Asset Investment Planning Software

For a Sustainable Future

Turn complex asset data into multi-year CAPEX & maintenance plans with scenario simulation across risk, cost, performance, and carbon—powered by Oxand’s intelligence engine.

Stop planning investments in spreadsheets.

Most organizations still rely on manual models, disconnected inventories, and one-off analyses—making it hard to justify budgets, prove impact, and deliver sustainability goals.

Disconnected data

inventory, inspections, finance, and energy data live in silos

Unclear trade-offs

budgets get cut without visibility on risk and outcomes

Reporting overload

teams spend weeks producing board-ready evidence

How it works

A complete workflow—from asset data to investment decisions.

Build the foundation

Centralize asset inventory, structure, and attributes into a single system of record.

Capture field reality

Run digital inspections and update asset condition from the field.

Simulate and plan

Generate multi-year, risk-based plans and compare scenarios for cost + carbon impact.

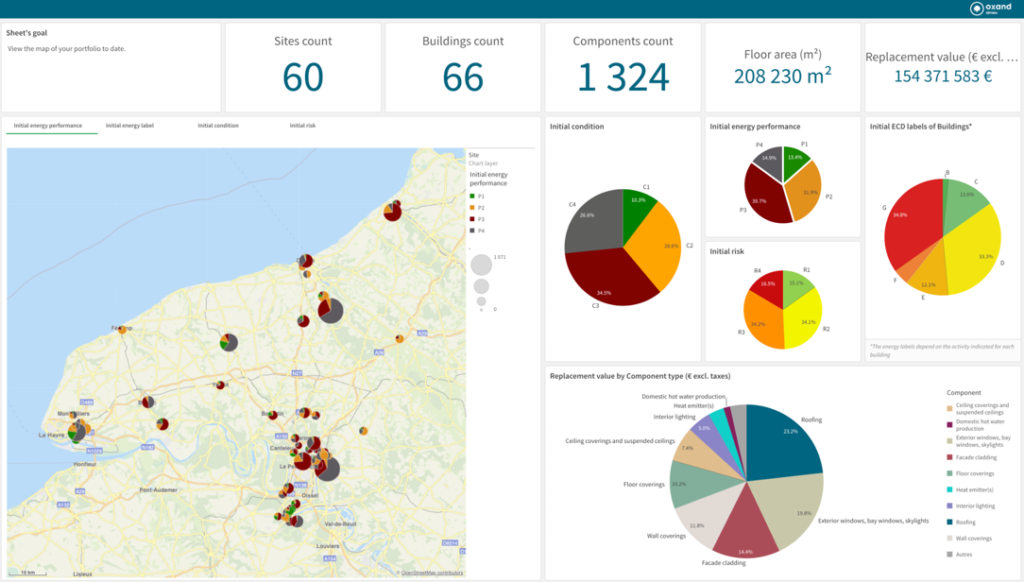

Designed for portfolio scale: thousands of buildings, networks, or sites—without duplicate data entry. Under the hood, Simeo leverages a large, continuously enriched library of predictive models and recommended actions to standardize decisions across your whole portfolio.

Key benefits

Model scenarios

in minutes

Compare budgets, risk reduction, service levels, and CO₂ impact

Portfolio clarity, not spreadsheets

Dashboards built for executives and asset teams

From data

to decision

Connect inventory, inspections, and lifecycle models into one plan

Product

One platform. Three core modules.

