ISO 55001:2024 and ESG frameworks together streamline asset management and sustainability efforts. The updated ISO 55001 standard focuses on predictive planning, lifecycle management, and integrating environmental, social, and governance (ESG) goals into asset strategies. Key benefits include:

- Cost Savings: Organizations can reduce maintenance and replacement costs by 10–30%.

- Risk and Opportunity Focus: The 2024 update separates risks and opportunities, enabling better planning for challenges and sustainability gains.

- Improved ESG Reporting: Aligning asset data with ESG metrics enhances transparency and compliance with regulations like the Corporate Sustainability Reporting Directive (CSRD).

- Lifecycle Management: Decisions across acquisition, operation, maintenance, and disposal phases are optimized to balance cost, performance, and sustainability goals.

This alignment not only improves operational outcomes but also builds trust with stakeholders through consistent, verifiable data. Tools like Oxand Simeo™ simplify compliance, automate reporting, and enable scenario modeling for carbon reduction and asset investment planning. By embedding ESG principles into asset management, organizations can achieve long-term goals while maintaining efficiency.

Integrating ESG: Best Practices and Innovations

sbb-itb-5be7949

Core Principles of ISO 55001 for Asset Lifecycle Management

ISO 55001 Asset Lifecycle Stages: Key Considerations and Sustainability Impact

ISO 55001:2024 provides a structured framework that ties asset performance, risk, and costs together across an asset’s entire lifecycle [2]. This approach not only improves operational processes but also aligns with ESG goals by promoting sustainable practices. At its heart, the standard emphasizes aligning asset management objectives with broader organizational strategies through the Strategic Asset Management Plan (SAMP) [1]. The SAMP, a concise 18-page document, acts as a bridge between high-level strategies and day-to-day operations, ensuring all asset-related decisions add measurable value.

The standard is built on two core principles: risk-based decision-making and lifecycle perspective. Section 4.5 highlights the importance of connecting asset decisions to organizational value creation, while Section 8.1 establishes lifecycle management as the foundation for planning, covering everything from initial demand to eventual disposal. These principles work together to help organizations not just maintain assets but optimize them for long-term performance and sustainability.

Risk-Based Decision-Making in Asset Management

ISO 55001 calls for organizations to address both risks and opportunities across assets, systems, and the organization as a whole [1]. The 2024 edition distinctly separates "Risk" (potential negative outcomes) from "Opportunity" (potential positive gains), ensuring planning focuses on both mitigating issues and creating value. Risk-based prioritization is key here, allocating CAPEX and OPEX investments based on factors like asset criticality, failure probability, and the cost of failure [5].

For instance, a medium-sized water utility used the ISO 55001 risk matrix to reprioritize its investments. By deferring $45 million in low-value renovations and reallocating $12 million to high-risk main pipe replacements, the utility reduced anticipated service interruption penalties by 60% [5]. This shift was guided by mapping asset criticality and focusing resources on the highest-risk infrastructure.

Natural gas plants have also benefited from ISO 55001 principles. By integrating IoT sensors and digital twins for real-time monitoring, these plants increased centrifugal compressor availability to over 98%. This approach extended the time between major overhauls and reduced unplanned downtime by 20% to 40% [5].

"Lifecycle management forms the basis of decision-making from demand through to asset and service delivery." – ISO/TC 251 [1]

Section 10.3 introduces a Predictive Action requirement that shifts organizations from reactive maintenance to proactive management of risks and opportunities. Instead of waiting for equipment failures, asset managers use assessments to adapt to changes like climate risks or regulatory updates. This method consolidates data from various sources into a single, auditable framework, enabling senior management to act on cost and risk indicators quickly [5]. This risk-focused approach naturally ties into a lifecycle perspective, ensuring every phase – from acquisition to disposal – supports long-term goals and sustainability.

