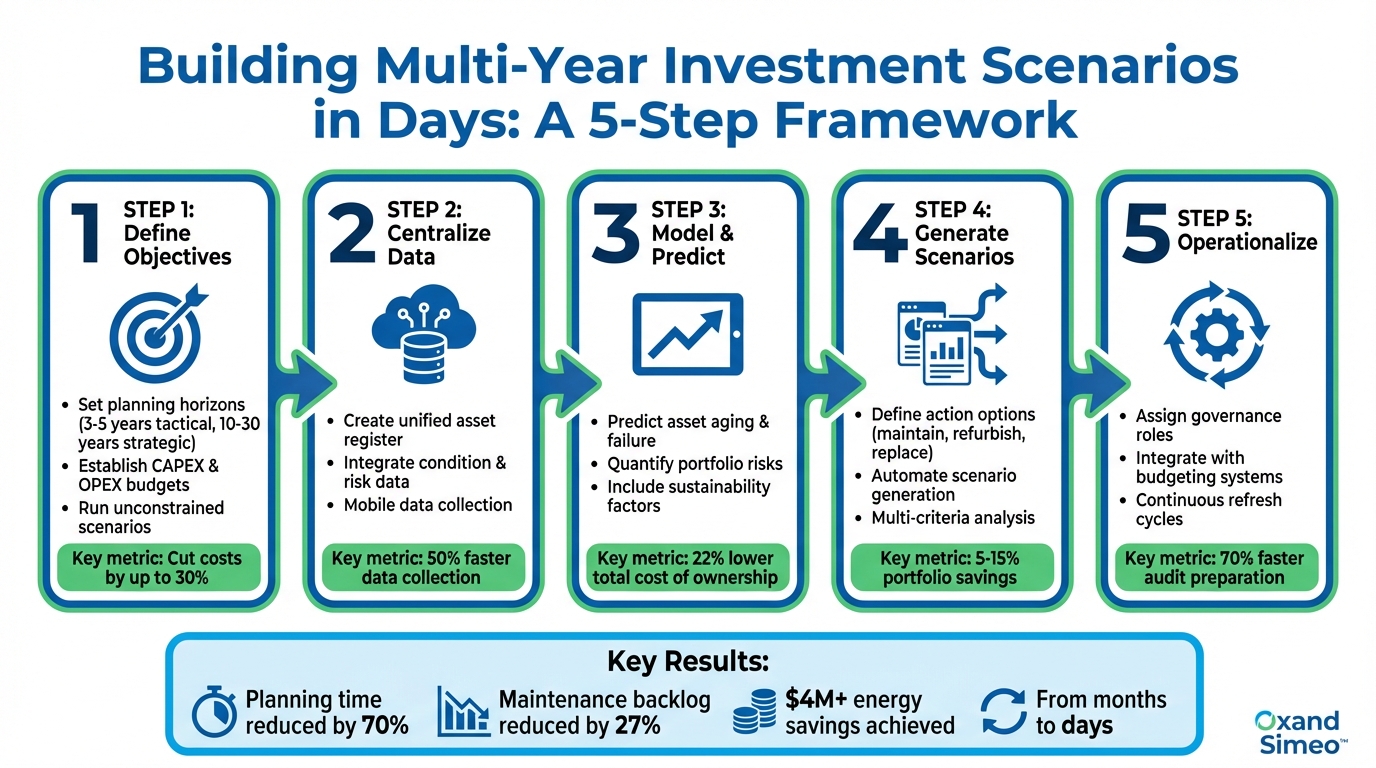

Creating multi-year investment plans doesn’t have to take months. By integrating data, using predictive models, and leveraging advanced tools like Oxand Simeo™, organizations can now build detailed CAPEX and OPEX scenarios in just days. This approach minimizes inefficiencies caused by outdated methods like fragmented spreadsheets and manual workflows.

Key takeaways:

- Centralized Data: Combines asset, condition, and financial data into one platform.

- Predictive Models: Simulate asset aging and failure to prioritize investments.

- Faster Planning: Generate scenarios in days, reducing planning time by up to 70%.

- Quantifiable Benefits: Reduce maintenance backlogs by 27% and cut lifecycle costs by up to 30%.

- Sustainability Metrics: Incorporate energy savings and carbon reduction goals.

5-Step Process for Building Multi-Year Investment Scenarios in Days

Step 1: Define Objectives, Horizons, and Constraints

Start by laying the groundwork for your investment plan: establish your objectives, planning horizons, and constraints. Without these elements clearly defined, your scenarios risk becoming too abstract or unrealistic, making it harder to secure stakeholder approval.