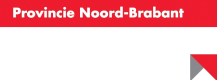

Simeo AIP

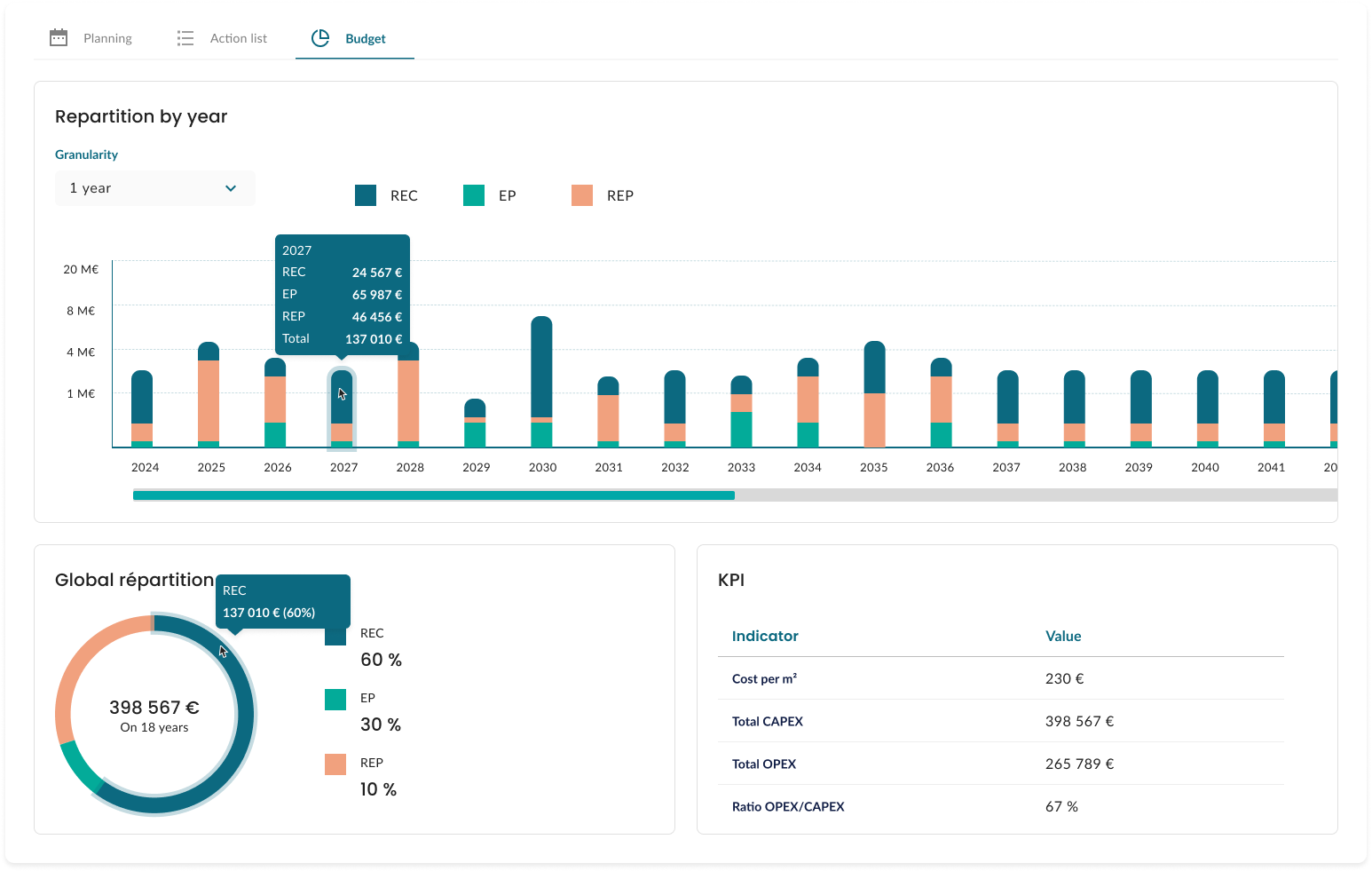

Scenario simulation + multi-year planning across risk, cost, and sustainability.