Lifecycle Perspective in Asset Policies

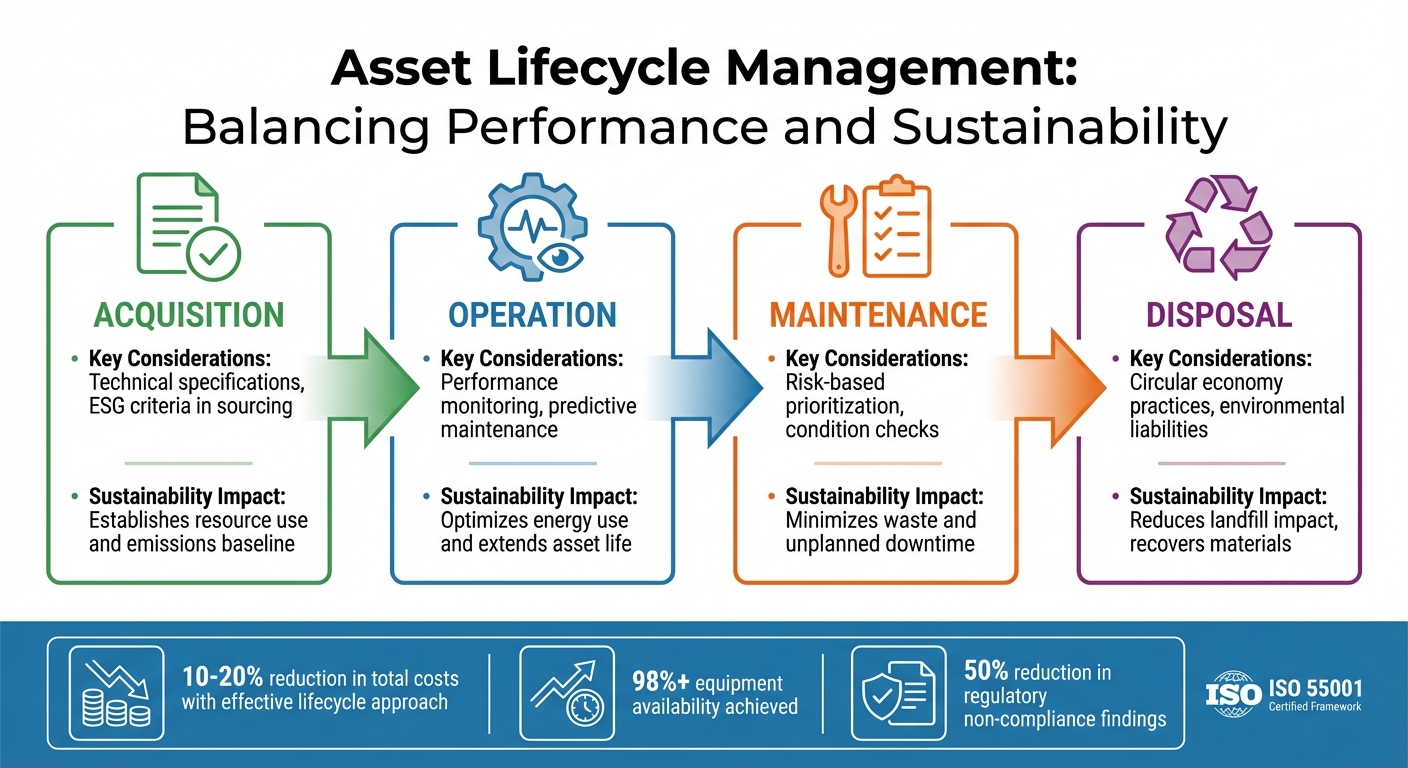

Section 8.1 of ISO 55001:2024 establishes lifecycle management as a core requirement [1]. This approach integrates ESG considerations, balancing cost efficiency with environmental and social responsibility. Decisions made during the design phase, for example, can significantly impact long-term maintenance costs, while operational choices shape future disposal liabilities and environmental footprints [5]. Organizations that focus solely on upfront CAPEX may overlook the bigger picture: the total cost of ownership (TCO) over the asset’s entire lifespan.