"Asset investment planning is the ongoing practice of deciding, over a medium to long-term horizon, how to allocate capital and resources to minimize total lifecycle costs and risks."

Create a scenario charter that outlines the scope, decision variables, and distinguishes between external factors (e.g., inflation, regulatory changes) and internal actions (e.g., refurbishments, capacity expansions). By clarifying what aspects are fixed versus flexible, you can avoid the confusion that often disrupts traditional planning cycles [5].

Set Planning Horizons and Goals

The length of your planning horizon dictates the level of detail your scenarios should capture. For tactical plans covering three to five years, aim for monthly granularity during the first 24 to 36 months. This approach captures seasonality, cash flow patterns, and operational rhythms [5]. For long-term plans spanning 10 to 30 years, annual granularity is more appropriate, focusing on lifecycle costs, sustainability priorities, and total cost of ownership [3].

Each horizon should align with specific organizational objectives. Tactical plans typically focus on immediate needs like reliability, maintenance, and near-term capital expenditures. In contrast, long-term plans address broader goals such as decarbonization, regulatory compliance (e.g., ISO 55000, CSRD/ESRS), and capacity expansion. For instance, a major U.S. infrastructure study estimated an average annual investment of $135.7 billion to fund cost-effective highway and bridge projects, illustrating the scale required for long-term planning [6].

Additionally, it’s essential to run at least one unconstrained scenario – free of budget limits. This "upper limit of optimality" helps identify the total investment required to address all risks and serves as a benchmark for comparing constrained scenarios. Organizations using this method have cut total ownership costs by up to 30% by pinpointing where additional spending yields the greatest long-term benefits [7].

With your horizons and goals clearly defined, the next step is to set your financial and resource boundaries.

Define Financial and Resource Limits

After establishing your planning horizons, determine your capital (CAPEX) and operational (OPEX) budgets in inflation-adjusted dollars, factoring in inflation and discount rates. For example, a "Sustain Spending" scenario might maintain annual investment at base-year levels (adjusted for inflation), while a "Maintain Conditions" scenario calculates the minimum funding needed to preserve system performance over 20 years [6].

Next, outline your resource constraints, including labor availability, material lead times, and operational limitations (e.g., maximum allowable outage durations). It’s also important to account for deferral costs – the financial risks and future expenses tied to delaying investments. By framing risk as a measurable cost, you can minimize it alongside acquisition and maintenance expenses [3].

In large-scale projects, investments that aren’t explicitly modeled – such as safety initiatives or environmental improvements – can account for about 29.3% of total spending [6]. Setting these constraints upfront ensures your scenarios remain realistic and defensible when presented to boards, regulators, or elected officials.

Step 2: Build a Centralized Asset and Data Foundation

To make informed decisions, start by creating a unified asset register. Without clean, standardized data, even the best planning models can lead to unreliable outcomes. Organizations that overlook this step often rely on fragmented data, resulting in decisions driven by guesswork rather than solid evidence. For instance, a railway company that adopted condition-monitoring data saved over 30,000 person-hours annually and redirected $20 million in annual engine-overhaul costs toward more strategic capital-replacement investments [4].

A centralized asset foundation eliminates data silos by combining information from various sources – like BIM models, SAP or Maximo systems, IoT sensors, and field inspection reports – into one reliable source. This step is crucial for setting the stage for effective asset management.

"We needed a tool that would allow us to consolidate the fragmented data we had and project it in a way that could be clearly presented to our elected officials, who are the decision-makers."

- Chief Executive Officer (General Director of Services) [2]

Create a Unified Asset Register

Begin by standardizing asset hierarchies and attributes across all portfolios. Tools such as Oxand Simeo Inventory™ can consolidate legacy data from spreadsheets, CMMS exports, and BIM models using REST and GraphQL APIs, allowing you to establish your asset inventory in just days instead of months [1].

For field data collection, ditch paper-based inspections in favor of mobile applications that use standardized templates and sync directly to the cloud. Organizations using mobile apps for data collection report 50% faster data collection compared to traditional methods [1]. Real-time syncing ensures your digital inventory reflects current conditions, aligning with the rapid scenario-building goals mentioned earlier.

Integrate Condition and Risk Data

Once your asset register is up and running, enhance it by integrating operational and risk data. Attach condition scores, failure histories, and criticality data to each asset. This integration supports predictive modeling by linking maintenance records to AI-driven models that forecast asset lifecycle changes.

Start small with a 90-day pilot involving 15 to 50 high-criticality assets to validate data accuracy and establish baselines before scaling up [8]. Focus on critical assets by using risk matrices to allocate resources where they matter most. Connect your centralized database to existing CMMS or ERP systems via APIs to ensure continuous updates.

