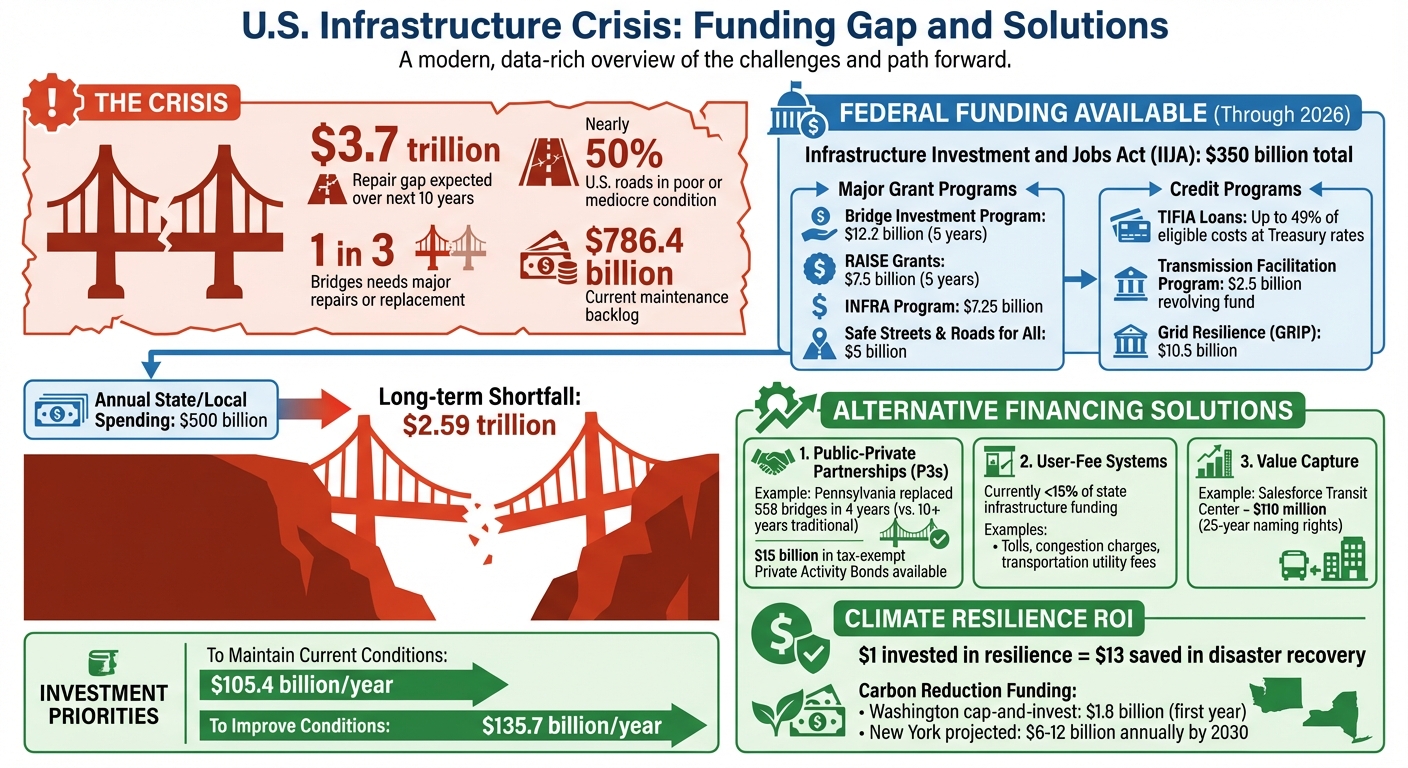

America’s infrastructure is in trouble. With a $3.7 trillion repair gap expected over the next 10 years, roads, bridges, and public buildings are rapidly aging. Nearly half of U.S. roads are in poor or mediocre condition, and one in three bridges needs major repairs or replacement. This neglect costs the economy billions annually in delays and inefficiencies.

Key Takeaways:

- Funding Shortfalls: Despite increased spending, real investment in infrastructure has declined due to inflation and outdated funding mechanisms like the gas tax.

- Federal Programs: The Infrastructure Investment and Jobs Act (IIJA) provides temporary funding through 2026, with grants like RAISE, INFRA, and TIFIA loans offering critical support.