| Lifecycle Stage | Key Considerations | Impact on Sustainability |

|---|---|---|

| Acquisition | Technical specs, ESG criteria in sourcing | Establishes resource use and emissions baseline |

| Operation | Performance monitoring, predictive maintenance | Optimizes energy use and extends asset life |

| Maintenance | Risk-based prioritization, condition checks | Minimizes waste and unplanned downtime |

| Disposal | Circular economy practices, environmental liabilities | Reduces landfill impact, recovers materials |

When implemented effectively, a lifecycle approach can cut total costs by 10% to 20% [5]. Organizations using ISO 55001 frameworks have reported key equipment availability exceeding 98% while reducing unscheduled downtime. Moreover, structured traceability and documentation required by the standard have lowered regulatory non-compliance findings by around 50% [5].

"The lifecycle perspective of ISO 55001 requires a holistic view: design decisions influence maintenance costs; operational profiles influence disposal liabilities." – José López, Technical Author [5]

The 2024 update mandates that organizations provide clear evidence showing how asset-related decisions align with strategic goals, including ESG criteria [5]. This means lifecycle planning must demonstrate support for circular economy principles and responsible resource use [2][3]. By treating each stage of an asset’s lifecycle as interconnected, organizations can achieve sustainability goals while maintaining operational efficiency and advancing ESG priorities.

Integrating ESG into ISO 55001 Decision Processes

The 2024 update to ISO 55001 brings ESG (Environmental, Social, and Governance) considerations into the heart of asset management. Section 4.5 now requires organizations to tie decision-making at every level to the value assets create, ensuring that this value aligns with stakeholder expectations – including environmental and social priorities [1]. What does this mean in practice? ESG goals must move beyond standalone sustainability reports and become an active part of the Strategic Asset Management Plan (SAMP), supported by real resources.

This integration isn’t just about compliance – it’s financially smart. ESG-focused asset governance can reduce operational costs (OPEX) by 12%–18% [7]. To make this work, ESG factors should be treated as essential performance indicators, not afterthoughts. The standard helps here by separating "Risk" (Section 6.1.2) and "Opportunity" (Section 6.1.3), allowing organizations to address sustainability risks – like shifting climate regulations – while pursuing opportunities such as energy-efficient upgrades [1].

"Organizations will therefore need to align their internal decision making with the evolving expectations of external stakeholders." – Boudewijn Neijens, Asset Management Expert [6]

A key step is aligning financial and non-financial data. ISO 55010 offers guidance on this, ensuring environmental metrics hold the same weight as financial ROI in decision-making [8]. By using value frameworks, organizations can quantify ESG goals in economic terms, enabling multi-criteria analysis. For example, they can compare carbon reduction efforts against cost savings in a structured way [6]. This approach turns abstract sustainability targets into actionable investment priorities, evaluated alongside traditional financial metrics. It also reinforces lifecycle and risk-based principles, embedding sustainability into every asset decision.

Embedding Environmental Objectives in Asset Management

Environmental goals become actionable when integrated into risk-based asset investment planning. Section 8.1 of ISO 55001 emphasizes lifecycle management, requiring organizations to track emissions, energy use, and waste at every stage of an asset’s lifecycle [7]. This data supports ESG reporting frameworks like the EU’s Corporate Sustainability Reporting Directive (CSRD) [7].

To make carbon reduction targets practical, organizations can use scenario modeling in their SAMP. Instead of vague sustainability promises, asset managers can simulate specific pathways. For instance, what if HVAC systems are replaced on a 12-year cycle instead of 15? Or how much could switching to low-carbon materials cut Scope 3 emissions over 20 years? These scenarios tie environmental goals directly to CAPEX and OPEX decisions, delivering measurable results.

The "Predictive Action" requirement in Section 10.3 supports this by encouraging proactive adjustments to asset strategies. For example, organizations can model the impact of future carbon pricing or regulatory changes and adapt their investment priorities accordingly. This shifts environmental compliance from being a reactive cost to a strategic advantage.

