When infrastructure starts falling apart, the warning signs are hard to miss – and costly to ignore. From rising failure rates to deferred maintenance, these red flags signal that your asset portfolio isn’t getting the investment it needs. Here’s what to watch for:

- Veelvoorkomende storingen: Recurring issues like burst pipes or power outages mean assets are wearing out faster than they’re being maintained.

- Soaring Emergency Costs: Spending more on urgent repairs than preventive maintenance drains budgets and inflates long-term costs.

- Deferred Projects: Postponing high-risk maintenance or capital projects increases repair costs and liability risks.

- Service Complaints: A rise in user dissatisfaction often points to neglected assets and operational risks.

- Non-Compliance: Falling behind on safety, building codes, or energy standards can lead to fines and operational disruptions.

- Poor Data Management: A lack of centralized, reliable asset data makes informed decision-making nearly impossible.

- Short-Term Budgeting: Annual planning without long-term strategies leads to missed opportunities and hidden liabilities.

- Focus on Upfront Costs: Prioritizing initial capital expenses over lifecycle costs creates financial burdens down the road.

- Neglecting Sustainability Goals: Ignoring energy performance and decarbonization in asset plans risks penalties and higher costs.

- Weak Budget Justifications: Without solid data, it’s hard to secure funding from boards, investors, or regulators.

Ignoring these signs can lead to skyrocketing costs, compliance failures, and service disruptions. However, shifting to risk-based, lifecycle-focused investment strategies can reduce total ownership costs by up to 30%, improve service levels, and avoid regulatory penalties. Prioritize reliable data, multi-year planning, and sustainability to future-proof your portfolio.

1. Rising Failure Rates Without a Long-Term Renewal Plan

Frequent issues like burst pipes, failing HVAC systems, and electrical faults are clear signs that your aging infrastructure is outpacing your current investment strategy. These recurring failures highlight the urgent need for a well-structured renewal plan. Without one, managing assets becomes a reactive process – turning manageable maintenance tasks into costly emergencies. Let’s dive into why a renewal plan is essential, supported by data and expert insights.

Risk is calculated as the likelihood of failure multiplied by its consequences [1]. Without a renewal plan, it’s nearly impossible to measure either of these factors effectively.

Looking ahead to 2025, critical infrastructure categories like Stormwater, Transit, and Wastewater received troubling grades of D, D, and D+ respectively in the ASCE Report Card for America’s Infrastructure [3]. Additionally, state and local governments are grappling with an estimated $105 billion in deferred maintenance for roads and bridges [5].

"Utilities that have implemented a proactive condition assessment program have reported that such programs cost-effectively reduce the risk of failure and provide value for both the utility and the community."

– Bryon Livingston, Senior Project Engineer, Black & Veatch [1]

A proactive renewal plan helps answer key questions, such as: What is the current condition of the asset? What service level is needed to ensure sustainability? Which assets are critical for performance? How can lifecycle costs be minimized? And what funding is optimal for long-term success? [1][6]

Without a plan built on these principles, failure rates will continue to rise, draining budgets on emergency fixes, lowering service quality, and widening compliance gaps.

2. Corrective Maintenance Costs Rising While Preventive Spending Stays Flat or Drops

When emergency repair expenses rise while planned maintenance budgets remain unchanged or decline, it’s often a clear sign of under-investment. Emergency repairs are significantly more expensive – about 10 to 15 times the cost of scheduled preventive maintenance – highlighting the importance of staying ahead with proactive care [7].

To put this into perspective, top-performing organizations allocate 2–4% of an asset’s replacement value annually to preventive maintenance. In contrast, spending only 1–2% often leads to frequent and costly emergency repairs [7]. For every $1 spent on preventive maintenance early on, organizations can save between $4 and $7 in future rehabilitation or replacement expenses [7].

"The industry’s fixation on near-term capital efficiency creates hidden liabilities and deferred challenges – precisely the conditions that TCO thinking is designed to avoid."