- Alternative Financing: Public-Private Partnerships (P3s), user-fee systems, and value capture strategies can fill funding gaps and speed up project timelines.

- Risk-Based Planning: Tools like Oxand Simeo™ help prioritize repairs, reduce costs, maximize ROI, and align investments with long-term goals, including carbon reduction.

- Climate Resilience: Investing $1 in resilience saves $13 in disaster recovery, highlighting the importance of future-proofing infrastructure.

To close the funding gap, a mix of federal support, alternative financing, and smarter planning is essential. Early preparation, clear priorities, and innovative tools are key to ensuring America’s infrastructure meets future demands.

U.S. Infrastructure Funding Gap and Federal Program Allocations

Get Started: Demystifying Infrastructure Federal Funding

sbb-itb-5be7949

Federal Funding Programs: Available Resources for Infrastructure Projects

Federal funding plays a crucial role in addressing the infrastructure gap. The Infrastructure Investment and Jobs Act (IIJA), also known as the Bipartisan Infrastructure Law, has allocated approximately $350 billion for federal highway programs through fiscal year 2026 [10]. This funding includes both formula-based allocations and competitive grants, supporting a wide range of projects.

To make navigating these opportunities easier, the government has created Build.gov. This platform allows users to sort programs by criteria like eligible recipient type, funding amount, or program name [5]. For example, if a local government is planning a bridge rehabilitation project, which can benefit from predictive maintenance strategies to optimize long-term costs, Build.gov can help determine whether direct application is possible or if coordination with the state Department of Transportation is required. It’s a one-stop resource to match projects with the right funding opportunities.

Grant Programs for Infrastructure Projects

Several competitive grant programs provide substantial funding for infrastructure upgrades. One standout is the Bridge Investment Program, which dedicates $12.2 billion over five years to improving bridge and culvert conditions [5]. Large bridge projects exceeding $100 million in costs may receive grants starting at $50 million, while smaller projects can access awards ranging from $2.5 million to 80% of eligible costs [11].

Other notable programs include:

- RAISE grants (formerly BUILD): Allocating $7.5 billion over five years for surface transportation projects with local or regional impact [5].

- INFRA program: Targeting freight and highway projects of national importance with $7.25 billion in funding [5].

- Safe Streets and Roads for All (SS4A): Providing $5 billion to support "Vision Zero" initiatives aimed at eliminating transportation-related injuries and fatalities [5].

Applying for these grants requires detailed planning and strong applications submitted through platforms like Grants.gov. Tools such as the BIL Launchpad and the BIP BCA Tool can help streamline the process [5][6][11].

U.S. Transportation Secretary Sean P. Duffy highlighted the value of these programs, noting:

Transportation Infrastructure Finance and Innovation Act (TIFIA) credit program policy update will allow all types of transportation infrastructure projects to finance up to 49 percent of eligible costs as authorized by TIFIA legislation [7].

Timing is critical. For example, the Federal Highway Administration (FHWA) has announced a Notice of Funding Opportunity for up to $9.62 billion in Bridge Project grants for fiscal years 2023–2026. The deadline for FY 2026 Large Bridge Project applications is August 1, 2025 [11]. Missing such deadlines means waiting for the next funding cycle, so early preparation is key.

Tax Credits and Loan Guarantees

In addition to grants, federal credit programs offer flexible financing options. The Transportation Infrastructure Finance and Innovation Act (TIFIA) program provides direct loans, loan guarantees, and standby lines of credit for projects involving surface transportation, transit, ports, and airports [7][8]. While these options require repayment, they make projects more financially viable.

TIFIA loans feature interest rates fixed at U.S. Treasury rates, allow repayment deferral for up to five years after project completion, and can now finance up to 49% of eligible costs [7]. To qualify, projects must demonstrate creditworthiness, supported by investment-grade ratings from at least two nationally recognized credit rating agencies (or one for projects under $75 million) [8].

Minimum project cost requirements include:

- $10 million for Transit-Oriented Development and Rural projects

- $15 million for Intelligent Transportation Systems

- $50 million for surface transportation projects [8]

For public-private partnerships backed by revenue, at least 25% private co-investment is required to qualify for a 49% TIFIA loan [7].