Automation can make this process more efficient. Manual ESG tracking can take up 15–20 hours per week for documentation and version control [7]. Automated systems reduce this burden by 40%–60% within six months, freeing up teams to focus on strategic initiatives [7].

Social and Governance Considerations in Asset Policies

Beyond environmental goals, ISO 55001 also weaves in social and governance aspects. Social impact and governance accountability fit naturally into asset management through stakeholder alignment and knowledge sharing. Section 7.7 of the 2024 update highlights the importance of organizational knowledge, including the expertise of employees, as a key driver of sustainability [1]. This means workforce competence and community impact are no longer side issues – they’re central to performance.

Organizations can address social factors by outlining how asset decisions affect communities, employees, and other stakeholders. For instance, multi-site operations might adopt centralized ESG policies with localized execution [7]. A hospital network could set system-wide standards for patient safety and accessibility while allowing individual facilities to adapt maintenance schedules to ensure uninterrupted care.

Governance accountability, meanwhile, hinges on transparency. ISO 55001 requires organizations to document how asset-related decisions align with strategic goals, including ESG criteria [5]. This traceability is critical for regulatory compliance. Structured documentation has been shown to reduce regulatory non-compliance findings by about 50% [5]. The standard’s emphasis on audit trails ensures that organizations can provide clear evidence of how sustainability commitments are being implemented.

Strong stakeholder communication also benefits from this alignment. By integrating financial and non-financial outcomes into asset management systems, organizations can show investors, regulators, and communities that their operations support broader sustainability goals [4]. This is becoming increasingly urgent as regulations like CSRD demand explicit ESG reporting. Organizations that fail to align ESG requirements with asset management could face 25% to 30% higher maintenance costs and greater risk exposure [7].

Tools and Strategies for ESG-Aligned Asset Investment Planning

To effectively align asset investment with sustainability goals, organizations need systems that can translate these targets into clear CAPEX and OPEX allocations, all while adhering to ISO 55001 standards. Moving away from outdated, reactive spreadsheet-based methods toward proactive, risk-focused investment planning is no longer optional – it’s essential. This shift enables scenario modeling, where investment choices are directly linked to measurable carbon reduction outcomes.

Scenario Modeling for Carbon Reduction Pathways

Scenario modeling empowers asset managers to predict the outcomes of their investment decisions before committing resources. Instead of relying on guesswork to balance risk and carbon savings, this approach allows organizations to simulate specific results. For instance, what would be the impact of replacing aging HVAC systems on a 10-year schedule versus waiting until they fail? Or how much CO₂ could be avoided by using low-carbon materials in the next renovation?

The 2024 ISO 55001 update reinforces this methodology by emphasizing tools like digital twins and predictive analytics (as discussed earlier) to optimize asset strategies for both performance and sustainability goals [5]. Multi-criteria decision-making frameworks further enhance this process by integrating traditional financial considerations with ESG priorities. Interactive dashboards allow organizations to model "what-if" scenarios, projecting OPEX reductions and carbon savings across various investment plans. These tools also support CSRD compliance by linking Scope 1, 2, and 3 emissions directly to asset operations [7]. The outcome? A transparent and defensible investment strategy that satisfies both financial and regulatory stakeholders.

Oxand Simeo™ for ISO 55001 and ESG Compliance

Platforms like Oxand Simeo™ take these modeling techniques a step further, integrating them into tools designed to streamline ISO 55001 compliance and ESG reporting. By converting asset data into detailed, multi-year plans, Oxand Simeo™ prioritizes CAPEX and OPEX investments based on risk, performance, and cost. This approach embeds energy and carbon footprint goals into the core of investment planning, ensuring sustainability is not treated as an afterthought but as a key component of every financial decision.