– Santiago Ferrer et al., Boston Consulting Group [9]

One critical issue to watch for is "pyramiding", where deferred preventive maintenance takes a backseat to urgent repairs. This cycle can dramatically inflate operations and maintenance costs, which already account for 60–90% of total asset ownership expenses [8][9].

Investing in strategic preventive maintenance pays off in the long run. It can cut total infrastructure lifecycle costs by 25% to 35% and extend asset lifespans by 40% to 60% beyond their original design limits [7]. Organizations that adopt robust preventive maintenance programs often see 50% to 70% fewer emergency repairs [7]. A pattern of increasing emergency costs paired with declining preventive spending signals systemic risk, emphasizing the need for smarter, risk-aware investment strategies.

3. Growing Backlog of High-Risk Work Orders and Deferred Capital Projects

When work orders start stacking up and capital projects keep getting shuffled into next year’s budget, it’s more than just a paperwork problem. A backlog of high-risk maintenance tasks and deferred projects is a clear sign your portfolio isn’t getting the attention it needs – and the fallout can snowball quickly.

Here’s the bigger picture: U.S. infrastructure is staring down a $3.7 trillion investment gap over the next decade. To fully address the needs across 18 major asset categories, $9.1 trillion will be required between 2024 and 2033 [10]. Deferring critical work doesn’t just delay spending – it feeds into a national trend of underfunding that’s already showing serious consequences. The longer these projects are postponed, the higher the upfront repair costs climb, and the more the risks to assets multiply.

Deferred maintenance also amplifies asset risk in a measurable way. Asset managers often rely on a straightforward risk formula: Kans op mislukking (based on condition) multiplied by Gevolgen van falen (based on criticality). A growing backlog of high-risk items – like malfunctioning emergency lighting, structural vulnerabilities, or outdated HVAC systems – means gambling that these failures won’t happen before repairs are made. But the reality is, delays in addressing critical issues often lead to escalating repair costs and increased liability risks. For instance, extreme weather events in 2024 alone caused over $180 billion in damage, much of it affecting neglected and aging infrastructure [10].

The financial argument for deferring work doesn’t hold up under scrutiny. Skipping maintenance might create short-term savings, but it triggers what engineers call a "snowball effect." Small problems grow into major failures that are far more expensive to fix. And it’s not just about the money – delaying maintenance raises serious regulatory and legal risks. Many deferred tasks are tied to safety standards, building codes, and environmental regulations. Ignoring these can lead to fines, penalties, or even liability claims, making the cost of inaction far greater in the long run.

4. Declining Service Levels and Increasing User Complaints

When tenant calls, customer outage complaints, and facility manager grievances start piling up, it’s often a red flag for under-investment. Declining service levels and rising user dissatisfaction point to an asset portfolio that isn’t getting the attention it needs to function properly. These service issues demand a closer look at potential operational risks.

Older, poorly maintained assets are more prone to failures, leading to service disruptions and even unsafe conditions.

"The customer base is increasingly educated about the quality of service they should receive… One day without water will turn many people into activists." – David Egger, Senior Vice President and Director of Heavy Civil, Black & Veatch [1]

Recurring complaints often highlight deeper problems, such as safety and sustainability concerns, and signal that assets are no longer meeting acceptable standards. These issues can jeopardize energy efficiency and may result in non-compliance with evolving safety and environmental regulations. Reports of visible wear, frequent malfunctions, or breakdowns from users often point to increased safety risks and potential violations of health and safety laws [11]. Persistent complaints confirm that assets are failing to deliver the required level of service [1][6].

To tackle these challenges, it’s essential to view complaints as indicators of risk rather than just customer service issues. Areas with frequent complaints often overlap with critical assets where failure could have serious consequences for operations, safety, or reputation [1]. This feedback should inform your risk analysis and guide investment priorities. Setting clear performance benchmarks – like production rates, temperature thresholds, or response times – can help detect problems early, preventing them from escalating into widespread failures [11].

5. Failure to Meet Safety, Building Codes, and Energy Regulations

When assets no longer align with current safety standards, building codes, or energy regulations, it’s a clear indicator of under-investment. Falling short in these areas can lead to hefty legal penalties and operational setbacks.