Ensure Data Quality and Governance

A centralized asset foundation is only as good as its data quality. Strong data governance ensures that your register not only consolidates data but also meets strict audit-readiness standards. Apply role-based access controls and single sign-on (SSO) for user management, and encrypt data with AES-256 at rest and TLS 1.3 in transit to maintain security [1]. Use validation rules and standardized forms during data ingestion to minimize errors, duplicates, and gaps.

By incorporating ISO 55000 checklists and automated audit trails, organizations can cut audit preparation time by up to 70% [1].

"Simeo reduced our maintenance backlog by 27% and enabled us to achieve €4 million in energy savings across 66 buildings during the first budget cycle."

- Asset Director, Public Sector Portfolio [1]

Step 3: Model Aging, Risk, and Sustainability Factors

Once you’ve established a centralized asset foundation, the next logical step is to predict how your assets will perform over time. This means identifying when components might fail, evaluating financial and operational risks, and factoring in energy and carbon performance to guide investment decisions. Without these models, planning becomes little more than educated guessing. By building on the centralized data foundation, these modeling techniques integrate seamlessly with risk-based planning.

Predict Asset Aging and Failure Patterns

Traditional models often assume assets degrade at a constant rate, but reality is far more complex. Factors like traffic loads, environmental conditions, maintenance history, and operational stress all influence how assets age. Probabilistic deterioration models account for this complexity, offering a range of possible outcomes instead of a simple linear forecast. By using historical data and established maintenance principles, you can better predict asset lifecycle behavior.

Take Oxand Simeo™, for example. It leverages a proprietary database containing over 10,000 aging and performance models and 30,000 maintenance laws accumulated from more than 20 years of infrastructure projects. Using advanced data analysis and probabilistic modeling, it simulates asset aging, failure patterns, and energy consumption. A real-world example? In July 2017, the South Carolina Department of Transportation used structural-health-monitoring technology to pinpoint specific bridge girders that needed replacement, avoiding an unnecessary full reconstruction [4].

"Advanced analytics – the ability to generate valuable insights from large amounts of data – has emerged as a powerful tool to understand and learn from past performance as a guide to more accurately predict trends." – McKinsey & Company [4]

Quantify Portfolio Risks and Prioritize Mitigation

Once aging predictions are in place, the next step is to assess the likelihood of failures and their potential financial and operational impacts. This allows you to rank assets based on criticality. Sensitivity analysis can help identify key variables – like interest rates, operational expenses, or regulatory changes – that have the greatest influence on outcomes [10] [11]. Running multiple scenarios (base-case, best-case, and worst-case) ensures your planning assumptions are realistic and not overly optimistic [9].

It’s also essential to go beyond financial risks and include environmental performance in your assessments. This gives you a full picture of lifecycle costs and risks.

Include Sustainability and Energy Drivers

Sustainability is no longer just a buzzword; it’s a core part of long-term investment planning. Incorporating factors like energy consumption, carbon reduction goals, and regulatory requirements into your multi-year scenarios ensures environmental risks are treated as integral to lifecycle costs – not as an afterthought. Ignoring these considerations can lead to compounding financial consequences over time [3].

For instance, overlaying carbon pricing and energy cost forecasts can reveal how fluctuating environmental costs might influence your plans [5]. Rising carbon prices, for example, could make energy-efficient retrofits more attractive, helping optimize portfolio savings. Advanced analytics can even fine-tune intervention timing, potentially cutting portfolio costs by 5% to 15% [4].

"Asset investment planning is the ongoing practice of deciding, over a medium to long-term horizon, how to allocate capital and resources to minimize total lifecycle costs and risks… [including] environmental performance." – Philippe Jetté, Product Manager, Asset Investment Planning, IBM [3]

A risk-based approach to asset management – such as prioritizing distribution transformers based on both their condition and energy performance – can lower the total cost of ownership by 22% over time compared to age-based replacement strategies [3]. This method not only extends the lifespan of assets but also reduces the carbon footprint tied to premature replacements, aligning your investment strategy with both financial and environmental goals. This integrated approach forms the backbone of an accelerated, risk-based planning process.

sbb-itb-5be7949

Step 4: Generate and Compare Multi-Year Scenarios

With your aging models and risk assessments ready, it’s time to move from analysis to action. This step focuses on testing and comparing various investment scenarios while considering budget, risk, and sustainability constraints.

Define Decision Variables and Action Options

The first step is to outline what actions you can take for each asset. For every component or asset type, identify actionable options such as run-to-fail, maintain, refurbish, replace, or upgrade [3]. Each option should detail its associated costs – both capital (CapEx) and operational (O&M) – as well as resource needs and expected downtime. This helps you understand the financial and operational implications of each choice.

