 83% of companies reporting on climate disclosures struggle to gather accurate and relevant emissions data, leading to fragmented information [6]. Many businesses rely on generalized industry averages, which fail to account for local variations. Adding to the challenge, only 56% of suppliers currently share emissions data with their corporate clients [6]. This incomplete reporting contributes to a global shortfall in greenhouse gas data, estimated to range between 8.5 billion and 13.3 billion tons annually [7].

"With so many organizations now committing to net zero, one key piece is still missing: a transparent and interoperable system to track, report and compare GHG emissions and removals."

– Lucas Joppa, Chief Environmental Officer, Microsoft [7]

Missing Embodied Carbon and Operational Emissions Data

Tracking emissions tied to materials and operational activities presents another set of challenges. While operational emissions can often be documented using utility data, embodied carbon – emissions generated during the production of materials – remains largely unmeasured. This is a critical oversight, especially since infrastructure projects account for a significant portion of global emissions [5][8]. The complexity of tracking increases when projects span vast geographic regions and involve numerous stakeholders over extended timelines.

Gaps in Current Regulatory Frameworks

Even within established regulations, significant gaps persist. For instance, the closure of the TCFD Knowledge Hub at the end of 2025 will eliminate access to essential tools like the Greenhouse Gas Protocol Scope 3 Evaluator, leaving a void in reporting capabilities [4]. Additionally, current regulations often allow companies too much flexibility in selecting metrics, such as choosing which IPCC Assessment Report to reference for Global Warming Potential values. This results in inconsistent carbon footprint calculations [11]. Inadequate methane reporting standards further exacerbate the issue, with an underestimation of 170 million tons of CO₂ equivalent identified in a sample of 2,864 companies [11]. Without mandatory third-party verification, 91% of businesses fail to calculate their full emissions accurately, and global corporations report error rates of up to 40% in their emissions data [10].

"The gaps revealed by our latest report are indicative of a broader challenge facing the UK – a lack of coordination, oversight, and consistency."

– Elle Butterworth, Senior Digital Consultant, Energy Systems Catapult [9]

How to Build a Reliable Carbon Baseline

To establish a reliable carbon baseline, ditch the scattered spreadsheets and opt for a centralized system that tracks the carbon footprint of every asset with precision. This kind of structured approach is critical for making informed investment decisions. Without it, even the most ambitious decarbonization goals risk being little more than educated guesses.

Een gecentraliseerd systeem voor activagegevens opzetten

Building a strong baseline begins with consolidating all physical asset data into a single repository. This means gathering critical details like drawings, CAD files, cost estimates, and material specifications, then standardizing the data across departments. Use consistent fields, units, and assumptions to ensure uniformity. Apply appropriate carbon factors to each asset, starting with structural materials – slabs, frames, and foundations – which often account for nearly 75% of embodied carbon in many office buildings [13].

For example, in November 2023, the landscape architecture firm SWA Group conducted 10 case studies as part of its Climate Action Plan. They designated "Climate Champions" in each department to collect CAD files and cost estimates. Using the Pathfinder tool, they processed material quantities and revisited specifications, such as replacing new concrete with salvaged alternatives. These efforts led to a 40% to 50% reduction in average emissions across projects [12].

Organizing data through a "carbon lens" rather than traditional project categories can quickly spotlight high-emission areas. Adding version control with a changelog ensures an audit trail, keeping the baseline defensible during reviews. This standardized data foundation is also a stepping stone for advanced predictive models to forecast future emissions.

Using Predictive Models for Future Carbon Metrics

Predictive models take baseline data a step further by simulating how assets age, consume energy, and emit carbon over time. These models can map out how upgrades – like retrofitting buildings or replacing equipment – could cut emissions over the years.

A Greenhouse Gas Emissions Reduction Planning (ERP) framework helps organizations prioritize actions based on their impact on Scope 1 and 2 emissions. By running simulations, this framework identifies cost-effective solutions and lays out a timeline for investments, ensuring that short-term actions align with long-term goals rather than creating isolated, ineffective projects.