Non-compliance doesn’t just result in fines – it often exposes deeper issues. For instance, outdated assets frequently fail to meet modern safety and energy benchmarks [2]. A striking example: in 2025, 9 out of 18 U.S. infrastructure categories earned a "D" (Poor) rating, signaling they were largely below standard and nearing the end of their usable lifespan [12]. Sectors like energy and rail are particularly affected, leaving them increasingly vulnerable to natural disasters and other hazards [12].

The financial stakes are enormous. With a $3.7 trillion investment gap [2] and extreme weather events racking up billions in damages annually [4], ignoring compliance risks can have devastating consequences. Closing these gaps is essential to building a more resilient and future-ready asset portfolio.

"Aging infrastructure systems are increasingly vulnerable to natural disasters and extreme weather events, creating unexpected and often avoidable risks to public safety and the economy." – ASCE [12]

Take water infrastructure as an example. Under-investment often shows up as the inability to handle contaminants like PFAS or other emerging pollutants [12]. The situation is made worse by a lack of reliable data, which hampers efforts to identify top-priority projects or secure funding from boards and regulatory bodies.

6. Lack of a Centralized Asset Register or Reliable Condition Data

Having a centralized asset register is essential for making informed, risk-based investment decisions. It serves as the single source of truth for your asset data, providing the clarity needed to assess risks accurately and plan strategically. Without it, decision-making becomes clouded by incomplete or scattered information. As Will Williams, Asset Management Director at Black & Veatch, aptly explains:

"Likelihood multiplied by consequence equals risk. Knowing that is a fundamental pillar of good asset management." [1]

The financial impact of poor data management is staggering – organizations lose an average of $15 million annually due to low-quality data. [14]

When data is trapped in silos or outdated, it forces teams into a reactive "find and fix" mode instead of enabling proactive planning. [1] Inconsistent naming conventions and formats across departments further complicate efforts to create a unified view of assets. This lack of cohesion makes it nearly impossible to determine which assets require immediate attention and which can wait. [14]

The consequences extend beyond inefficiency. Fragmented or unreliable data can lead to serious compliance risks, making it difficult to prove adherence to environmental, safety, or building regulations. This can result in legal penalties or even the suspension of operating permits. [6] Additionally, incomplete asset registers hinder accurate reporting on sustainability goals and decarbonization efforts, creating regulatory vulnerabilities and disrupting long-term planning. Reliable data is critical to ensuring that lifecycle costs and risk assessments guide your investment strategy.

"Business intelligence is only as good as the data supporting it." – Keith D. Foote, Researcher and Consultant [14]

The challenge is compounded by the fact that key contact data can degrade by as much as 40% every two years, leaving asset registers outdated and unreliable. [14] Without a centralized system to track repairs, replacements, and condition updates, your digital twin risks becoming disconnected from real-world conditions, undermining every investment decision you make.

sbb-itb-5be7949

7. Annual Budgeting Without Multi-Year Risk-Based Planning

Relying solely on annual budgets without a long-term strategy often leads to underfunding and missed opportunities for proactive risk management. When planning is confined to a 12-month cycle, it prioritizes quick fixes over addressing deeper, systemic issues, creating hidden financial liabilities. This problem becomes glaringly obvious when examining the numbers.

In the U.S., state and local governments collectively spend around $500 billion each year on infrastructure. Yet, the deferred maintenance backlog for roads and bridges alone has reached a staggering $105 billion. This highlights not only funding gaps but also significant shortcomings in tracking and accountability.[5]

"Most states lack the tools to track maintenance, repair, and investment needs for critical public infrastructure and, as a result, create unmonitored, long-term liabilities that could pose significant fiscal burdens in the future." – Pew Charitable Trusts[5]

Without multi-year planning, governments often scramble to allocate resources for compliance, sustainability, and climate-related risks. This reactive approach drives up emergency costs and regulatory burdens, making it harder to manage risks effectively.[5] Clearly, a more strategic solution is needed.