The platform leverages predictive lifecycle modeling, including aging models and risk forecasting, to maximize predictive maintenance ROI by determining the best timing for interventions. This not only extends asset lifespans but can also reduce total ownership costs by up to 30% [10]. With implementation timelines as short as 6 to 12 weeks, it’s a practical solution for organizations looking to quickly act on their ESG commitments [10].

Oxand Simeo™ also simplifies ISO 55001 certification by automatically generating audit-ready reports directly from investment plans. These reports provide clear traceability, demonstrating how asset decisions align with strategic and ESG objectives. Structured documentation like this has been shown to cut regulatory non-compliance findings by approximately 50% [5]. Additionally, the platform’s centralized asset inventory – via Simeo Inventory – creates a single source of truth for asset data, a critical feature for both ISO 55001 and ESG audits.

One of the standout features is its scenario simulation capability. Within weeks, organizations can compare and contrast investment scenarios, evaluating carbon reduction pathways and energy performance under various budget constraints. This level of transparency makes it easier to communicate decisions to boards, investors, and regulators, offering clear, data-backed evidence rather than vague sustainability claims.

Practical Examples of Sustainability Reporting with Asset Data

As ESG principles become a cornerstone of asset management, practical applications demonstrate how asset data strengthens sustainability reporting. By transforming maintenance insights into audit-ready evidence, asset data supports credible ESG reporting, aligning with the 2024 ISO 55001 updates on "Data and Information" (Section 7.6) and "Knowledge" (Section 7.7) [1]. Treating carbon data with the same precision as financial accounting allows organizations to create transparent, verifiable records for auditors [12].

Tracking Scope 3 Emissions via Asset Inventories

Scope 3 emissions – often accounting for 80–95% of an organization’s total carbon footprint [13] – are notoriously difficult to measure. Asset inventories help close this gap by linking procurement records and material inventories to specific assets. This enables organizations to calculate both upstream impacts (e.g., purchased goods) and downstream impacts (e.g., use of sold products) with greater accuracy.

For instance, in September 2025, Unilever onboarded over 300 suppliers to address 44% of its Scope 3 emissions. By integrating supplier contracts with climate data and action plans, the company reported a 42% reduction in industrial Scope 3 emissions [13]. Similarly, Tarmac, a leading building materials company in the UK, achieved a 75% emissions reduction on the A64 road resurfacing project in 2025. This was accomplished by utilizing electric plants, low-carbon binders, and embedding carbon data directly into procurement requirements [13].

Conducting a materiality assessment is crucial to pinpointing the most relevant Scope 3 categories for a given portfolio. For example, infrastructure assets can present vastly different challenges. An airport managing its ground handling services will face distinct considerations compared to one outsourcing those services [11]. Erik Landry, Director of Climate Change at GRESB, highlights this complexity:

"Scope 3 emissions – those occurring in a company’s value chain, both upstream and downstream – represent a significant share of total emissions for infrastructure assets" [11].

To streamline emissions tracking, organizations can establish a greenhouse gas (GHG) data ledger. Each entry should document verifiable emitting activities – such as diesel usage or electricity consumption – tagged with metadata like "Asset ID", "Cost Center", and "Emission Factor Source" [12]. These detailed records enable asset managers to monitor critical ESG performance indicators effectively.

KPI Monitoring for ESG Performance

Tracking the right metrics at the right frequency is essential for impactful ESG reporting. Asset management systems aligned with ISO 55001 naturally generate data supporting key performance indicators (KPIs) across environmental, social, and governance dimensions.

- Environmental KPIs: Focus on energy consumption by asset type (Scope 2), material use and waste (Scope 3 Category 1), and emissions from asset transport (Scope 3 Category 4) [7].

- Social KPIs: Include safety incident rates and customer satisfaction related to asset functionality [5][14].

- Governance KPIs: Emphasize regulatory compliance and the accuracy and integrity of asset data governance [14][15].