The Build America Bureau explains:

The TIFIA credit program is designed to: Fill market gaps and leverage substantial private co-investment through supplemental, subordinate investment in critical improvements to the nation’s transportation system [7].

Early engagement with the Bureau’s outreach staff is essential to identify project needs and receive technical guidance before submitting a formal Letter of Interest [8]. Applicants should also be prepared for transaction costs, which can range from $400,000 to $700,000 per transaction, along with an annual loan servicing fee of about $13,000 [8].

For energy-related infrastructure, the Transmission Facilitation Program (TFP) offers a $2.5 billion revolving fund, providing direct loans, partnerships, and capacity contracts where the Department of Energy acts as an "anchor customer" for new transmission lines [9]. Additionally, the Grid Resilience and Innovation Partnerships (GRIP) Program provides $10.5 billion to improve grid flexibility and resilience [9].

These programs offer substantial funding opportunities, but success depends on understanding eligibility criteria, meeting strict deadlines, and submitting well-prepared applications. Starting early, using available tools, and aligning projects with program goals are essential for securing federal support.

Alternative Financing Methods for Infrastructure

Federal grants and loans play a crucial role in funding infrastructure projects, but they often fall short of covering the complete costs. Alternative financing methods step in to fill this gap, speeding up project timelines and creating steady revenue streams. Each year, state and local governments spend $500 billion on transportation and water infrastructure, yet the long-term investment shortfall stands at $2.59 trillion [3]. Addressing this deficit requires thinking beyond traditional budgets, using approaches that reduce financial risks and ensure infrastructure remains durable over time.

Public-Private Partnerships (P3s)

Public-Private Partnerships, or P3s, are a proven way to fast-track large-scale infrastructure projects. In a P3, a private company takes on the responsibility of designing, building, financing, operating, and maintaining (DBFOM) infrastructure under a long-term agreement with a public agency [14]. This model allows the private partner to provide upfront funding, handle significant project risks, and oversee the asset’s upkeep for decades – often 25 to 30 years.

A standout example is the Pennsylvania Department of Transportation (PennDOT). Between 2015 and 2019, its Rapid Bridge Replacement program used a P3 model to repair 558 bridges in just four years, a task that would have taken over a decade with traditional methods [1]. The private partner not only managed construction but also committed to maintaining the bridges for 25 years, ensuring quality from the outset.

P3s work by transferring risks – like design flaws, construction delays, or operational inefficiencies – to the private sector, which has strong incentives to deliver on time, within budget, and at high quality [1][14]. As the National Academies of Sciences, Engineering, and Medicine explains:

Public–private partnerships (P3s) can provide solutions to the project delivery challenges faced by state departments of transportation (DOTs) and local transportation agencies… by aligning risks and rewards between public and private sectors, accelerating project delivery, improving operations and asset management [12].

Funding for P3 projects often comes from tolls, availability payments, or shadow tolls based on usage [1][14]. Successful examples include managed lanes in Texas and high-occupancy toll (HOT) lanes in Virginia, where private investment and creative financing delivered results quickly and cost-effectively [15].

To make P3s more attractive, the U.S. Secretary of Transportation can issue up to $15 billion in tax-exempt Private Activity Bonds (PABs) for eligible transportation projects [15]. However, careful planning is essential. Public agencies must conduct a Value for Money (VfM) analysis to confirm that a P3 offers better value than traditional methods. Additionally, states need enabling legislation to authorize long-term agreements [14].

P3s often work hand-in-hand with user-fee systems, which provide the ongoing revenue needed to maintain infrastructure over its lifespan.

User-Fee Systems

User-fee systems ensure that those who directly benefit from infrastructure contribute to its costs. Unlike general taxes, which fund a variety of public needs, user fees link payment directly to usage. Common examples include tolls, congestion charges, transportation utility fees, and parking fees.

These systems generate steady, reliable revenue that can fund large-scale projects and cover operations and maintenance (O&M) expenses – areas often overlooked by federal funding [3]. When combined with P3s, user fees provide private partners with a dependable income stream, motivating them to maintain high standards throughout the contract period [16].

Despite their potential, most states collect less than 15% of their infrastructure funding from non-tax sources like fees and charges [3]. Legal restrictions also pose challenges: only 7 out of 15 surveyed states allow local fuel taxes, and just 6 permit local vehicle registration fees [3]. According to The Pew Charitable Trusts:

These limits on local governments’ ability to raise funds can lead to investment gaps that delay maintenance and improvements for critical infrastructure managed by these governments [3].