Adopting a comprehensive framework that focuses on asset condition, required service levels, criticality, lifecycle costs, and optimal long-term funding can make all the difference.[6] By shifting from a short-term mindset to a risk-based, strategic process, annual budgeting can better align spending with long-term priorities and organizational goals.

8. Focus on Initial CAPEX and Visible Projects Over Lifecycle Costs

Many organizations tend to prioritize securing the lowest upfront costs or funding attention-grabbing projects. However, initial construction expenses typically account for only 10% to 40% of an asset’s total lifetime costs. The other 60% to 90% is spent on operations, maintenance, energy, and eventual replacement [9]. This short-term focus on cutting capital costs often leads to hidden, long-term financial burdens. Real-world examples shed light on these risks.

Take, for example, a high-speed rail operator in December 2025 and a global mining company that adopted Total Cost of Ownership (TCO) frameworks. By shifting their focus to lifecycle costs, they achieved remarkable savings: the rail operator cut lifetime expenses by roughly $5 billion, while the mining company saved $100 million annually [9].

Focusing solely on minimizing initial CAPEX without considering total ownership costs can lead to deferred liabilities. These costs compound over time, accelerating asset wear and tear, increasing energy expenses, and ultimately negating any upfront savings. By involving operations and maintenance teams early in the planning stages, organizations can reduce lifecycle costs by 20% to 40% [9].

To mitigate these risks, it’s essential to move away from a "lowest bid wins" mindset and adopt a "best lifecycle value wins" approach. During the initial planning phase, set clear baselines for energy, financing, and disposal costs. Use historical data to account for unplanned maintenance expenses, and schedule regular lifecycle reviews to manage costs effectively throughout the asset’s lifespan [9].

9. Energy Performance and Decarbonization Goals Not Integrated into Asset Plans

When sustainability goals are left out of asset investment planning, it’s a recipe for trouble. This disconnect can lead to what experts call "transition risks" – unexpected, often hefty costs that arise when infrastructure needs to be adapted quickly to meet greenhouse gas reduction targets or regulatory demands [16]. These risks can throw a wrench into the revenue streams that fund infrastructure projects, leaving organizations scrambling to meet deadlines and avoid penalties.

The financial stakes are high. For instance, climate-related damage to paved roads could cost state and local governments up to $20 billion in repairs by the end of this century [16]. On top of that, municipalities that neglect climate adaptation planning risk credit rating downgrades. Lower ratings mean higher borrowing costs, which in turn reduce the funds available for future infrastructure improvements [16]. The gap between what’s planned and what’s needed creates a cascade of challenges, from compliance issues to funding shortfalls.

This misalignment between sustainability goals and actual investments also amplifies other risks. Aging infrastructure that doesn’t meet modern energy standards becomes a liability, driving up compliance costs. Meanwhile, the growing adoption of electric vehicles is already chipping away at traditional revenue sources like fuel taxes. Without adjusting capital improvement plans to account for these shifts, organizations risk being unprepared for future funding gaps [16]. In essence, failing to integrate these factors into planning is like using yesterday’s roadmap for today’s journey, all while tomorrow’s expenses pile up.

"Investments must consider a project’s full life cycle, including the impact of more frequent extreme weather." – ASCE [4]

There’s a clear financial incentive to act now. Every $1 spent on resilience and preparedness saves $13 in post-disaster costs [4]. By incorporating climate assessments and lifecycle costing – factoring in energy performance and carbon penalties – organizations can sidestep regulatory fines and reduce unpredictable financial risks. For example, investing $10 billion in climate adaptation for roads or nearly $1 trillion for water systems by 2025 could slash damage costs by up to one-third [16]. These upfront investments don’t just mitigate risk – they’re a smart move for long-term financial stability.

10. Unable to Justify Budgets with Data to Boards, Investors, or Regulators

If you can’t back up your budget requests with solid data, it often signals under-investment. Metrics like the Faciliteitconditie-index (FCI) en Asset Priority Index (API) are critical for identifying which assets need immediate funding and which ones can be divested [15]. Without these numbers, budget proposals based on intuition or vague reasoning rarely satisfy boards, investors, or regulators.