"Het proces dat in dit kader wordt beschreven, ondersteunt organisaties bij het ontwikkelen van een uitvoerbaar plan dat prioriteit geeft aan maatregelen voor emissiereductie, oplossingen identificeert en een gefaseerd traject uitzet om aanzienlijke emissiereducties te realiseren."

– Hannah Kramer, Nora Hart, Jessica Granderson, and Tom Abram, Lawrence Berkeley Nationaal Laboratorium [15]

Combining Operational Data with Scenario Analysis

To create effective investment plans, it’s crucial to merge current operational data with future scenarios. Normalize emissions using intensity metrics, such as MTCO₂e per square foot, to adjust for changes in portfolio size. This approach directly addresses earlier data gaps, making investment risk assessments more precise.

In April 2024, MetLife Investment Management en PineBridge Investments demonstrated this by modeling a hypothetical 10-property portfolio totaling 2,000,000 square feet. Starting with a 2020 baseline of 6,000 MTCO₂e, they showed that combining portfolio growth with ongoing energy efficiency improvements allowed the portfolio to meet intensity-based targets, even as total square footage increased [2].

Segmenting operational data by asset class is equally important. Office buildings, for instance, perform differently from industrial facilities. Conducting like-for-like analyses can separate true efficiency gains from changes due to buying or selling assets. When modeling scenarios, lease structures also matter – it’s often easier to save energy in office buildings, where utilities are directly managed, compared to industrial properties with triple-net leases. Lastly, establish a policy for recalculating base-year emissions if portfolio changes exceed 5% of total emissions, as recommended by the Initiatief voor wetenschappelijk onderbouwde doelstellingen [14].

sbb-itb-5be7949

Meeting Regulatory Requirements for Carbon Reporting

Once you’ve established a solid carbon baseline, the next step is aligning it with regulatory standards. In the U.S., carbon reporting requirements differ depending on the jurisdiction and industry. Ensuring your data aligns with recognized standards not only builds trust with investors and regulators but also keeps you compliant. This alignment also creates opportunities to integrate carbon reduction strategies into investment plans using frameworks like ISO 55001 and EPA guidelines.

Gebruik ISO 55001 for Asset Management

ISO 55001 offers a structured approach to managing physical assets, making it a valuable tool for embedding carbon reduction goals into asset management practices. The standard emphasizes setting clear objectives, defining decision-making criteria, and maintaining transparent documentation.

Under ISO 55001, carbon data should be treated with the same level of precision as financial data. This involves defining boundaries, setting clear targets, and fostering collaboration across departments. For instance, finance teams might focus on spend-based accounting for Scope 3 emissions, while facilities teams oversee energy use and waste management for Scope 1 and 2 emissions.

The EPA’s four-step inventory process complements this approach. It includes defining organizational and operational boundaries, collecting and quantifying emissions data, creating a Greenhouse Gas (GHG) Inventory Management Plan (IMP), and setting reduction targets while tracking progress [17]. To streamline this process, the EPA’s IMP Checklist can be used to formalize data collection and ensure transparency and audit readiness.

Integrating Carbon Reduction into Investment Plans

Incorporating carbon reduction into investment strategies is becoming essential for regulatory compliance and long-term planning. For example, California’s Mandatory Greenhouse Gas Emissions Reporting (MRR), enacted under AB 32, requires major emitters to report GHG emissions with independent third-party verification [18]. Similarly, the EPA’s Air Emissions Reporting Requirements (AERR) will include hazardous air pollutant (HAP) emissions starting in 2027 [16].

Organizations can align their investment strategies with the GHG-protocol Corporate Standard, which the EPA often references for calculating Scope 1 (direct) and Scope 2 (indirect) emissions [17]. This ensures data collection is thorough and useful for both regulatory compliance and investor decision-making.

Audit-klare documentatie maken

Transparent and detailed documentation is critical for meeting compliance requirements. Organizations need to back up both qualitative claims and quantitative data with solid evidence. This includes maintaining detailed records like facility-level data, Gross Asset Value, and revenue to provide context for carbon intensity metrics [19].

As regulatory standards shift from "limited assurance" to "reasonable assurance", the need for more comprehensive documentation grows. This involves establishing robust internal controls, using consistent methodologies across the value chain, and preparing for independent third-party verification [20].