Quantify end-of-life risks as direct costs, allowing for clear comparisons between acting now and delaying maintenance [3]. Add sustainability metrics to each proposed action, like kWh savings and GHG reductions, to align decisions with broader goals – whether that’s maintaining reliability, meeting safety standards, or hitting net-zero targets [1]. By defining these options clearly, you set the groundwork for quickly generating actionable scenarios.

Automate Scenario Generation and Evaluation

Manual planning can be slow and prone to errors. Tools like Oxand Simeo™ simplify this process by running thousands of investment scenarios in minutes. Using your aging models and maintenance data, Simeo evaluates scenarios based on budget, risk, and carbon alignment [1].

Start by running an "unconstrained" scenario to explore the maximum potential of your investments. This approach highlights areas where additional funding could deliver the highest returns [3]. Then, incorporate real-world constraints like budget limits, resource availability, and regulatory requirements. This produces a range of scenarios that outline what’s achievable at different funding levels.

Prioritize Investments Using Multi-Criteria Analysis

Once scenarios are generated, the next step is ranking them objectively. Multi-criteria decision frameworks help prioritize investments based on factors like risk reduction, lifecycle costs, and sustainability outcomes [12]. Each project is scored on financial metrics (like ROI and total cost of ownership), risk mitigation (such as safety and service reliability), and environmental benefits (like CO₂ reductions and energy efficiency) [1][2].

Organizations using this method often see a 30% reduction in total ownership costs and a 10% boost in asset availability [2]. Advanced analytics can further optimize results, delivering portfolio savings of 5% to 15% by fine-tuning intervention timing and avoiding unnecessary replacements [4]. The real challenge lies in balancing competing priorities – sometimes the lowest-cost option isn’t ideal when considering risks or environmental penalties. Multi-criteria analysis makes these trade-offs clear and provides a solid foundation for stakeholder discussions.

Step 5: Operationalize a Continuous Planning Process

Creating scenarios is just the starting point. The real power lies in transforming planning into an ongoing, adaptable process that fits seamlessly into your organization’s workflows. By building on rapid scenario generation, a continuous planning process helps your organization stay flexible and aligned with shifting risks and opportunities.

Assign Governance and Stakeholder Roles

To ensure plans don’t just sit on a shelf, clear ownership is essential. Start by defining a Value Framework that reflects your organization’s priorities – whether that’s reliability, safety, compliance, or another critical factor – and assign roles to uphold these priorities [3]. For example:

- C-Suite executives need a high-level view of risk and cost trade-offs across the portfolio.

- Finance teams should monitor cash flow and understand the financial impact of delaying projects.

- Asset managers require a pipeline of condition and capital data informed by inspections and failure history.

- Maintenance teams benefit from a rolling 12- to 18-month plan that minimizes emergencies and emphasizes planned work [3].

Each model assumption should have a designated owner, verified source, and a confidence label (High/Medium/Low) [5]. This approach ensures accountability and allows decisions to be traced back to specific data and the person responsible for its validation. For major planning cases, implement a Scenario Charter to document external factors, parameter sets, and management actions [5]. This kind of transparency fosters collaboration between departments and simplifies decision-making. With clear governance in place, these plans can integrate smoothly into your budgeting and reporting systems.

Integrate with Budgeting and Reporting Systems

To avoid surprises, investment scenarios need to tie directly into annual budgets and sustainability reports. By consolidating your operations and maintenance (O&M) and capital expenditure (CapEx) planning into one platform, you can ensure the CFO has a clear view of how maintenance spending connects to long-term capital needs [3]. Tools like Oxand Simeo™ make this possible by linking scenario modeling directly with financial systems, shifting budget discussions toward risk-based planning. This also ensures that sustainability reports reflect the same data used in your investment decisions, creating a unified and dynamic planning process.

Refresh Models and Scale Across Portfolios

Static models lose relevance quickly. Instead, adopt a rolling planning cycle: refresh external factors monthly and update your portfolio quarterly, prioritizing the 20% of assets that drive 80% of performance [3][5]. This approach creates a continuous feedback loop, avoiding reliance on one-time analyses.

When scaling, focus on the most critical assets first. Use the 80/20 rule: improve data quality for the factors that have the largest impact on asset performance rather than trying to perfect data across all assets [3]. Demonstrate results with these key assets, then expand your efforts. Regularly updating models with advanced analytics can lead to portfolio savings of 5% to 15% [4]. As McKinsey emphasizes:

"Leaders must make it clear that analytics is not a marginal capability; on the contrary, they must ensure that its practitioners have the authority and organizational reach necessary for impact."