This lack of data makes it difficult to illustrate the condition of critical assets. Securing funding for infrastructure improvements becomes an uphill battle when you can’t clearly show the timing of necessary investments or the "true costs" of delivering services [6][1]. The issue is even more pronounced with hidden infrastructure – like pipes, electrical systems, or structural components – because decision-makers are less likely to invest in what they can’t see. Without detailed condition assessments that highlight both the risk and potential consequences of failure, your case for funding becomes weak and unconvincing [1].

This situation reflects a larger, nationwide pattern of deferred maintenance [5]. If you’re unable to tie asset condition directly to mission-critical goals – such as meeting water quality standards, maintaining service reliability, or achieving energy reduction targets – your budget requests are often the first to be cut or postponed.

"Asset management is more than a computerized maintenance management system or software. It’s an overall approach… to deliver levels of service at the least whole-life cost."

– Will Williams, Asset Management Director, Black & Veatch [1]

To overcome these challenges, adopting structured frameworks is essential. Proactive condition assessments form the foundation for creating defensible budget proposals. Tools like the API-FCI quadrant help categorize assets, prioritizing immediate investment for high-risk items and divestment for low-priority ones [15]. This approach ties investment decisions to asset risk and lifecycle costs. When combined with life-cycle assessments that predict future budget needs based on design life and replacement schedules, you can present a clear, data-driven roadmap for approval. Organizations that embrace proactive condition assessment programs report reduced failure risks and measurable benefits for both their utilities and the communities they serve [1].