Another promising approach is value capture, which leverages the economic benefits created by infrastructure improvements. For instance, the Salesforce Transit Center in California secured a 25-year naming rights deal worth $110 million, providing a steady income to support its operations [13].

For local road maintenance, Transportation Utility Fees charge property owners based on the traffic their property generates, much like utility billing for water or electricity [13]. This method treats infrastructure as a utility, creating a reliable revenue source specifically for O&M costs.

| Fee Type | Revenue Potential | Primary Function |

|---|---|---|

| Tolls / Congestion Charges | High | Capital costs and debt repayment |

| Transportation Utility Fees | Moderate | Operating and maintenance (O&M) |

| Parking Fees | Moderate | Project costs and active transportation |

The Federal Highway Administration (FHWA) highlights the importance of these funding strategies:

Value capture is one proven sustainable source that can be tapped to supplement much-needed funding and get the project off the ground for a variety of State and local transportation projects [13].

To maximize success, agencies should consider P3 and user-fee options early in the planning process. Financial experts can help evaluate tolling or value capture opportunities, while environmental reviews should account for innovative procurement models [15]. With proper legal frameworks and strategic planning, these alternative financing methods can help close the gap between public funds and the true costs of renewing America’s infrastructure.

Risk-Based Investment Planning with Oxand Simeo™

While alternative financing can open up new revenue streams, decision-makers still face the challenge of prioritizing asset repairs amidst a $786.4 billion backlog [17]. The key lies in prioritizing projects based on risk, lifecycle costs, and long-term performance rather than simply focusing on available funds. Risk-based investment planning offers a way to complement alternative financing by giving managers tools to make every dollar count.

Oxand Simeo™ is a platform designed for multi-year asset investment planning, helping infrastructure managers distribute budgets strategically over 5- to 30-year periods. Instead of reacting to failures or spreading funds thinly, the platform uses risk-based asset management to pinpoint investments that provide the most value throughout an asset’s lifespan. This method ensures a balance between costs, risks, and expected performance, enabling decision-makers to address the most critical needs first [18]. Below, we’ll explore how Oxand Simeo™ simplifies prioritization, maintenance planning, and budget scenario testing.

Prioritizing Investments by Risk and Cost

Prioritization begins with identifying projects that deliver a benefit-cost ratio (BCR) of 1.0 or higher, meaning the benefits outweigh the costs [17]. Oxand Simeo™ supports this process by using multi-criteria analysis to rank investments based on financial returns, risk levels, criticality, and carbon reduction goals.

The platform leverages 10,000+ proprietary aging and performance models to simulate how infrastructure components deteriorate over time. This allows agencies to predict when assets – such as bridge decks, pavement sections, or building systems – will reach critical condition, enabling proactive interventions before failures occur.

For instance, under an "Improve Conditions" scenario, U.S. highways would need an average annual capital investment of $135.7 billion to fund all cost-beneficial projects [17]. By adopting risk-based planning, agencies can assess whether their current budgets are sufficient to maintain key metrics like pavement ride quality (IRI) or bridge deck condition. If not, they can adjust their strategies to prevent further deterioration.

Predictive Maintenance and Cost Reduction

Oxand Simeo™ goes beyond prioritization by forecasting maintenance needs, shifting management from reactive repairs to proactive planning. Using probabilistic modeling and a library of 30,000+ maintenance protocols, the platform estimates the total cost of managing an asset throughout its lifecycle. This approach ensures a balance between costs, risks, and performance at every stage [18].

Clients often see tangible benefits, with maintenance costs reduced by 10–25% on targeted components through optimized intervention timing. By extending asset lifespans and delaying costly replacements, infrastructure concession holders can "gain a maintenance cycle" while maintaining safety and service standards.

The platform also integrates carbon reduction goals by analyzing how different maintenance strategies affect energy use and emissions. Extending asset lifespans through preventive maintenance and energy-efficient upgrades helps reduce the need for carbon-intensive replacements, aligning investment strategies with sustainability objectives.