"33% of CEOs globally say climate-friendly investments initiated in the last five years have increased revenue from product and service sales." – PwC’s 28th Annual Global CEO Survey [20]

To prepare for audits, organizations can centralize their data systems, ensuring consistency across teams and alignment with a unified baseline. Standardized tools, such as the EPA’s GHG Emission Factors Hub and the Simplified GHG Emissions Calculator, can further enhance data reliability [17]. Even when third-party verification isn’t required, it can improve data quality and demonstrate transparency to stakeholders. The verification process typically takes 4 to 12 weeks [6].

Platforms zoals Oxand Simeo™ simplify the creation of ISO 55001-aligned, audit-ready plans by leveraging the same data and scenarios used in investment planning. Treating carbon baselines as dynamic documents and updating them regularly ensures data remains accurate and defensible during regulatory reviews. This level of documentation not only meets audit requirements but also supports better, more informed investment decisions.

Maintaining Data Quality Over Time

Creating a carbon baseline is just the beginning; the real challenge lies in keeping it accurate as your organization grows and changes. This means going beyond annual reporting cycles and building systems that continuously capture, validate, and update carbon metrics. To achieve this, strong governance across teams is essential.

Setting Up Data Governance Across Teams

Good data governance starts with clearly defined responsibilities across departments. For instance, finance teams might handle spend-based Scope 3 emissions, while facilities managers focus on energy use and waste. IT teams are crucial for maintaining the technical infrastructure that ties all this data together. Without clear roles, data quality can quickly degrade as teams duplicate efforts or rely on conflicting data sources.

The move toward detailed carbon accounting demands the same level of precision as financial records. Instead of relying on spreadsheets updated once a year, organizations are adopting centralized systems that track emissions data at the transaction level [21]. These systems also provide detailed, timestamped audit trails to ensure accountability.

A great example is Salesforce‘s approach during 2024–2025 with its Net Zero Cloud platform. By hiring dedicated technical staff, using MuleSoft to integrate data across systems, and leveraging Snowflake as a centralized data lake, Salesforce eliminated months of manual work. This shift allowed the company to enable real-time carbon accounting across its global operations [3]. Treating carbon data governance as a technical project – not just a sustainability initiative – produced more reliable and actionable results.

Training Staff on Carbon Metrics and Predictive Methods

Beyond technical systems, maintaining high-quality data requires well-trained staff. Employees need to understand what is being measured and why. Training should cover the Greenhouse Gas Protocol’s scope definitions, the role of emission factors, and how everyday activities contribute to carbon data accuracy. This education isn’t just for sustainability teams; procurement staff and facilities managers also play critical roles in maintaining data integrity.

For organizations adopting automated systems, internal help desks and user communities can ease the transition [3]. Take Centigrade as an example. When the company implemented the Carbon Crediting Data Framework (CCDF) in July 2025 to analyze 6 million carbon credits across 25 projects, staff had to familiarize themselves with technical documentation and JSON schemas for software integration [1]. The effort paid off, enabling faster due diligence and more accurate real-time data verification.

"Companies can’t manage what they don’t measure. Carbon accounting enables businesses to define meaningful net-zero targets, model reduction pathways, and track emissions performance alongside financial KPIs." – SAP [21]

Additionally, having contingency plans, like manual data uploads during system changes, can help prevent reporting delays [3].

Improving Carbon Baselines Through Regular Updates

Keeping carbon baselines up to date is essential for aligning data with new investment strategies. Carbon baselines aren’t fixed; they need to be recalculated when significant changes occur, such as acquisitions, divestitures, regulatory updates, or improved supplier data. Robust version control and audit logs are critical for documenting these adjustments and ensuring transparency [21].

Organizations should establish clear triggers for baseline updates. For example:

- Structural changes like mergers might require recalculating historical emissions.

- Operational shifts could involve replacing industry averages with supplier-specific data.

- Regulatory updates may demand changes in reporting boundaries or emission factors [21].

Platforms like Oxand Simeo™ support dynamic baseline updates, ensuring data stays reliable and defensible during regulatory reviews.

Transitioning from spend-based estimates to supplier-specific data is another important step in improving carbon baselines [21]. As supply chain transparency increases, regularly updating baselines with more precise information enhances both compliance and decision-making. Over time, this commitment to data quality delivers even greater value.