• Budget scenarios, investment

prioritization, and long-term roadmaps

• Risk and criticality modeling to defend decisions

• Executive dashboards and board-ready reporting

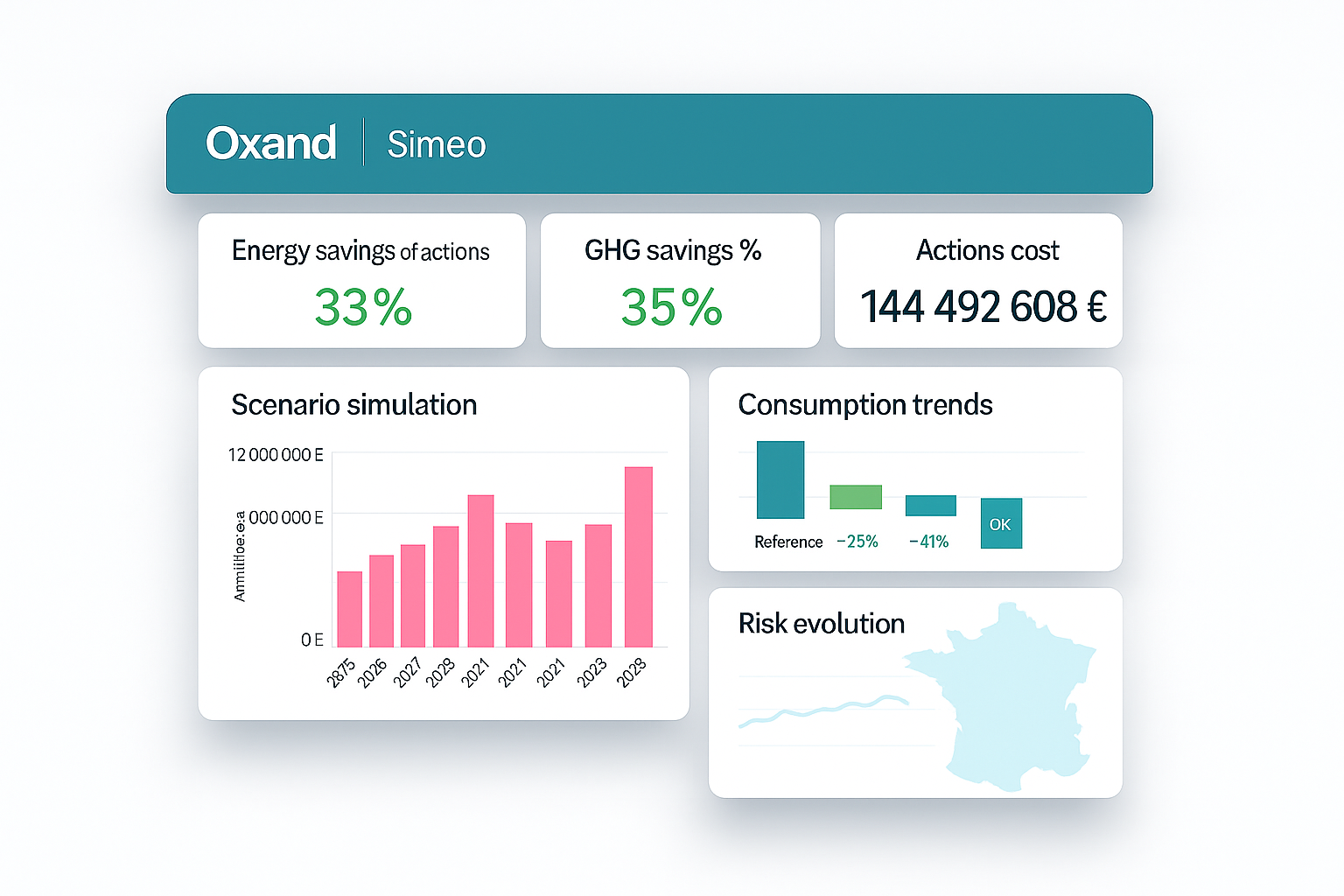

Simeo Inventory

A centralized asset knowledge base—clean, structured, and always up to date.

• Single source of truth for sites, buildings, systems, components

• Data governance (ownership, completeness checks, audit trails)

• Fast onboarding via imports + templates (adjust if needed)

What makes Simeo different

AI where it matters (and where it’s safe) : Simeo uses AI/ML to help detect patterns, calibrate models, and improve recommendations over time—while keeping decisions explainable and repeatably, controlled.

Simeo isn’t a generic BI tool. It’s a decision platform powered by a large, evolving library built specifically for asset owner.

Key capabilities

Built for decision-making at portfolio scale.