Organizations adopting formal asset governance have reported a 12–18% reduction in operational expenses compared to less structured approaches. Additionally, automating ISO 55001 compliance can cut administrative overhead by 40–60% within six months [5][7]. For example, High Speed 1 (HS1) in the UK achieved ISO 55001 certification in 2024 for its 109 km high-speed rail line, establishing a framework that enhanced safety and operational performance [16]. Similarly, Network Rail improved its asset management maturity from 51% to 66% by implementing ISO 55000 principles, better managing its extensive infrastructure investments [16].

The move from annual ESG reporting to real-time visibility is gaining momentum. Automation now enables organizations to schedule preventive maintenance more efficiently, reducing manual efforts and improving response times for asset-related issues. This creates continuous data streams feeding directly into ESG dashboards, replacing fragmented spreadsheets with comprehensive, audit-ready documentation [7][16].

Conclusion

Integrating ISO 55001 with ESG principles is transforming how infrastructure and building management are approached. The 2024 update focuses on data-driven decision-making and predictive maintenance, moving maintenance strategies from reactive fixes to proactive, risk-based planning [1]. This shift not only extends the lifecycle of assets but also prioritizes resource efficiency, directly supporting seven Sustainable Development Goals, including Climate Action and Sustainable Cities and Communities [2].

This integration also simplifies compliance by automating audit-ready documentation and providing clear evidence trails, which bolsters transparency in sustainability reporting. For instance, tools like Oxand Simeo™ streamline data collection and create multi-year scenarios, replacing disjointed spreadsheets with structured, ISO-compliant processes [9]. This structured approach allows organizations to manage capital more effectively while hitting both financial and environmental targets.

Organizations can strengthen their competitive position by starting with a maturity assessment to uncover gaps in current practices before pursuing ISO 55001 certification [9]. Formalizing asset management systems – grounded in data-driven strategies – offers tangible benefits like better risk management, increased transparency, and measurable progress toward sustainability goals. Transitioning from manual reporting to automated, predictive planning builds resilient infrastructure that meets today’s demands while preparing for future challenges. This strategy ensures that asset management delivers long-lasting value for both present operations and future generations.

FAQs

Where should we start to align ISO 55001 with ESG reporting?

To incorporate ESG criteria into your ISO 55001 asset management framework, begin by crafting policies that specifically address environmental, social, and governance factors. These policies should align seamlessly with your organization’s strategic goals.

Adopt a risk-based decision-making approach to evaluate how asset investments impact ESG factors, ensuring that decisions are both responsible and forward-thinking. Establish clear ESG goals along with measurable performance indicators to facilitate transparent tracking and reporting.

Conduct a gap analysis to pinpoint areas where your current practices fall short. Use the insights from this analysis to develop a detailed roadmap that guides your organization toward better alignment with ESG principles.

What asset data is needed for CSRD and emissions reporting?

For CSRD and emissions reporting, companies must rely on asset data that reflects environmental impacts, particularly emissions. Critical metrics to focus on include energy consumption, greenhouse gas (GHG) emissions, and resource usage throughout an asset’s lifecycle. Detailed records, such as carbon footprint measurements, energy usage per asset, and maintenance activities that influence emissions, are crucial for accurate reporting. By aligning asset management systems with ISO 55001 standards, organizations can ensure consistent and reliable data collection, supporting both compliance and sustainability goals.

How can we show that ESG goals influence CAPEX and OPEX decisions?

To align capital (CAPEX) and operational (OPEX) decisions with ESG goals, it’s essential to weave sustainability into asset management strategies. Frameworks like ISO 55001 can help structure this integration effectively. By assessing how investments affect environmental and social outcomes – such as cutting carbon emissions – you can directly connect these impacts to financial planning.

Incorporating ESG metrics, conducting materiality assessments, and adopting sustainability reporting are key steps in this process. These tools provide measurable evidence that supports decision-making. For instance, case studies often highlight organizations transitioning to low-carbon infrastructure or adopting sustainable practices, showcasing how ESG considerations reshape spending priorities.