Testing Budget and Risk Scenarios

Oxand Simeo™ also enables detailed budget scenario testing, a critical tool for strategic planning. Decision-makers can compare various budget allocations and risk levels before committing funds. Scenarios such as "Sustain Spending" (keeping budgets steady), "Maintain Conditions" (funding to prevent further deterioration), or "Improve Conditions" (addressing all cost-beneficial investments) allow users to project long-term infrastructure outcomes [17].

For example, maintaining current conditions requires 2.9% less funding than 2014 expenditure levels, totaling $105.4 billion annually [17]. Under an "Improve Conditions" scenario, the percentage of bridges in poor condition (by deck area) could drop from 6.8% to 0.6% over 20 years [17].

The platform also tracks the investment backlog – the cost of deferred maintenance – which can represent nearly 29% of total funding required under an "Improve Conditions" strategy [17]. By visualizing these trade-offs, agencies can make informed decisions about whether to prioritize system rehabilitation, safety improvements, or environmental upgrades, all while staying within budget limits and meeting decarbonization targets.

Integrating Carbon Reduction into Infrastructure Funding

The infrastructure decisions we make today will shape carbon emissions for decades to come. Since infrastructure assets often last for generations, their design and funding choices lock in energy use and maintenance patterns far into the future. For example, climate-related damage to paved roads is projected to cost up to $20 billion annually by the end of the century. However, investing in resilience now can prevent even greater expenses down the line [4].

Aligning Investments with Carbon Goals

States are shifting away from traditional environmental programs and embracing funding models that directly connect infrastructure spending to carbon reduction. In 2023, Washington’s cap-and-invest program generated $1.8 billion in its first year, channeling funds into public transportation and clean energy projects [19]. New York anticipates its program could bring in $6 billion to $12 billion annually by 2030 [19]. Vermont took a bold step in May 2024 by enacting "Climate Superfund" legislation, which requires fossil fuel companies to cover the costs of infrastructure upgrades and disaster preparedness [19]. These initiatives reflect a growing trend of linking financial strategies with climate objectives.

To effectively incorporate these funding sources, decision-makers can start with vulnerability assessments that map out assets and identify climate risks by region [4]. For instance, California used federal PROTECT funds in 2022 to launch the Local Transportation Climate Adaptation Program, which supports climate-resilient upgrades for state roads and bridges [19].

Tools like Oxand Simeo™ play a key role in aligning funding with carbon reduction. This platform allows users to simulate various carbon-reduction scenarios while managing budgets. Its multi-criteria analysis ranks investments not only by financial returns and risk but also by their impact on carbon emissions, ensuring that every dollar spent supports both financial and environmental objectives. This strategic approach naturally leads to energy-efficient solutions that can extend the lifespan of infrastructure.

Extending Asset Life Through Energy Efficiency

Energy-efficient upgrades deliver a double benefit: they lower operating costs and reduce carbon emissions. For example, retrofitting an existing building can cut embodied carbon by 50% to 75% compared to constructing a new one. Similarly, using materials with lower embodied carbon can reduce costs by 30% and decrease embodied energy by 74% [20]. Green infrastructure solutions, such as permeable pavements and rain gardens, not only minimize environmental impact but also reduce long-term maintenance and disaster recovery expenses. In fact, climate adaptation measures can reduce extreme weather damage costs by up to one-third [4].

A thorough Life Cycle Cost Analysis (LCCA) that considers costs across planning, construction, operation, maintenance, and decommissioning can pinpoint opportunities where upfront investments in energy efficiency lead to long-term savings and extended asset durability [2].

"Sustainable retrofits increase the asset value of a project over time while also reducing embodied carbon compared with demolishing and building new." – AIA [20]

Oxand Simeo™ supports these goals by analyzing how various maintenance strategies influence energy use and emissions. With a database of over 30,000 maintenance protocols, it enables comparisons between proactive green upgrades and reactive, carbon-heavy replacements.

Funding strategies also need to account for transition risks – such as revenue losses from reduced fuel tax collections as electric vehicle adoption grows [4]. Addressing these risks underscores the importance of integrating carbon reduction with financial planning. By preparing for these changes now, agencies can create resilient funding strategies that meet both infrastructure needs and carbon reduction commitments.