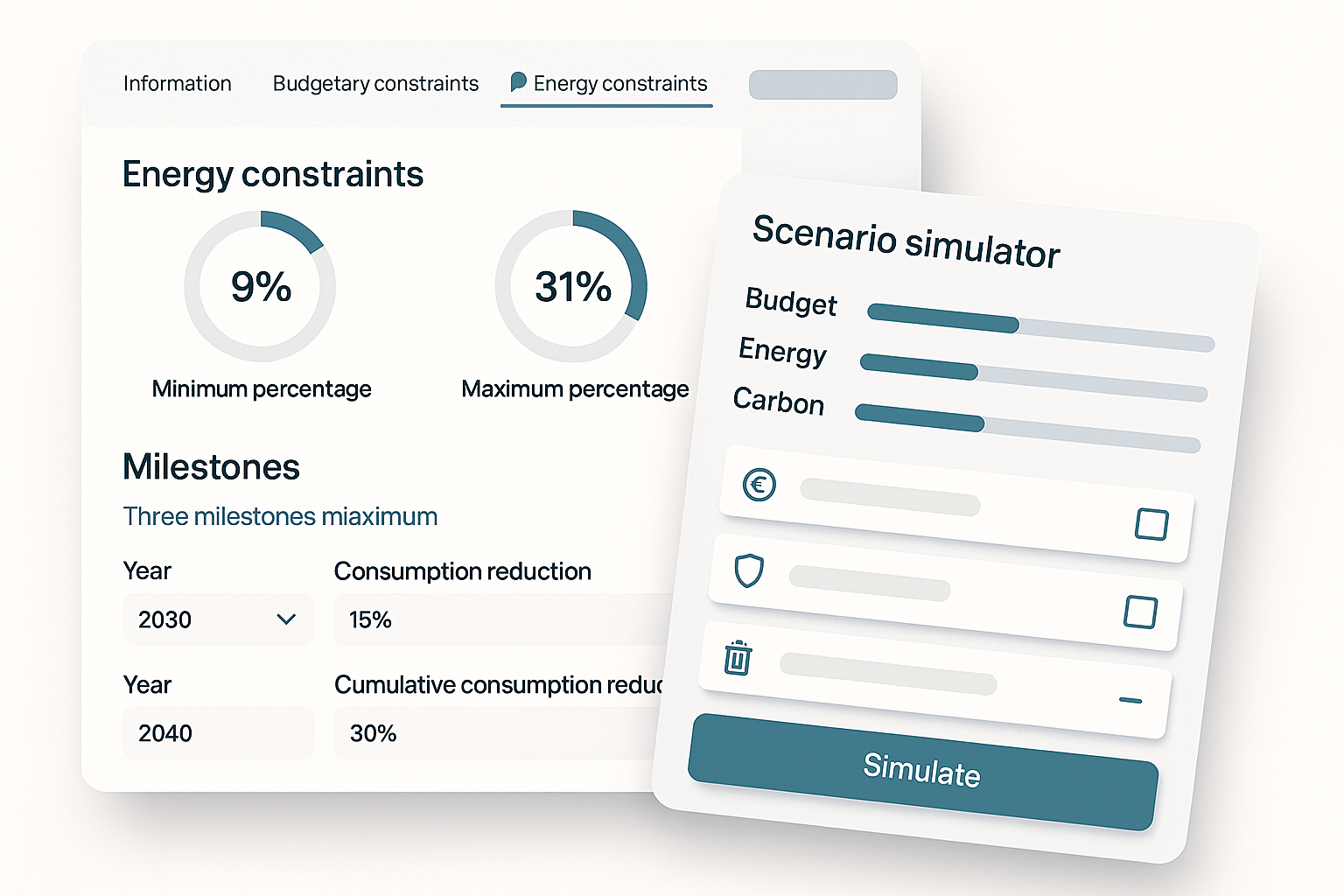

Scenario simulator

Compare investment scenarios across budget constraints, risk reduction, service levels, and carbon impact — all in one unified view. Instantly understand the trade-offs between financial performance, asset resilience, and sustainability goals.

Lifecycle & predictive models

Forecast asset degradation using advanced lifecycle and predictive models to anticipate failures before they occur. Quantify the financial, operational, and risk impact of deferring critical interventions.

Risk-based prioritization

Identify critical assets based on failure probability, operational impact, and exposure to risk. Quantify where failures would create the greatest financial, safety, or service disruption consequences.