Conclusion: Closing the Carbon Data Gap for Better Investment Decisions

The lack of detailed carbon data isn’t just a reporting issue – it directly impacts the quality of investment decisions. When organizations depend on subjective estimates rather than detailed, project-level data, they risk misdirecting capital to less effective projects. Without structured and reliable data, it’s nearly impossible to prioritize decarbonization efforts effectively across portfolios.

Building a dependable carbon baseline starts with clearly defining parameters for accurate risk assessment. Shifting from generalized, spend-based estimates to supplier-specific data provides greater precision and improves risk modeling. As Pedro Faria, Technical Director at CDP, puts it:

"Setting a meaningful emissions reduction target requires taking into account and communicating how these two relevant and largely complementary dimensions of a target will vary in the future: your absolute emissions and some meaningful physical indicator of your carbon efficiency" [2].

This kind of rigorous baseline paves the way for adopting advanced carbon accounting practices. Transactional carbon accounting, which tracks emissions with the same level of detail as financial data, is revolutionizing portfolio management. Tools like Oxand Simeo™ integrate carbon metrics into long-term investment planning, enabling scenario modeling that aligns sustainability goals with financial performance. By improving data reliability, organizations can enhance risk assessments across their asset portfolios, meet growing regulatory requirements, and identify operational inefficiencies often tied to high emissions.

Bridging the carbon data gap offers multiple advantages. It lowers capital costs, improves access to ESG-focused investments, and enhances decarbonization forecasting by reducing uncertainty in project evaluations. Organizations that approach carbon accounting with the same discipline as financial accounting gain a decisive edge, making informed, audit-ready decisions that balance environmental goals with economic outcomes. In the end, precise carbon data strengthens both sustainability efforts and financial strategies.

FAQs

How does centralizing asset data help improve carbon tracking for investment decisions?

Centralizing asset data simplifies carbon tracking by consolidating information from all assets into one consistent source. This eliminates scattered data and silos, giving investors a clearer, more accurate picture of their portfolio’s carbon footprint. With this streamlined approach, real-time monitoring becomes achievable, enabling more precise greenhouse gas emissions estimates and actionable insights.

A centralized system also opens the door to advanced tools like predictive models and machine learning. These technologies can bridge data gaps and fine-tune carbon metrics, helping investors make smarter, more informed decisions. By aligning portfolios with regulatory requirements and sustainability objectives, this method ensures decisions are both compliant and mindful of risks. In essence, centralizing asset data lays the groundwork for building dependable carbon baselines, which are key to creating sustainable investment strategies.

How do predictive models help in reducing carbon emissions for sustainable investments?

Predictive models play a key role in cutting carbon emissions by using current and historical data to anticipate future trends. Leveraging machine learning and other advanced techniques, these models can pinpoint areas with high emission risks and forecast the outcomes of various strategies. For instance, they can predict CO2 emissions in specific regions, enabling planners to focus on areas that need the most attention.

In the realm of sustainable investments, predictive models address data gaps and establish reliable carbon benchmarks. This allows stakeholders to compare scenarios, meet regulatory requirements, and make well-informed choices aimed at long-term decarbonization. By incorporating these tools into their planning, organizations can craft investment strategies that balance environmental priorities with financial goals.

Why is it important to align carbon baselines with regulatory standards?

Aligning carbon baselines with regulatory standards is crucial for ensuring precision, uniformity, and trustworthiness in greenhouse gas (GHG) reporting. Frameworks like those established by the EPA offer clear guidelines for tracking and managing emissions, helping organizations stay compliant while avoiding fines or damage to their reputation.

This alignment also fosters open and reliable communication with key stakeholders, such as investors and regulators, by providing consistent and trustworthy carbon data. Beyond compliance, it allows organizations to incorporate carbon metrics into broader evaluations of climate risks and financial disclosures, including those recommended by the Task Force on Climate-related Financial Disclosures (TCFD). For infrastructure and building projects, adhering to these standards ensures realistic carbon reduction goals, enables accurate progress tracking, and aligns environmental efforts with financial priorities.