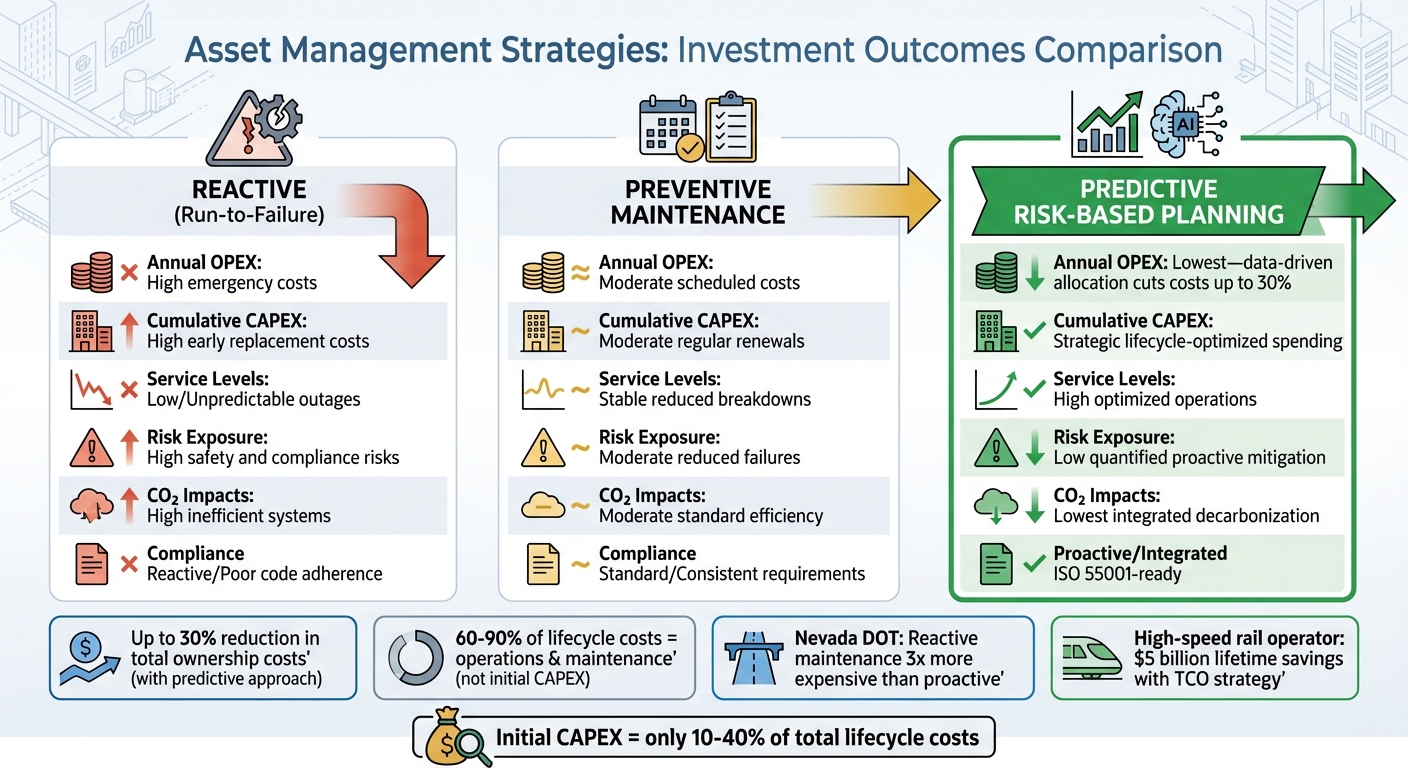

Comparison Table: Investment Strategies and Their Outcomes

Asset Management Strategies: Cost and Performance Comparison

The table below compares three asset management strategies – reactive "run to failure", scheduled preventive maintenance, and data-driven predictive risk-based planning – to highlight their varying outcomes. Predictive risk-based planning stands out as the most cost-effective and efficient approach. Organizations transitioning from reactive to predictive strategies can cut total ownership costs by as much as 30% [13]. For instance, Nevada DOT found that reactive "worst-first" maintenance for CCTV and flow detectors was nearly three times more expensive than their proactive approach [17]. Similarly, a high-speed rail operator saved around $5 billion in lifetime costs by adopting a Total Cost of Ownership strategy, optimizing both maintenance schedules and energy consumption [9].

The figures provided follow standard U.S. formatting. Predictive planning minimizes operational expenses, optimizes capital spending, reduces risk exposure, and maintains high service levels, all while achieving the smallest carbon footprint. This comparison demonstrates the value of incorporating risk-based analytics into asset investment strategies.

| Metrisch | Reactive – Run-to-Failure | Preventief onderhoud | Predictive Risk-Based Planning |

|---|---|---|---|

| Annual OPEX | High emergency costs | Moderate scheduled costs | Lowest – data-driven allocation cuts costs up to 30% [13] |

| Cumulative CAPEX | High early replacement costs | Moderate regular renewals | Strategic lifecycle-optimized spending [9] |

| Service Levels | Low/Unpredictable outages | Stable reduced breakdowns | High optimized operations [9] |

| Risk Exposure | High safety and compliance risks | Moderate reduced failures | Low quantified proactive mitigation [13] |

| CO₂ Impacts | High inefficient systems | Moderate standard efficiency | Lowest integrated decarbonization [13] |

| Naleving | Reactive/Poor code adherence | Standard/Consistent requirements | Proactive/Integrated ISO 55001-ready [13] |

It’s worth noting that initial capital expenditures (CAPEX) typically account for only 10% to 40% of an asset’s total lifecycle costs, while a significant 60% to 90% comes from operations, maintenance, and energy use [9]. These findings highlight the importance of adopting a proactive, lifecycle-focused investment strategy to achieve long-term savings and efficiency.

Conclusie

Spotting these 10 red flags early can save you from skyrocketing costs, compliance headaches, and service interruptions. When failure rates rise without a renewal plan, corrective maintenance drains your budget, of high-risk work orders stack up, you’re looking at immediate disruptions and long-term liabilities piling up fast [5]. Shifting from reactive fixes to proactive, risk-based planning can cut your total cost of ownership by 30% and boost asset availability by 10% [18][19]. But this shift requires a solid investment strategy.