Conclusion: Funding Solutions for Aging U.S. Infrastructure

Tackling the $3.7 trillion infrastructure investment gap in the U.S. demands a blend of diverse funding sources and smart, data-driven planning [1]. Federal programs, state infrastructure banks, and Public-Private Partnerships (P3s) are key players in providing much-needed capital. At the same time, value capture mechanisms allow communities to leverage the economic growth generated by infrastructure upgrades. For instance, recent P3 initiatives have significantly sped up essential repairs that would have otherwise taken decades to complete.

Tools like Oxand Simeo™ bring a risk-based approach to the table, helping align spending with both financial efficiency and environmental targets. By using Asset Investment Planning, infrastructure managers can cut total ownership costs by as much as 30% while also extending the lifespan of critical assets [21][22]. This forward-thinking strategy ensures that climate resilience becomes a core consideration in every funding decision.

Incorporating climate resilience isn’t just about being prepared – it’s also about saving money. For every dollar spent on preparedness, $13 is saved in post-disaster recovery costs [2]. To make this happen, it’s crucial to establish baseline inventories, conduct life-cycle cost analyses, and adopt scoring methods that balance short-term needs with long-term sustainability.

"Proactively addressing climate-related risk to infrastructure requires steep initial investments, ultimately the benefits far exceed the costs." – Fatima Yousofi and Mollie Mills, The Pew Charitable Trusts [4]

FAQs

What are some alternative ways to finance infrastructure projects in the U.S.?

Alternative ways to fund U.S. infrastructure projects are stepping in to complement traditional federal funding. One increasingly common approach is the use of public-private partnerships (P3s). These partnerships allow private entities to shoulder responsibilities like design, construction, or financing, easing the burden on public resources. Another strategy involves value-capture tools, such as tax-increment financing and development impact fees, which tap into the rise in property values that often follows infrastructure improvements.

State and local governments also turn to municipal bonds – both general-obligation and revenue bonds – to draw private investors into the fold. On top of that, revolving loan funds and infrastructure banks offer low-cost loans or grants to help eligible projects move forward. Newer approaches are also emerging, like blended finance, which mixes public and private funding sources, and climate-resilient financing, designed to support upgrades that align with sustainability and carbon-reduction efforts.

These financing methods empower decision-makers to bridge funding gaps, focus on essential projects, and extend the life of aging infrastructure – all while tackling modern challenges like climate adaptation and economic sustainability.

How can risk-based investment planning help improve infrastructure management?

Risk-based investment planning shifts the focus to funding projects that deliver the most impact, rather than simply addressing issues in the order they arise. By assessing both the likelihood and potential consequences of risks – like structural deterioration, severe weather events, or safety concerns – planners can prioritize initiatives based on their risk-adjusted return on investment. This ensures that limited resources are allocated to projects that meaningfully lower system risks, prolong the life of assets, and improve public safety.

This method also leverages tools like predictive maintenance data and climate risk evaluations, helping infrastructure managers take a proactive approach. Planning upgrades early can prevent expensive emergency repairs and curb long-term costs. Additionally, aligning these investments with sustainability goals, such as reducing carbon emissions, allows organizations to create infrastructure that is not only more durable and efficient but also focused on addressing the most pressing needs.

Why is it important to include climate resilience in infrastructure funding?

Incorporating climate resilience into infrastructure funding is essential for safeguarding older systems against growing threats like extreme weather and climate-related pressures. By pinpointing weaknesses in roads, bridges, and water systems early on, decision-makers can shift from expensive emergency fixes to planned, budget-friendly upgrades. This forward-thinking strategy not only cuts costs over time but also ensures infrastructure is better prepared for future challenges.

Investing in climate-resilient projects also supports national efforts to lower greenhouse gas emissions and achieve sustainability goals. Prioritizing such initiatives opens doors to new state and federal funding, extends the life of critical assets, and improves public safety – all while maintaining dependable services. Balancing resilience with sustainability promotes both financial prudence and environmental progress.

Related Blog Posts

- Infrastructure Asset Management: A Risk-Based Approach for Multi-Year CAPEX Planning

- Strategic CAPEX Planning for Highway Concessions: Balancing Grantor Compliance and Profitability at End-of-Term

- Aging Infrastructure in Europe: How to Prioritise Renewal Under Budget Constraints

- Climate Change Adaptation for Aging Assets: Where to Invest First