Sustainability & ESG analytics

Link every investment decision to measurable energy performance and emissions impact. Understand how capital allocation influences your decarbonization trajectory and long-term ESG objectives.mitments are backed by credible data.

Dashboards & reporting

Access high-level portfolio dashboards designed for executive decision-making. Drill down into asset-level details with operational insights tailored for asset managers.

Outcomes

Prove impact—financial and environmental.

TCO reduction

25% to 30% through optimized intervention timing and prioritization

Risk reduction

Decrease in avoidable risk exposure across the portfolio

Time to plan

A defendable multi‑year plan in hours (instead of months of spreadsheets)

Carbon-aware decisions

CO₂ impact modeled alongside CAPEX and service levels for every scenario

Who it’s for

Designed for every stakeholder—from field teams to the board.

Executive Leadership & Sponsors

Clear trade-offs, defendable budgets, scenario comparisons, and KPI dashboards.

Facility & Asset Managers

Asset-level insights, work prioritization, condition visibility, lifecycle planning.

Sustainability & ESG Teams

Carbon-aware planning, evidence generation, and portfolio-wide reporting.

Industries

Used across infrastructure and real estate portfolios.

Infrastructure

Manage aging networks of assets (roads, bridges, stations, structures) with a risk–cost–service view, and prioritize CAPEX/OPEX through investment simulation and predictive maintenance.

Real Estate

Optimize portfolio performance and value by planning component lifecycles, works and energy, with clear budget trajectories comparable site by site.

Social Housing

Prioritize renovations where impact is highest (comfort, safety, decarbonization) despite tight budgets, by making decisions objective and ensuring regulatory compliance.

Health Buildings

Ensure operational continuity in healthcare facilities by reducing critical failures, planning investments by criticality, and strengthening compliance and traceability.

Cities & Regions

Consolidate governance of a diverse public asset base (buildings, equipment, infrastructure) with multi-stakeholder control, scenario-based prioritization, and tracking of climate/ESG targets.

Integrations & data

Works with your existing stack.

Connect Simeo to your asset, finance, and operational data—so decisions are based on reality, not manual consolidation.

Integration examples:

ERP / Finance

CMMS / Maintenance

GIS

BIM / Documentation

Data exports + API

Security & governance

Enterprise-grade security and governance. Keep only statements you can fully support.

Role-based access control (RBAC) and audit trails

Secure authentication options (SSO where applicable)

Encryption in transit and at rest

Data governance to prevent duplicates and ensure completeness

Customer stories

How teams use Simeo to move from data to investment clarity.

From fragmented data to a defendable 10-year plan (metric

Scenario simulation to align CAPEX with carbon targets

Digital inspections feeding portfolio dashboards in near real time

See Simeo on your portfolio in one walkthrough.

Get a product tour tailored to your portfolio—planning, inventory, inspections, sustainability, and reporting.

FAQs

Frequently Asked Questions

Predictive asset management uses data analytics and modeling to predict when maintenance should be performed, helping to extend asset life, reduce costs, and avoid downtime.

Predictive asset management uses data analysis, ageing models and risk forecasting to determine when interventions should be planned.

It enables better investment decisions, extends asset life, reduces lifecycle costs and creates more reliable, ROI-focused investment plans.

Most clients obtain a first investment plan within 6–12 weeks, depending on data availability.

Measurable results follow quickly, including:

- optimised CAPEX/OPEX decisions,

- reduced total cost of ownership (TCO),

- improved reliability and compliance with sustainability and regulatory requirements.

Yes. Oxand directly integrates sustainability and carbon metrics into investment planning.

Our models help organisations align their investments with European regulations, ISO 55000, CSRD/ESRS standards and long-term decarbonisation goals, providing compliant, transparent and verifiable investment plans.

Absolutely. Oxand supports investment planning in many sectors, including: public infrastructure, commercial property, energy and utilities, transport and manufacturing.

Our methodology adapts to the specific risk, compliance and budgeting requirements of each sector, ensuring robust investment plans.

You can start by requesting a demonstration or speaking directly to our experts.

We can help you quickly develop your first CAPEX/OPEX investment plan, prioritise actions and evaluate return on investment, even if your data is incomplete.