To move forward effectively, focus on securing centralized condition data, gaining multi-year CAPEX and OPEX visibility, and integrating sustainability goals directly into your decision-making. Without these tools, it becomes nearly impossible to justify budgets to boards or regulators, and you risk making stranded investments that fail to meet tightening environmental standards [21]. Consider this: 76% of OECD countries now mandate formal asset management plans for infrastructure, and 52% actively monitor to prevent accelerated asset deterioration [20].

Addressing these challenges is where Oxand Simeo™ comes in. With over 20 years of data, including 10,000+ aging and energy laws en 30,000+ maintenance actions, this platform offers a structured framework to help you tackle risks head-on. It enables you to prioritize investments based on real asset risks, simulate budget scenarios, and model carbon-reduction pathways in line with ISO 55001 and decarbonization goals [18].

"We needed a tool that would allow us to integrate fragmented data and present it in a way that could be clearly presented to our elected officials, who are the decision-makers" [18][19].

Start by conducting a maturity assessment of your current practices. Then, consolidate all your asset data into a single, reliable source. Use scenario simulations to explore strategies under varying budget, risk, and sustainability constraints [18]. Finally, adopt lifecycle costing that takes into account not just construction but also operation, maintenance, and decommissioning [4][20]. This proactive, risk-based approach turns potential pitfalls into a sustainable and efficient roadmap for the future.

FAQs

What are the advantages of having a proactive asset renewal plan?

A well-thought-out asset renewal plan can breathe new life into aging infrastructure while keeping emergency repairs – and their hefty price tags – at bay. By carefully timing maintenance, repairs, or replacements, organizations can lower overall lifecycle costs and make the most of tight budgets. Plus, this kind of planning brings predictability to expenses, making it easier to craft budgets and present a strong case to stakeholders.

Taking a proactive approach also cuts down the chances of surprise breakdowns, safety hazards, or regulatory fines. Asset managers can focus their efforts where they’re needed most – whether that’s addressing high-risk areas, meeting service demands, or aligning with sustainability goals. The result? Improved reliability, enhanced public safety, and adherence to environmental and performance standards. Over time, this strategy builds a stronger, more cost-efficient asset portfolio that supports both financial stability and long-term sustainability goals.

How can organizations focus on preventive maintenance to avoid costly emergency repairs?

Focusing on preventive maintenance means staying ahead of potential problems through regular inspections, cleanings, and small repairs. This proactive approach helps identify issues early, extends the life of your assets, and keeps overall costs in check. Plus, it reduces unplanned downtime and avoids the hefty price tag that comes with emergency fixes.

To make this work, organizations can develop a well-structured asset management plan. This plan should assess the condition of assets, evaluate the risk of failure, and consider lifecycle costs. By conducting regular condition checks and focusing on critical assets, resources can be allocated where they’re needed most. Using a centralized system to track maintenance activities ensures that tasks are scheduled and completed on time. When you base decisions on data and aim for the lowest total cost of ownership, preventive maintenance becomes a smart, cost-efficient way to keep assets reliable and performing at their best.

Why is it important to include sustainability goals in your asset management plans?

Incorporating sustainability goals into asset management plans is essential for aligning long-term investments with environmental, financial, and regulatory priorities. Overlooking sustainability can result in higher failure rates, expensive emergency repairs, and non-compliance with increasingly strict environmental standards. Aging infrastructure is especially at risk from climate-related stresses, making forward-thinking planning a necessity.

By weaving sustainability metrics – like carbon reduction targets and life-cycle cost analyses – into these plans, asset owners can cut down on future repair costs, extend the lifespan of their assets, and avoid investments that might become outdated as policies evolve. This not only helps meet regulatory requirements but also strengthens financial stability while safeguarding the reliability and reputation of your assets.

Verwante Blog Berichten

- Beheer van infrastructuuractiva: Een op risico gebaseerde aanpak voor meerjarenplanning van CAPEX

- Asset Investment Planning 101: Hoe te bepalen waarin te investeren, wanneer en hoeveel

- De levensduur van activa verlengen zonder het budget te overschrijden: investeringsstrategieën voor de levenscyclus

- 7 veelvoorkomende fouten bij het plannen van vermogensinvesteringen (en hoe u deze kunt vermijden)