- McKinsey & Company [4]

Conclusion: Faster Investment Planning with Oxand Simeo™

Speeding up your investment planning process is more achievable than ever. With the strategies outlined – defining objectives, centralizing data, modeling aging and risk, generating scenarios, and adopting continuous planning – real estate and infrastructure owners can cut planning timelines from months to just weeks. Multi-year investment scenarios that once seemed time-consuming can now be developed with remarkable efficiency.

Oxand Simeo™ plays a central role in this transformation. By pulling together fragmented data sources and utilizing advanced aging, energy, and maintenance models, the platform predicts portfolio performance across a variety of investment strategies. Most users can integrate their existing data and start building multi-year scenarios in under two weeks [1]. Plus, the platform’s simulation engine allows you to test budgets, risks, energy performance, and carbon goals in mere seconds – shifting from static yearly planning to a dynamic, ongoing approach.

The results speak volumes. For example, one public sector asset director reported a 27% drop in maintenance backlog and $4 million in energy savings across 66 buildings in just one budget cycle [1]. Additionally, precise intervention timing can lower total ownership costs by up to 30% while cutting ISO 55000 report preparation time by 70% [1].

By transitioning from reactive, age-based replacements to risk-focused, carbon-conscious investment planning, you gain the insights and flexibility to justify CAPEX requests, hit sustainability goals, and keep your plans aligned with budget realities. The Simeo Go mobile app further boosts efficiency, enabling real-time condition data collection that’s 50% faster than traditional paper-based methods [1].

This shift to continuous, data-driven planning doesn’t just improve operational efficiency – it redefines how you approach asset management. Whether you oversee infrastructure, commercial properties, or public facilities, this forward-thinking approach ensures smarter capital allocation and contributes to a more sustainable future. Every dollar spent works harder, and every decision leaves a greener legacy for the next generation.

FAQs

How does Oxand Simeo™ help simplify and speed up multi-year investment planning?

Oxand Simeo™ streamlines long-term investment planning by bringing together all asset data and predictive models into one comprehensive simulation platform. This makes it easier for users to quickly develop, compare, and fine-tune risk-based maintenance and CAPEX plans for extended timeframes.

By leveraging its advanced tools, Simeo™ cuts down the time required for scenario planning from months to just days. At the same time, it ensures precision, supports alignment with sustainability objectives, and adheres to regulatory standards. The platform equips infrastructure and real estate owners with the tools they need to make confident, data-backed decisions efficiently.

How do predictive models improve investment planning for infrastructure and real estate?

Predictive models take raw asset data and turn it into practical insights, helping asset owners make smarter and more strategic decisions. By predicting how assets will perform and spotting potential failures early, these models let you focus on high-risk areas, cut down on emergency repairs, boost safety, and save money – all while keeping service disruptions to a minimum.

Data-driven forecasting delivers tangible results, such as 10–20% savings on maintenance budgets, extending asset lifespans by 20–40%, and reducing overall costs. These insights also provide a clear, audit-ready foundation for multi-year investment plans, ensuring transparency and building confidence in decision-making.

On top of that, predictive analytics simplify scenario planning. They let you quickly run multiple "what-if" simulations, making it easier to align capital investments with sustainability goals, regulatory demands, and market shifts – all with confidence in the data and assumptions driving your decisions.

How does including sustainability metrics influence investment planning?

Incorporating sustainability metrics into long-term investment planning turns environmental factors into actionable insights. By tracking key indicators like carbon emissions, energy use, and other ESG (Environmental, Social, and Governance) data, asset owners can better evaluate project options. This allows them to prioritize initiatives that meet regulatory standards and steer clear of risks like stranded assets or penalties from stricter climate policies. Integrating these metrics into CAPEX planning not only helps fine-tune maintenance schedules but also extends asset lifespans and lowers overall costs.

Using sustainability metrics can also open doors to better financing opportunities. Many lenders now tie financing terms to ESG performance, making it easier to access green-bond capital or secure lower interest rates. Consistent tracking of carbon footprints and visible progress boosts stakeholder trust, strengthens portfolio credibility, and supports long-term value growth. Simply put, sustainability metrics lay the groundwork for smarter, future-focused investment strategies.

Related Blog Posts

- Strategic CAPEX Planning for Highway Concessions: Balancing Grantor Compliance and Profitability at End-of-Term

- Aging Infrastructure & Lifecycle Management

- Aging Infrastructure in Europe: How to Prioritise Renewal Under Budget Constraints

- Financing the Green Transition: How to Use Your Investment Plan to Access Sustainable Funding